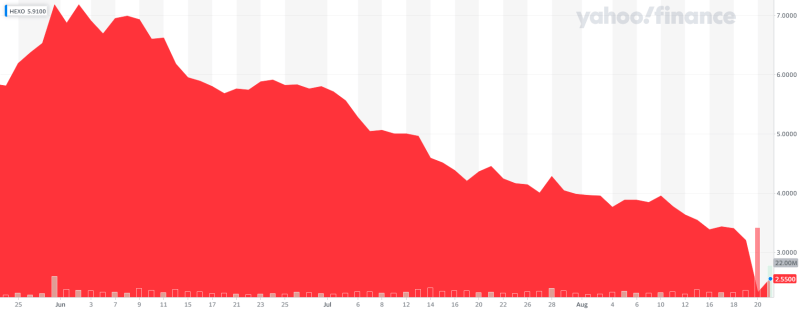

-65%

Over the summer Hexo (HEXO.N) shares have dropped from $7.18 USD to $2.54 US, a 65% decrease. The company’s market cap currently sits at $387.9 million CAD despite a recent barrage of M&A activity that theoretically should have added to the company’s value.

Hexo is positioning itself to be one of the biggest cannabis brands in the world, and, that ability to scale has been provided by mass dilution like the new public offering the company announced last week. The offering will add 47 million shares to the 152 million share pool, this is of course following the reverse split from December 2020 when Hexo had a thick stack of 489 million shares outstanding.

Hexo plans to raise $140 million CAD from the offering and will use the net proceeds to pay a portion of the cash component of their recent Redecan acquisition valued at $925 million CAD.

YOLO M&A

Hexo’s Redecan acquisition is comprised of $400 million CAD in cash and $525 million CAD in Hexo shares. Hexo is paying nearly a billion dollars in value for a licensed producer, I hope their revenue numbers are strong. Redecan is a private company and its financials aren’t public. Hexo also hasn’t given any specific targets or estimations on how much product or revenue this will potentially bring. The deal is set to close in Q3 of 2021. Hexo also raised $360 million USD from a convertible note round in May to help pay for the transaction.

Hexo also acquired Zenabis in an all-stock transaction valued at $235 million CAD back in February. The Zenabis acquisition gives Hexo access to licensed capacity with the ability to produce approximately 111,200 kg of additional cannabis annually.

Hexo also gets two indoor facilities (approximately 635,000 sq. ft.) and access to a 2.1 million sq. ft. greenhouse facility, totaling approximately 2.735 million sq. ft. of space.

In Q1 of 2021, Zenabis saw a 34% decline in its adult-use recreational revenue category over Q4 2020. But, Hexo is excited about entering the European market through the Zenabis acquisition.

In 2020, Zenabis received an export license from Health Canada to export cannabis for medical purposes to the EU. In May, ZenPharm ( a Zenabis subsidiary) received its Medicinal Cannabis License from the Government of Malta. Zenabis also began shipping to Israel in 2020.

Hexo also acquired 48North in an all-stock transaction worth $50 million CAD deal in May. Within one year of closing, Hexo estimates the deal could generate up to $12 million worth of accretive synergies through reductions, additional capacity utilization at Hexo’s Belleville facility, and selling, general and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative savings. 48North announced in March that it would lay off about 20% of its staff and end outdoor cultivation at an Ontario facility.

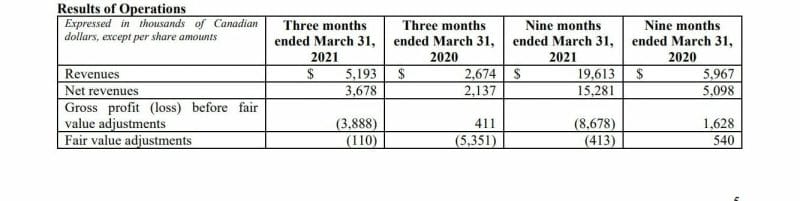

Dilution and pissed-off retail investors aren’t the only company’s problem – they aren’t really selling much weed, which explains the full-on YOLO M&A strategy for LPs this year. In Hexo’s most recent financials the company boasted a 2% sales increase year over year with a $10.2 million CAD drop in sales from the previous quarter.

Hexo’s non-beverage revenue decreased by 7% from Q3 2020 and declined 29% from the previous quarter Q2 2021 primarily as a result of a $5.2 million CAD decline in the province of Quebec due to the specific timing of strain cultivation decisions made by the company, as well as certain production decisions regarding hash oil.

Hexo reported a loss of $20.7 million CAD in the third quarter compared with a loss of $19.5 million CAD in the same quarter last year.

This is kind of starting to look like Aurora (ACB.N).

Aurora

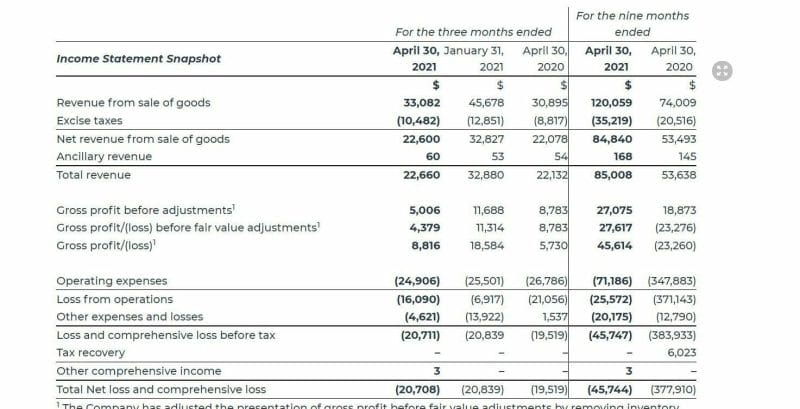

For people following the cannabis space, Aurora has been a beautiful disaster to watch unfold. In 2017 they were on top of the world acquiring everyone, building trillions of sq/ft of grow space, all of it funded of course. But, Aurora’s aggressive M&A strategy and stomach for dilution has seen the stock get beaten up pretty bad since its 2017/2018 heyday.

In May 2020 Aurora was forced to enact a 1-for-12 reverse split to avoid being delisted from the New York Stock Exchange. Aurora had 115 million shares on June 30, 2020, which has increased to 200 million shares in just six months due to an ATM (at the money) share buying program.

The program allows Aurora to issue and sell up to the U.S.$300 million CAD of common shares in the capital of the company. Aurora believes this filing will provide maximum flexibility for the Company to pursue select acquisitions going forward.

In 2020, Aurora reported a CA$3.3 billion net loss, which was magnified by more than CA$2.8 billion in writedowns and impairment charges. While some of these charges were tied to the closure of the company’s smaller cultivation facilities and to layoffs, most relate to the company’s grossly overpriced acquisitions.

Aurora has $477 million USD cash in the bank with an almost identical $480 million USD in debt, giving the company a whopping debt/equity ratio of 22.08.

But even as Aurora slaughters its retail investors year after year, many of them are still beating Aurora’s drum.

Hydropothecary

Personally, I don’t think Hexo should have changed their name from Hydropothecary. Hexo sounds like a Mexican gas station chain and Hydropthecary was pretty sexy.

I was at a cannabis investor conference in 2017 and one of the Hexo founders said they ran a bunch of focus groups and the feedback was the Hydropothecary brand was too feminine. I’m a 30-year-old dude and it was some of my favorite branding outside of Tokyo Smoke, DOJA and Supreme.

Everything was about medical cannabis back then and apparently, women were less likely to go against their doctor’s suggestion as most doctors weren’t on board with prescribing medical cannabis.

So they switched it up to Hexo and things have been pretty rocky for investors ever since other than the Molson deal.

For Hexo’s market cap to only be $387.9 million CAD is definitely cause for concern for management, retail investors, and the new big-time shareholders Zenabis, 48North, and Redecan.

But for others looking at the space, this could be a good buying opportunity as Hexo deserves to be beaten, but probably not this badly. It has the assets alone to justify its market cap and I would be shocked if this stock doesn’t recover at least somewhat. Coming into next year with all of these new acquisitions at least revenue numbers will likely shoot way up.

This is what you pay for diluting your shareholders over and over and over again. Most weed investors have been in the game for at least a few years now, and the weed space has so much dog shit in it that anyone who follows it gets the added benefit of a better sense of smell. People can see exactly what Hexo is doing and realize this thing might be soupy to succeed in the long term. It’s like when a store starts slashing its prices, there’s only so far down you can go, the same goes for dilution.

On the other hand, with all of these acquisitions, and the safety of being in bed with Molson – $2.55 kind of looks like a steal as their recently acquired assets have more value than their market cap, the math on that is pretty attractive on a short term swing. Again, as a long term investment, I would hesitate on that one, but I’d be surprised if this thing goes much lower.

You can say a lot about Hexo, but at $2.55 USD per share, being overvalued certainly isn’t one of those things.