Water is something most of us take for granted. In recent years, we have seen more and more headlines warning of a water crisis. There has already been tons of Netflix documentaries and content regarding the upcoming water crisis. Let’s just say that for young investors, investing in water is seen as the next big (and no brainer!) play.

Not going to lie, but I think many traders and investors interested in markets began paying attention to water after the Hollywood film “The Big Short”. At the end of the movie, we get some script telling us that Dr. Michael Burry is now focusing on investing in water. I remember that really made an impression on me back in the day. Man, this Dr. Burry guy is definitely smart, and he has a point with water!

So what did I do? Well, I began to read up on fresh water. Here are some stats to consider:

3% of the earth’s water is fresh. 2.5% of the earth’s fresh water is unavailable: locked up in glaciers, polar ice caps, atmosphere, and soil; highly polluted; or lies too far under the earth’s surface to be extracted at an affordable cost. 0.5% of the earth’s water is available fresh water.

If the world’s water supply were only 100 liters (26 gallons), our usable water supply of fresh water would be only about 0.003 liter (one-half teaspoon).

In actuality, that amounts to an average of 8.4 million liters (2.2 million gallons) for each person on earth.

Wow. When you think about the growing demand and declining supply of water due to factors such as population growth, urbanization, water-extensive agriculture, industrialization, and climate change, it is time to pay attention to this asset. Governments and corporations are more likely to get involved with water as securing and managing fresh water will become paramount for humans as a species. They have in some countries such as Australia.

There are ways to combat this. Desalination is the process by which salt water (sea water) is converted into fresh water. The issue right now is this requires a LOT of energy (another crisis which is upon us and the Europeans will probably experience this Winter). It is also very expensive given the chemical bonds in salt water are difficult to break. Dollar costs vary around the world due to labor and energy costs, land prices and other financial commitments, but it can cost from just under $1 to well over $2 to produce one cubic meter (264 gallons) of desalted water from the ocean. That’s about as much as two people in the U.S. typically go through in a day at home.

It is actually cheaper to switch to a source like river water or an aquifer. It is cheaper to use local freshwater than desalinated seawater but the price gap is closing. Perhaps green/clean technology such as solar or wind can make things more cost effective. Currently, the largest US desalination plant is in San Diego and is privately financed and developed.

I can’t say too much about this next technology so I won’t explore it too much, but it might be an interesting avenue for curious readers. Weather technology is improving. We have seen the Chinese use this extensively to clear smog in Beijing during the 2008 Olympics, and just recently in 2020 and 2021, the Chinese used cloudseeding to create artificial rain. One would think it would be possible to cloud seed to create fresh rain to top up fresh water supplies. Or even make it rain in places that don’t receive much. It warrants more investigation. Perhaps there are some negative effects to the atmosphere and maybe the artificial rain can’t be drunk? Regardless, this technology is likely to be kept with the government.

Both of these technologies are something to keep an eye out for in the medium to long term.

So how have I invested in water? Well, I should first off say that I am one of those guys who is big into drinking water. Team “don’t drink tap water”. Although I know that Vancouver has pretty clean tap water compared to the rest of the world, I still am big on filtered water. I alternate between reverse osmosis water and high 8.8 alkaline water. I note this because clean and pure drinking water is already becoming a trend. It is part of the health trend with consumers paying the extra bit for organic food and for vitamins and supplements. I also mention this so readers know that I take water seriously.

Perhaps the most popular way of investing in water in Canada is through the iShares Global Water Index ETF ticker CWW. Holdings include companies like American Water Works, Xylem, Essential Utilities, Ferguson, Tetra Tech and more.

Performance has been stellar since breaking out in 2014. CWW is now 20% off from its highs printed in December 2021. A pullback provides a great price for long term investors who are looking to enter a position betting on water.

Besides CWW, there are a few water stocks I have bought and followed. Many of them have been bought out and have been winners in my book.

Recently, a Canadian company has caught my attention.

Dominion Water Reserves (DWR.CN) is a hot stock! More on the technicals below.

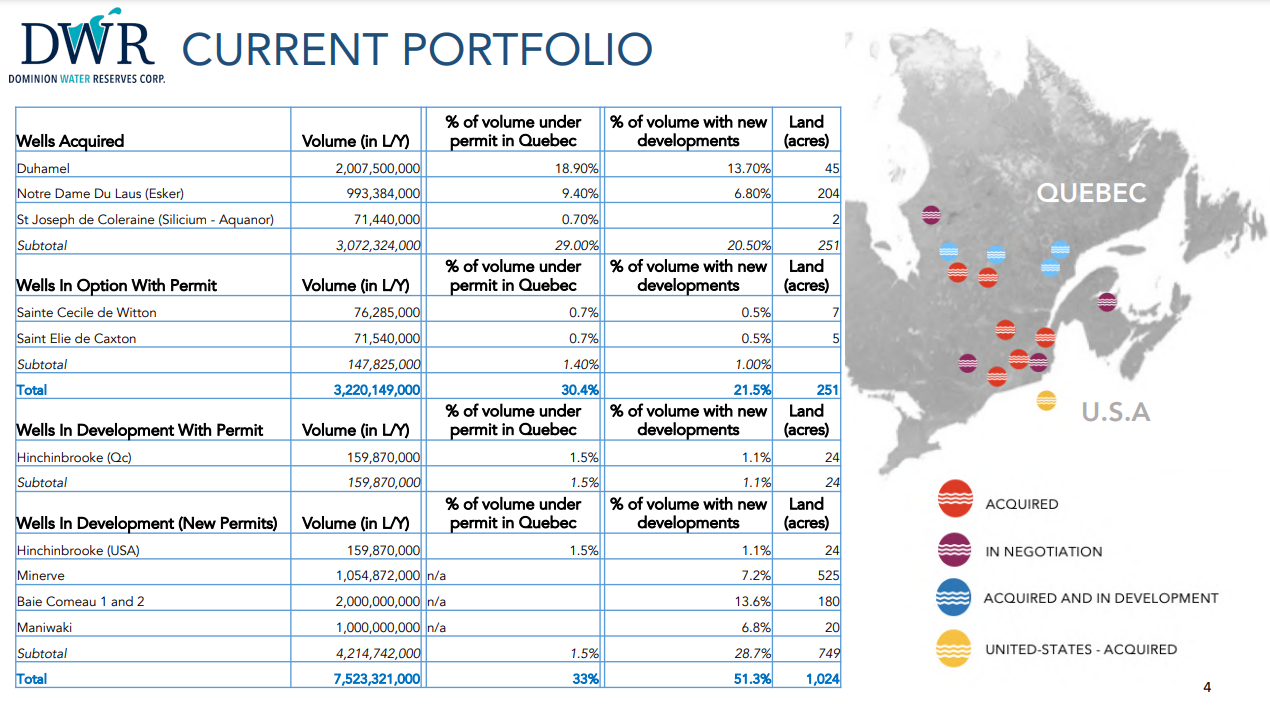

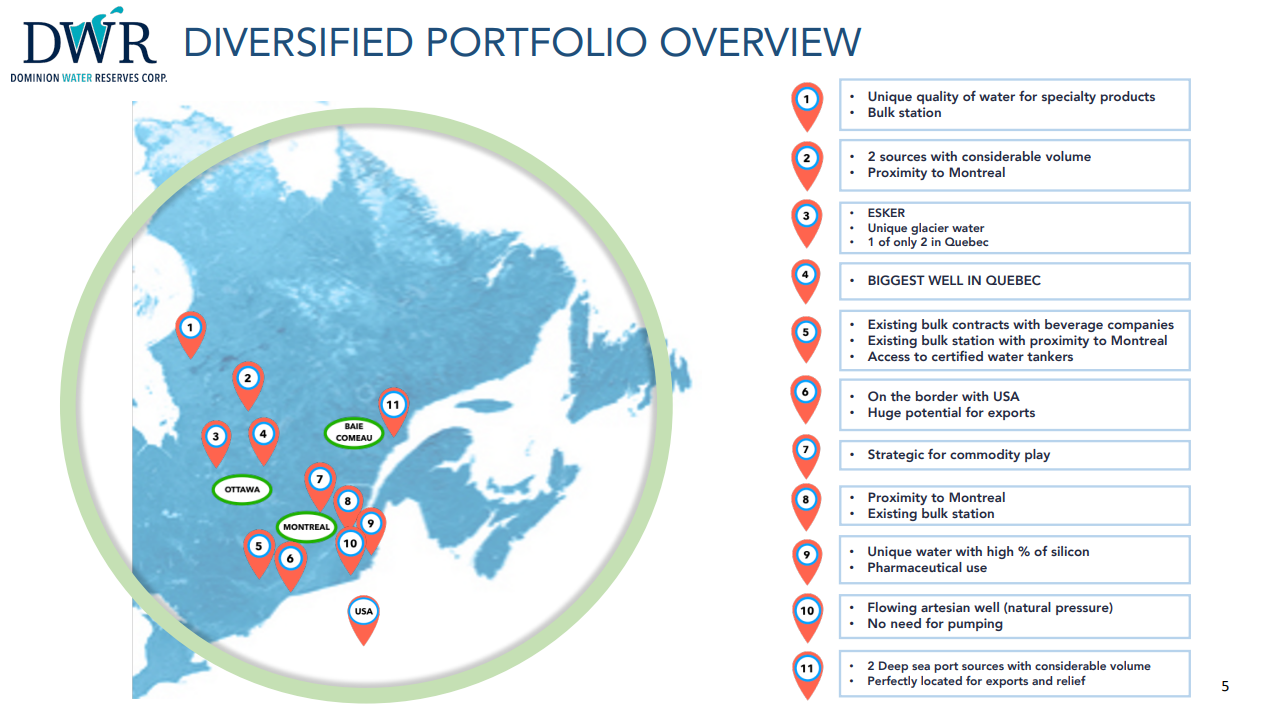

The company states that the new gold is blue. The goal is to acquire fresh spring water permits and developing operations across Quebec with plans to expand across Canada and the U.S. DWR is strategically positioned to control over 50% of Quebec’s volume of fresh groundwater reserves under permit currently and currently control close to 31%. The DWR team is working to develop innovative solutions, products and partnerships to promote and create value for this resource today and mainly for the future.

By consolidating the spring water market in Quebec, the company will be able to provide solutions to problems arising from the considerable imbalance between supply and demand of fresh water.

The close to 31% control of Quebec’s fresh ground water reserves (technically is 30.4%) comprises of over 3 billion litres of permitted spring water and a portfolio of 10 fresh water sources.

Dominion Water also entered a definitive share purchase with Aquanor Inc, giving Dominion a 100% interest in the St Joseph de Coleraine water source that features 71 million liters per year of permitted extraction volume and 13 ppm silicon content. This matters for the specialty water market, and Dominion will be able to sell this specialized water providing a revenue based.

So we have established the resource. Great.

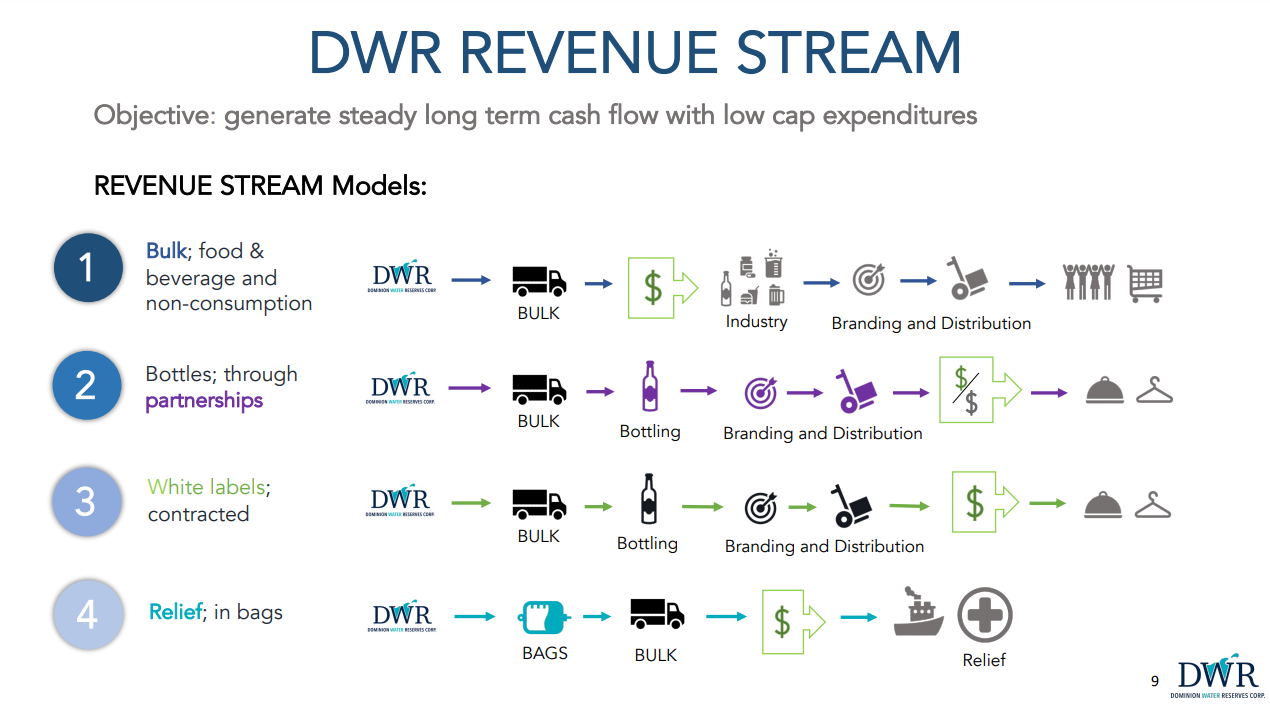

Some might be asking how will revenues come in? Well, I spoke about specialty water, but here are other revenue streams:

Future catalysts include acquiring more strategic water reserves. ROI includes the water sale contract with Aquanor, the introduction of a water trading strategy in the rest of Canada (this happened in Australia and Alberta which saw prices rise by 5,000%), potential government play with the nationalization of spring water which means the government will need to buy back permits (happened in Australia), and of course, potential for a complete buyout of the company.

The company recently appointed a new CEO. Olivier Primeau is the new CEO with previous CEO, Germain Turpin, stepping down but remaining a member of the board. Mr. Primeau is a serial entrepreneur and influential public figure in Quebec. He is notably a successful entrepreneur in the ready-to-drink and energy drink markets. His Beach Day Every Day brand is one of the largest ready-to-drink beverages in the Canadian market and is rapidly expanding in the United States.

A new CEO and money in the bank for momentum as Dominion Water just raised $3,350,000 with warrants at $0.10.

The stock has been on a tear ever since the news. Since September 8th 2022, the stock has risen 155% to recent highs. We have also had BIG volume with over 3.8 million shares traded yesterday (September 22nd 2022). This also saw double digits gains including a 33% green day on September 20th, and a 50% green day on September 22nd.

What next? Well I don’t see resistance until $0.22. There is more room to the upside. However, when a stock has made a run like this, you need to think some people will be taking profits. Watch for a pullback as an entry opportunity. The stock remains in a strong momentum uptrend as long as it remains above the $0.09 zone. This is the support zone we are working with.

In summary, if you are bullish water and want a play, then Dominion Water Reserves should be on your list. I am very interested in following this company’s story. It really is the right time and right place. With a market cap less than $20 million, there is a lot of room for growth and upside.