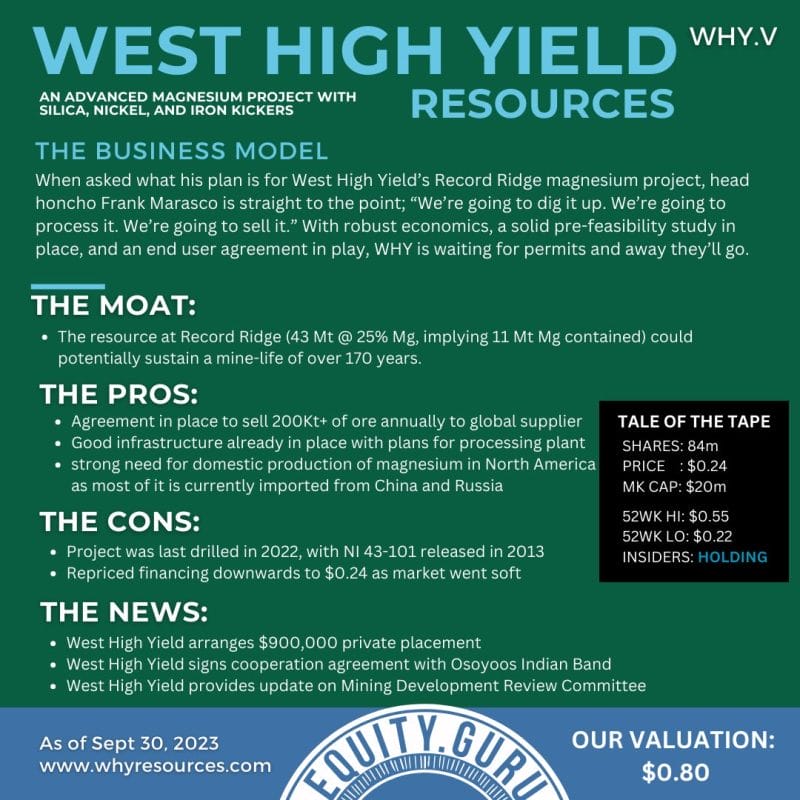

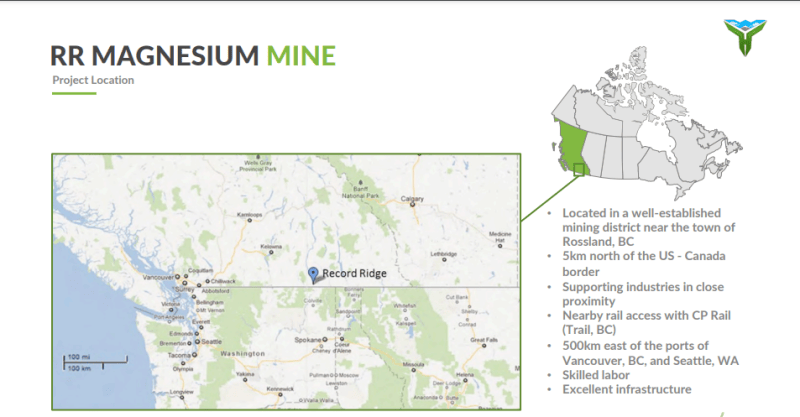

West High Yield resources (WHY.V) is a company with the objective to bring into production one of the world’s largest, greenest deposits of high-grade magnesium. The Record Ridge magnesium deposit is located 10 kilometers southwest of Rossland, British Columbia has approximately 10.6 million tonnes of contained magnesium based on an independently produced preliminary economic assessment technical report.

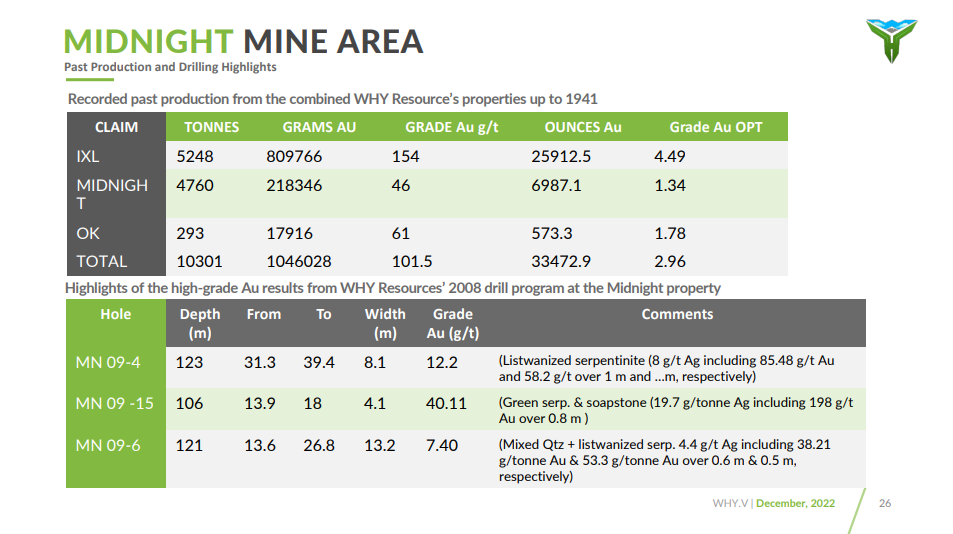

While the focus is on magnesium, it should not be forgotten that West High Yield also has a high gold mine rejects project. With a permit ready for over 200k metric tons grading at average 2.5 ppm Au for a total of >18k ounces of gold and > $30 million value. Over 225k metric tons of mine rejects have already been mined from many historic mines in the area.

The company recently announced additional high-grade gold assays in its update from the 2022 6,000 metre exploration drilling program which was completed on November 15th 2022 at West High’s Midnight Gold claim located in the Rossland Gold Camp area in BC. The Rossland Gold Camp historically produced over 2.76 million ounces of recovered gold and 3.52 million ounces of recovered silver.

Here are highlights from the campaign:

- 41 holes completed in 6,197 metre NQ2 diamond drilling program

- Targets tested in historical Midnight, IXL and OK mining areas

- Additional high-grade gold assays including:

- MN22-13 72.35-72.65 metres depth – 154 g/t Au (visible gold)

- MN22-13 185.7-186.20 metres depth – 21.4 g/t Au (visible gold)

- MN22-08 38.7-39.4 metres depth – 15.85 g/t Au, and

- MN22-09 205.1-206.6 metres depth – 37.9 g/t Au

NQ2 diameter core showing two visible gold occurrences in MN22-13 72.35-72.65m. Gold grains range from <1mm to 4mm.

“We continue to intersect structurally-controlled mineralization with visible gold (see Figures1 and 2) in high-grade assay intervals such as those in MN22-13 northwest of the central Midnight mineralization (see Tables 1 and 3). Assays using gravimetric and metallic screen protocols verified significant grades up to 154 g/t Au in narrow intervals from 30cm to 1.5 metres,” stated Greg Davison, P.Geo and QP for Midnight. “Screen metallics of the highest-grade interval confirmed 996 g/t Au in the coarse fraction which contributed 58% of the contained Au (MN22-13 72.4 metres).”

“The high-grade gold occurred mainly within variably deformed and serpentinized peridotite showing moderate to pervasive quartz-serpentine-carbonate (listwanite) replacement transected by discrete quartz-dominant veins to 50cm and sets of <1-10 mm veinlets with minor to sparse sulphides. Core intervals measuring up to 60 metres of massive, weakly altered peridotite, consistently with 5% to 10% disseminated to microfracture-controlled pyrite and/or pyrrhotite, intersected west of the Midnight and in the IXL, generally exhibited lower Au grades (0.2-2.0 g/t Au). Leapfrog 2D and 3D mapping, with current and historical drilling and underground workings, and recently flown high-resolution LiDAR topographic control, will be used to evaluate their geospatial significance in the mineralizing system,” said Mr. Davison. “Geological logging and 80% of the half-core sampling (2868 including QA/QC) were completed prior to the winter shutdown. The remaining core intervals will be processed in a Q2 2023 program.”

Here is a summary of the drill core intersections:

I released my technical analysis on the stock on November 21st 2022. West High Yield Resources met the criteria for a trend reversal set up. Not only did we confirm a breakout of the range with a large green candle, but we also took out the first resistance zone at $0.30. Now, $0.30 becomes the new support or price floor. As long as the stock remains above this support, we can expect to see more highs.

The stock did hit my second resistance zone at $0.565. This remains the key level for bulls. Fortunately for bulls, the stock has just made one higher low in the current uptrend. And according to market structure theory, we should expect to see at least one more. This next higher low swing should take us above our key resistance zone

Currently, the stock is forming a flag pattern. I have drawn the trendlines for readers above. Price is respecting these lines, and a close above would trigger the next run up back to the $0.565 zone and then higher.