I have been keeping tabs on Ethereum and other cryptocurrencies as they attempt to climb back over an important resistance zone. This needs to happen for me to shift back to bullish in the short term. Ethereum more pain before gain? Funnily enough, this can be said about Gold, Silver and Bitcoin as well. The assets people think will go higher on a crisis and the death of the US Dollar.

The one criticism Bitcoin, Ethereum and other cryptocurrencies receive (and I know there are a lot of them!) is the fact that they have never gone through a financial crisis. This is important because we do not have any price history to compare with. Now I am not saying a financial crisis is definitely around the corner, but it is feeling like some sort of crisis may occur.

We have energy issues not just in Europe, but also in China. Chinese supply chains have been impacted. The Evergrande issue has not been resolved. Covid and rising cases and possible new variants remain a threat. The Federal Reserve telling us a taper is coming soon, and for those that think this stock market and assets are only up on cheap money, a taper tantrum could bring down stocks. Something I wrote about in yesterday’s Market Moment. And then we had Janet Yellen spooking markets. The former Fed chair, now Treasury Secretary, said that the richest nation in the world is about to run out of money by mid October, unless the government gets its act together and resolves the debt ceiling issue. It would be devastating to markets if this happened, but the debt ceiling is an issue almost every year. The surprising thing is that this drama is happening when the Democrats on everything. So some infighting and disagreement within the party.

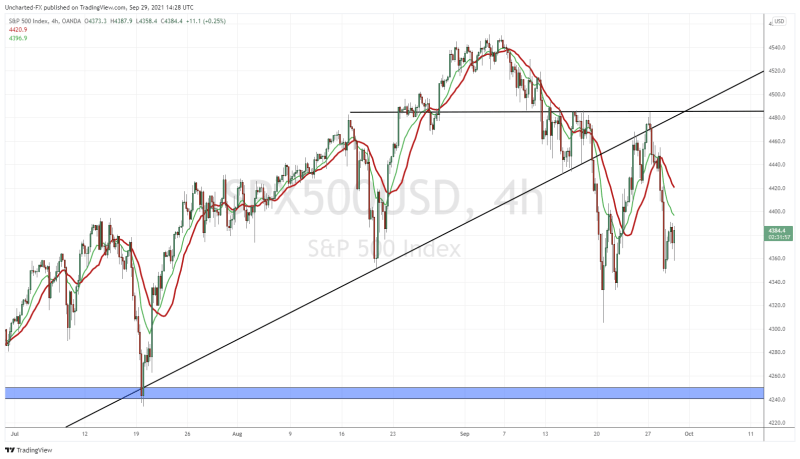

A lot of this is weighing in on markets…but my readers know that the technicals were telling us a drop was coming. Stock markets are getting a nice bid right now but we shall see if we take out yesterday’s lows. Why do I bring this up? Well, what I have been seeing is a positive correlation between stocks and cryptocurrencies. When stocks move up, crypto’s move up. When stocks move down, crypto’s move down.

Cryptocurrencies are moving like an asset class rather than a safe haven. By the way, the same can be said about Gold too.

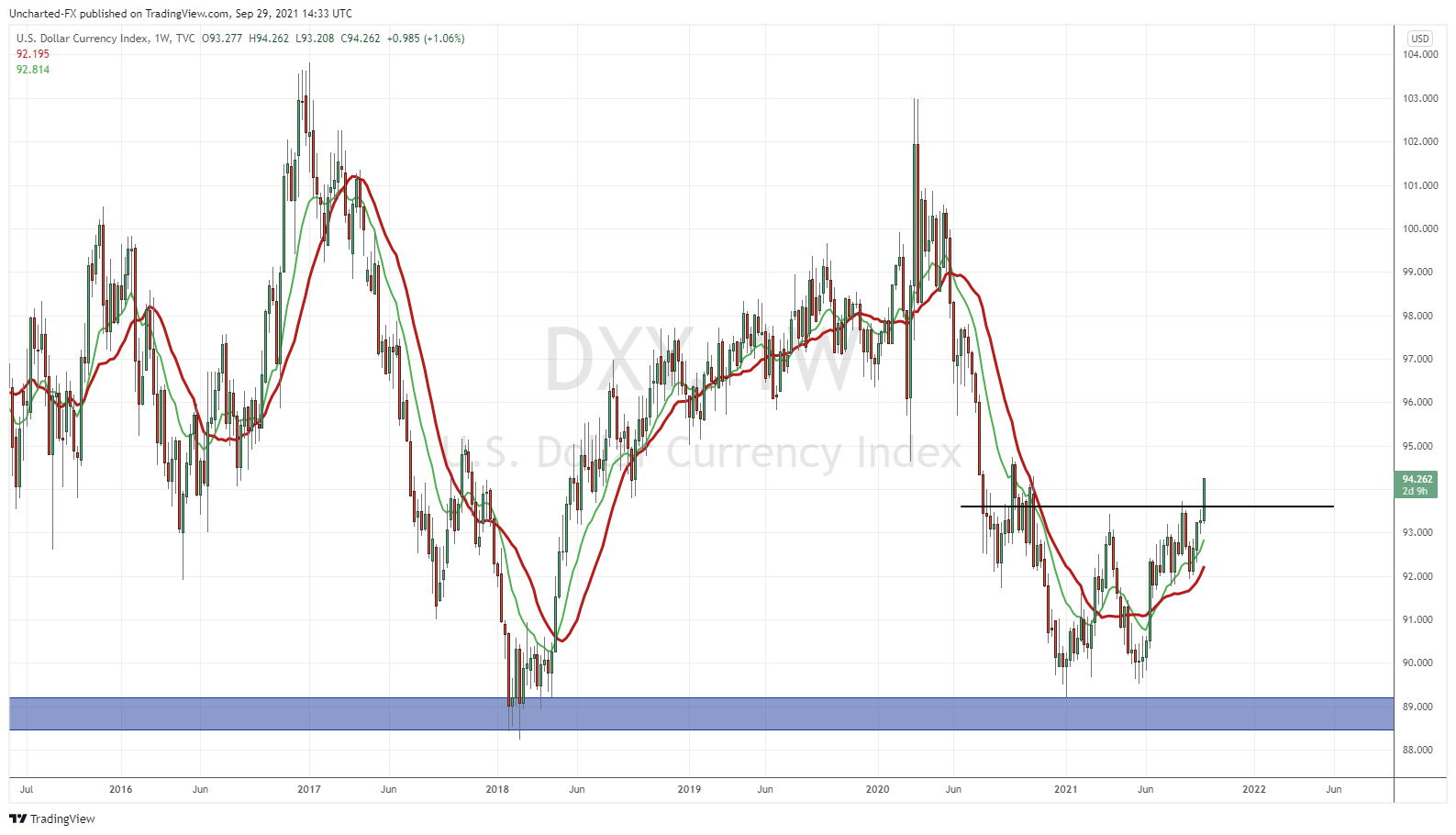

The US Dollar is on a tear, due to the market pricing in Fed tapering. This is impacting both precious metals and cryptocurrencies. Been saying this for a few months, but this US Dollar chart is super important for future macro trends. It does look like the Dollar may begin a new bull run.

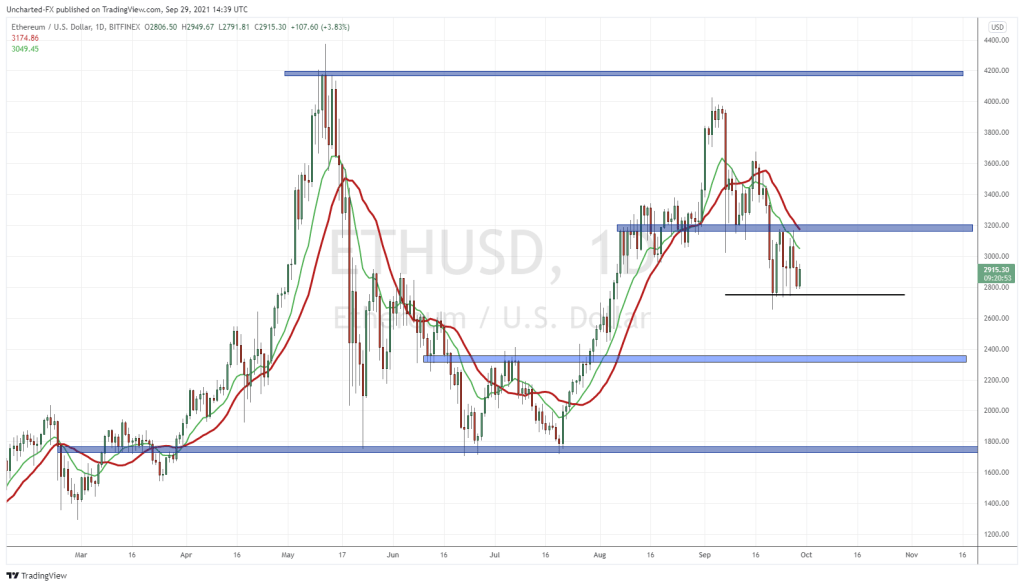

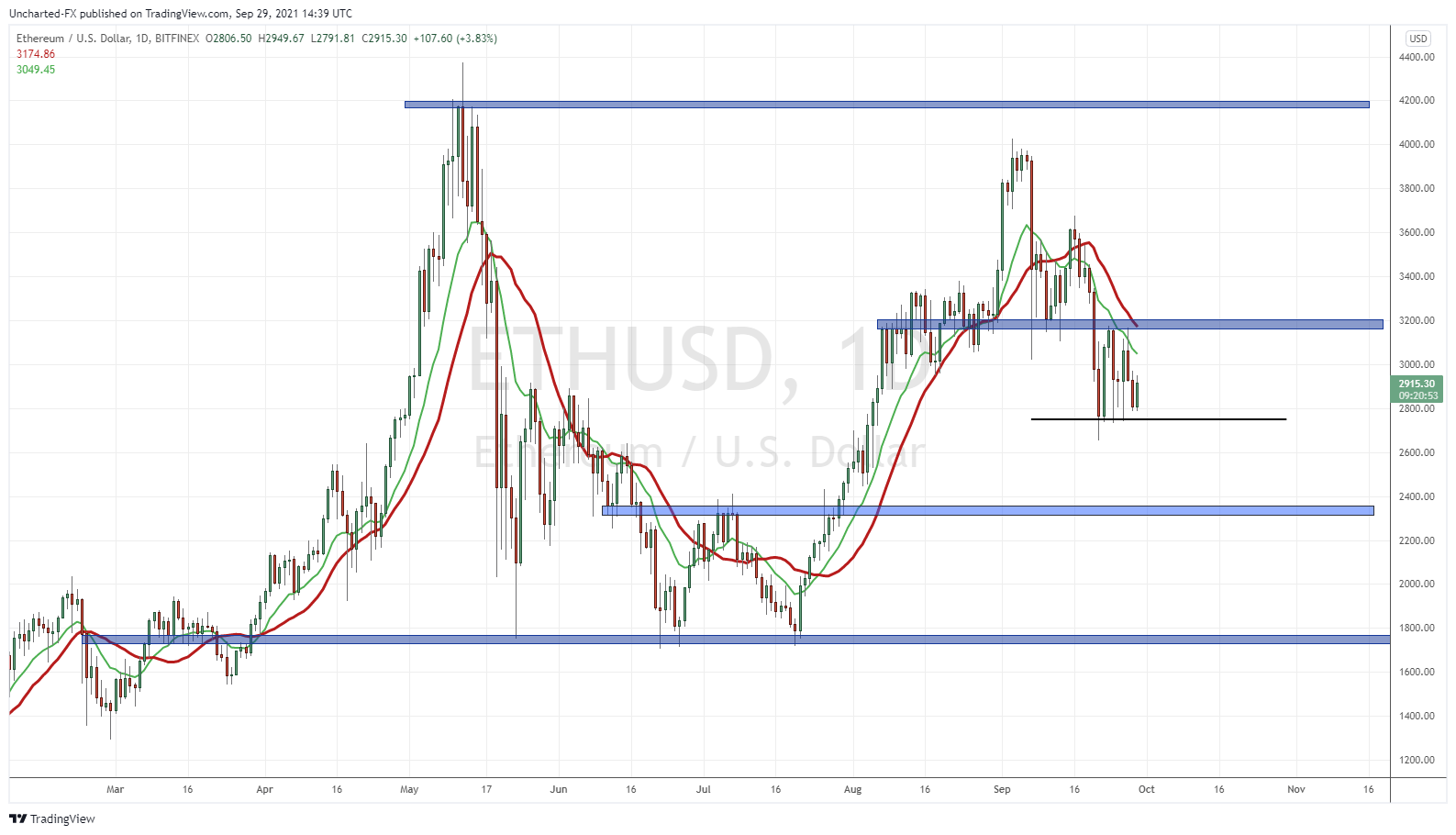

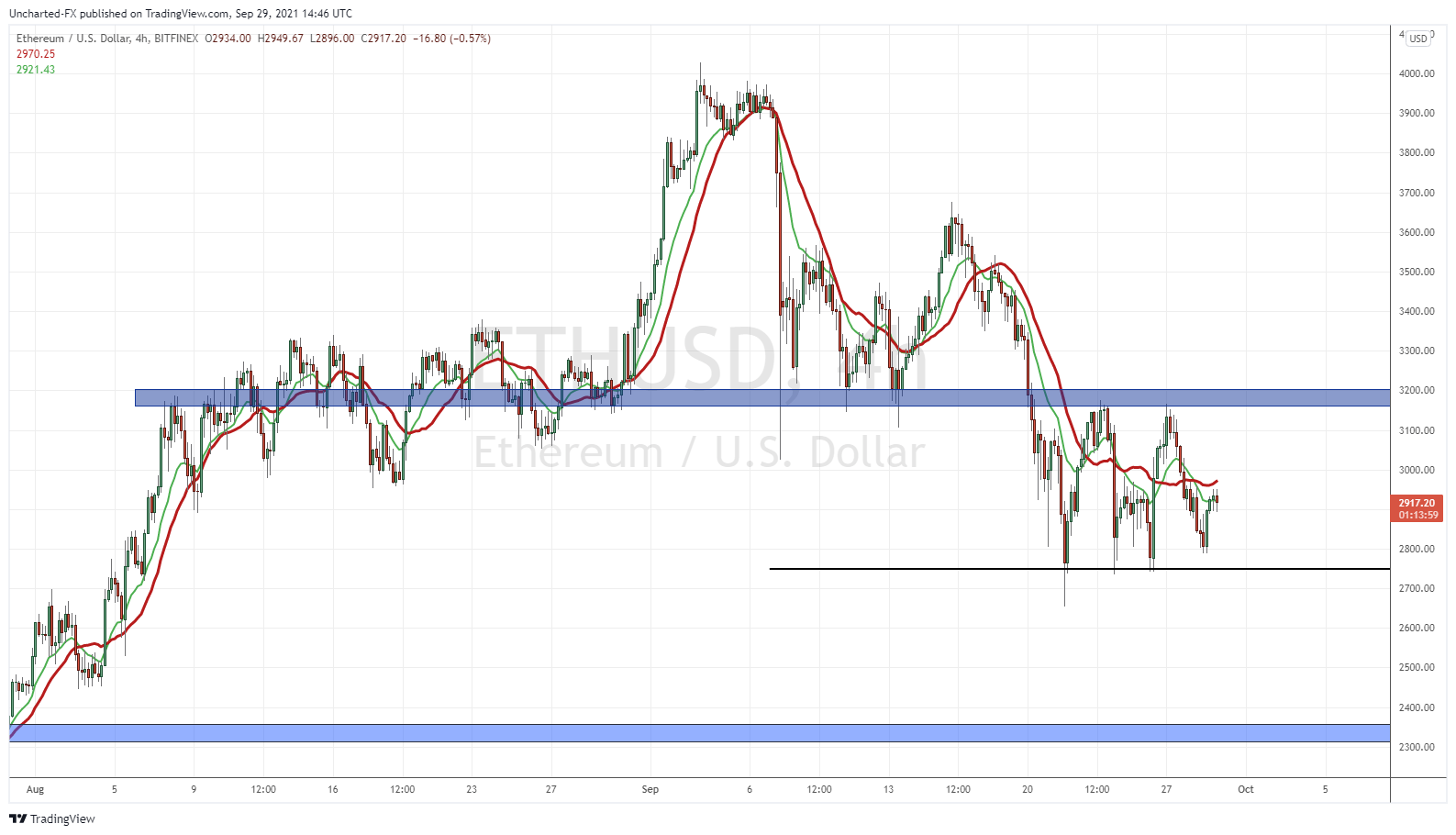

Ethereum broke the major support up at $3200. And since then, I have been expecting some more pain. Note the typical breakdown action: price pulled back to retest the previous support now turned resistance at $3200. Sellers have jumped in every time we moved to retest that zone. I am looking for another leg lower with a lower high swing. My moving averages have turned. Bearish, unless we climb and close back above $3200.

Ah, I should also mention the big news on China banning all cryptocurrency trading and transactions. China has done it before, so it really is about how they enforce this. My readers know that I am worried that with the roll out of central bank digital currencies, central banks and governments may do something about private crypto’s. Central banks don’t really like competition, it isn’t really their thing. So I am thinking that maybe China is ready to fully deploy their Digital Yuan soon.

Going down to the 4 hour chart, you can clearly see the levels we are playing with. $3200 resistance above, and $2750 as support. So far we have been ranging and just need a break in either direction.

Favoring the downside, especially if the Dollar rises and stock markets come under pressure. This would take us down to the $2300 zone.