One billion shares

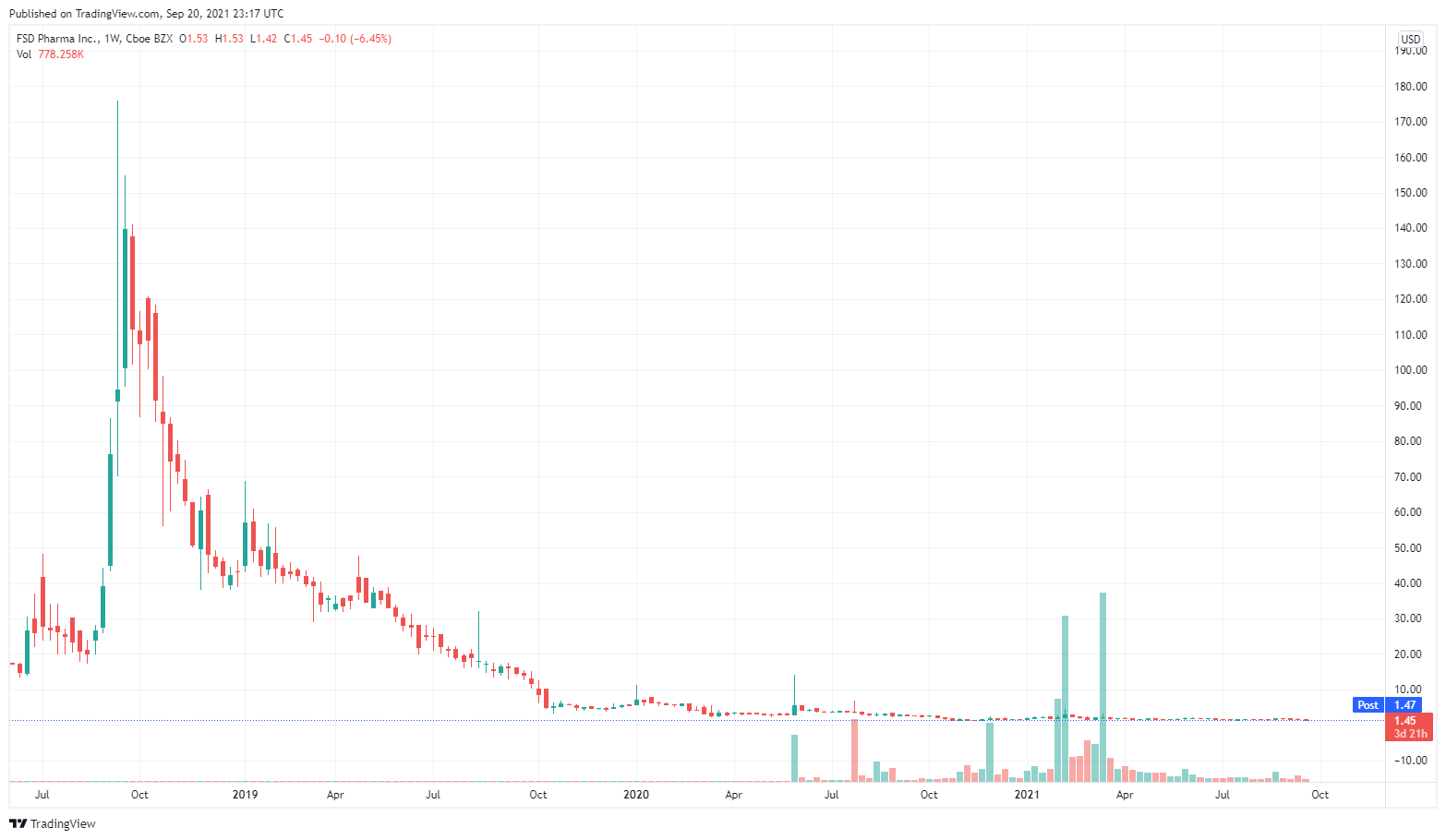

No matter what FSD Pharma (HUGE.N) does, I will always remember them as the company that bragged endlessly about having more than a billion shares outstanding. That was their whole philosophy, they went so far as to go with HUGE as their ticker. They also completed the biggest reverse split I have ever seen.

With news that FSD Pharma, a Nasdaq listed company is getting involved in psychedelics I thought there might be at least some excitement, maybe some investors who weren’t around in the cannabis days. The general consensus from what I have seen is to stay away at all costs unless something fundamentally shifts, there are other more qualified and better run companies out there. FSD Pharma has been a gong show since its inception.

FSD Pharma had over a billion shares out before they were producing revenue. They were originally a Cannabis Wheaton/Auxly (XLY.T) streaming client who eventually broke off from their deal and went their own way. Now in 2021 what I assume is an attempt to kind of revamp the company, FSD Pharma is starting to make some ripples in the psychedelics sector. The company is looking for a new face as it recently canned its CEO, Dr. Raza Bokhari, after a committee found him guilty of breaching court orders, improperly issuing shares, and attempting to misappropriate company funds. According to Bokhari’s website,

Recipient of Philadelphia Business journal “40 under 40” award, Physician turned entrepreneur, Dr. Raza Bokhari, has over the past several years, developed outstanding expertise in aggregating and accelerating life sciences and healthcare services companies. He has a vast knowledge base of developing creative concepts, implementing programs and forming strategic alliances.

Our good pal Ben Ward also made it into some top 40 under 40 thing, must be cursed.

I feel like FSD Pharma will soon be all of the Motley Fool articles talking psychedelics companies listed on the Nasdaq. There’s gotta be some incoming marketing push to maybe attract new investors, or try to convince the more seasoned ones that hey we have a new CEO and a new direction, that being psychedelics. We already did our big fat rollback, and it won’t happen again, we promise. In 2019, FSD Pharma did a, are you sitting down for this? A 1:201 reverse split.

Yes, two hundred and one.

This is how they got onto the Nasdaq, the company currently has 201 million shares outstanding. At $1.45 USD they are playing with fire in regards to Nasdaq’s minimum share price requirements. I assume that’s partially why they are diving into psychedelics, and while psychedelics stocks are largely at a 6 month low, investors are excited coming into Q3 and Q4 that there are enough catalysts to bring the sector back up. Stocks, in general, have slowed down as they typically do in summer, China’s fiasco isn’t helping markets either. FSD better hope things turn around quickly or that massive rollback may have been done in vain as they retreat back to the OTC and CSE.

Lucid

FSD Pharma announced back in August it was acquiring 100% of the issued and outstanding shares Lucid Psycheceuticals Inc. (“Lucid”), a Canadian-based specialty psychedelic pharmaceutical company focused on the development of therapies to treat critical neurodegenerative diseases, for roughly $11.3 million CAD in FSD Pharma stock. Prof. Lakshmi Kotra, co-founder and CEO of Lucid, commented, “We started with a vision to accelerate therapies for Total Brain Health.” My counter to that would be, you just took $11.3 million CAD in FSD shares.

According to FSD, Lucid is developing novel molecules and combinations with the goal of addressing brain health and targeting some of the most challenging neurodegenerative diseases, such as Multiple sclerosis, and other brain conditions.

Seems a bit vague.

Lucid apparently also has exclusive worldwide licensing rights from the University Health Network, North America’s largest health research organization, to a patent-protected family of new chemical entities (NCEs), on which Lucid’s development platform is based and from which its lead neurodegenerative disorders therapeutic candidate, Lucid-21-302, has been derived.

Lucid’s pipeline includes Lucid-201, a psychedelic drug candidate targeting mental health disorders, and it is also investigating certain cannabinoids. But, funny enough, FSD Pharma is axing its cannabis operations.

No more weed

FSD Pharma, the once proposed weed giant is getting out of the weed game. At one time FSD Pharma held three licenses from Health Canada:

- a Cultivation License

- a Processing License

- a Sale for Medical Purposes Licence

In 2019 FSD said their Cobourg facility will be able to produce 400 million grams of dried cannabis flower per year. They were aiming at having the world’s largest hydroponic indoor cannabis production and processing facility. They terminated their agreement with Auxly and went full world domination mode. Again, following that ‘HUGE’ philosophy that seems to meander itself through every aspect of this company.

But on July 30, 2020, the company announced that it has notified Health Canada of the Company’s decision to forfeit the licenses

of FV Pharma and suspend all cannabis-related activities of FV Pharma within 30 days. As of September 30, 2020, the Company

ended all activities of FV Pharma and had surrendered its Licenses. The Company is actively marketing the Facility and Facility Property for sale and expects that the sale of the Facility and Facility Property will be completed within the next twelve months.

The company filed an Investigational IND with the FDA in August 2020 and was given the green light just a month later to initiate a phase 2 clinical trial for the use of FSD201 to treat COVID-19. But last month announced they were terminating the study. Another L for FSD Pharma. Can we please change this company’s name to SMDH Pharma. They were cannabis, then they were Covid, now they are psychedelics. They can’t seem to make up their mind, it all feels pretty random and fly by night.

They also seem to burn their bridges after each phase instead of integrating a series of different verticals under one rooftop kind of like Revive (RVV.C) did. It’s been a bizarre strategy and the company’s share price has been nothing more than a flatline with the occasional blip for years now. Whatever trend comes after psychedelics I wouldn’t surprised to see another pivot, CEO, rollback, etc.