Revive Therapeutics (RVV.C) is an interesting play. You like cannabis and its health benefits? Revive Therapeutics is one to add on your list. Maybe you are more bullish Psychedelics? No worries, Revive has got you covered. Maybe you aren’t a fan of either, but want a Covid play. Boom, Revive Therapeutics enters your watch list.

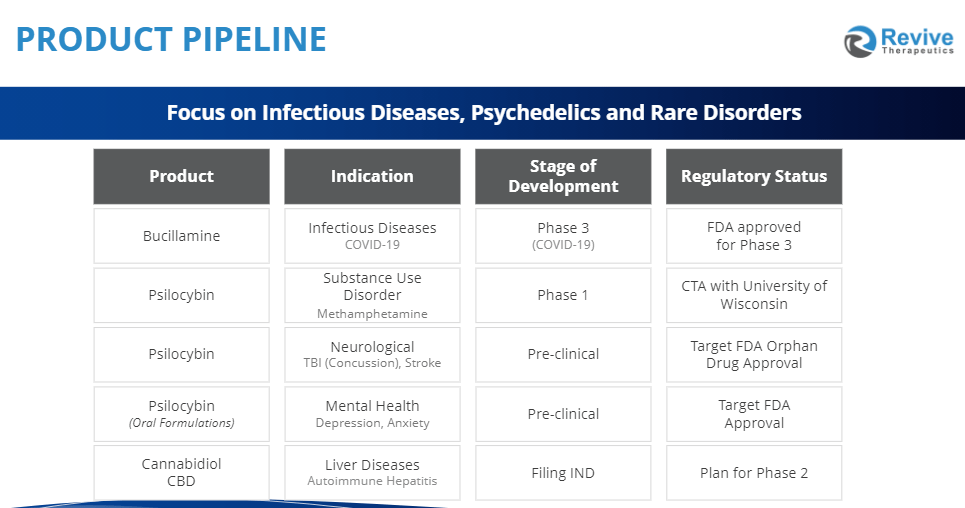

Revive Therapeutics is a life science company focusing on the research and development of therapeutics for rare disorders and infectious diseases. I summarized it above, but here are some notes from their website worth mentioning:

The Company was granted FDA orphan drug status designation for the use of CBD to treat auto-immune hepatitis (liver disease) and FDA orphan drug status designation for the use of CBD to treat ischemia and reperfusion injury from organ transplantation.

With its recent acquisition of Psilocin Pharma Corp., Revive will advance Psilocybin-based therapeutics in various diseases and disorders and will prioritize development efforts to take advantage of several regulatory incentives awarded by the FDA such as Orphan Drug, Fast Track, Breakthrough Therapy and Rare Pediatric Disease designations.

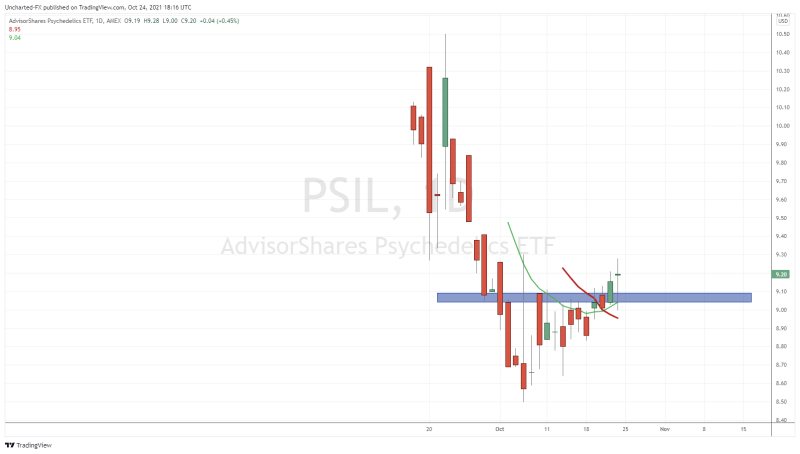

The acquisition of Psilocin Pharma was big, and the market considers the company a psychedelic play. Revive Therapeutics was recently added to AdvisorShares newly launched Psychedelic ETF. The ticker is PSIL. Here is how it looks so far…and to be honest, it seems Psychedelics could be ready to turn. I like the break above $9.00. Price is above my Moving averages, and my shorter term average (green line) has just crossed above my medium term average (red line). This is typically a bullish sign, and it gets even more bullish factoring the other confluences such as a breakout above $9.00.

I mentioned the Cannabis part. Let’s just take a look at MSOS. This is the chart I use to gauge interest in Cannabis. If you have read my other chart attack articles on Cannabis companies, you see me quote this chart a lot. For good reason too. Right now it isn’t looking too good. The trend is obviously downwards. There was some hope earlier on with signs of a double bottom, but the pattern did not trigger. Another reason for traders to be patient and wait for breakouts and patterns to be confirmed! You may miss out on some of the move but who cares! Our job is to take high probability trades! For MSOS, we have to wait further. There was some hope with a nice strong green candle on the 19th of October, but it turned out to be a pullback in the downtrend.

I am approaching this stock as a Covid play. Why? Because they have gotten good results on their study of Bucillamine for the treatment of Covid. When I mean good, I am talking FDA approved phase 3 type good. Actually, the Covid treatment is the most advanced product in their pipeline.

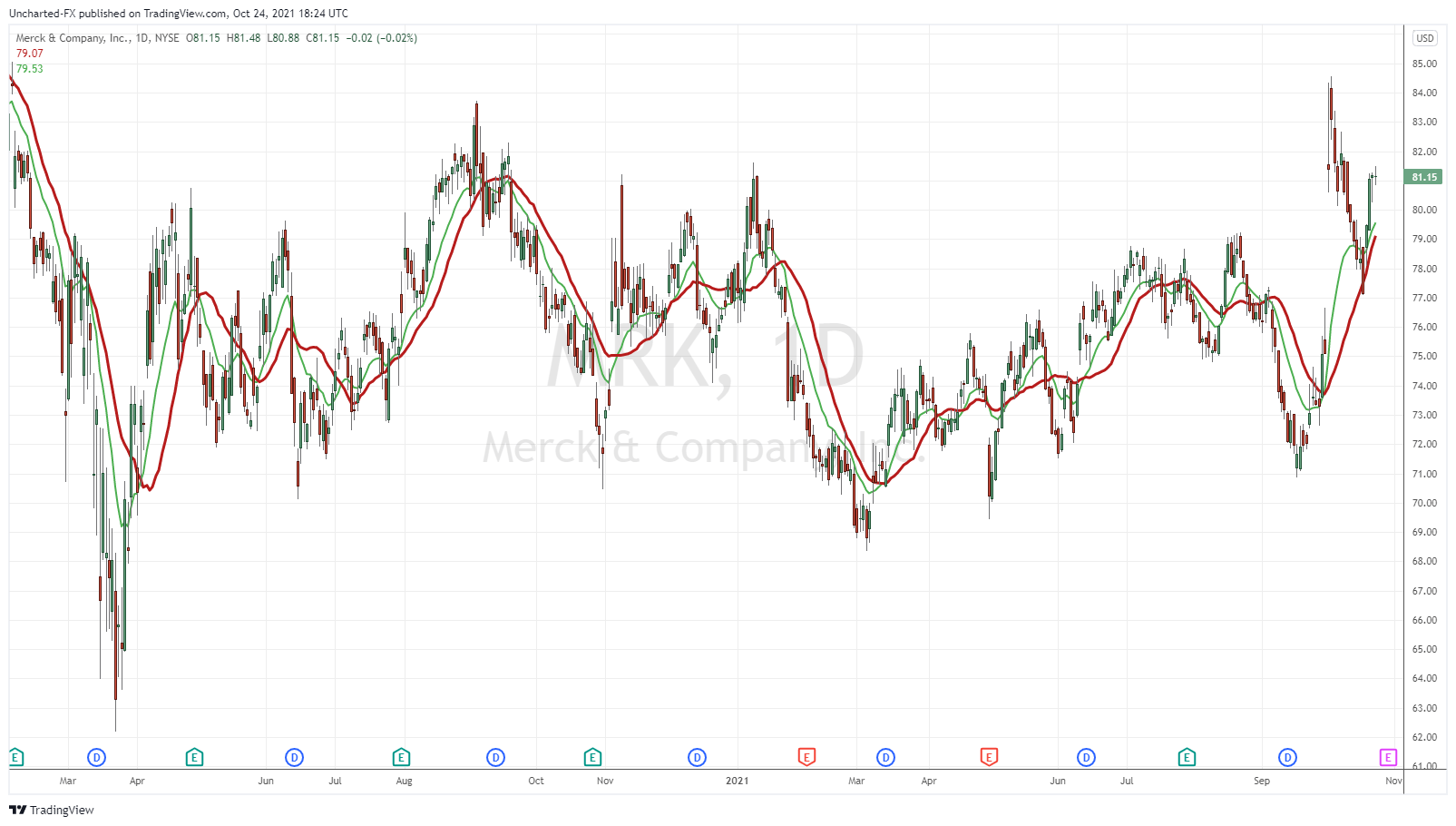

At a time when cases and deaths are rising in some countries, treatment other than the vaccine is still going to be big business, and illicit great market response. Remember when Merck came out with news regarding a Covid pill which can be taken for 5 days and reduces the worst effects of Covid? Here is how the stock reacted. A gap up pop, which gave up gains but to me, it is just a pullback to retest the breakout zone. Buyers have stepped in, and I expect the trend to continue.

Exciting stuff, and I think the market will be more responsive to positive Covid news from Revive rather than Cannabis and Psychedelics, but that’s just me. The psychedelics pop on PSIL could get this stock moving as RVV composes 1.76% of the ETF, so keep that in mind as we delve into the RVV chart.

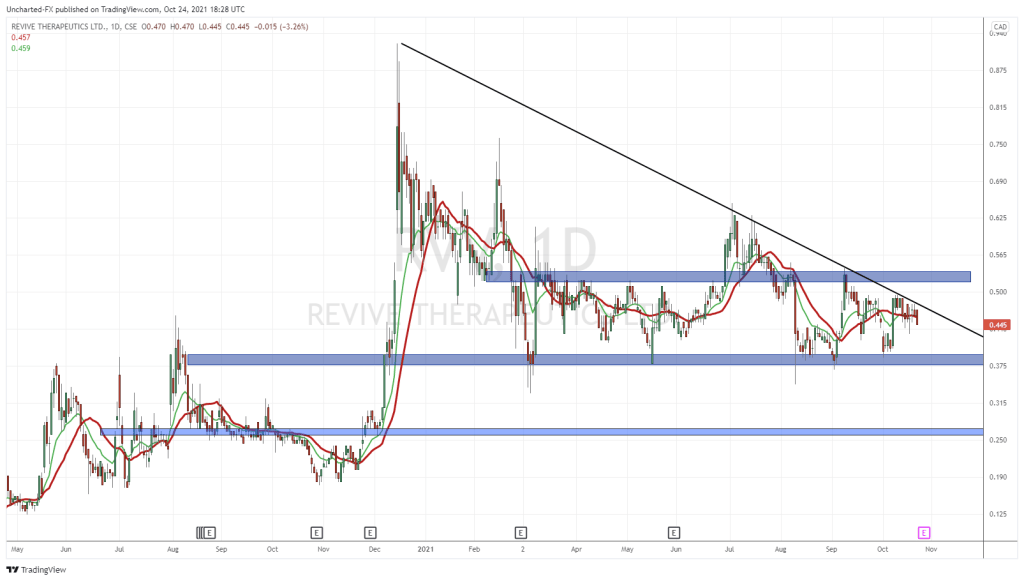

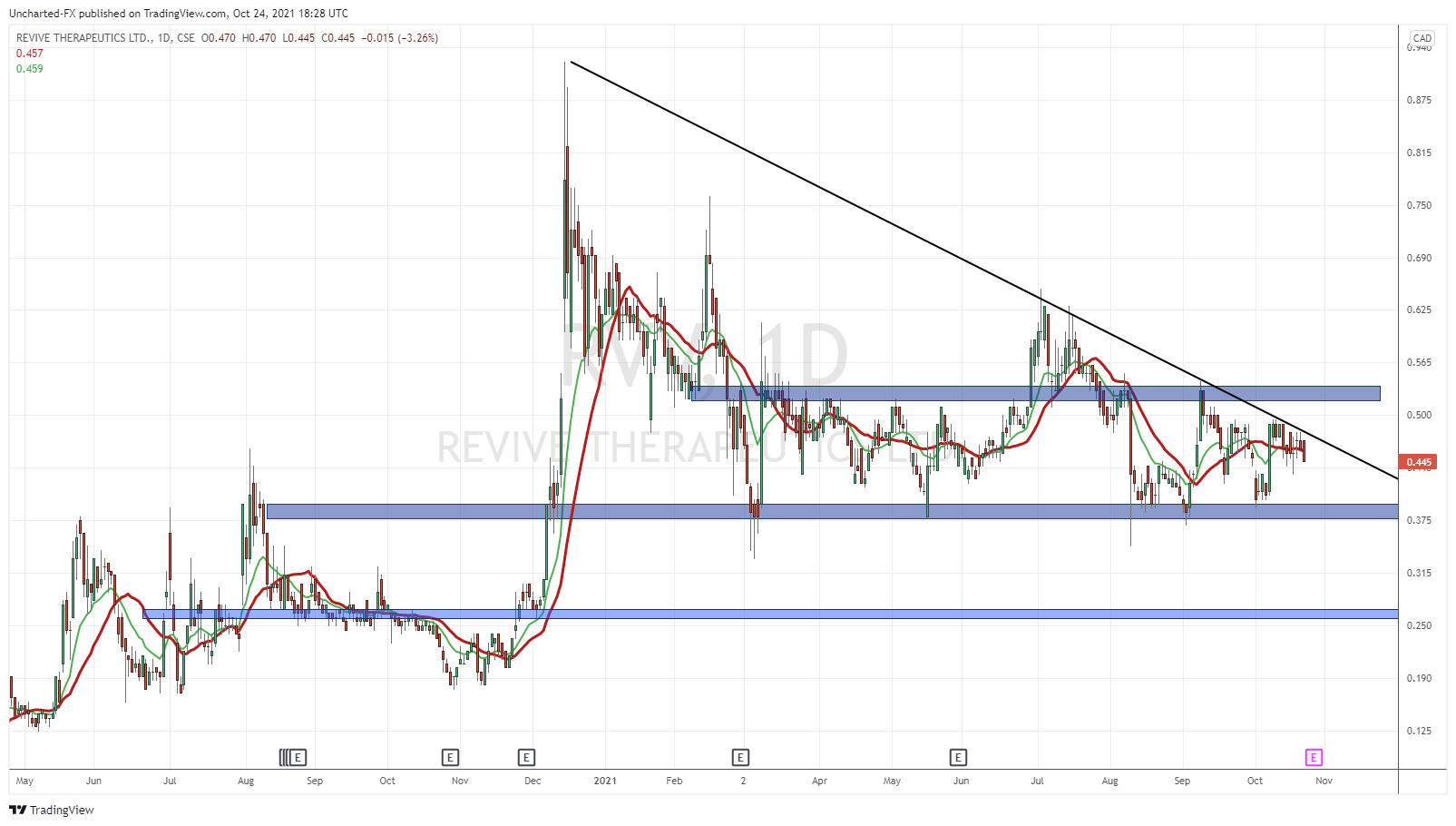

Now, let’s take a look at the chart:

Not much has changed since I looked at RVV two weeks ago. The support still holds, and the trendline breakout is waiting to be triggered.

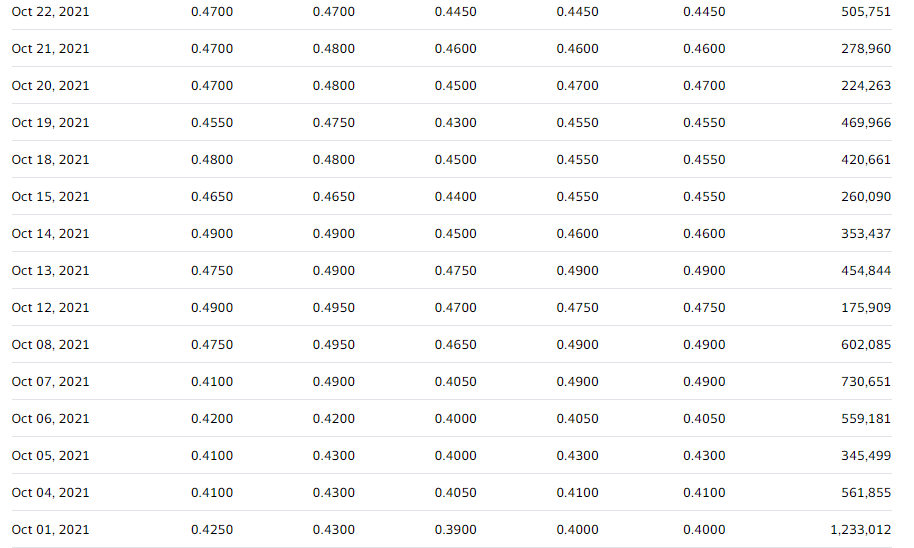

It remains clean and crisp. The levels are well laid out and obvious. Look at how the support zone of $0.375 has held in the past. When we tested here multiple times, bulls never let it close below $0.40. Look at the test here on October 7th. A nice engulfing candle 20% pop with 730k shares traded. If price dips below, one can place an order to pick up shares as every time price has been bid back up.

I have a resistance zone at around $0.54. Even though we have a trendline, or a triangle pattern here, I would wait for the resistance break for more momentum to the upside. Let’s get above this range and trendline for a run up to $0.625 and then $0.75.

It should be noted that volume is really good on RVV. Investors and traders are noticing this major support zone and potential for a larger run. Some sort of catalyst in the form of a good press release could be the trigger. Technically, I have a sense the market is expecting good news. The best way I can describe the chart is ‘coiled’. The technicals are hinting at a large breakout move. As long as we remain above $0.375, that breakout is expected to be to the upside.

Really liking the technicals on this one. One of the best technical charts I have come across recently in the small cap world, especially with this type of consistent volume. One can enter now, frontrunning the breakout, but just remember, the stock could just range or breakdown. That’s the opportunity cost, but won’t be an issue if you don’t mind holding long term. Being a little more patient, the breakout trigger remains a daily candle close above $0.54.