The US stock markets are still digesting that non-farm payrolls employment blowout data from Friday which indicated a strong labour market. The Fed has been saying that the labour market remains robust, and does not point at an economic slowdown or recession. With Friday’s data, expectations are that the Fed will continue to raise rates even in a recession.

The Fed has made this very clear. Jerome Powell and other Fed members have been saying that interest rates will need to remain high for a long time. They cannot just start cutting on recession fears unless we see demand get hit big time. The Fed will stay the course until they bring inflation back down to the 2% level, even if this means raising interest rates in a recession and keeping interest rates high in a recession.

Most of the trading world already thinks we are in a recession, as the US met the two consecutive negative GDP growth criteria. But oddly, instead we got articles from the White House stating that the way to confirm recessions which we have used for decades, suddenly is not the way to define recessions anymore.

Fed members have said that what matters is the terminal rate (the interest rate level where the Fed stops raising rates) not necessarily if the Fed starts slowing the pace of interest rate hikes. While the markets believe the Fed will pause rate hikes and even begin cutting in 2023, the Fed is saying that interest rates could head higher than 5% if inflation does not cool down. Pressures have increased due to the rising wage pressures seen from Friday’s NFP numbers.

Wall Street Journal’s Nick Timiraos reminded readers about this fact:

Federal Reserve officials have signaled plans to raise their benchmark interest rate by 0.5 percentage point at their meeting next week, but elevated wage pressures could lead them to continue lifting it to higher levels than investors currently expect.

brisk wage growth or higher inflation in labor-intensive service sectors of the economy could lead more of them to support raising their benchmark rate next year above the 5% currently anticipated by investors.

The takeaway is that the Fed could take interest rates higher than the current market expectations while beginning to raise rates at a slower pace (50 basis points) beginning this month.

Timiraos’ comments have sparked selling in bonds and stocks.

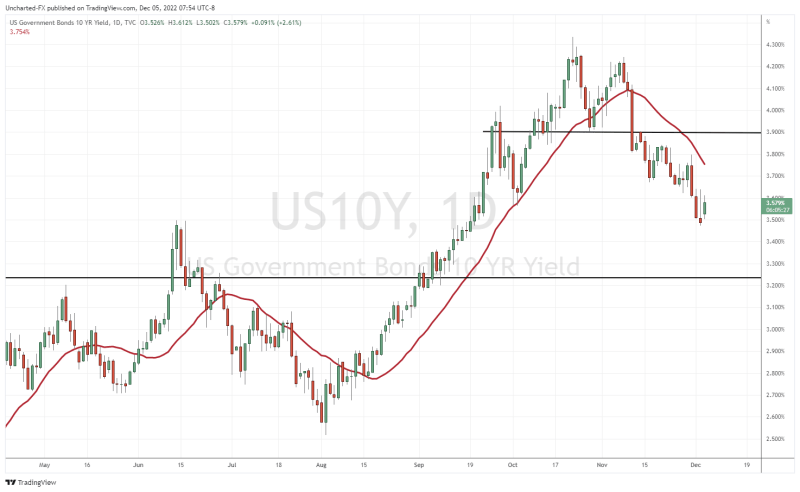

My readers know the 10 year yield is the number one chart you need to follow if you want to determine where the stock markets are going. When yields rise, more often than not, the stock markets drop. When yields drop, the stock markets rise.

After breaking down below 3.9%, rates triggered a reversal pattern. Technically, we should expect yields to continue to drop lower. Fundamentally, things could change if interest rate expectations head higher.

Today’s price action could just be a pullback or a relief rally in the current downtrend, which means that the sell off should resume and stock markets should rebound.

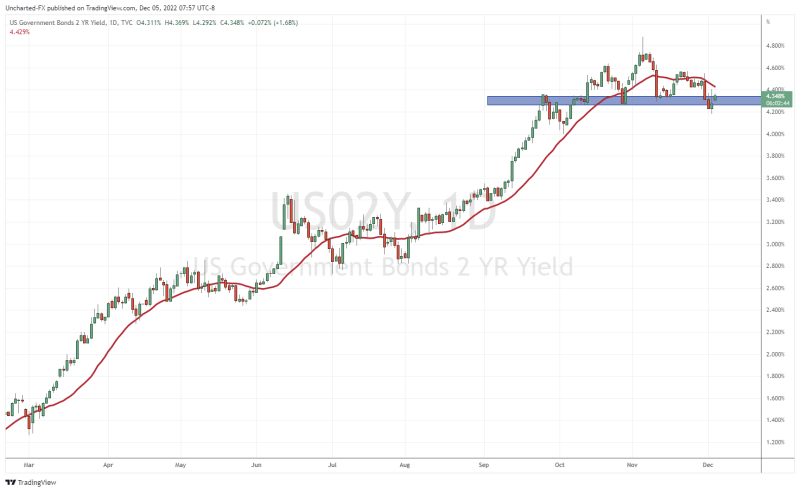

The chart I will closely be following this week is the 2 year yield. Those with a keen and experienced technical eye might see the infamous head and shoulders pattern. A key reversal pattern. If we see a close below 4.20% and this reversal pattern triggers, it would signal the top of short term interest rates.

But then again, fundamentally, things could change depending on interest rate expectations. If we do not see this reversal pattern trigger, then the 2 year yield will continue higher, and we would expect the 10 year to do the same.

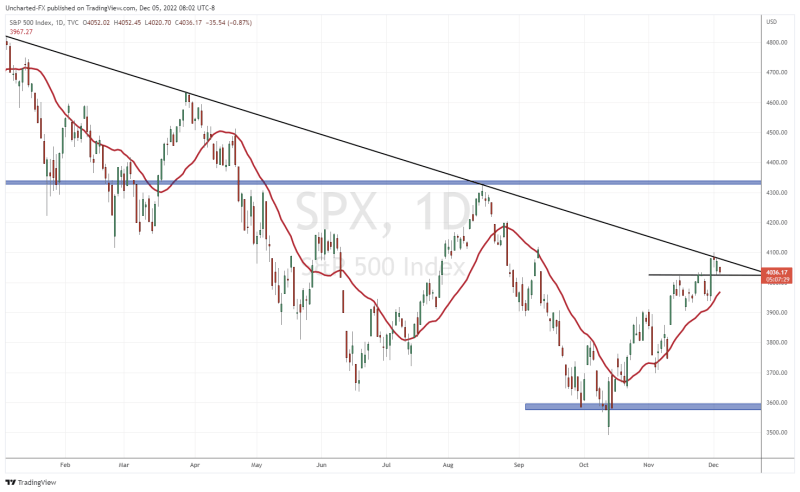

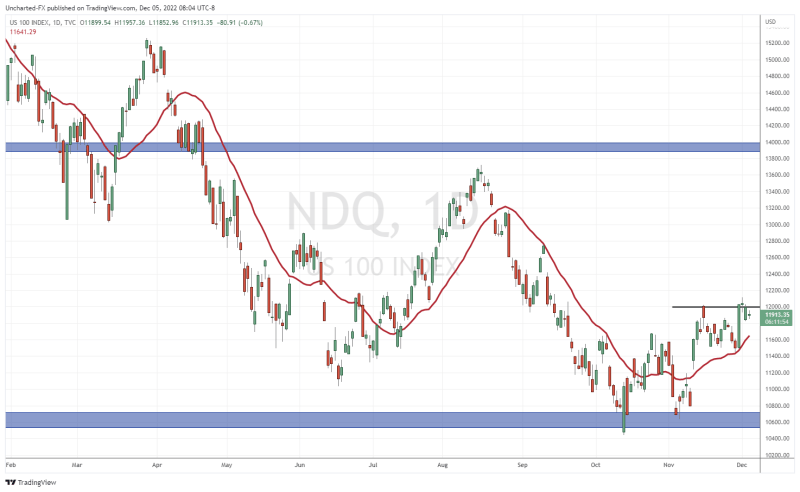

US markets open the week red after the bond market sell off. But we are seeing some signs of recovery.

There are positives from a technical perspective for stock market bulls:

The S&P 500 remains above the breakout zone of 4025. The intraday chart may look bearish, but we always need to remember the bigger picture. As long as the daily closes remain above 4025, the uptrend remains intact.

The Nasdaq also is looking to join the party. I have written about the double bottom reversal pattern that triggered, and we traders have ridden the first upwards wave. We get a close above 12,000 and the party continues.

In summary, keep watching those 2 and 10 year yield charts. If we see sell offs there, then markets will rebound. Circle December 14th on your calendar. That is when we hear from the Federal Reserve. A 50 basis point hike is expected, but all ears will be focused on picking up a more hawkish or dovish Federal Reserve.