FansUnite (FANS.TO) is a sports and entertainment company, focusing on technology related to regulated and lawful online sports betting, esports betting, casino and fantasy. Their mission is to be a leader in the gaming industry by providing their partners and players the industry’s most versatile and vertically integrated platforms with a portfolio of unique products and a focus on esports, sports betting, casino and the next generation of bettors.

Chameleon is a complete business-to-business (B2B) sports and esports white label iGaming platform offering turn-key and API solutions. Two distinct offerings (turn-key & API) make it flexible and scalable for FansUnite clients. Chameleon provides a client dashboard with tailored reporting and real-time analytics.

Platforms powered by Chameleon include Dragonbet.co.uk and betr.

McBookie has been a leading online sportsbook in Scotland for over a decade. McBookie has been operating in the UK market since 2009 and is recognized for its sports betting, casino, and virtual sports offerings. At the time of acquisition, McBookie boasted approximately 10,000 active members and handled a total of CAD$340 million in betting since its inception. Additionally, in the last two years, McBookie has taken over CAD$100 million in betting volume onto its platform.

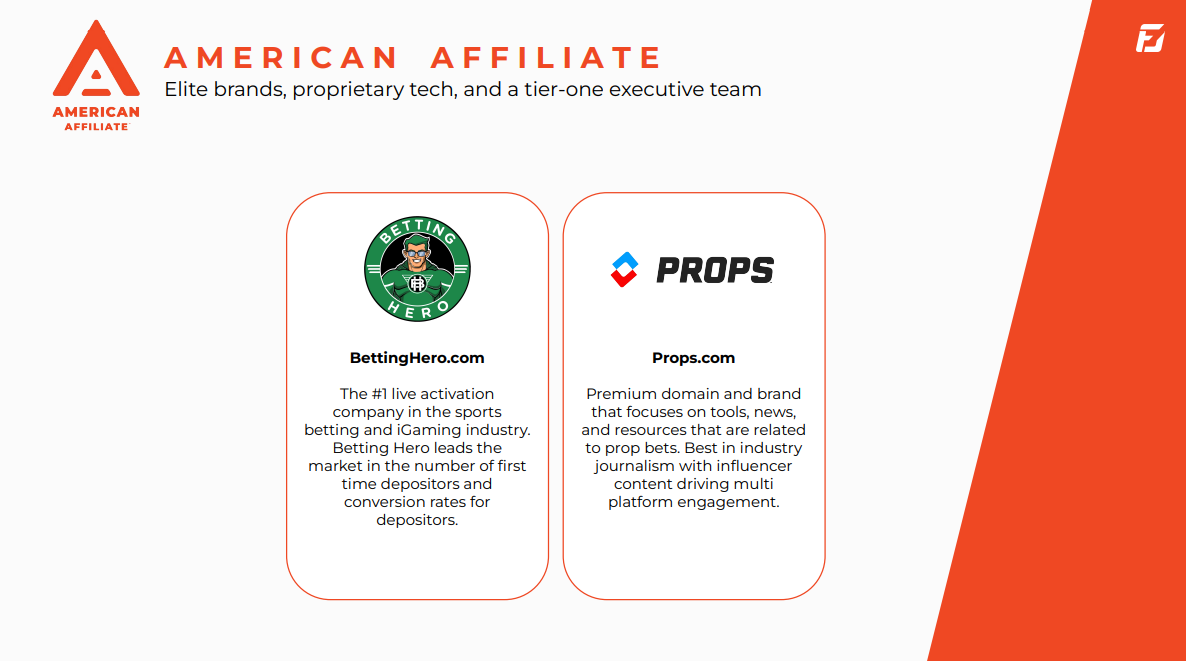

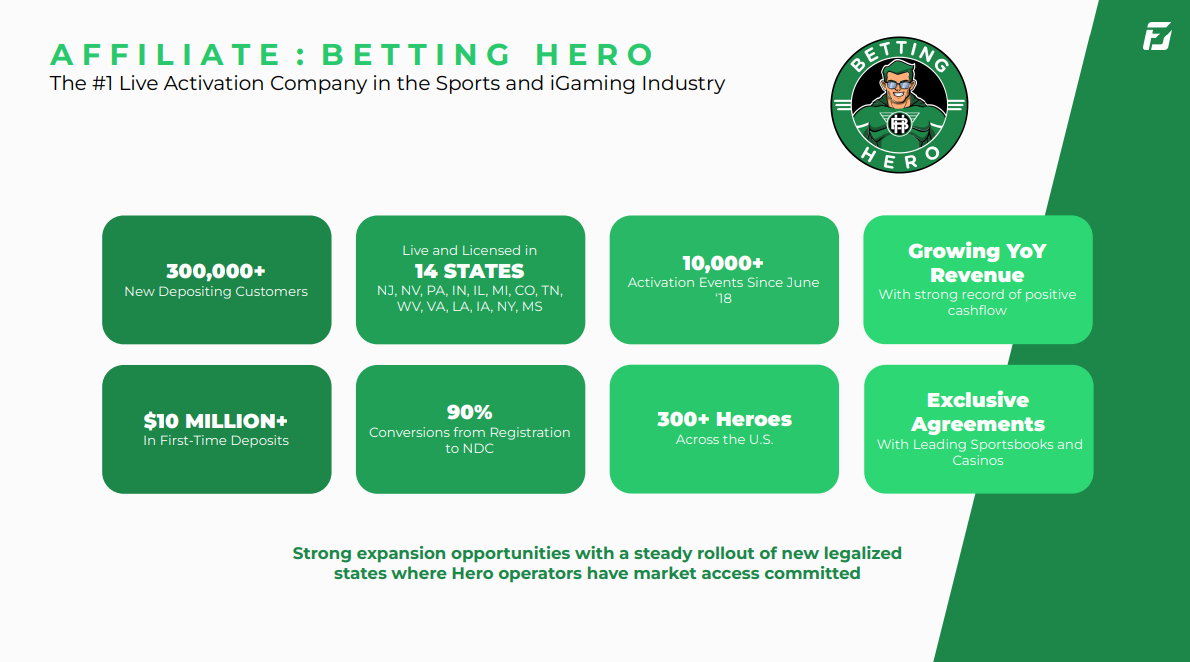

FansUnite subsidiary American Affiliate (AmAff) is making bank. AmAff produced CAD$1.88 million in revenue from its betting affiliate network during March Madness, with margins over 30%. In terms of retail activation, their Betting Hero brand guided ambassadors to dozens of sportsbooks, bars and other venues across 14 states, to help thousands of consumers through creating, funding and betting with an online sportsbook in March.

One of the affiliates, Betting Hero, is the #1 live activation company in the US gaming market. Here is its overview:

And here are partnerships (some very familiar names in the industry):

Recently, FansUnite announced the upsizing of a private placement led by strategic investor Tekkorp Capital due to strong investor demand. Tekkorp has agreed to acquire 13,750,000 units. The non-brokered private placement of units will go for a price of $0.08 for aggregate gross proceeds of $2,000,000.

The stock is currently sitting at a major support zone, very close to previous record lows printed at $0.06. You can see that FansUnite actually popped from this support at the beginning of the year. The pop provided a return of over 100% from support at $0.07 to highs just above $0.15.

We know this is an important support zone, the thing is, will FansUnite have a reason to repeat the same pop move?

There actually is. And it is coming this week.

FansUnite is to report fiscal year ended 2022 financial results on Thursday March 30th 2023. Management will host an investor webinar discussing the results and the growth outlook at 10 AM EST on Friday March 31sr 2023.