We resume uranium week here on Equity Guru! For those that missed out on the uranium fundamentals, take a look at yesterday’s uranium sector mini roundup. The charts remain the same, and we have very nice price action at all the levels I provided for readers.

A little spoiler: the uranium momentum is not over. However, we do expect a pullback.

One uranium junior that will benefit from the next uranium leg up will be Azincourt Energy (AAZ.V)

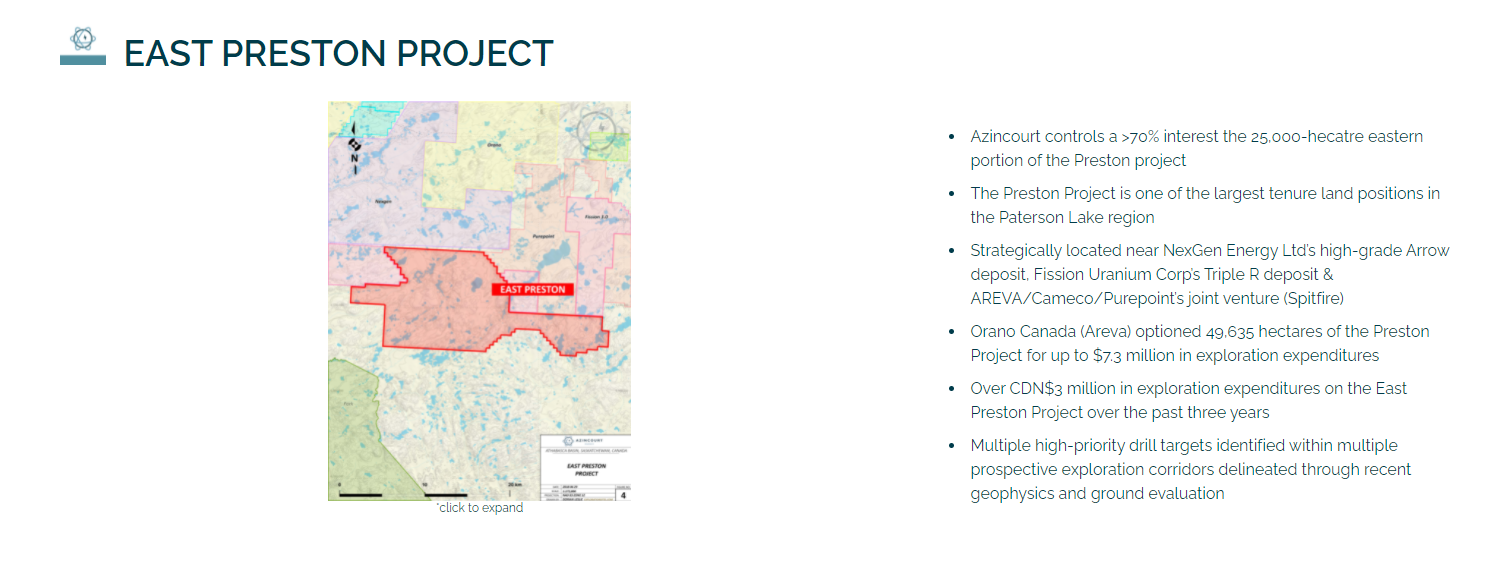

Azincourt Energy (AAZ.V) is a Canadian-based resource exploration and development company focused on the alternative fuels/alternative energy sector. The core projects are in the green energy space focusing on Uranium projects in the prolific Athabasca region. Good jurisdiction, and high grade Uranium. The place you want to be. Azincourt also holds lithium/uranium projects in Peru, on the Picotani Plateau. Currently, Azincourt is developing the East Preston uranium project, located in the prolific Athabasca Basin, with partners Skyharbour Resources (TSX.V: SYH) and Clean Commodities Corp (TSX.V: CLE) , and the Escalera Group lithium/uranium project in Peru.

The last project could be sold off to Oberon Uranium corp. A Letter of Intent was signed with Oberon an arms-length party, for a proposed transaction wherein Oberon would be granted an option to acquire the Escalera Group, a 100%-owned series of uranium-lithium exploration projects. Under the terms of the LOI, Oberon has 90 days to conduct due diligence on the projects, following which Oberon has the right to negotiate an option to acquire 100% interest in the projects from the company.

Azincourt controls a majority interest (72%) in the 25,000+ hectare East Preston project as part of a joint venture agreement with Skyharbour Resources (TSX.V: SYH), and Dixie Gold. Three prospective conductive, low magnetic signature corridors have been discovered on the property. The three distinct corridors have a total strike length of over 25 km, each with multiple EM conductor trends identified. Ground prospecting and sampling work completed to date has identified outcrop, soil, biogeochemical and radon anomalies, which are key pathfinder elements for unconformity uranium deposit discovery.

A drill program was completed at East Preston at the end of March 2022. The upcoming catalyst will now be the results from these drills. A total of 5,004.5 meters was completed in 19 drill holes over eight weeks. A total of 420 samples were collected throughout the program and sent to the Geoanalytical Laboratory at the Saskatchewan Research Council in Saskatoon, Saskatchewan for analysis. Complete assay results, expected to be received beginning in late April and into June, will be reported once received, reviewed, and verified by the Company’s QP.

The most recent news was the closing of a $5.1 million private placement. The company now has cash in the bank to deploy and initiate catalysts. In the same press release, Azincourt announced a share consolidation on a 2.5 for 1 basis, which upon completion, would mean there would be approximately 227,000,000 common shares outstanding.

Chris Parry recently had a chat with Alex Klenman, the CEO and director of Azincourt Energy. In The Gauntlet, Mr. Klenman addresses investor concerns over the 2.5 to 1 share consolidation. Check it out:

In terms of the chart, the technicals remain the same from my recent Azincourt analysis earlier this month.

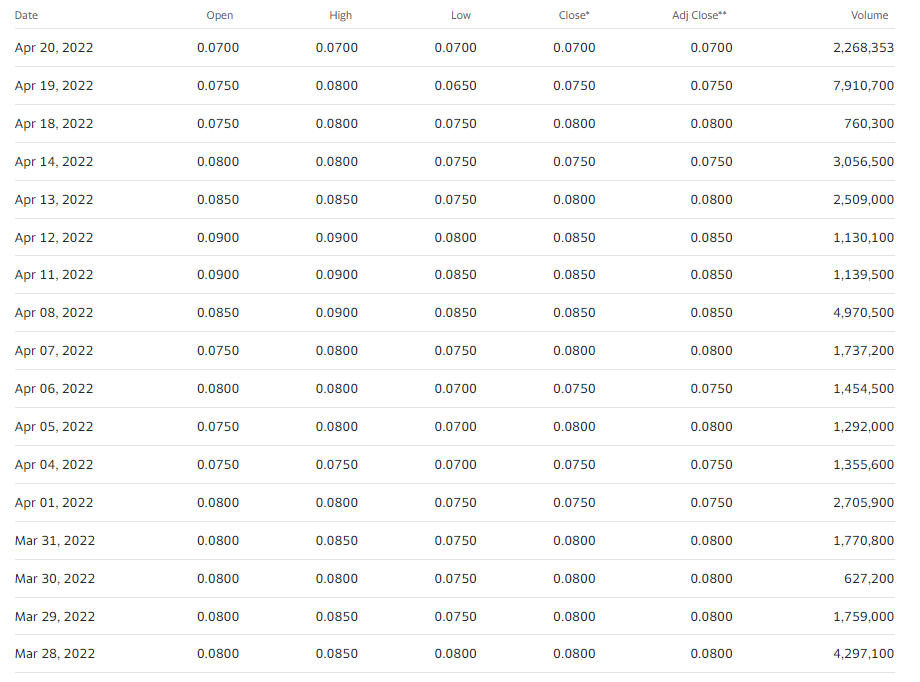

The stock is heavily supported between the $0.05-$0.06 zone. Not that it matters now because of the trendline breakout. We did pullback to retest the breakout on March 4th 2022. Buyers stepped in, indicated by the green candle and the large volume. We have had volume in the millions in the past few days.

We are now waiting for round 2 of the rip. Note how after a triangle breakout, the stock goes for a run! This happened back in August of 2021. The key here is going to be a candle close above $0.085. It is very likely this will coincide with spot uranium price confirming its breakout. We remain bullish on the stock above $0.05.

Adjusting my levels, we have support at $0.07 and resistance at $0.09. NOTE the prices will change after the share consolidation which will be completed by today. However, the market structure will remain the same.

From a risk vs reward perspective, Azincourt is very appealing. We have broken above technical zones and patterns, and are seeing big volume come in. The company has catalysts in terms of drill results, and has money in the bank to trigger more catalysts. I would wait to see how the share price reacts after the share consolidation. But this is definitely one of the uranium explorers to keep on your radar as the uranium bull market continues!