The currency markets have been very volatile this year. The Japanese Yen, the British Pound, the Euro all see major drops. Being a currency trader, I have not seen volatile like this ever. Okay, with the British Pound I have with the Brexit vote, but what we are seeing now with multiple currencies is unprecedented.

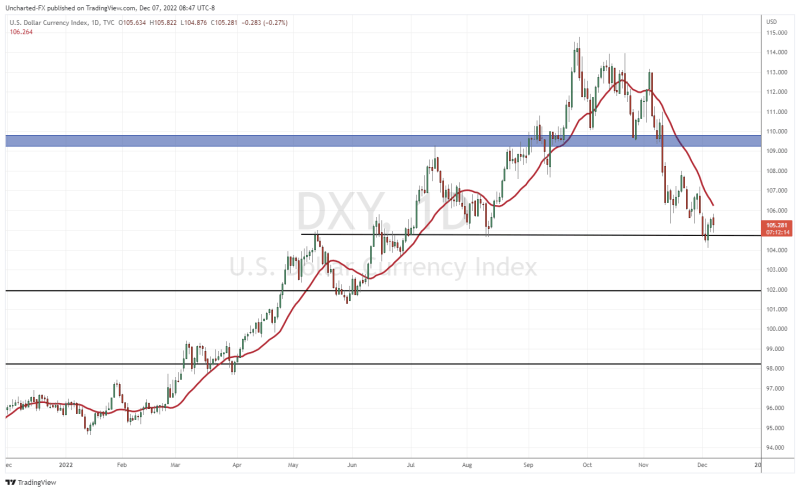

The US dollar strength has been putting pressure on currencies, and could continue to do so for two reasons. Either the Fed continues its hawkish tone which sees the dollar rise. Or we face some sort of event risk which spooks markets and we see a risk off environment that sees money run into the safety of the US dollar.

Why is this important? Well, the OG definition of inflation has to do with the strength of the currency. A weaker currency elevated inflation because it means spending more of that weaker currency to buy something. Hence higher prices. If the US dollar continues to rally and crushes other currencies, those nations will have another inflationary problem to add to supply chain disruptions and consumer spending.

The currency markets are going to be super important in this period of time that many call a “soft landing”. For someone wanting to preserve wealth during times of inflation, then currencies are the key market. We have all read about inflationary periods where people make millions in Venezuela or Argentina, but it doesn’t mean much when the currency is weakening because purchasing power actually goes lower.

I can ramble all day on foreign exchange, but I want to get straight to the point. Asian currencies have been a key interest for me personally. I have been sensing something brewing in Asia for some time. Perhaps something geopolitical is coming down the road.

However, there has been a KEY shift in an Asian currency that has people talking. And it might come as a big surprise.

I am talking about the Chinese Yuan, and the technicals hinting at a major rally for the Yuan. A surprise given the state of China’s economy, and the current lockdown protests we are seeing.

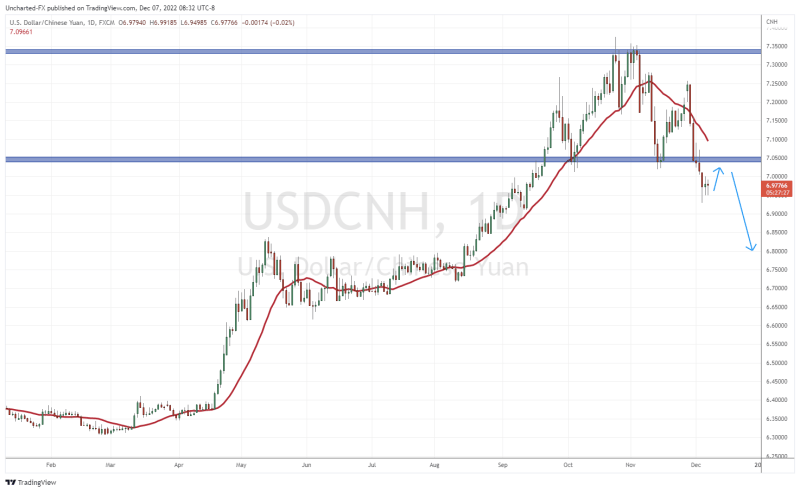

Let’s first talk about the chart.

For those new to reading forex charts, above is the USDCNH on the daily chart. When prices are rising, the USD is strengthening and the Yuan is weakening. When prices are moving lower, the USD is weakening and the Yuan is strengthening.

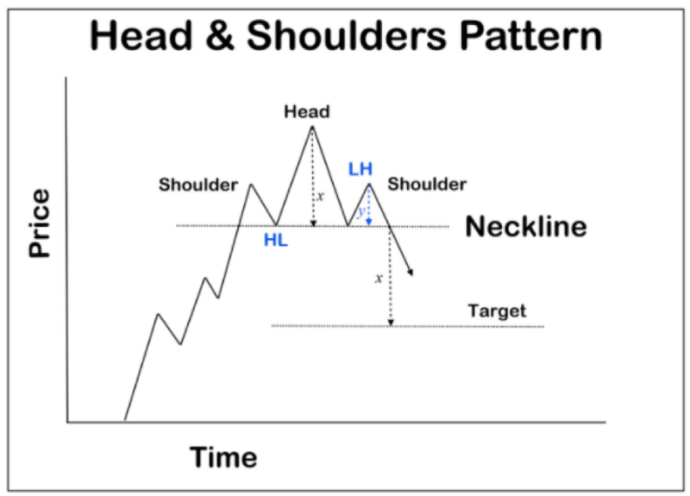

Those with a keen technical eye might spot the quintessential pattern known as the head and shoulders pattern. This is a pattern which indicates the top, and subsequent reversal. It must occur after a long uptrend, which is what we have here on the USDCNH.

The neckline on USDCNH has been broken at 7.05 which means the pattern has triggered. On my chart above, I have outlined the potential pullback to retest the neckline before we head lower, or see the Yuan strengthen. Retests are completely normal, and provide an entry for those who missed the first leg down.

Our next target comes in at 6.80. If we end up closing back above 7.05, then the reversal pattern will be nullified, and the Yuan will continue to weaken.

As noted earlier, what has the market talking is why the Yuan strength given what is occurring in the country.

There are a few speculations we can entertain.

Okay, firstly this one is not really a speculation. The Yuan could be strengthening because of the fall in the US Dollar. Not just the Yuan, but many other currencies which have been hit by the US Dollar strength.

This will be tested when we hear from the Federal Reserve come December 14th 2022. If the Fed is dovish and the dollar drops, we should see the Yuan continue to strengthen alongside other currencies.

Speculation #2? It has to do with the current situation in China. Some analysts believe the strength in the Yuan is due to the upcoming loosening of China’s zero-covid rules. Basically the CCP succumbing to pressures from protests. This would be positive for the stock markets which have reacted to China’s lockdowns and slowdown.

Speculation #3 is a bit more ‘out there’. Some are seeing the strength in the Yuan having to do with changes in the global economic system. Pertaining to the Digital Yuan. There is also some saying the Yuan is rising due to China boosting gold reserves for the first time in over 3 years in an attempt to diversify away from the US dollar. It looks like China could have been that big undisclosed gold buyer.

Whatever the case, we have a major technical break in the USDCNH and the Yuan is ready to start a new trend where it gains strength. Now we wait for a fundamental event to confirm the technicals.