This mini Plant Based technical round up will focus on Else Nutrition (BABY.TO) because of the current technical set up. I will also look at two new IPO’s in this sector: Plantable (PLBL.NE) and Cult Foods (CULT.CN).

Let’s face it, plant based foods and companies will be attracting investors’ hard earned money due to the ongoing climate issue. For those that want to focus on the sector as a whole, a newly created ETF, the Future of Food, is being traded under the ticker YUMY.

The ETF went live in December 2021, and has recently printed record lows below $22 in 2022.

“The growing global population and the concurrent threats from climate change are driving the need for more sustainable agri-food processes and technologies in order to provide for a future with more affordable, nutritious and safe food for all,” said VanEck’s Shawn Reynolds, who will co-manage the portfolio with Ammar James.

The firm sees opportunities in themes including precision agriculture, alternative proteins and sustainable packaging. One area of the industry — plant-based products — has attracted an abundance of capital in recent years, with firms like Beyond Meat Inc. and Oatly Group AB going public.

Bloomberg Intelligence anticipates sales of plant-based foods and dairy will quickly accelerate in 2022, and estimates that the global market could grow to $162 billion in the next decade from $29.4 billion in 2020.

Plantable Health (PLBL.NE)

Plantable is a clinically supported lifestyle change program that combines behavioral psychology, neuroscience and nutritional science to transform health and wellness. Plantable drives healthy weight loss and an improvement in performance, health and well-being, by bringing together plant-based meals, personalized coaching support and lifestyle tools to empower people to change their dietary habits.

Think of it as a combination of Noom and a food delivery app.

The signature product is the reboot program. A 28 day program for immediate results and habit change that lasts. This includes 48 chef prepared plant based meals, and one-on-one coaching with a personal coach and access to lifestyle tools.

The stock sold off, which tends to happen on an IPO. Early investor’s want to take some profits, which causes the stock to fall. Big action on January 28th 2022. A nice engulfing candle which is my favorite candle especially after a downtrend. Yesterday, we had another 22% pop.

Personally, I am one that waits for support and resistance zones to develop after an IPO. Also, it is prudent to wait for some earnings to determine the growth trajectory for the company. Right now, our two levels remain record lows at $0.18 and record highs at $0.44. The breakout can be a trigger for a long, and a breakdown could be seen as a sign to remain patient and wait for earnings and other news.

Cult Foods (CULT.CN)

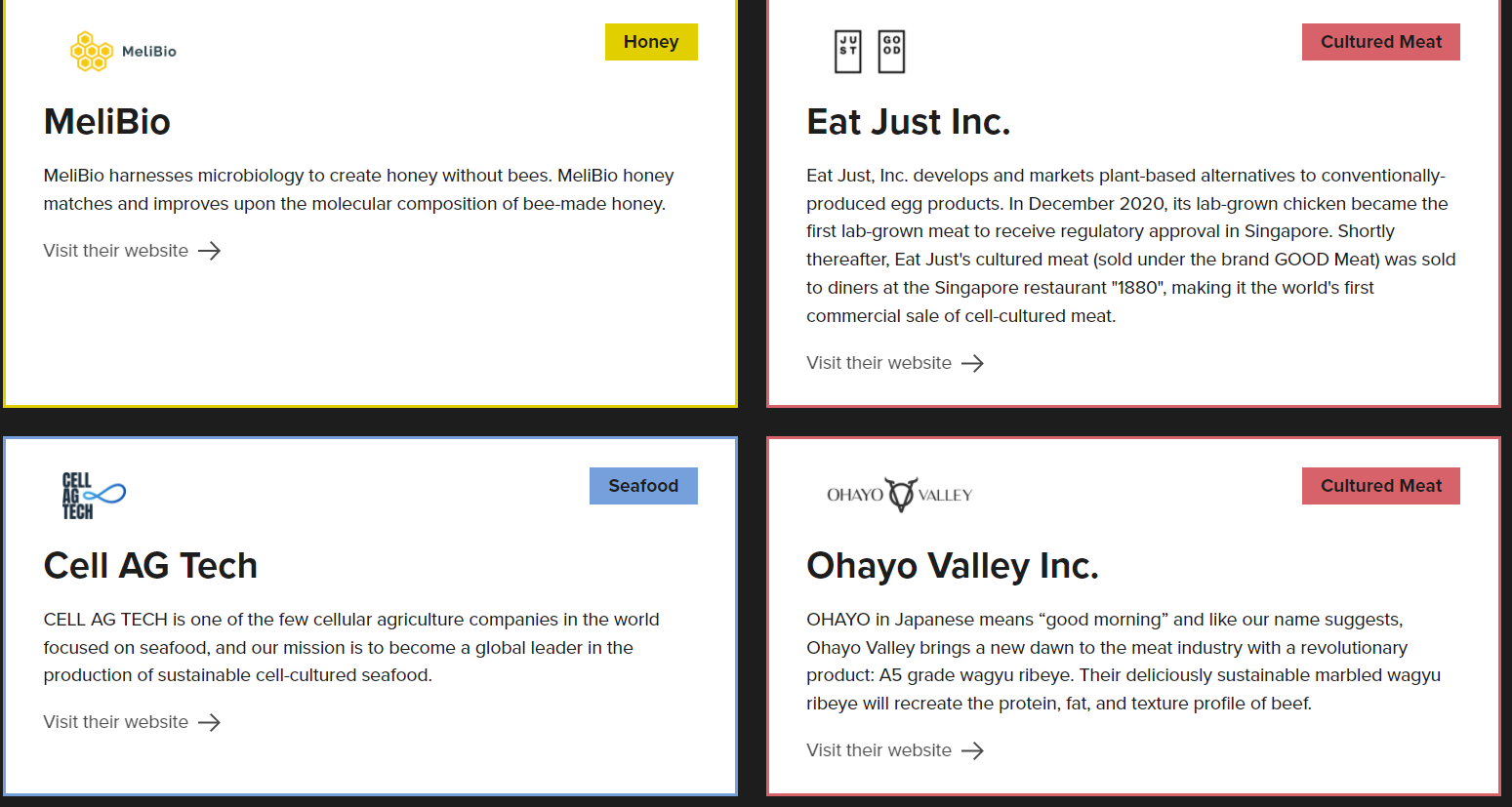

Cult Food Science is an innovative platform advancing the future of food with a focus on cultivated meat, cultured dairy and cell based food. Cultured meat is even something Bill Gates is supportive of. The rearing of animals does play a large role in affecting the climate. Soy based meat is one option, the other is lab grown cultivated meat. Cult invests and also is a startup incubator for companies in this field.

Below are some companies in the portfolio, but Cult deals with cultured proteins, cultured meat, honey, technology, seafood and cultured dairy.

The stock also recently IPO’d, and is now in a range. Once again, I prefer waiting for levels to develop after a couple of earning reports, but this range could be played. Obviously to the upside. If CULT gets a break and closes above $0.275, a breakout is confirmed and the stock could rally with sustained momentum.

Else Nutrition (BABY.TO)

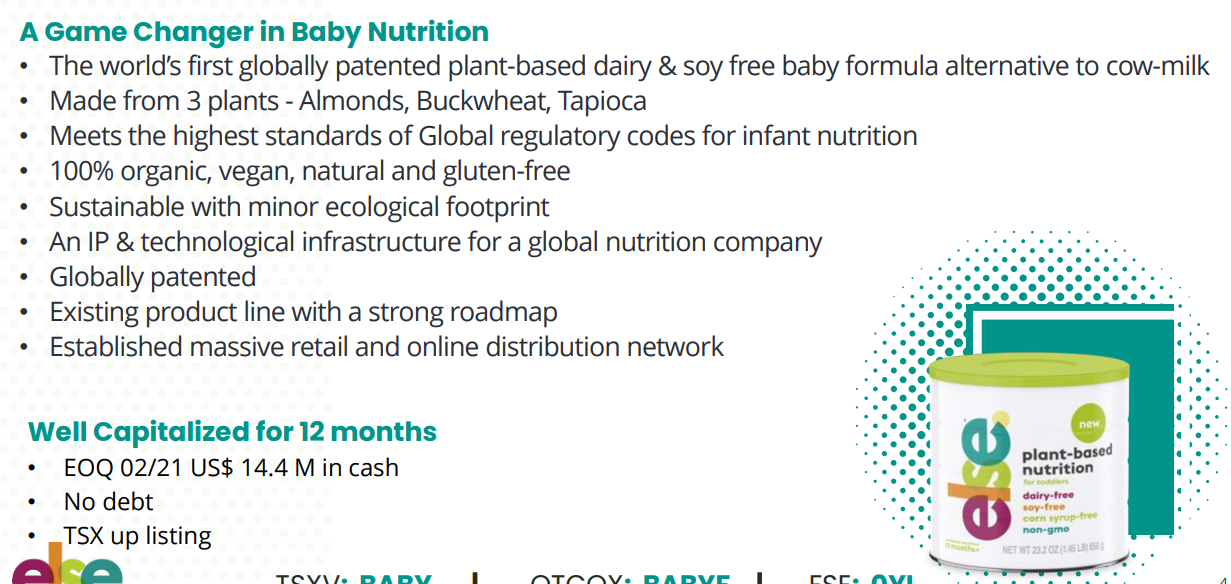

Else Nutrition is a company most of us are familiar with. The company innovates and creates plant-based food and nutrition products for infants, toddlers, children, and adults. It is mostly known for its plant based baby food, hence the ticker.

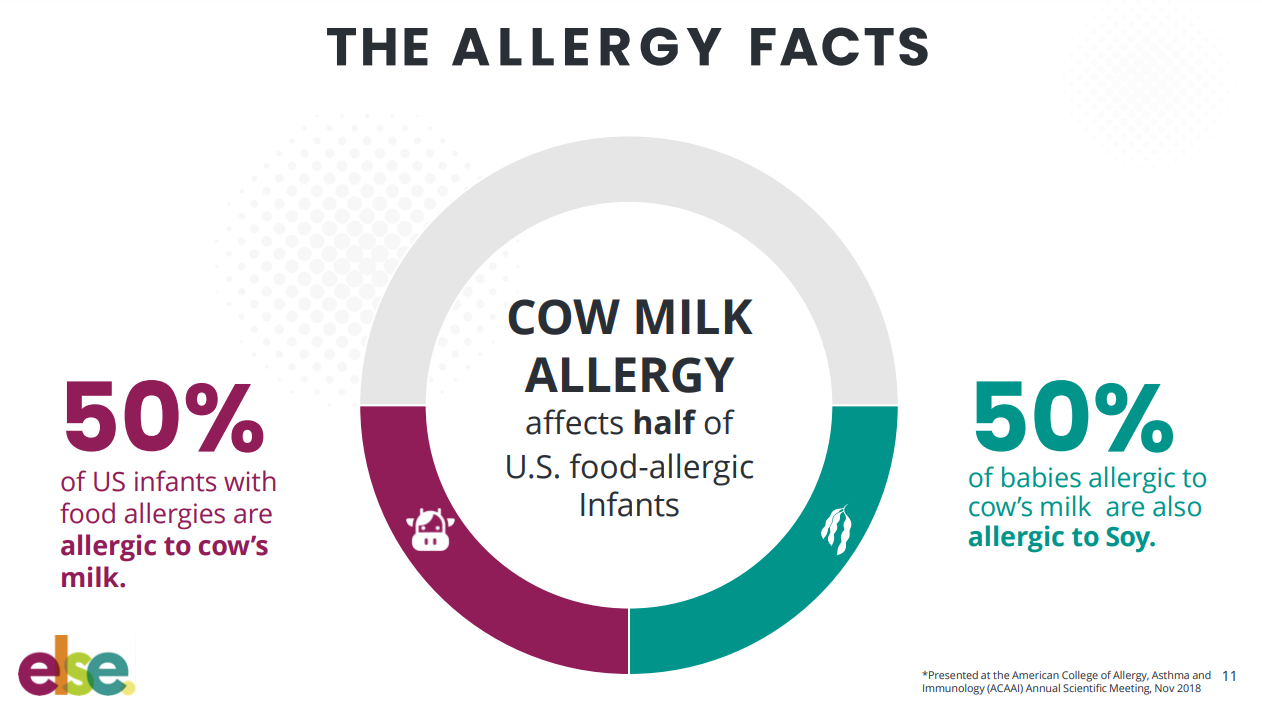

I did not know this, but the amount of infants with cow milk and soy allergies is quite high.

Else Nutrition recently announced an up listing to the Toronto Stock Exchange. They also announced a major deal with the largest grocery retailer in the US. A company you might have heard of called Walmart.

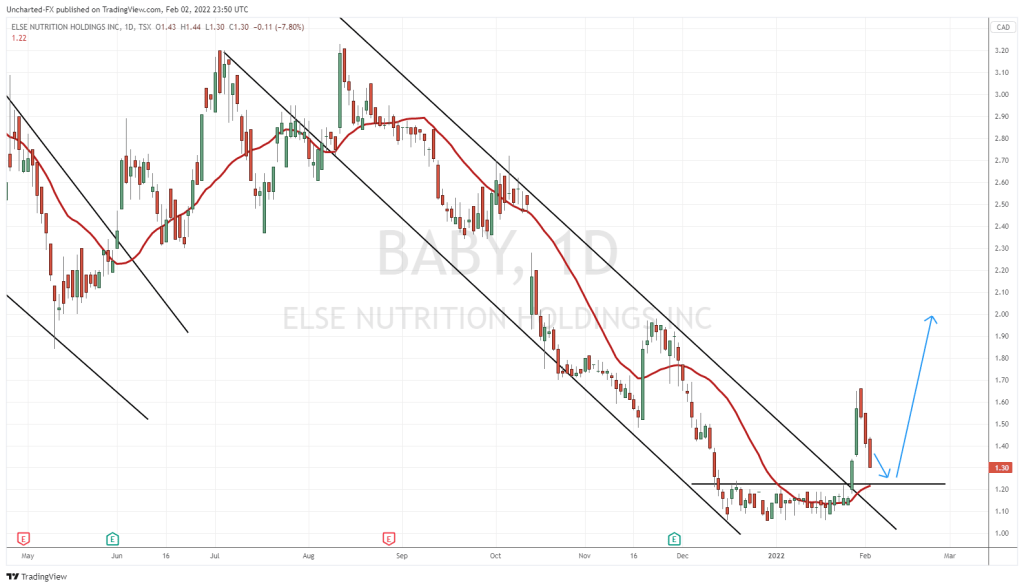

First off, a broader look at the stock of Else Nutrition. The stock made waves when the stock ripped up to record highs near $5.00 in 2020. Since then, the stock has drifted lower. No bad news or problems. To the contrary, the company kept putting out good news. This appears to be investors pulling out for profits. Which sets up a great opportunity for us.

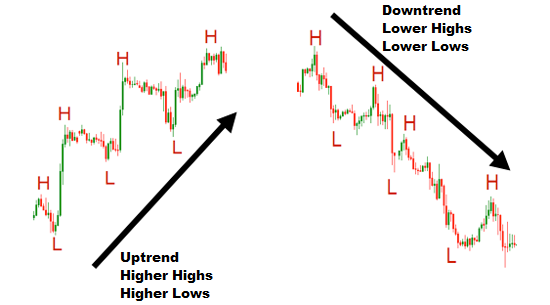

Zooming in, and we see a chart that I personally love to trade. I am a trend reversal trader, and this chart meets all of my criteria. A long downtrend, with basing at support indicating the exhaustion of the downtrend, and then the breakout.

The stock has been ranging just above the all important $1.00 zone for about a month, before breaking out on January 27th 2022. A breakout confirmation triggered. To add more bullish confluences, we also broke out of a channel which I have drawn for you. After the break, the stock has begun pulling back. To me this is normal as it hints to a breakout retest. Any asset tends to pullback to retest the breakout zone, giving buyers another opportunity to enter.

I expect to see a big wall of buyers ready to buy as we approach $1.20. There is a chance of a false break out. If the price of the stock falls below the breakout candle, or below $1.20, we can say the bulls could not sustain momentum and the breakout is a fake out.

I hope to see a new uptrend with multiple higher lows and higher highs.

The company has cash, no debt, positive news flow, an exchange up listing, and major retail news. The fundamentals and the technicals are aligning well and point to a new uptrend being triggered. I like what I am seeing!