I am here to talk about what I love most in this world. Women.

I recently found myself out for cocktails with a friend in Toronto. We were approached by two average looking men who ordered us picklebacks and asked us things like “how are you still single?” (As if singledom is a plague reserved for the “less attractive” and every woman is figuratively sitting on a bench in a gymnasium, just waiting to be asked to dance).

Not 10 minutes later, Pickle Joe (I don’t remember his name so this suits) went for the jugular with a cliché that puts every wave of feminism to shame. “I’ve never met anyone like you. You are not like other girls.”

Pickle Joe, you have met everyone like me. I am exactly like the other girls. In fact, I aspire to be like the other girls. I have coffee with oat milk every morning, I endure Satan entering my uterus once a month (with a smile on my face nonetheless), I sing Taylor Swift songs in the shower and did so with a passion before ever being in a relationship, I have an intimate connection to a Romanian woman named Ligia who waxes me that no man would ever begin to comprehend. And, to top it all off, I am most certainly the girl with the fruity little drink because I honestly cannot shoot a whiskey. I have tried and failed.

Next time, for Pickle Joe and those alike, the true compliment would come in the phrase, “you’re not like other men”. Funny though, we’ve never heard that one before.

All this to say, women just happen to be relentlessly superior. And this isn’t me working with a bias, it is simply a statement of fact. An article in my inbox last week headlined: “Women investors are still outperforming men, study finds”. Duh.

It’s in our nature:

We have already talked about why, inherently, women tend to be more successful investors.

To reiterate, I will cite LouAnn Lofton’s book Warren Buffett Invests Like a Girl.

In it, Lofton studied the habits of the world’s most renowned investor and compared them to the latest research about women, men, and money. The conclusion: The Oracle of Omaha has a decidedly feminine investing style. Like Buffett, women are more likely to have a calm temperament, a longer-term outlook, trade less, do more research and remain steady under pressure, says Lofton. And what does Buffett think about the claim?

“I plead guilty,” he said.

It’s in the statistics:

An analysis of annual performance across 5.2 million investment accounts from January 2011 to December 2020 shows that on average, women investors surpass men by 0.5%.

The latest findings align with past research that shows women outshine men with a buy-and-hold investing strategy versus frequent trading, which tends to stunt performance over time.

Think of it like baking the perfect batch of chocolate chip cookies. The male investor, too lazy to look at a recipe and too eager to eat, ends up mowing the cookie dough and contracting salmonella. The female investor, following instructions and baking to perfection, ends up enjoying a flawless cookie (this is an awful metaphor because I am the male investor in this scenario any day of the week, but you get the sentiment).

Women have also made strides beyond retirement accounts, with two-thirds now investing extra savings outside of emergency funds, a 50% increase since 2018 (hell yes).

While the pandemic caused unprecedented financial challenges for many women, it also sparked motivation. There has been a 43% year-over-year increase in women opening new investment accounts since last summer, and a 37% uptick in women reaching out for guidance over the past two years (more hell yes).

It could get even better:

Although every study, and I mean every study (I tried to be a good journalist and look for opposing evidence, there is none) suggests women are more successful investors, findings show that only one-third of women feel confident in their ability to make investment decisions (maybe it’s all those years of trying to untangle deeply patriarchal roots and upend concrete, misogynistic societal structures, but what do I know? Far be it for me to get political!).

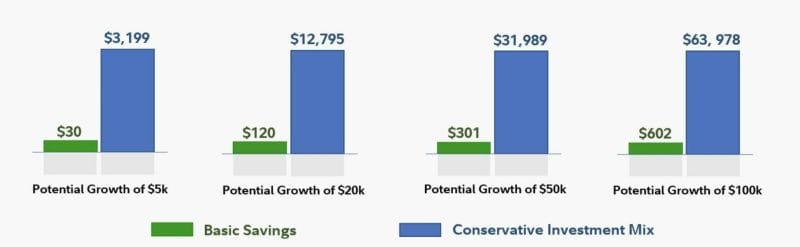

The main issue the most recent Fidelity study found was that women keep too much money sitting on the sidelines. Nearly half of women reported keeping $20,000 or more in savings on top of emergency reserves and significant percentages are holding cash in excess of $50,000 to $100,000. The problem with this, of course, is that the growth potential for these funds can be staggering over time.

For my numbers people: Here is how your money might grow if you invested your savings over 10 years in an average market.

I relate to the women holding on to $20,000 (I would also relate to those holding $100,000 but unfortunately, I haven’t that kind of money to hold onto). I too am a financial hoarder and no matter my degree of research feel that I do not know enough. This is not my field. I must have missed something.

Fidelity and every other statistic are telling us that we are dead wrong and that these misconceptions are, in fact, holding us back. For example, the study reported that 70% of women believe they need to know more about picking individual stocks prior to investing. (This is simply untrue. There are many “beginner” investment funds that take a cohort of consistently well-performing stocks and put them all in a single fund that you can invest in prior to cherry picking individual company’s).

Despite this lack of confidence, Lorna Kapusta, head of women investors at Fidelity Investments, argues that…

“We’re seeing a notable shift in women wanting to learn more not just about how to start investing, but how to dig deeper – how to evaluate and select different types of investments to align with specific goals and how to manage an existing portfolio to ensure you’re invested appropriately and on track…We see time and again when women do get more engaged and ensure their money is invested to achieve what’s important to them, their stress levels go down. When women know their money is working as hard as they do – that’s goodness and helps them feel better about their future.”

Here’s to women, our money, our future, and never waiting to be asked to dance.

Until next week.