What a wild evening session for me last night. I had some market shorts, and I have been warning readers about the reversal structure on the weekly charts. On US markets AND global market indices. You can read my breakdown on US markets here, and the global market indices here.

Anyways, I was sitting in Japanese Nikkei shorts, German Dax shorts, and UK FTSE shorts. Just initiated them yesterday afternoon. Suddenly, I see major drops. Automatically, I assumed some sort of escalation in the Russia-Ukraine situation. News reports came out stating that Putin has initiated special operations. Certain military bases, even near Kiev, were hit. Pretty crazy stuff. My shorts printed.

Readers know I love my money flows. So automatically, I looked at the two markets that were open at the time (couldn’t look at bonds). Oil was ripping as expected, and the US Dollar was ripping. It still is by the way. Even potentially going to take out recent highs.

With the Dollar being the reserve currency, money still runs into it for safety. A lot of talks about the death of the US Dollar, and yes, this can happen in the future. But as for now, the US Dollar remains the best out of the fiat. The cleanest laundry in the dirty pile of laundry.

Gold also rocketed.

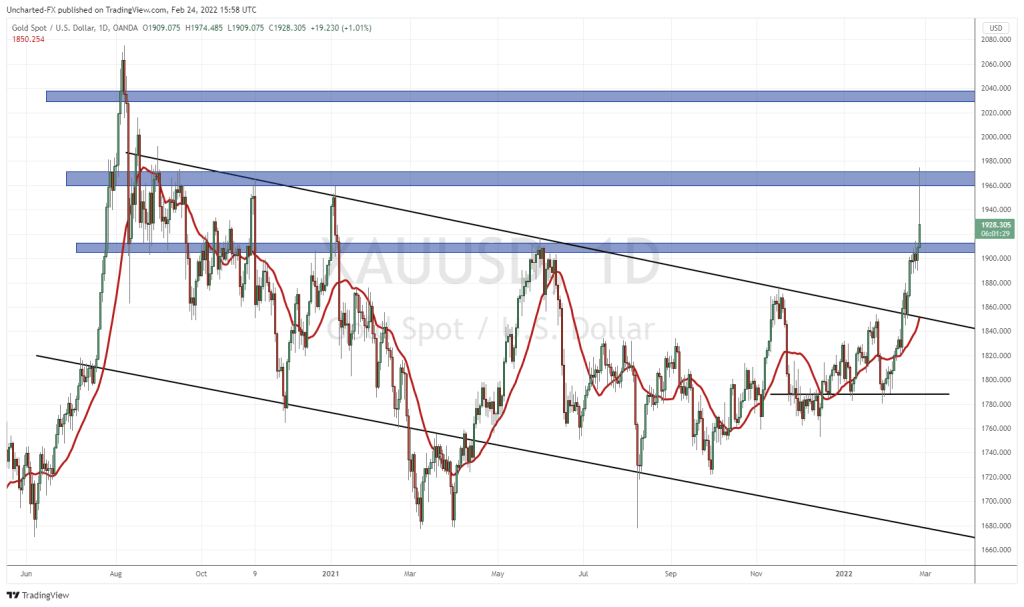

Gold has hit our SECOND resistance zone which I laid out in my Gold breakout article on February 14th 2022. Take a look at the price trajectory I laid out.

Gold hit the $1960 zone, and is now retreating. I will talk about this in a bit, but first, let’s take the time to appreciate Gold being a safe haven. Yes folks, both the Dollar and Gold can spike when it comes to a confidence crisis. In times of war, people do run into Gold because it tends to be money in any regime.

Currently, prices are retreating. Risk off assets are retreating. The big sign is from the bond markets. Yes, we gapped up, but are now selling off. Obviously this can reverse by the time this article comes out. For stock market traders, if TLT drops, then it would be a sign that money is leaving the safety of bonds. Not what you want to see in a risk off asset. This would hint at a stock market recovery.

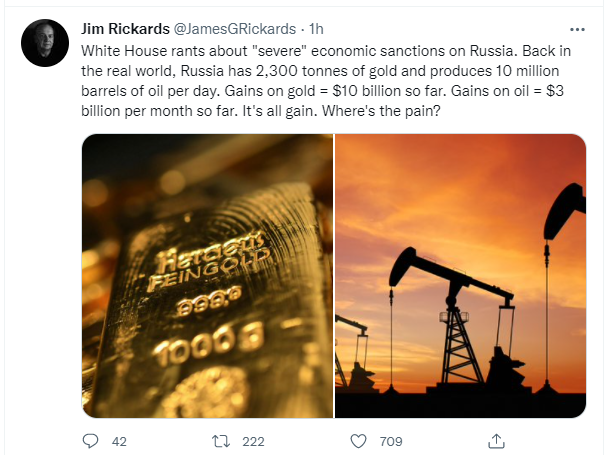

I should also mention that Gold is playing a pivotal part in the current geopolitical situation. President Biden is going to be unveiling the toughest sanctions ever on Russia. The US has been imposing sanctions on Russia for a very long time. Really doesn’t affect the Russians much…one large reason is because European nations still need Russian gas, so business with them is conducted.

Secondly, Russia has been playing chess. While the Russian Ruble depreciates against the USD and other fiat, Gold vs the Ruble appreciates, meaning sanctions that intend to hurt Russia don’t do so much damage. Barring a military conflict, the only other thing the west could do is to kick Russia off of the SWIFT system. But the issue once again comes back to European nations needing Russian energy.

By the way, China has a large stockpile of Gold. If Russia and China really want to make a dent in US hegemony, China would send ships near Taiwan. The US would then need to declare war against two nations. If they do not, it would be a sign to allies that the US won’t be coming to their aid. US hegemony takes a big dump. Other nations knowing this, would begin to make deals with the Eastern sphere.

Funnily enough as I write this, reports from Reuters is that Chinese jets are penetrating Taiwan’s air defense zone.

Let’s end off with one more chart.

Many crypto holders, which by the way I am, say Bitcoin is a safe haven. It sure isn’t acting as one. I have said many times here on Equity Guru that Bitcoin is acting like a RISK ON asset, and not a risk off asset. Bitcoin and other crypto’s have a positive correlation with stock markets. Meaning they dump when markets dump, and rise when markets rise.

Gold clearly acted like the risk off asset on initial headlines of war. Bitcoin did not, as it fell following the price action of market indices.

On a positive note, with stock markets recovering currently, Bitcoin will follow along. Why do I still hold some Bitcoin you might be asking? I still think it is worth holding as a bet against the debt. Remember, the real crisis continues to be with the currencies and central banks. The Fed may have bought some more time though with this geopolitical situation. They likely will not hike rates aggressively, and keep the cheap money going. Since Bitcoin and crypto’s are non-fiat assets, I think it is prudent to own some. I still prefer Gold and Silver more.

Let’s keep an eye out on what happens in Ukraine, but also what China may do here. US inaction might just embolden them.