The short arc of blockchain’s relatively short history has been a collective, ongoing story of beating the odds. At first it was for basement dwelling geeks and they would fizzle when actual adults started playing with it. Then it was going to zero when it got over a dollar, ten dollars, a thousand dollars and there’s probably someone out there chomping down on their A&W Mama burger in the greasy food court of some shady mall pontificating that it’s going to zero any day now.

But against all odds. Yeah. It hasn’t.

The first story is an example of how cryptocurrency can both simultaneously be the butt of its own joke.

The biggest winner in this year’s crypto sweepstakes has been Dogecoin to date. Weird.

November usually isn’t the right time to look back on the year. It’s too early. There’s too much time left and literally anything can happen, and probably will. But it’s also hard to deny that this year has been especially strange for cryptocurrency.

For example, so far in 2021, investors have thrown US$8.9 billion into crypto related products, which is almost one third more than all of 2020’s crypto spending. Let’s also pause a moment and recognize that this year’s big winner in the cryptocurrency growth sweepstakes has been the joke coin about the little dog—the original little dog. Dogecoin has been the source of a lot of conversation, and no small amount of consternation as Tesla’s (TSLA.Q) CEO and certified Bond villain Elon Musk is apparently testing Doge for payments under the code name ‘Shiba.’

As if that wasn’t confusing enough. There are now three coins using the Shiba Inu image—including the coin, Shiba Inu. Regardless, AMC Entertainment Holdings (AMC.NYSE) is on board with accepting Doge at its theaters. This could open up new vistas for crypto. About doge, though, for the coming year? Even odds. It depends on how the Cult of Elon reacts to their Bond villain messiah’s tweets.

Sweden adopts their first digital currency

The perfect response to the haters and skeptics giving strong odds on cryptocurrency going to zero is that governments are starting to give it serious attention. If we’re being completely honest here, I was not expecting El Salvador to be the first company to adopt an official cryptocurrency. When China came out with the Digital Yuan, I don’t think anyone was surprised. Their love-hate relationship with cryptocurrency had been ongoing for years and it was only a matter of time before they went all in.

Now Sweden has created and adopted its own cryptocurrency. They’re calling it the eKrona, and it fired out the gate at $0.02.

Apparently, it’s been baking for awhile and been through a few iterations before finally going live. Even as I was reading more into it, I remember vaguely hearing about it in the distant past. And by distant I mean last year. But it was always one of those peculiar, vague rumours that float around the crypto-sphere and generally to be taken with a heaping load of salt.

Well, it’s here. Curiously enough, it won’t be a stablecoin. Instead, it’s going to float freely complete with volatility and competition with other coins. Naturally, you’ve got one exchange option to buy and sell, but you’ll have that with a government backed coin, and I wouldn’t necessarily expect any eKrona millionaires to come from this coin until the government gets it out to more distributors.

Bakkt Holdings extends its offerings to ETH

Adding onto the story of the country of Sweden adopting a crypto, the use cases for digital currencies are steadily increasing,

Last week Bakkt Holdings (BKKT.NYSE) indicated they were going to offer their users and partners the ability to buy, sell and hold Ethereum. They’ve already been doing this for Bitcoin for years now, having produced the first physically delivered Bitcoin-based future’s contracts in 2020 when they first came on our radar.

“At Bakkt, providing flexible opportunities for users to enjoy their digital assets is a top consideration, and adding Ethereum brings a popular and growing cryptocurrency to our roster. Bakkt users have already enjoyed the app’s capabilities to leverage bitcoin and we are confident that our addition of Ethereum will be a complement to our growing ecosystem of partners and assets,” said Gavin Michael, Bakkt CEO.

The global cryptocurrency market size is projected to reach USD 4.94 Billion by 2030, growing at a compound annual growth rate of 12.8% from 2021 to 2030, according to Allied Market Research.

A Few Mining-Related Quick Hits

The9 Limited (NCTY.Q) mentioned earlier this year their NBTC Limited, their subsidiary, and a Kazakhstan company LGHSTR entered into a non-binding agreement to form a joint venture in Kazakhstan. NBTC will get 51% and LGHSTR will get 49% of the JV respectively. The plan is to invest in and build places where they can theoretically mine cryptocurrency with a total capacity of 200MW within the next two years.

Clearly, odds are good it won’t be Bitcoin they’re mining but there’s definitely room in the more popular altcoins to make money with that amount of megawatt offering.

Earlier this year, Sphere 3D (ANY.Q) announced their intent to merge with Gryphon Digital Mining, a private bitcoin miner making broad use of renewable energy. The newly merged company will take Gryphon’s name and focus on expanding their digital mining operations while using Sphere’s enterprise solutions to optimize said mining processes.

“Gryphon’s future focus on mining using 100% renewable energy will set the bar for mining companies of the future. We have been engineering GPU-based converged systems for many years and are excited to leverage our experience to enhance the performance of Gryphon’s operations. We believe the merger of the two companies provides an excellent opportunity to create meaningful value for our shareholders,” said Peter Tassiopoulos, Sphere 3D’s CEO.

Finally, Hello Pal (HP.C), the former Chinese-based cryptocurrency miner meets language acquisition school, is to complete their migration from mainland China. They leveraged the relationship they have with Shanghai Yitang Data to carry out a thorough review of the best potential mining locations, and decided to send the majority of their mining rigs to New York State. All locations are hydro-powered and in line with the company’s dedication to only using clean renewable energy to mine their coins.

“We expect that the relocation of our mining operations to North America will set us up for long term stability in our crypto-mining operations. In turn, this will provide us a solid base to execute our plans of integrating crypto into our social networking core business,” said KL Wong, founder and chairman of the company.

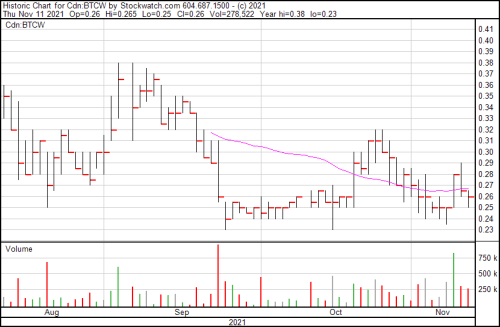

Bitcoin Well bucks the odds through Montreal and Winnipeg expansion

Bitcoin Well (BTCW.V) opened two new retail customer over-the-counter shops in Montreal and Winnipeg, and launched their 200th ATM in Canada. BTCW builds and uses products to help facilitate the adoption of Bitcoin. These OTC shops give shoppers looking to spend larger bitcoin amounts the opportunity to do so, but also will service the small guy looking to learn about the cryptoasset.

“I’m excited that Bitcoin Well continues to grow more rapidly than anticipated by our internal forecasts and that we continue to realize our vision, by allowing customers to access Bitcoin in the fastest and safest way possible,” said Adam O’Brien. “The white-glove approach offered through our OTC model allows us to adapt to the customers’ needs and gives our team more flexibility to proactively connect with the local community, rather than waiting for them to come to us. We will continue to execute our aggressive growth strategy by opening additional OTC offices and expanding our fleet of Bitcoin ATM machines around the world.”

They’re not going with a traditional retail location setup either, but instead working form a full service office space with flexible hours to work around their customer’s schedule.

New Cryptocurrency Compliance Cooperative (CCC) takes aim at bad actors in crypto

Certainly by now you’ve heard of the Crypto Climate Accord. It’s the initiative put forth by companies like Mogo (MOGO.T) and DMG Blockchain Solutions (DMGI.V) towards resolving Bitcoin’s (actually all of cryptocurrency’s) nasty environmental issues. That’s only one half of the compliance requirements that make up the large part of crypto’s bad reputation.

The other is crime. The Cryptocurrency Compliance Cooperative (CCC) is a collaborative association led by top Bitcoin operators and blockchain industry types working for compliance standards in the cash-to-crypto industry. They held their first meeting with members back in October, wherein they announced 11 new signatories, but also put down the opening framework for how the nearly 30-member group will move forward with its aims of making a safer environment for consumers.

“It was amazing to see representation from so many different organizations in the cash-to-crypto industry at our first meeting, and we are thrilled with the amount of interest that we’ve received from prospective members since our launch just a few months ago. This industry can be a crucial mechanism for getting individuals involved with cryptocurrency. Our goal is to make the cash-to-crypto industry as safe and sustainable as possible, and that starts with getting the right voices in the room,” said Seth Sattler, director of compliance for DigitalMint and leading contributor of the Cryptocurrency Compliance Cooperative.

The CCC organized their next few months during the meeting. They intend to establish strong public and private partnerships, with efforts placed on dialogue and building relationships with law enforcement agencies and regulators at the federal, state and local levels, and narrowing their collective influence on battling money mule activities using anti-human trafficking initiatives.

New members included:

- TRM Labs – www.trmlabs.com

- Crystal – https://crystalblockchain.com/

- Blockchain Intelligence Group, a subsidiary of Bigg Digital Assets (BIGG.C)

- ComplyAdvantage – https://complyadvantage.com/

- Hummingbird – https://hummingbird.co/

- Castellum.AI – https://www.castellum.ai/

- Bitcoin Whos Who – https://www.bitcoinwhoswho.com/

- Q6 Cyber – https://q6cyber.com/

- Marinus Analytics – https://www.marinusanalytics.com

- Feedzai – https://feedzai.com/

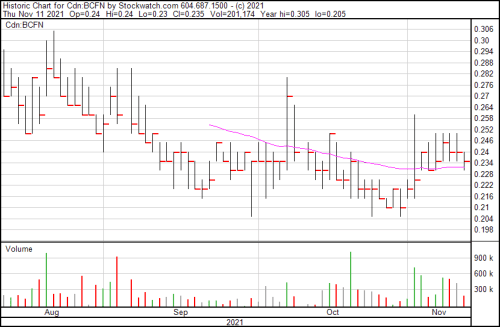

Speaking of Blockchain Intelligence Group…

They’re now able to completely integrate Syscoin into its ecosystem. If you’re unfamiliar with Syscoin, it’s the technological firstborn of blockchain mavens Blockchain Foundry (BCFN.C), which is incidentally an equity guru former client. Syscoin is a proof-of-work blockchain with a hashrate second only to Bitcoin. It’s trustless and combines Ethereum and Bitcoin protocols via technological bridge into one system to power tomorrow’s distributed applications. It’s cool.

“By joining the BitRank Verified ecosystem, we are able to offer compliance and a regulatory framework to Syscoin customers for the first time on a public ledger that brings the same benefits as traditional financial services,” said Jagdeep Sidhu, Syscoin Foundation president and BCF chief technology officer. “These benefits will integrate seamlessly for users all while they hold their tokens in their own digital wallets.”

What BCFN is getting is none other than Blockchain Intelligence Group’s BitRank Verified solution, which gives banks and businesses the jump they need towards reducing risk and getting ahead of the curve in terms of the coming regulations. It places a certain risk factor on any given wallet, with a higher score going towards high odds criminals (and other bad actors) like Tony Soprano’s Bitcoin wallet than say, Jerry Seinfeld.

“Interoperability is the future of blockchain, and as more organizations seek out the benefits of crypto, our solutions are their north star for securing and legitimizing the future of finance,” said Lance Morginn, president at Blockchain Intelligence Group. “Integrating Syscoin is a proof point to the vision we share with our partners: building the future of cryptocurrency’s global adoption and utility.”

Lion’s, Tigers and NFT’s—oh my!

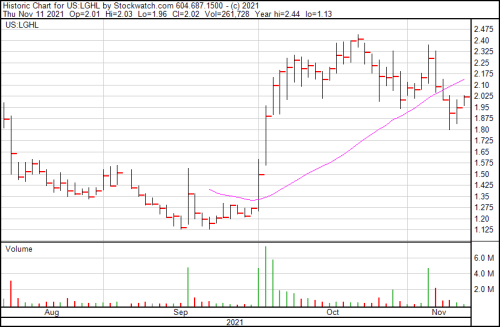

Lion Group Holding (LGHL.Q) launched its Metaverse project, Lion World, today. Presumably there’s lions involved, but given that this company exists simultaneously in some strange quantum superposition as a trading platform that also does insurance brokerage, futures and securities brokerage, total return service trading, and NFTs, we can’t entirely be certain. Seriously, we need Werner Heisenberg out here to decipher this strange messaging.

Mostly because their advertising is bonkers and makes no sense. They apparently have something against embeds, so you’ll need to shoot the link listed before to see their promo video. Maybe it’s just me, but I couldn’t figure out what it is they were selling—was it a video game? Was it a version of the Oasis from Ready Player One?

It wasn’t until I went to YouTube and went for a look around that I discovered it was an actual trading platform from China, not unlike Robin Hood (HOOD.Q) over here.

Just on sheer morbid curiosity alone, I went into their investor deck to see what kind of weird monkey dung they have hanging on the walls—and was pleasantly surprised. The company itself presents itself well in its pitch deck, the stats aren’t bad and the chart looks promising. It’s their art department that needs a change. Maybe don’t get the monkeys drunk this time. See what happens to your odds of success.

Voyager Digital Caps Off Miracle Year with One Million Funded Accounts

Against all odds Voyager Digital (VOYG.T) jumped from a $2 stock this time last year to where they are now at $23. Don’t believe me? I’ll drop the year chart at the bottom. This is really what you can expect from the cryptocurrency and blockchain sector. For every five companies that go bust or go nowhere, there’s going to be one or two that are going to blow up. On the mining side, we have Marathon Digital Holdings (MARA.Q). They were well below $5 two years ago, and now they’re up hundreds of percentage points.

Now Voyager Digital has surpassed one million funded accounts on its platform, which is a 23% increase from last year, when it was coming in at 43,000 accounts.

“Reaching one million funded accounts is an incredible milestone for Voyager,” said Steve Ehrlich, CEO and co-founder of Voyager. “Our strategy of focusing on our loyalty program and on customer acquisition in the September quarter paid off extremely well for us as we continue to gain market share reflected by our increased App Store rankings.”

They’ve also picked up considerable marketing partnerships, including professional athletes Landon Cassill and Rob Gronkowski, and a five year deal with the Dallas Mavericks.

—Joseph Morton