In last week’s agriculture sector round up, I discussed the Canadian vaccine mandate for truckers. At the time of writing that week, the Canadian government was set to rescind the mandate because of supply chain consequences. All of a sudden, last minute, the Canadian government changed their mind and went forth with the vaccine mandate. The new rule now requires US truckers to be vaccinated to cross the border.

The mandate has exacerbated the shortage of truck drivers and made wait times at border crossings even longer. Eighty percent of trade between the US and Canada is transited by truck. America exports about 90% of Canada’s fruits and vegetables during the winter season. As shipments decline because only about half of US truck drivers are vaccinated, grocery stores report shortages.

“We’re seeing shortages,” said Gary Sands, senior vice president of the Canadian Federation of Independent Grocers. “We’re hearing from members they’re going into some stores where there’s no oranges or bananas.'”

According to North American Produce Buyers, the cost of sending a truckload of fresh produce from Southern California to Canada is now $9,500, up from $7,000. That means companies are paying more for freight and will pass on costs to consumers.

The situation will only worsen on Jan. 22 when the US begins imposing its vaccine mandate on Canadian truckers. The Canadian Trucking Association warned the mandate would sideline up to 16,000 truckers.

Canadian truckers are not happy, and recently blocked the highway near the US-Manitoba border to protest the mandates.

Supply issues are being felt in supermarkets that are already showing signs of food shortages. Food prices are set to move higher. The impact of food inflation is already being felt.

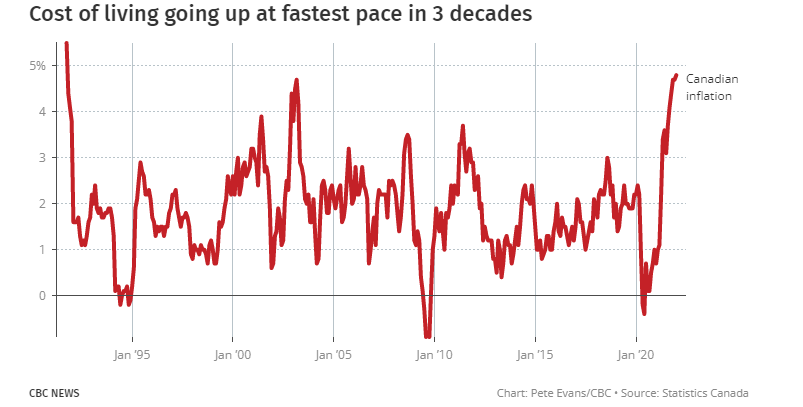

Canada’s inflation rate rose to new 30 year highs of 4.8%. Statistics Canada reported Wednesday that grocery prices increased by 5.7 per cent, the biggest annual gain since 2011. The price of apples has increased by 6.7 per cent in the past year, and oranges by almost as much — 6.6 per cent. The price of frozen beef has gone up by almost 12 per cent in the past year, while ham and bacon are up by about 15 per cent.

Any Orange juice fans? I am. And I am prepared to now pay more for my daily glass of vitamin C. Florida is experiencing a plant disease called citrus greening, and this major growing region is on track to produce the smallest number of oranges since 1945.

“If you’re an orange juice drinker, it means your prices are going to be going up at the store,” analyst Phil Flynn, with Chicago-based commodity trading firm Price Group, told CBC News. “The cost of orange juice has almost doubled here in the last few months, and that’s going to be passed down to the consumers.”

Orange Juice futures is a chart I highlighted a few weeks ago. We were watching that breakout. Orange juice just keeps going. I am thinking we will be seeing many commodity charts like this. Seeing big pops on Cocoa and Sugar this week.

As we look at some company news and charts, keep in mind that broader stock markets have actually broken major support and technical zones. You can read my Market Moment work if you are interested in markets, but it is not looking too good. This could be a sell off due to easy money policy ending, or it can be fear of something geopolitical with Russia.

CubicFarm Systems (CUB.TO)

CubicFarm Systems announced $1.26 million Hydrogreen sales in North and South Dakota. Nine Hydrogreen Grow System modules to be exact. HydroGreen Certified Dealer Grohs International initially committed to selling 12 HydroGreen Grow System indoor growing technologies to its customers in 2022. In the first month of the year, Grohs International has placed orders for nine of the 12 and signed the contract to purchase the modules from CubicFarms, which represents equipment sales valued at approximately CAD$1.26 million.

Total sales commitments to date from members of the HydroGreen Certified Dealer Network include more than 100 modules in 2022, valued at over CAD$21.5 million.

Chart wise, things remain the same. CubicFarms is still holding the major support zone above $1.00 and is providing a great zone for an entry at this highly psychological support level. I am still keeping tabs on this as a breakout watch. A reversal pattern can be confirmed with a break and close above $1.20-$1.25. That is what I would prefer to see.

But it should be said that CubicFarms is holding up relatively well given what is happening in other markets, both small and large caps.

MustGrow Biologics (MGRO.CN)

No news but a tad bit of speculation here on MustGrow. The company halted trading yesterday at 10:47 EST at the request of the company pending news. From the open to the halt, just a tad bit over 200,000 shares were traded. This could be big and great news for shareholders. Rampant speculation on message boards. By the time you are reading this, the news might be out and the stock resumes trading. Perhaps it is something to do with the trials with Sumitomo.

Can we predict what the news will be by looking at the chart? Not really, although sometimes one can based on volume profiles and if the stock is bottoming after a long downtrend. In the case of MustGrow, we still remain supportive above $3.25, with major resistance coming in at $5.60. Halts and resumptions generally cause major gaps. Of course if this news is good, we can possibly gap to the upside. If it is negative, then look at support around $2.25.

Earth Alive Clean Technologies (EAC.V)

Earth Alive Clean Technologies Inc. develops, manufactures, and distributes microbial technology-based products in Canada, the United States, Central and South America, Europe, Africa, and China. The company operates in two segments, Agriculture and Infrastructure & Maintenance.

This week, Earth Alive announced a follow up purchase order for its proprietary ea1 dust suppressant from a leading global mining company in Mexico. A lot of silver miners down there.

This order is in the amount of US $473,000 and is the 7th consecutive purchase of ea1 by this mine since 2018 totaling $4.7 million in aggregate.

Being a reversal trader, I must say this chart catches my fancy. I really like what I am seeing. In the past, I have spoken about this major support zone. The stock did break below, printing new record lows, but now we have closed back above confirming a false break down. A few months ago, the company reported the most earnings in its history. Volume can be a hit or miss, but the stock has seen 172,000 and 587,000 volume days this week. When I see this at support, I get intrigued. Earth Alive can easily be setting up for a major reversal.

Water Ways Technologies (WWT.V)

We did it! New record highs on Water Ways Technolgies!

Last week, we discussed the retest of resistance. I said we will approach this as we do with all breakout plays. We wait for the candle confirmation of the breakout. We got this on January 17th 2022. And further continuation after a green close with great volume. Big volume over 500,000 shares followed on the 19th and the 20th.

When I fib the latest move on the daily, we actually have hit my extension. I also think $0.50 seems like the next important resistance level.

I would love to see a pullback back to $0.35 for a re-entry and a breakout retest, but the stock is very strong. Performed very well given the broader stock market sell off.

EarthRenew (ERTH.CN)

I spoke about EarthRenew last week, but their chart still remains my favorite set up in the space. A trigger is nearly confirmed.

I have been closely following this basing after a long downtrend. The stock has been in this range since Fall 2021. A breakout is looking very likely. We just need that daily close above $0.20. It would be a great way to end the week if we get this close on Friday.

The company did announce positive results for its 2021 product field trials with Replenish Nutrients (a subsidiary of EarthRenew) Lethbridge College and Biome Makers. I covered this last week. So we do have a future upcoming catalyst that can support this breakout and new uptrend in the stock price.

Argo Living Soils (ARGO.CN)

Argo Living Soils is an agribusiness company specializing in producing and developing organic products including soil amendments, living soils, bio‐fertilizers, vermicompost, and compost tea kits formulated specifically for high value crops.

This week the company provided a corporate update. Production of their fungal dominant vermicast fertilizer at the Galiano Island farm has ramped up. In addition, newly designed composting bioreactors are being brought online. The new bioreactors are more efficient, and user friendly. These bioreactors will continue to produce Argo’s proprietary fungal dominant feedstock, which is the principal worm feed digested in the second stage of the process, in the vermicast reactors.

Argo’s Specialty Fertilizer is as much as seven times richer in phosphates than basic soil that has not been digested by earthworms. Their Specialty Fertilizer has approximately ten times the available potash, five times the nitrogen, three times the usable magnesium and is one and a half times higher in calcium. Very interesting given the fertilizer shortage the world could be headed towards.

A month ago, the stock broke out of a range. The breakout did not lead to further momentum. The stock could be pulling back to retest the $0.25 zone once again. We shall see if buyers step in. The stock sees sporadic volume here and there so I would want to see more than average volume on that retest.

Deveron Corp (FARM.V)

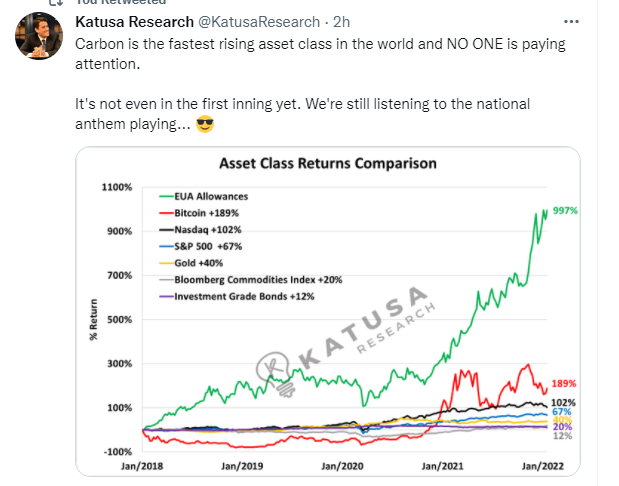

Anyone interested in the Carbon Credits market? Well you should be. Marin Katusa in his latest book wrote about why this market will be the next big opportunity.

I have been looking for Carbon Credit plays since I read his book, and Deveron is one of them.

The company is an agriculture digital services and insights provider in North America, and has signed a $750,000 enterprise contract with carbon-credit focused investment company Generic Carbon Credit. The contract provides the client access to Deveron’s new scalable and streamlined platform for collecting, analyzing, and sharing in-field soil carbon data. Additionally, Deveron will work with Generic to create, certify and invest in Canadian carbon credits. This is now the fifth enterprise contract signed to use Deveron’s carbon services platform since its launch in Q3 2021. It is the first to include the purchase of credits directly from the company.

“Deveron has invested significantly in our digital ecosystem and boots on the ground network to create a vertically integrated soil carbon data solution. This network uniquely positions Deveron to act as an intermediary between buyers of carbon credits and the aggregated growers, allowing for buyers to acquire any volume of credits to match their ESG needs,” said David MacMillan, Deveron’s President and CEO.

The stock remains in our large triangle pattern, and we just await the breakout. Hopefully to the upside. I am liking the support at $0.70, and if price remains above this level, it is a good chance we breakout of this triangle.

Agrify (AGFY)

I am ending off with another potential bottoming play. And it looks really promising.

Agrify announced record bookings of over $250 million in Q4 2021.

The more than $250 million in new bookings for the fourth quarter of 2021 is $150 million greater than the previously provided fourth quarter guidance of $100 million and over $220 million greater than the bookings the Company generated in the third quarter of 2021. The new bookings are an operational metric comprised of the Company’s sales of its state-of-the-art cultivation and extraction solutions, including its Vertical Farming Units (“VFUs”), as well as the expected revenue from Agrify’s Total Turn-Key Solution (“Agrify TTK Solution”) agreements over the first three years of cultivation. The Company expects to generate substantially more value over the full 10-year term of the TTK partnerships.

“Our record high revenue and bookings this quarter are a testament to the current strength of our business and our growth trajectory,” said Raymond Chang, Chairman and CEO of Agrify. “2021 was a transformational year for Agrify. We have seen significant and consistent improvement in our financial results quarter-over-quarter. Additionally, the introduction of our TTK Solution has proven to address multiple pain points in the rapidly evolving cannabis and hemp industry, while simultaneously creating compelling and long-term value for our shareholders. We look forward to providing a more detailed update on our recent progress and future prospects during our next earnings call.”

The stock has reached a major support level. Previous all time record lows. If this stock is going to bounce, there isn’t a better zone than this. Really will be watching for a large wick candle or a large green candle. My only worry is the overall stock market sell off. If markets weaken, Agrify could find itself making new record lows. This is why we wait for our confirmation candles.