This news shouldn’t have come as a surprise to us bullish agriculture, but news outlets are reporting on the growing indoor farming market size. And we are playing this sector because we want a piece of that pie.

Rising population and climate change are the reasons why farming will be moving indoors, into controlled environments. This has also been our bullish case going back to my maiden Agriculture sector round up.

Grand View Research has come out saying the indoor farming market will reach $75.3 Billion by 2028. Here are some points they mentioned:

The increasing demand for food owing to the rising population is expected to drive the growth. Factors such as declining water supply, urbanization, and climate change have contributed to the loss of arable land. This in turn is driving demand for indoor farms to produce food. The challenges, such as rising global temperature and extreme weather conditions, act as a barrier in the traditional farming technique.

Indoor farming increases the crop yield and reduces the farming impact on the environment by reducing the distance traveled in the supply chain. It reduces the need for the land space required to grow plants compared to traditional farming methods by using growing shelves mounted vertically. Rising consumer awareness regarding the consumption of healthy and fresh food is anticipated to positively influence the growth of the market for indoor farming over the forecast period. Furthermore, the use of technology, such as LED indoor farming to create nature-like conditions will help farmers meet the expected demand for food supply in near future.

I like the supply chain tie in. Reducing the distance traveled in the supply chain is something I never thought about. I always approached indoor farming as being able to grow things anywhere any time, so countries with not much arable land would also benefit. Reducing burden on supply chains is another bullish case, especially as they get challenged now and for the months to come.

KD Market Insights are even more bullish. They believe the Global controlled environment agriculture market is projected to grow to $172 Billion by 2025. Here is what they have to say:

The world’s population is expected to grow to almost 10 billion by 2050. It is becoming increasingly difficult to satisfy the rising global demand for food in a sustainable manner. Due to this, in order to meet the food demand of an increasing population, the government and farmers are adopting more advanced farming techniques such as Hydroponics, Aeroponics, Aquaponics, soiled based and other hybrid methods. The farmers are majorly growing leafy greens, tomatoes, cannabis, flowers, microgreens, strawberries, herbs, cucumbers, peppers, mushrooms, onions, leeks, hops, figs, sweet corn, eggplant, fish, insects, carrots, and shrimp. This rising popularity of controlled environmental agriculture techniques is resulting in an increase in the number of small and large indoor farms across the globe and these farms are also encouraging the consumption of other supplies such as nutrients, growing media, and others. Today, 55% of the world’s population lives in urban areas, a proportion that is expected to increase to 68% by 2050. Yet, the population living in urban areas are demanding locally grown foods such as fruits, vegetables, meat, etc. Controlled Environment Agriculture (CEA) producers across the globe are setting up their production centers near to urban consumers to take advantage of this trend due to their proximity to urban centers. Other advantages of CEA such as the requirement of less time and expense in the transportation of crop products and better product quality are also expected to strengthen the growth of global controlled environment agriculture market in upcoming years.

They also name a handful of companies, most of which are familiar with my readers…and one of which will be discussed in this post. But the publicly traded companies they mention are: AgriFORCE, Raven Industries, AGCO, Trimble, and Deere & Company.

So now that we know we are in the right sector (but you KNOW that if you’re reading this sector roundup!) Let’s get into some of the charts and major company news!

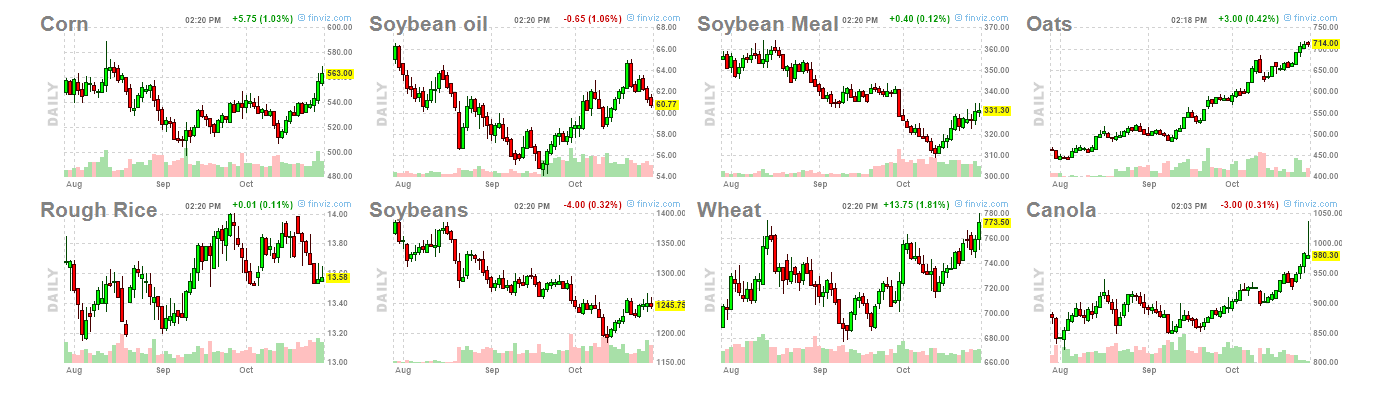

A lot of great looking charts when it comes to the commodities themselves. Soybeans, Wheat, and Corn on watch. By no means a trade recommendation, but I picked up some Corn contracts on the breakout above 540. Soybeans is looking like a head and shoulders pattern, but we just need the breakout. While Wheat could confirm a breakout by the time this sector roundup is released! Pay attention to how it moves after as it tried three times to breakout from this important resistance.

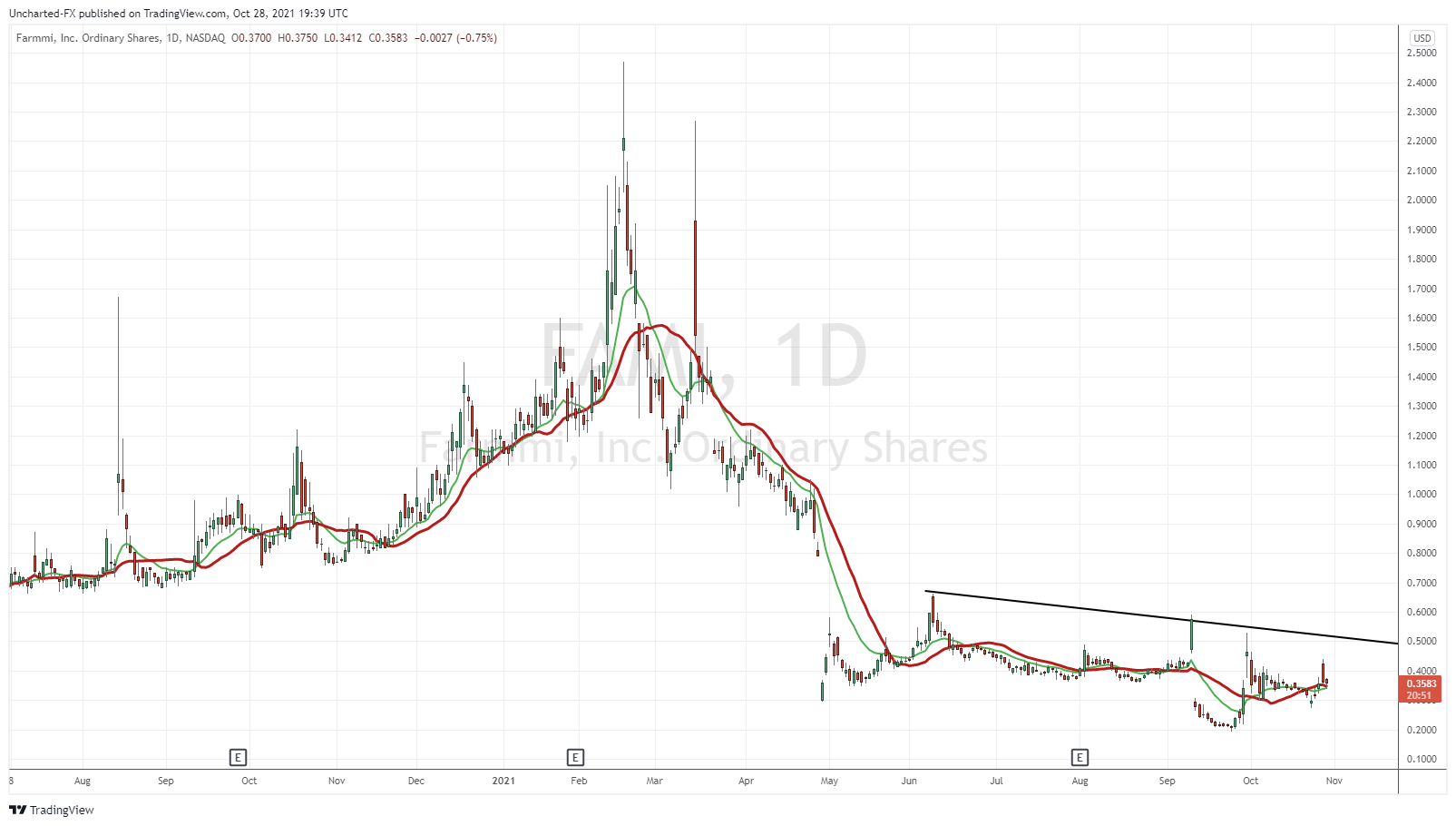

Farmmi (FAMI)

Farmmi is an agricultural products supplier, processor and retailer of shiitake mushrooms, Mu Er mushrooms, and other edible fungi and agricultural products. They are located in Lishui City, China.

Their aim is to build a global trading platform for agricultural products. Farmmi manages an industry chain of Internet marketing for agriculture products with agricultural technology research and development, family farm development and product processing. Their products are sustainable, organic and green agricultural products and healthy food.

If you are bullish on China and its agricultural products market, then Farmmi is the company for you.

Recent news regards one of its subsidiaries, Zhejiang Farmmi Food Co., Ltd., showcased its extensive product line and cultivated sales at a major conference from October 23-25, 2021 held at the Jiangsu Baima Agricultural International Expo Center. The conference was sponsored by the Circulation Industry Promotion Center of the Ministry of Commerce, and undertaken by the People’s Government of Lishui District, Nanjing, and co-organized by the China Agricultural Machinery Circulation Association, the China Vegetable Circulation Association, and the National Agricultural and Commercial Internet Industry Alliance The Rural Revitalization Production and Marketing Matchmaking Conference.

Ms. Yefang Zhang, Farmmi’s Chairwoman and CEO, commented, “We are proud to have been featured at this major event given our market position and strong support for both economic development in Lishui and growth of the broader agriculture sector. The conference served as an excellent platform for us to engage with customers and supply chain partners as we continue to cultivate sales opportunities. There has been a lot of interest in the expanded business strategy we outlined last month and interest in working with Farmmi as we actively pursue greater opportunities for revenue and profit growth. The strong platform and brands we have built give us an advantage that we believe is scalable for the company and investors.”

The technicals are attractive. It seems like a bottoming pattern is developing near all time lows. I smell a cup and handle pattern too. I would love to see my trendline break in order to neutralize the downtrend with lower highs…but there is also a large gap the stock needs to deal with. Take a look at the volume though, this stock sees 100 million plus shares traded on a regular basis.

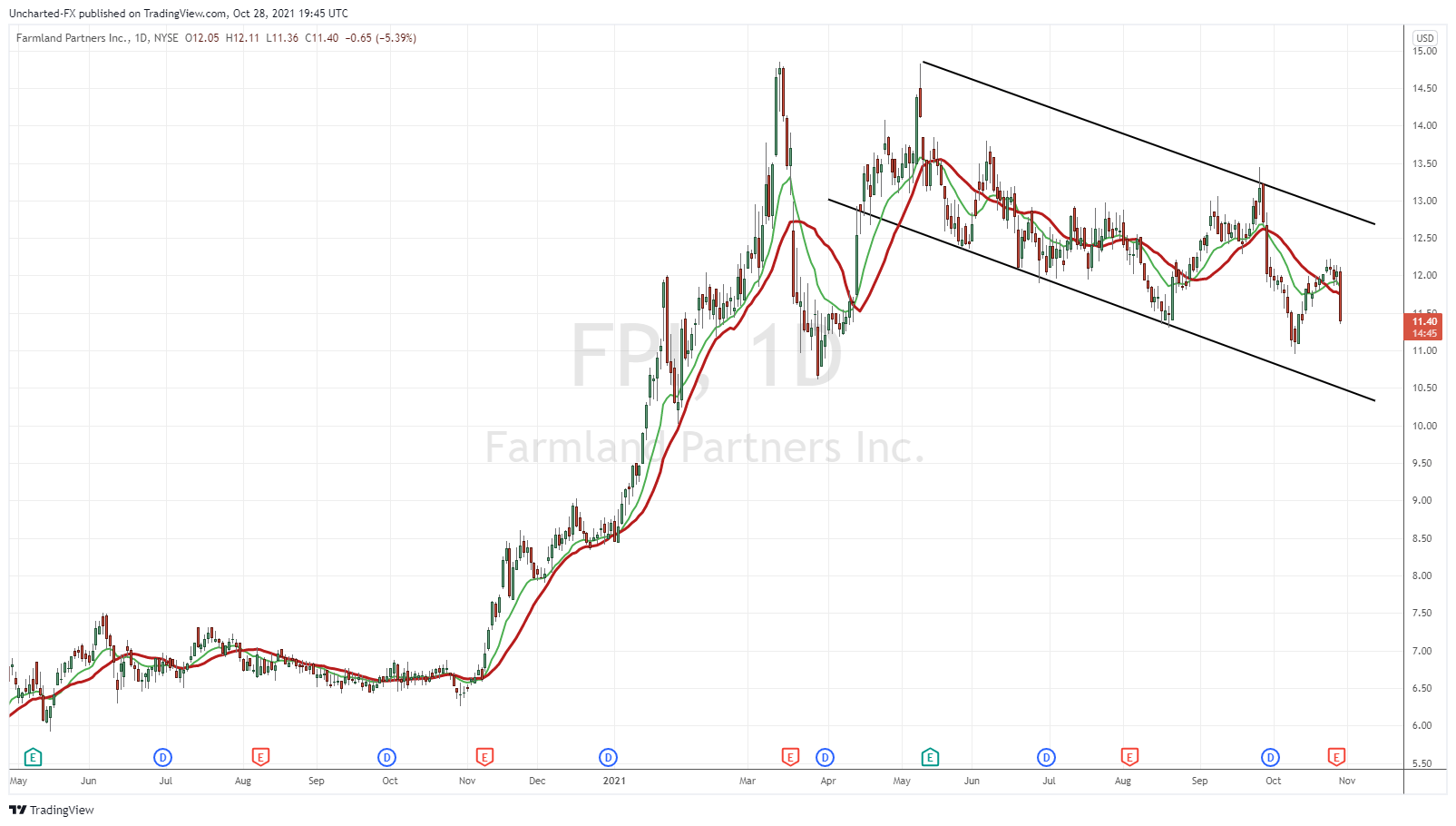

Farmland Partners (FPI)

Now this is the type of company I have been searching for. Agricultural farmland is one of my top long term wealth preservation investments. It’s best to own high quality farmland, but if you cannot, then this is the next best thing.

Farmland Partners Inc. is an internally managed real estate company that owns and seeks to acquire high-quality farmland throughout North America addressing the global demand for food, feed, fiber, and fuel.

As of August 4th, 2021, Farmland Partners owns approximately 157,000 acres in 16 states, including Alabama, Arkansas, California, Colorado, Florida, Georgia, Illinois, Kansas, Louisiana, Michigan, Mississippi, Nebraska, North Carolina, South Carolina, South Dakota, and Virginia. This land is currently being farmed by over 100 tenants who grow 26 major commercial crops.

Earnings came out on Thursday. Here are some highlights:

- recorded net income of $(3.1) million, $3.8 million excluding litigation-related items1, compared to $1.2 million, $1.9 million excluding litigation related items2, for the same period in 2020;

- recorded AFFO of $(8.5) million, $(1.6) million excluding litigation-related items1, compared to $(3.2) million, $(2.4) million excluding litigation related items2, for the same period in 2020;

- completed five acquisitions, for total consideration of $31.0 million;

- completed seventeen property dispositions, for total consideration of $31.1 million and total gain on sale of $3.4 million;

- retained property management for ten out of seventeen disposed properties and closed an additional acquisition in the third quarter, growing the asset management business’s assets under management to over $50 million; and

- sold 1,959,512 shares of common stock at an average price of $13.12 for aggregate net proceeds of $25.4 million under the ATM Program.

The stock did not react well to the earnings. However, we are in a flag channel. Flags have been my favorite chart pattern to trade recently. The key though is that breakout. Farmland Partners is one I like. Even as an inflation hedge. When I read one of Jim Rickards latest books, he details an interview with an Italian family who have maintained their wealth for 500-600 years. The three assets they mention for maintaining generational wealth are Gold, Art and Agricultural Land. As I said earlier, its not something everyone can own, so I like Farmland Partners as my way to play the Agricultural Land through equities.

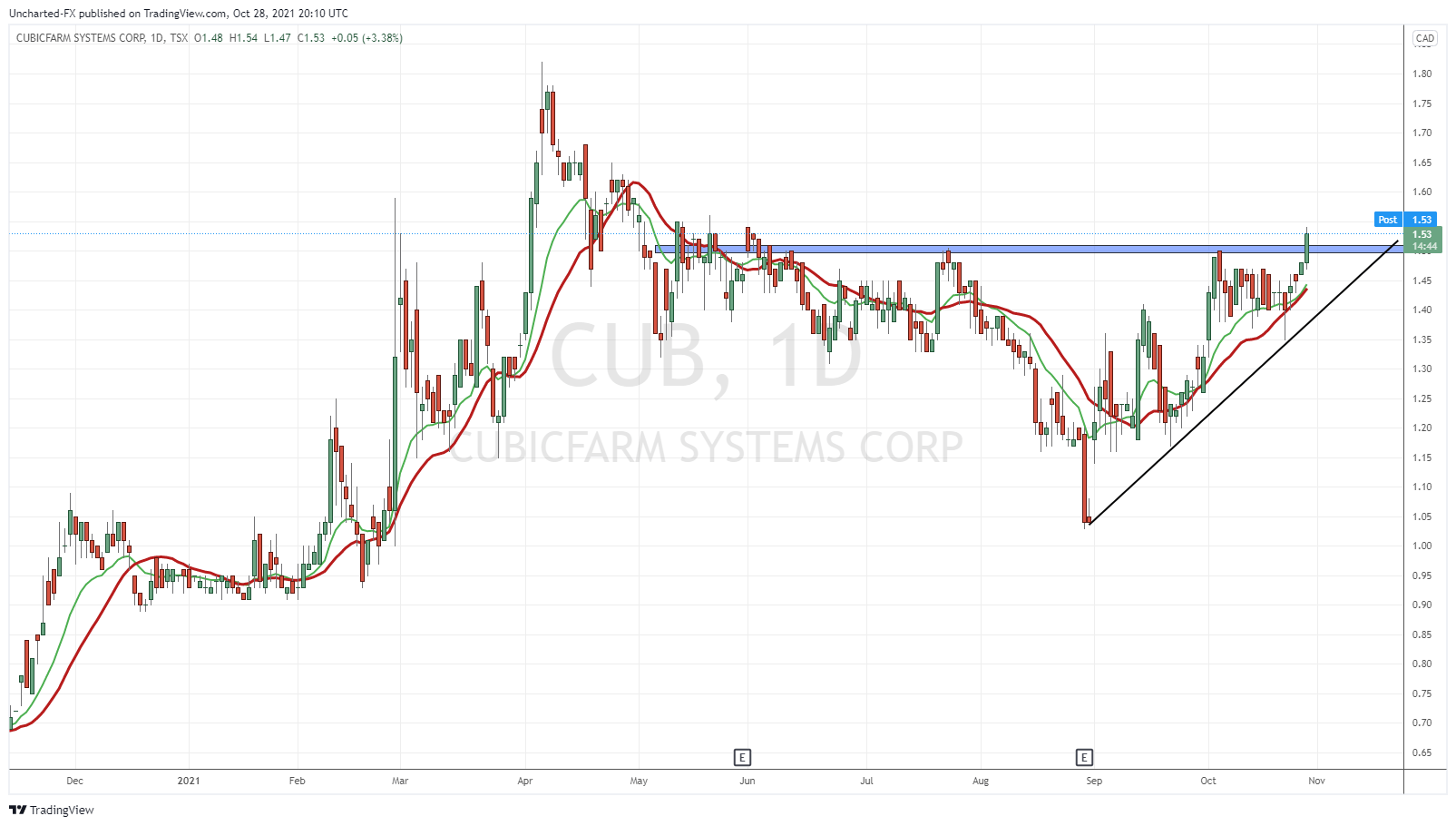

CubicFarm Systems (CUB.TO)

CubicFarms is well known to my readers. The company is a local chain agricultural technology company developing and deploying technology to feed a changing world. Its proprietary ag-tech solutions enable growers to produce high quality, predictable produce and fresh livestock feed with HydroGreen Nutrition Technology, a division of CubicFarm Systems Corp. The CubicFarms™ system contains patented technology for growing leafy greens and other crops onsite, indoors, all year round. CubicFarms provides an efficient, localized food supply solution that benefits our people, planet, and economy.

CubicFarms had a virtual conference on all things agriculture and ag tech. The highlight for me being Canadian Astronaut and Former Commander of the International Space Station Chris Hadfield discussing his life growing up on a farm, and agriculture heading into the future. You can still watch the virtual conference here.

On the 25th of October, CubicFarms announced two additional dealers of its HydroGreen Certified Dealer Network to meet the rising demand for the company’s automated HydroGreen technology for on-farm growing fresh green livestock superfeed. Initial sale commitments include over 80 modules in 2022 valued at over $17.5 Million CAD.

We have been watching that $1.50 zone, and I can finally say the breakout has happened! Thursday gave us a close above $1.50 with higher than average volume, and a nice green close. Get ready for a run! Previous record highs at $1.80 is next before we print new all time record highs. The company is making headlines and moves. Expect more big things. A bright future indeed.

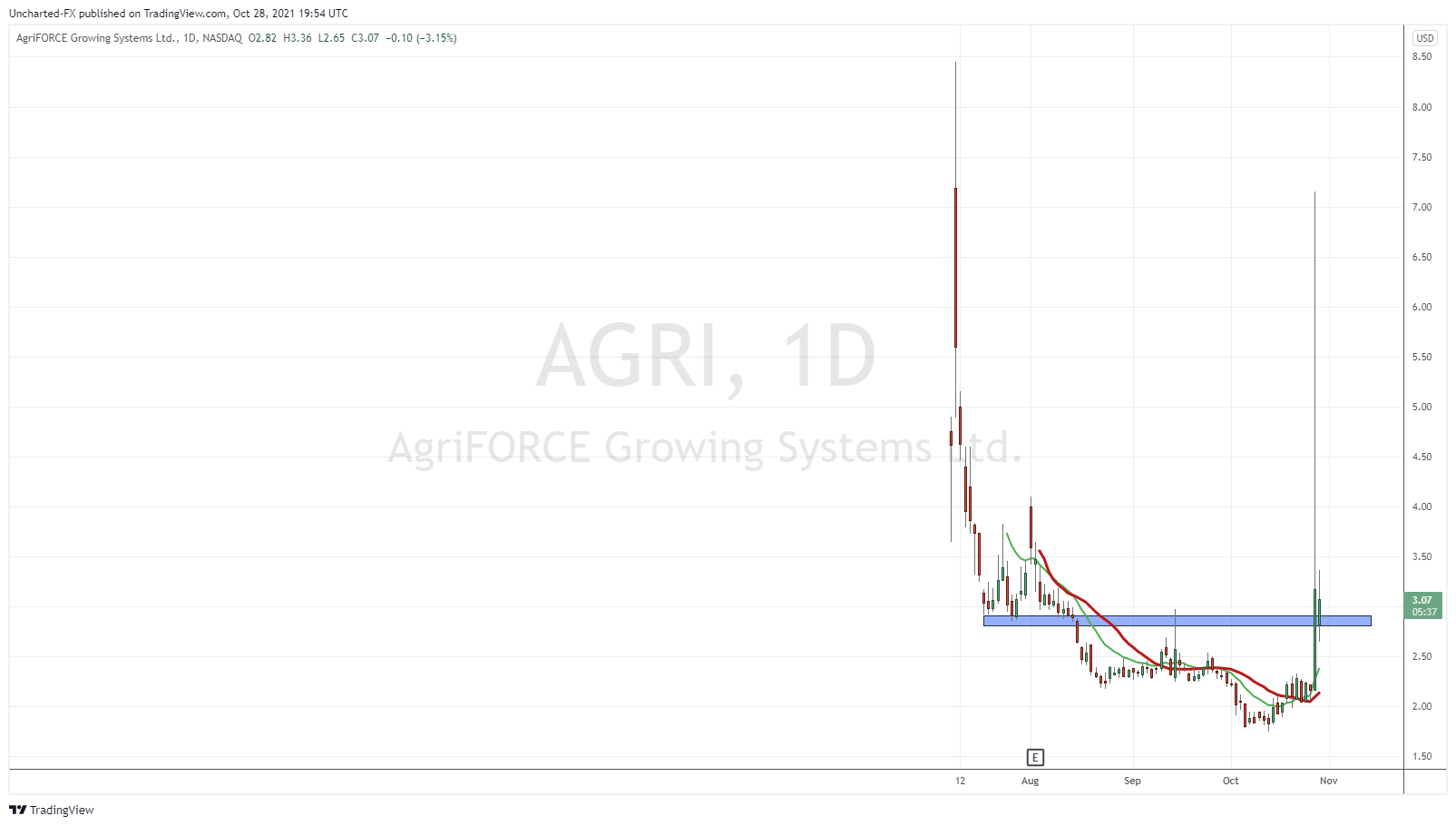

AgriFORCE Growing Systems (AGRI)

What action on AgriFORCE. The company is an AgTech company focused on developing and acquiring innovative agriculture IP that changes the way cultivation and crop processing are done. The Company’s vision is to be a leader in delivering plant-based foods and products through advanced and sustainable AgTech solution platforms that make positive change in the world – from seed to table. The AgriFORCE foundational IP – called the AgriFORCE Grow House – includes a proprietary facility design and automated growing system for high-value crops focused on improving the way that controlled-environment agriculture (CEA) is done.

What a performance for the stock on Wednesday October 27th. Over 240 million shares traded when average volume is at 618,500. The stock was at one point over 100% on news of an acquisition. AgriFORCE Growing Systems Announces Binding LOI to Acquire a Leading European Agriculture/Horticulture and AgTech Consulting Firm, with Global Operations and 2020 Annual Revenues of US$26 million and EBITDA of US$3 million (IFRS Based). You can find more details on this deal here.

Some of you may recall AGRI in previous weeks ag sector roundups. We were watching the basing, and also the reversal with prices flipping above my moving averages. The key zone though was resistance at the $2.90 zone. We were watching for a confirmed close above for the trigger. Well…things escalated quickly on the news. We got the close above $2.90 on that crazy Wednesday pop. Although we sold off a bunch of the move which is expected. Traders taking profits. For a long term hold though, things get spicy. We have already retested the breakout zone on Thursday, and are seeing buyers step in. This retest is where one would want to enter. Buyers are here, and things look promising for another move upwards.

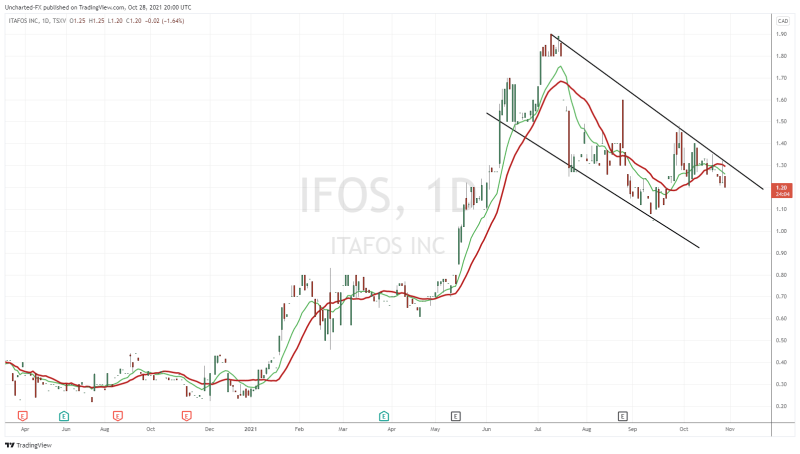

Itafos (IFOS.V)

Itafos operates as a phosphate and specialty fertilizer platform company. It operates through Conda, Arraias, and Development and Exploration segments.

Recent news saw the company announce a draft environmental impact statement for Conda Mine life extension.

“The publication of the Draft EIS is an important step in executing on our key objective of extending Conda’s mine life through permitting and developing H1/NDR. Conda has a more than 30-year track record of safe and reliable operations and we look forward to continuing to serve our customers for many years to come,” said Tim Vedder, General Manager of Conda.

Yes, Phosphate demand is set to grow. But Itafos has an opportunity where both the fundamentals and the technicals align. The technicals caught my eyes, especially since this pattern is what I have been trading more of recently. Gold, Oil, Copper all have had this flag pattern. Itafos has the same market structure. A breakout trigger takes us back to $1.90 and higher.

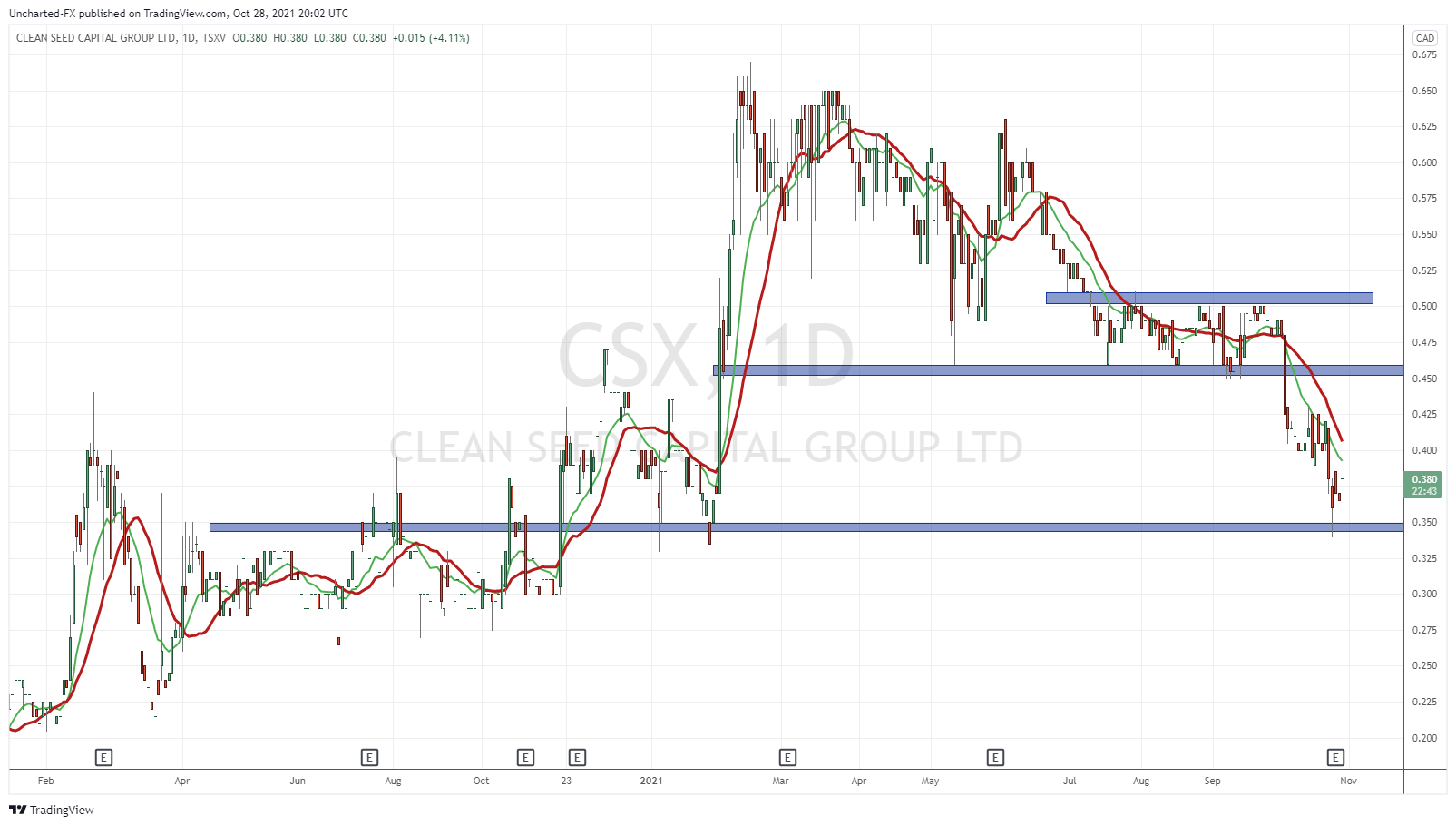

Clean Seed Capital (CSX.V)

This one will be a quick update.

Last week I spoke about Clean Seed Capital’s corporate update. The technicals is what caught my attention, and I detailed the breakdown below $0.45. I said we should be watching the support at $0.35. A major support zone. Well we are there now, and saw first signs of buyers stepping in with a large wick candle on October 25th. Let’s watch for a support play. I like the wick, but a nice green candle would add more positive confluence.

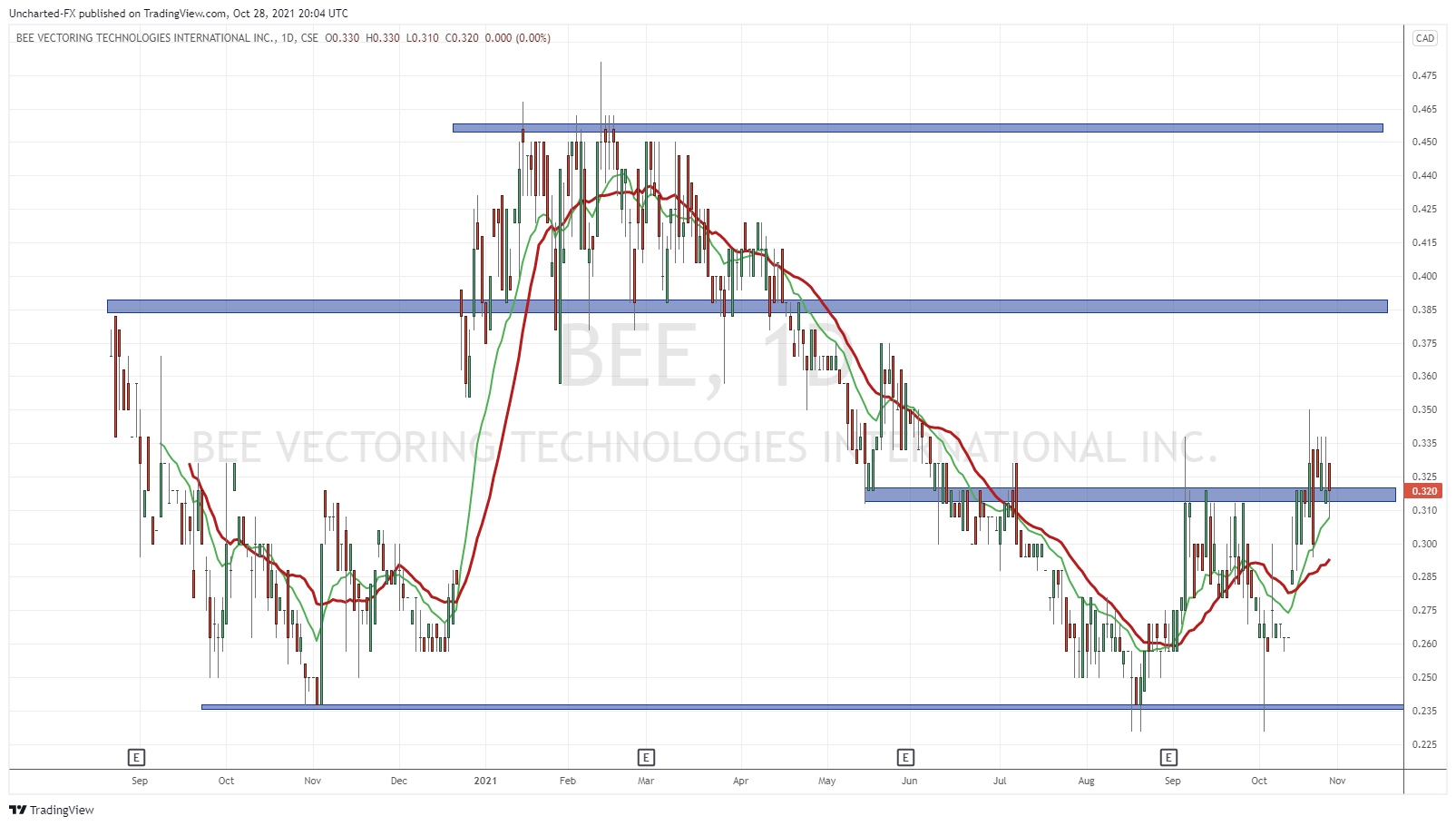

Bee Vectoring Technologies (BEE.CN)

Another follow up from last week! But with great developments on both the fundamental and technical sides. News wise, Bee Vectoring (BVT) announced that the International Biocontrol Manufacturers Association (IBMA) has recognized BVT with the prestigious Bernard Blum Award for novel biocontrol solutions, awarding Bronze for BVT’s VectorHive™ system.

The Bernard Blum Award is presented annually for the year’s most innovative biocontrol products – those that have a high impact in pest/disease management and low impact on human health and the environment. All 230 members of the association, along with third parties, were invited to submit their most innovative solutions.

“BVT being recognized with a Bernard Blum Award is a strong indicator of the robustness and sustainability of our natural precision agriculture solution,” said Mr. Lehnen. “It emphasizes solutions with proven impact and performance in the field, not on technologies still in an experimental phase.”

Technically, playing out just as I expected. Breakout, pullback, and then a retest confirmation. I like that buyers are coming in at the $0.31 retest. For more details on Bee Vectoring, both the technology and the technicals, read my article on the company here. I am expecting a push higher here as long as the bulls hold this support.

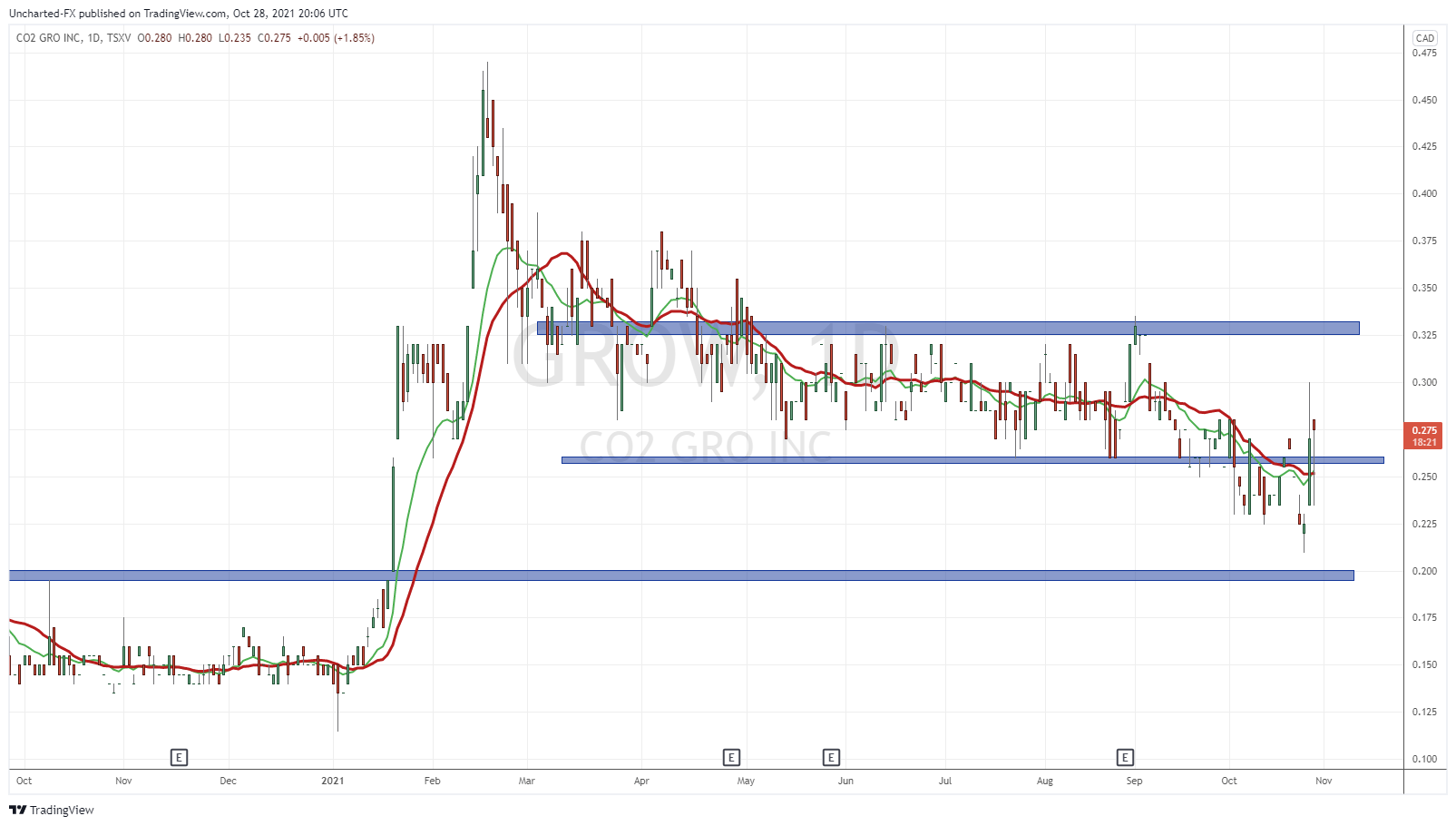

CO2 Gro Inc (GROW.V)

CO2 Gro focuses on commercializing patent-licensed CO2 gas infusion technology and patent-pending US PTO CO2 delivery solutions system.

We have had many recent news regarding sales and feasibility studies. Add another good news to the mix. A big commercial sale. The company announced a commercial installation sale of CO2 Delivery Solutions™ for a one-hectare (107,000 square foot) greenhouse to El Salvador based pepper grower Hidroexpo S.A de C.V. (“Hidroexpo”).

This is GROW’s first CO2 Delivery Solutions™ commercial sale to a very large greenhouse vegetable grower. Hidroexpo operates 36 one-hectare greenhouses totaling 3,852,000 square feet. This is GROW’s largest sale to date defined by both the size of the facility and the purchase price. GROW is now well positioned to expand the use of CO2 Delivery Solutions™ across Hidroexpo’s 35 remaining one-hectare greenhouses. In addition, having achieved this significant sale, GROW can now leverage this success to expand their ever-growing number of commercial feasibilities and ultimately sales with very large greenhouse vegetable growers globally.

A big congrats to the team!

Last week we spoke about the range breakdown. We wanted to see a close back above $0.26. And boy is that happening. The market loves the news. It is big for the company and the market expects more good news to come in the future. Watch for a move higher as long as we stay above $0.25!

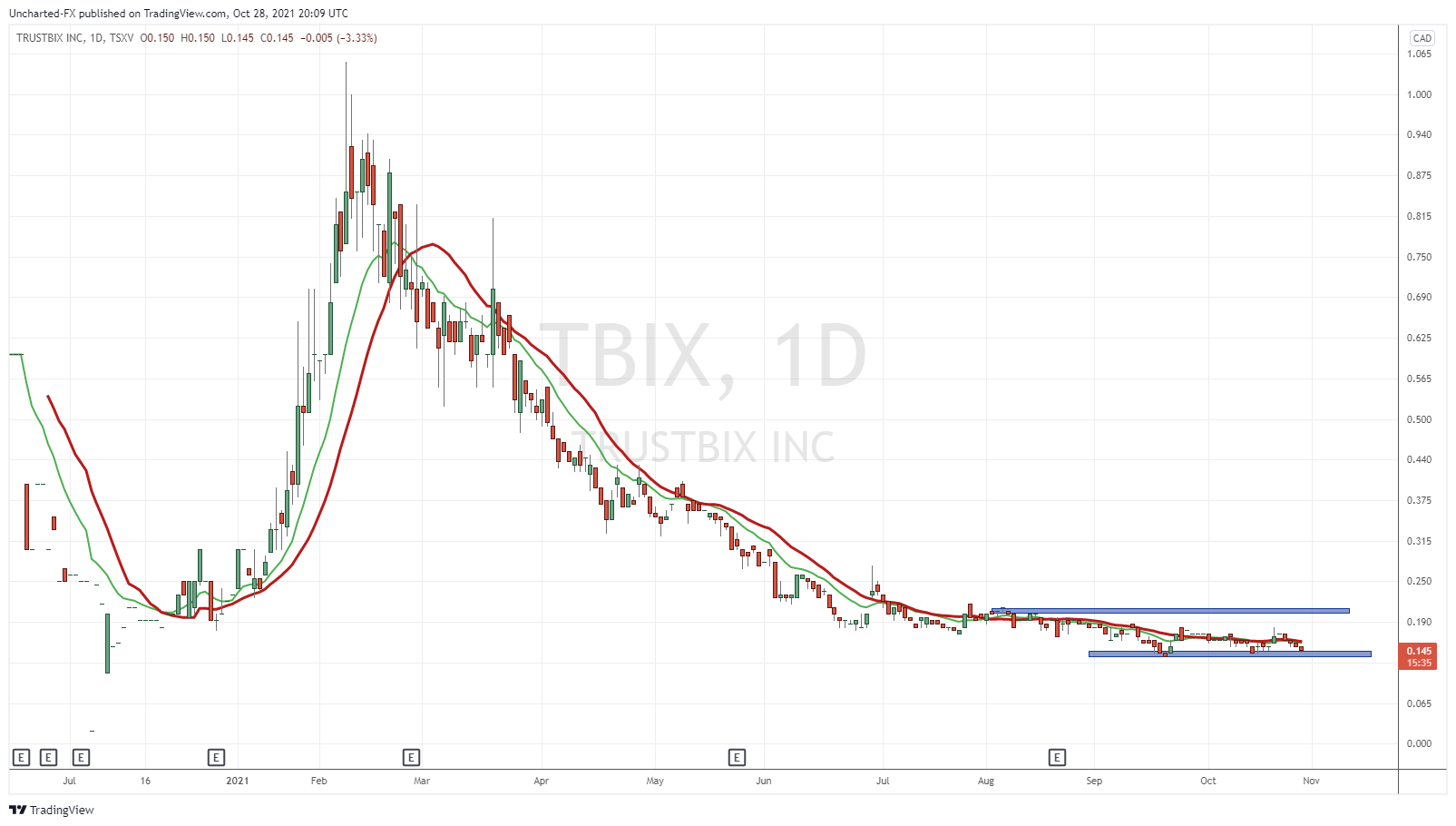

TrustBIX Inc (TBIX.V)

TrustBIX provides agri-food traceability and chain of custody value solutions. The Company’s goal is to create a world where we trust more, waste less and reward sustainable behaviour by addressing consumer and agri-food business demands. The proprietary platform, BIX (Business InfoXchange system), is designed to create trust without compromising privacy through innovative, blockchain-derived use of technology and data. By leveraging BIX and its unique use of incentive solutions, TrustBIX delivers independent validation of food provenance and sustainable production practices within the supply chain – Gate to Plate®.

Recent news saw a continued collaboration between GBI Global, Cantriex livestock and TrustBIX to test market shipments of high quality Authentic angus beef to Hong Kong. These shipments of beef were sourced from animals that feature tracked attributes – Angus, hormone-free, feed details, and Triple A grading or higher, as well as harvest and shipping dates.

To add to the value of the product, the BIX platform was integrated with the Company’s trusted blockchain partner, Innoblock. This will enable beef to be sold in Hong Kong with a QR code that features the grade, harvest date, shipping date, arrival date, and other attributes.

An interesting combination of blockchain and agriculture. Something I am sure will be of huge value in the near future as consumers want to know where their food comes from.

Chartwise I have one word: range. I like these types of set ups, but the big trigger is the breakout. Potential of a double bottom here and a break above $0.215. The stock seems like a good pickup here at the $0.15 level.

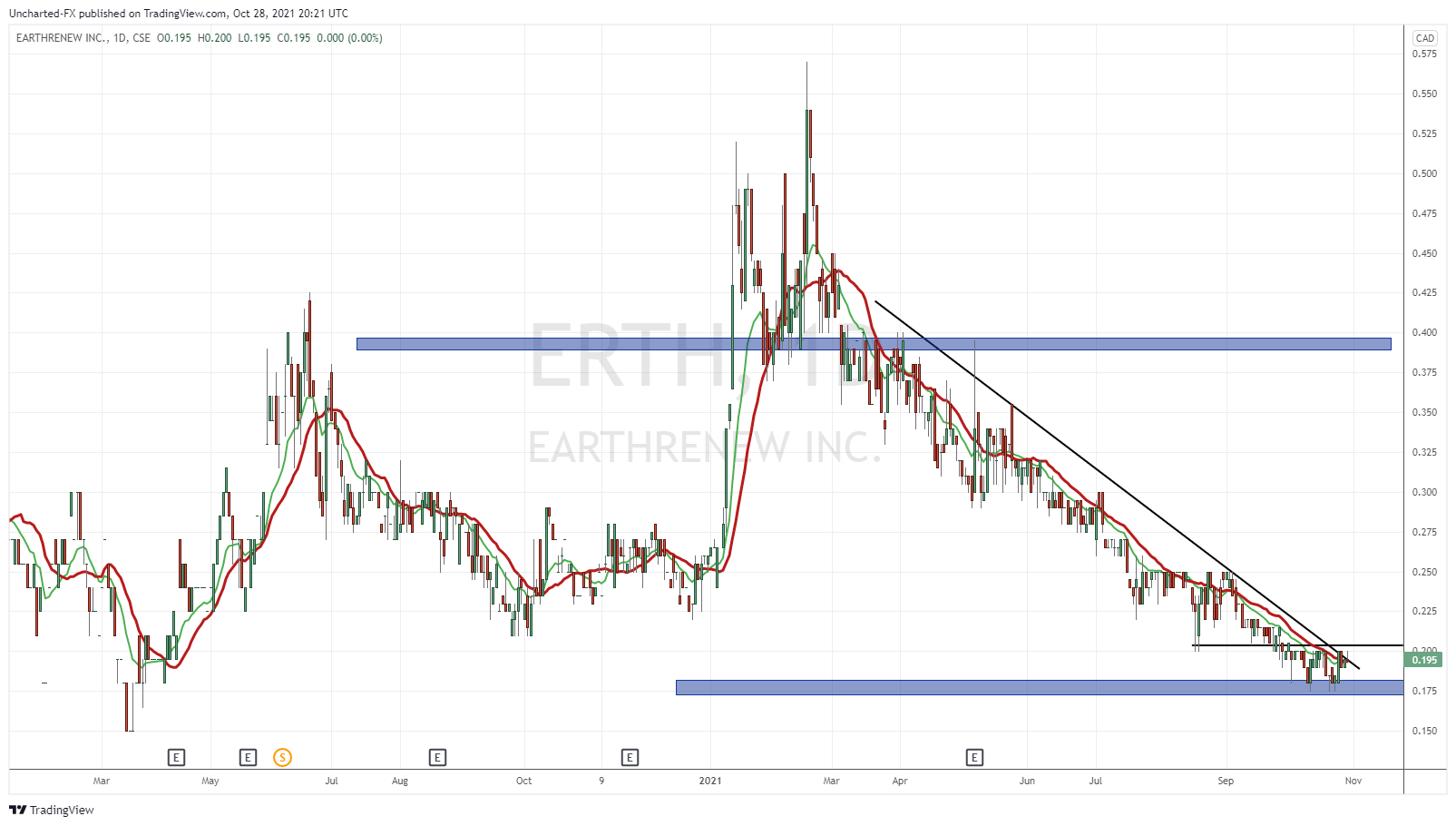

EarthRenew (ERTH.CN)

EarthRenew Inc. produces and sells organic fertilizers from livestock waste in North America and Europe. It also produces electricity from natural gas using an industrial-sized gas turbine and supplies to electrical grid and cryptocurrency miners. The company sells its fertilizers under GrowER and GrowER Biochar names.

An ESG investment in regenerative agriculture.

The company recently closed an over-subscribed private placement for $1,420,000. Management now has the cash to initiate a catalyst. I say this with positivity because look at this:

You all know this is the type of chart I love to enter. A long downtrend, finally finding support at a support zone. We have begun to base at $0.175, and just are awaiting the breakout above $0.20. This would also takeout my downward sloping trendline. A lot of bullish confluences on this one, but the breakout is required. We did appear to be basing at $0.225, but we could not breakout above $0.25 to trigger