The stock markets have been frustrating for many investors and traders. One needs to balance Fed speak, inflation, interest rates, and all sorts of geopolitical things. Oh, and not to mention a near 100% chance of a recession come 2023. Exciting times, but also tough times to be a market participant.

We have seen the favorites like Amazon, Tesla, Meta, Apple, Netflix etc get smashed. They are FAR AWAY from their previous all time highs.

But what if I told you that there is one sector experiencing a bull market? These stocks are either already printing new all time record highs or are very close to printing new all time record highs. Closer to new highs than the favorites mentioned above.

Believe it or not, but the defense/military stocks are booming. It is easy to see why. Look around the world. Russia-Ukraine, China-Taiwan, Turkey-Greece, North Korea. Not only is military equipment being sent over to Ukraine, but other nations are spending big on defense given the risk in the world. World War III unfortunately, is something regularly spoken about.

Japan, in a major shift, is spending more on defense, setting their defense spending budget target at 2% of GDP for the first time. This would put Japan on par with NATO’s defense spending standard. Everyone will want a piece of that pie, but most likely Japan will look to American weapon systems to meet their demands.

Speaking of NATO, many European countries in NATO are planning to increase their spending on the military. Estonia is calling on European countries to double military spending. This kind of spending means a defense stock boom is coming. Technically, it is already happening.

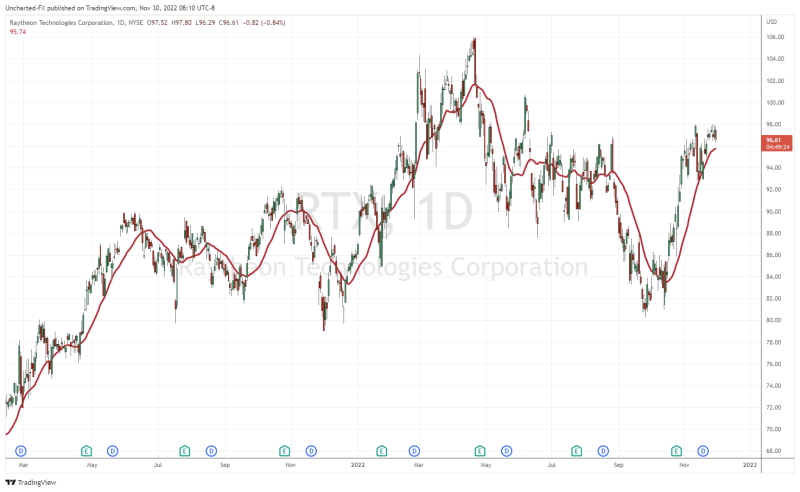

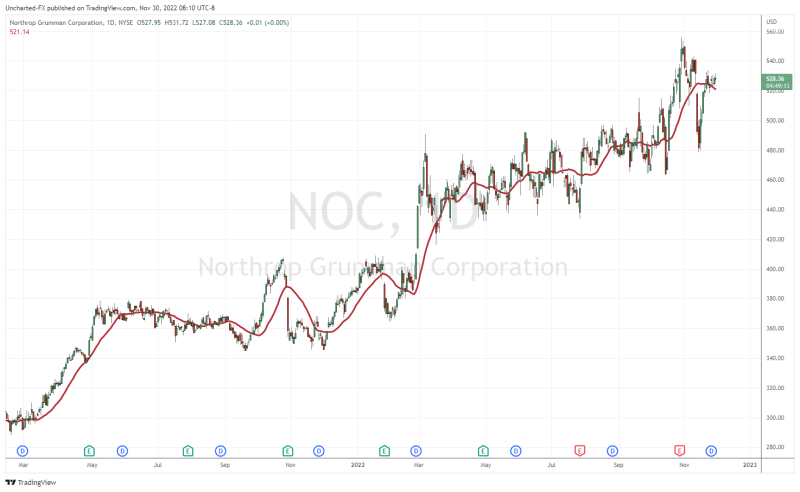

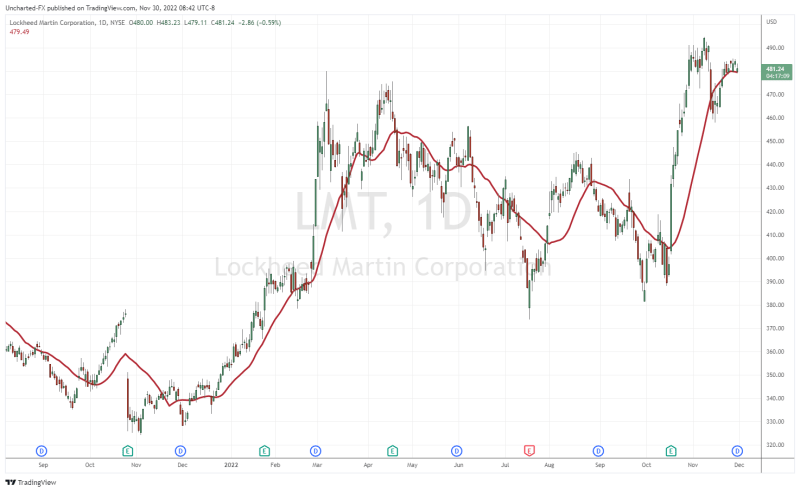

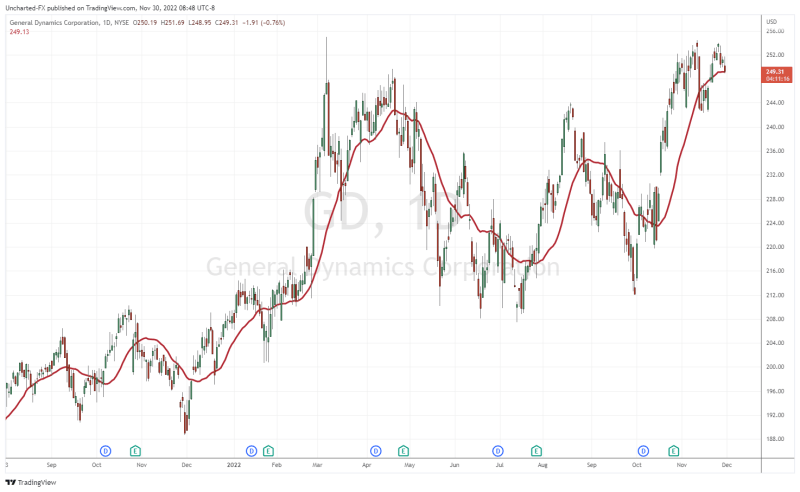

As many stock charts look ugly, take a look at some of these defense stocks:

Raytheon is key in the war in Ukraine as they produce the anti-aircraft stinger missile system. The US gave a large portion of its stinger inventory to Ukraine to defend against Russian advances. Earlier in 2022, the US military awarded a new $687 million contract to Raytheon for 1,468 additional Stinger missiles to replenish its supply. Not game changing, but we can expect more of these kinds of orders in the future given the state of the world.

The stock is currently less than 10% away from printing new all time record highs.

Northrop Grumman just recently printed new all time record highs at the end of October 2022. The company is known for its stealth bombers and weapons in space. It is also closely tied to the nuclear triad of nuclear missiles, bombers, and submarines.

The stock is less than 6% away from printing new all time record highs. There is some support here at $520, and if that breaks, then support comes in at the psychological important $500 zone.

No article about defense stocks would be complete without mentioning Lockheed Martin. They are the world’s largest defense company and the US government’s biggest contractor. Well diversified too dealing with fighter jets, electronic warfare, hypersonics, space and satellite systems and more. I am sure many of you have heard of the F-35 fighter jet, one of the world’s (if not THE) most advanced fighter jet in the world with nations such as Japan being a customer too.

The stock just recently printed new all time record highs on November 8th 2022. The stock is less than 3% away from printing new all time record highs. Support comes in at $460, but with the world spending a lot of money on defense, the world’s largest defense company will be making bank.

Another large defense contractor is General Dynamics. The company is known for its defense focused IT, software and services with NATO countries being key clients. However, the company also is a primary shipbuilder and has a portfolio of tanks and land vehicles. The American M1 Abrams main battle tank is built by General Dynamics Land Systems.

The stock printed record highs in March 2022, and attempted to print record highs once again on November 10th and the 25th. Could not breakout, which is setting up a possible double topping pattern. However, to trigger, the stock will need to close below $242.50.

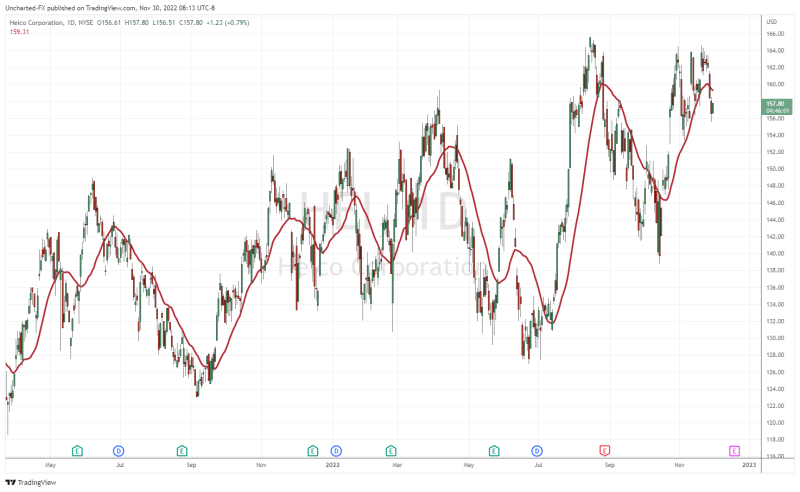

Heico sells replacement parts for the aerospace and space industry, commercial aircraft, and even NASA vehicles. But the company has exposure to the defense industry as well. Replacement parts is big money, especially when it comes to the military. A very under the radar type stock.

The stock setup looks similar to GD with a topping pattern. Heico printed new record highs in August 2022, and has attempted to break out three times recently but with no success.

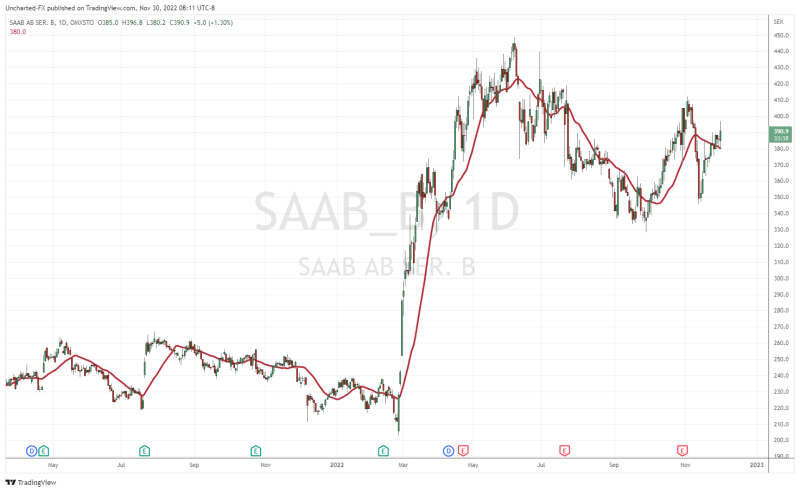

One company I want to include is Swedish SAAB. Sweden has quite the active defense sector. The company has been in the news lately as a Swedish MP is calling for Sweden to sell SAAB JAS Gripen fighter jets to Ukraine. Many military analysts believe this fighter jet would be the ideal jet to send over to aid Ukraine being able to operate regularly outside of air bases and having a relatively low logistical requirements.

The stock recently broke out of a wedge/trendline pattern and could make a run back to previous highs if Sweden does sell Gripen fighters to Ukraine.

There you have it, defense stocks are some of the best looking stocks in the markets and are bucking the recent trend. I have left out Boeing because well… they have commercial aircraft in their stock.

It should be noted that the US military stocks listed above pay dividends, which adds to the idea of being defensive in these markets. With military spending set to increase around the world, these companies will be making bank which translates to higher dividends and a higher stock price.

Investing in the military industrial complex definitely provokes some ethical questions. Individuals will have to deal with this themselves. Investing in markets is about making money, and these setups look the best. As they say, more money is made in a single day of war than an entire year of peace.