It was a wild day in the cryptocurrency market yesterday. But saying that, those of us who do invest or trade the cryptocurrency markets know that it will be volatile. It isn’t for the faint of heart. This is something we accept going in. We have seen days like yesterday in the past, and will likely see more days like that in the future.

I am talking about the large 10% plus drop in Bitcoin and 20% plus drops in some alt coins. There were two coins which held onto gains. Solana and Fantom. Lot of talk about those two coins in crypto circles, so keep your eyes on them.

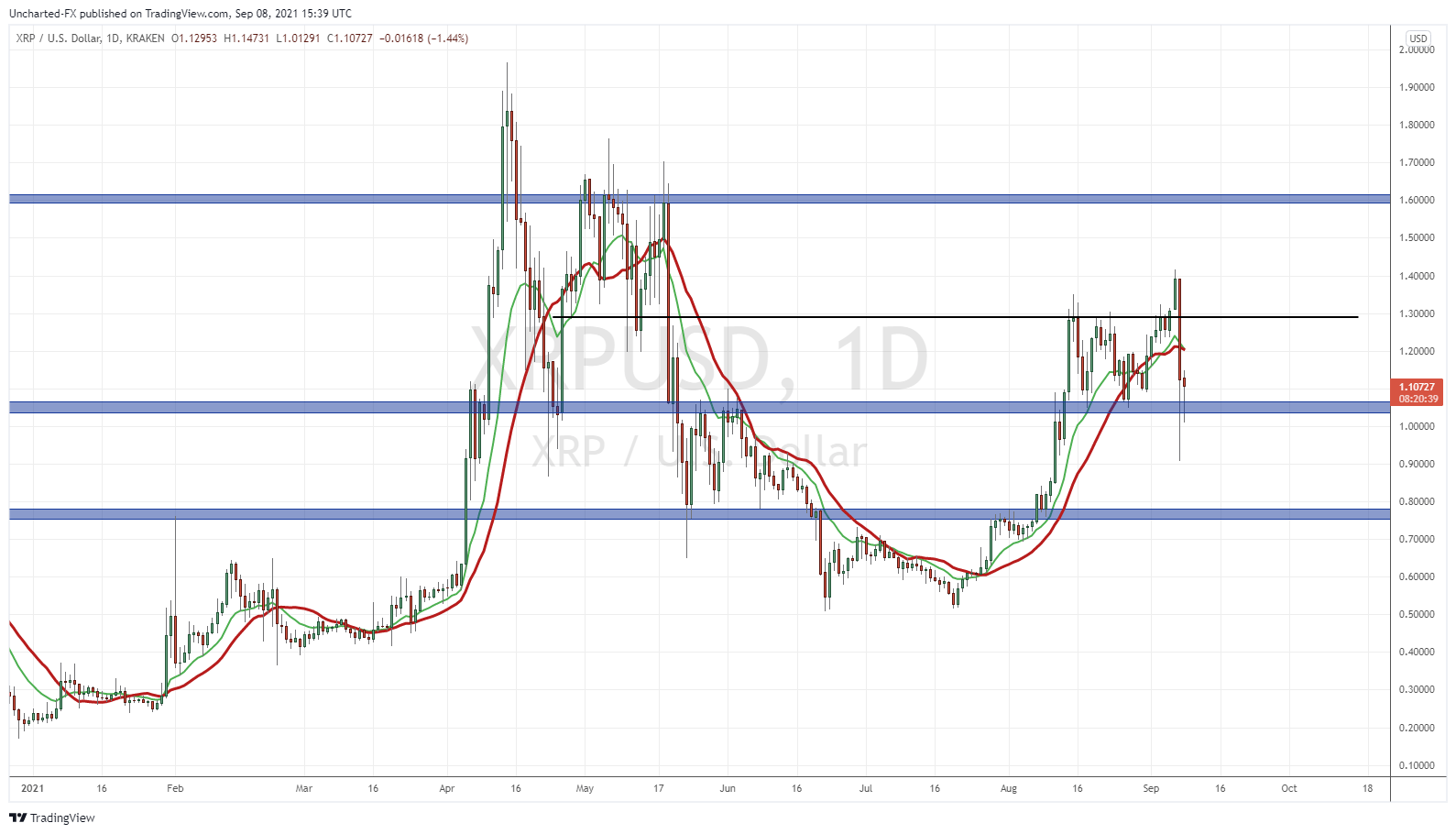

But let me give you a quick rundown from yesterday. I just finished posting my Market Moment on XRP and the levels to watch (still holding by the way), and then I went down to brew my coffee. Crypto’s were green. Now I brew my coffee the old school way. I measure 15 grams of beans on my scale. I then grind those beans by hand, before putting them in a Hario pour over mechanism. Top notch pour over paper from Japan, and Santevia filtered water. The coffee just tastes so much better after putting in the effort. Anyways I got distracted, but back to crypto’s. So it takes me about 15 minutes to brew a coffee, and in those 15 minutes…crypto’s went from positive to negative 10% and 20%.

Many on Twitter were like wtf just happened! We had good news regarding Bitcoin being accepted as legal tender in El Salvador. The first country to do so. A huge milestone for Bitcoin and cryptocurrency in general, with the nation of 6.5 million people buying 200 Bitcoin. That number has now increased to above 500. So you have a country now buying Bitcoin, so should be bullish right? What we saw folks was the typical buy the rumor sell the news. Big money and whales knowing that money would jump in on this news, and then set traps. New money took large leveraged longs, fell for the trap, and then got crushed. But maybe the rabbit hole goes even deeper?

In the past I have spoken about central bank digital currencies (CBDC). They are coming. All money will be tracked and taxed. If we go into negative interest rates, you will be forced to keep money in the banks, and lose money monthly for saving rather than spending. This was a big reason central bankers believe negative interest rates failed to cause inflation in Japan and Europe. The goal was to punish people for saving and get them to spend. They didn’t. They saved instead. Either by putting money into chequing accounts, or just taking it out of the bank as cash. CBDC’s will fix this problem. And it will suck.

The issue with a CBDC is what to do with the people who put their money into Bitcoin and other crypto’s. This has led many to speculate that when Central Banks are ready, they will go after Bitcoin. In my opinion they don’t need to do much. Just say Bitcoin is banned. The average Joe traders and investors will get out, and if you look at society now a days, they are very compliant. Issue fines or punishment for holders and there won’t be much of a fight.

There were some on social media claiming this adoption of Bitcoin by El Salvador goes against what the central banks are planning to do. To add fuel to this fire, the President of El Salvador directly blamed the International Monetary Fund (IMF) for the dump:

Pretty savage stuff.

Even if you aren’t bullish Bitcoin…El Salvador then basically becomes a bag holder.

And then the World Bank came out saying that they cannot support El Salvador with Bitcoin due to environmental and transparency issues. Seriously. I laugh a bit because I read the book called ‘confessions of an economic hitman’. Even if you haven’t read that book, I think you know how it works with countries in Central America, South America and Africa. World Bank or the IMF get these nations in economic trouble, then loans them the money, usually with a high interest the country cannot pay. But no worries, a compromise is made where the banks tell the politicians to impose austerity measures and get to control monetary policy.

To me, it seems El Salvador is breaking apart from the system, and this is dangerous especially if other nations follow.

Honestly, if this is the beginning of the transfer to CBDC’s, I would be watching for more regulations to follow. Keep an eye on what happens in El Salvador. I just heard that there are thousands of people protesting against the adoption of Bitcoin. But not just that, we have heard the SEC is planning to sue Coinbase. Maybe just FUD, but lot of people tweeting people to get their money out of Coinbase accounts.

Now let’s take a look at the charts of some crypto’s. Even though we had a huge drop, crypto’s are holding onto the higher low…meaning the uptrend is still intact. While looking at these charts there is one thing to keep in mind: Will this drop deter regular traders and investors from jumping into crypto’s? I know many people who made great gains in these previous weeks only to lose it all in one day. They might just think that this is rigged and go elsewhere.

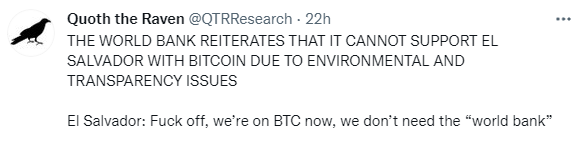

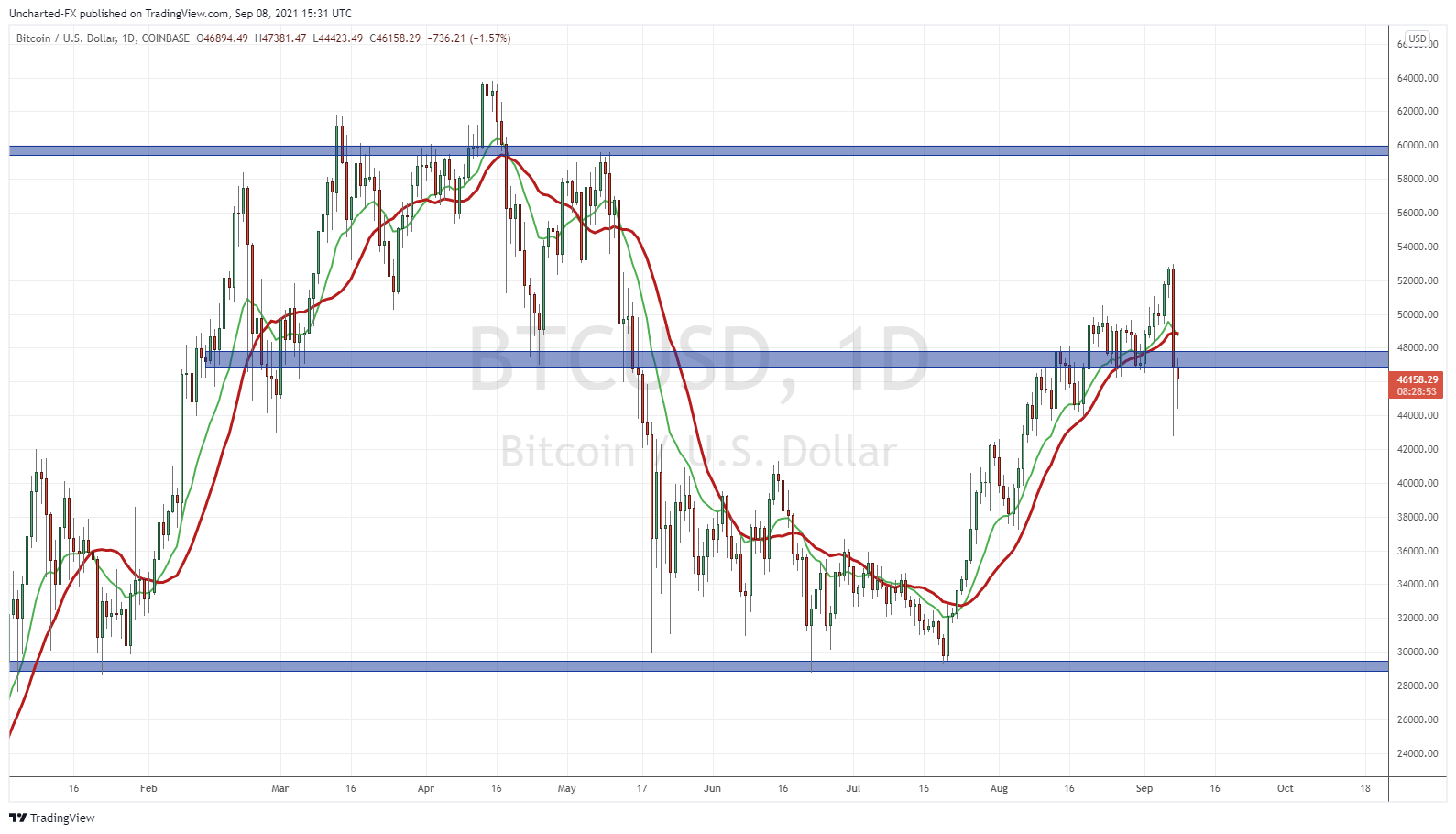

I spoke about the $48,000 support zone on Bitcoin in yesterday’s Market Moment post. Things got scary with the sell off, but remember, WE TRADE CANDLE CLOSES FOR CONFIRMATION. And the close kept us above support. We have some interim support at $44,000 too and buyers did jump in there as you can see from the candle wick.

We barely closed above $48,000 support, but the important thing is that we did not break down. Now I am watching today’s candle to see if we can get bid up and climb over our zone. Not surprised with the drop earlier on, as it should be expected given the volatility we had. But buyers are bidding this up. Wouldn’t be surprised if we get a nice close today.

For those who have followed my work, and understand my criteria for trading, you might see something that I am worried about. I will talk about it in detail if it happens next week on Market Moment, but I am worried that we form a head and shoulders reversal pattern. Meaning Bitcoin bounces for a few days, only to then sell off hard and taking us lower.

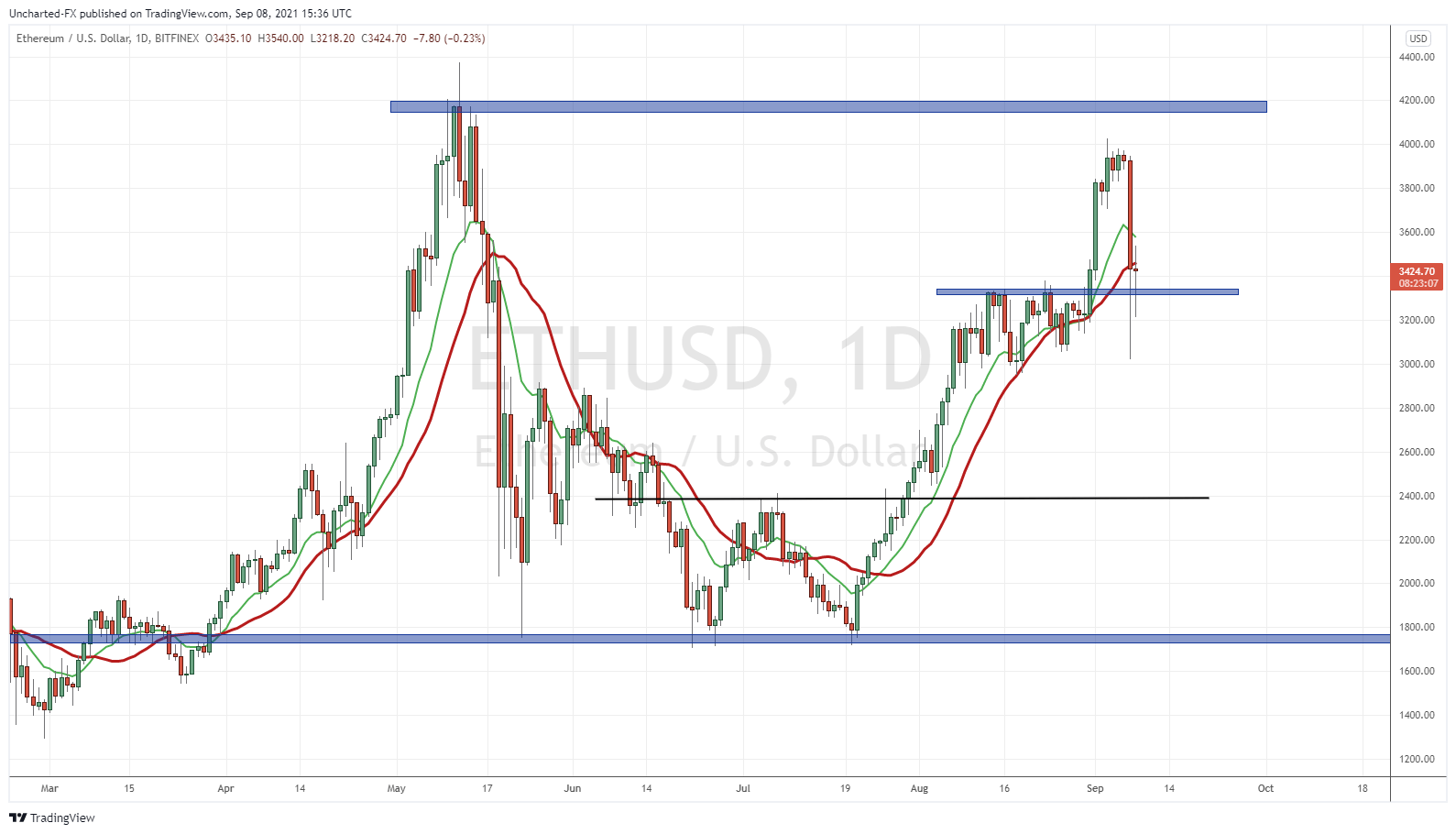

Not much to be said on Ethereum. The crypto is a beast. Still popular with the surge in NFTs and DeFi. I noted in previous posts that Ethereum will pullback to retest the breakout zone at the $3320 zone. Well we did. And buyers held. We are still battling at this zone today, and I would only get worried if sellers manage to get a close below $3320. But overall, still looks strong. The higher low and support has held, so the uptrend is still intact.

Finally XRP. We did not hold above the $1.30 zone as discussed yesterday. BUT we held above the all important $1.00 zone. A huge psychological number and a major flip zone (an area that has been both support and resistance). Large wick indicates a big group of buyers.

So in summary, we definitely saw some crazy price action. Seems like it was whales and big money taking advantage of new traders having large leveraged trades. You take them out and you can create huge drops like this. For someone like me, who knows CBDC’s are coming but the challenge is selling it to people, I wouldn’t be too surprised to find out that central banks were involved. This market sees volatility, but focus on the long term charts and market structure. Uptrends are still intact, indicating this was all one big pullback.