Black swan

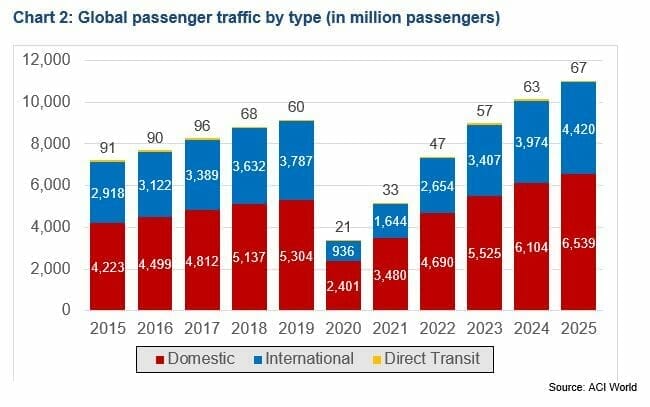

It’s no surprise that Delta (DAL.C) is down 21% since the delta variant became dominant. While Delta has taken a worse beating than the other major airlines, the sector as a whole has understandably taken a hit as fewer people have been flying since the pandemic started.

The airline industry has traditionally always been at the mercy of black swan events.

The U.S. airline industry suffered losses of about $7.7 billion in 2001 despite massive federal aid, largely due to a plunge in passenger demand after the 9/11 attacks.

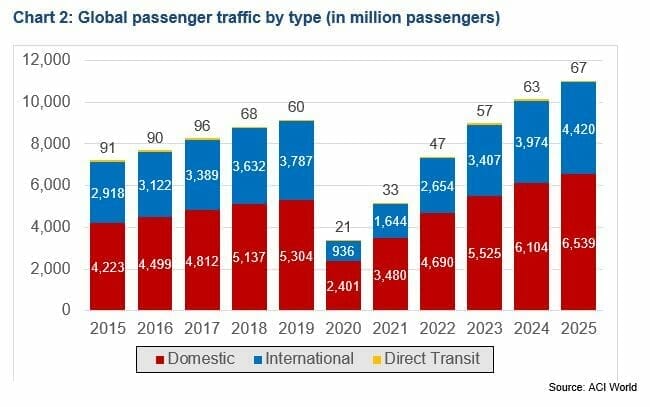

The impact of the COVID-19 crisis removed more than 1 billion passengers for the whole year 2020 compared to the pre-Covid projections representing a decline of 64.6% of global passenger traffic. The pandemic is forecasted to remove additional 4.7 billion passengers by year-end 2021 compared to the projected baseline (pre-COVID-19 forecast for 2021), representing a decline of 47.5% of global passenger traffic.

According to ACI World, world travel is expected to go back to normal in 2023/2024. With more optimism likely to gather over time the further we get away from peak pandemic numbers – the bottom might be right now.

A resurgence in leisure travel has helped, but airlines are still far from pre-pandemic profit and sales as some of their businesses, including business travel, are still nowhere near usual levels.

Domestic passenger traffic volume was helped by the early recovery of major domestic markets like China, Russia, and the US. Globally, domestic traffic volume for 2020 was recorded slightly above 2.4 billion passengers, a decline of 54.7% compared to the 2019 volume

After being hit first, Asia-Pacific embarked on recovery earlier and faster than other regions—mostly driven by China’s sizable domestic market— and closed the year 2020 with a decline of 61.3% compared to the projected baseline, a 59.8% decline from 2019. Asia-Pacific, however, recorded the highest traffic loss of all regions with a loss of 2.15 billion passengers in 2020.

Airlines also faced increased costs, including labor and fuel. In the U.S., major airlines received about $50 billion in a series of government bailouts and grants during the pandemic, mostly so they could make payroll. The airline industry has incredibly thin margins, which can make it a risky investment choice, that said, who will always get bailed out in a pandemic-like situation? The airlines.

Airline companies require vast amounts of investment to get the business to take off. This investment includes the purchasing of airplanes, purchasing space at airports. Because of these high startup costs airlines have some of the biggest creditors in the nation, this is common for countries all over the world and it’s why airlines rarely go out of business.

Chipotle

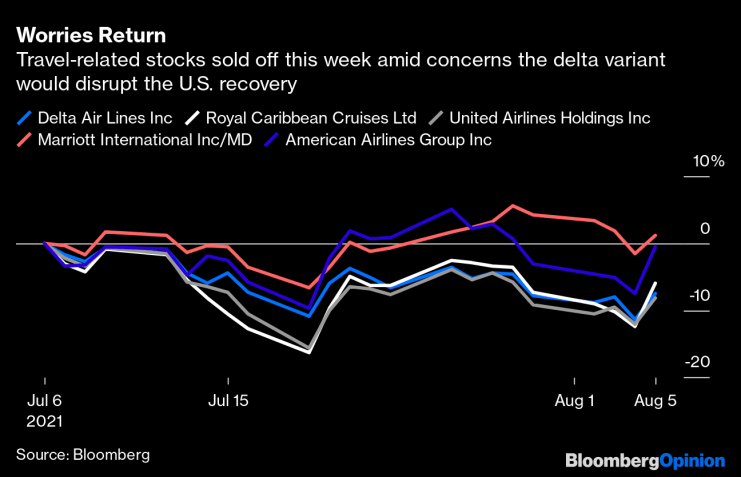

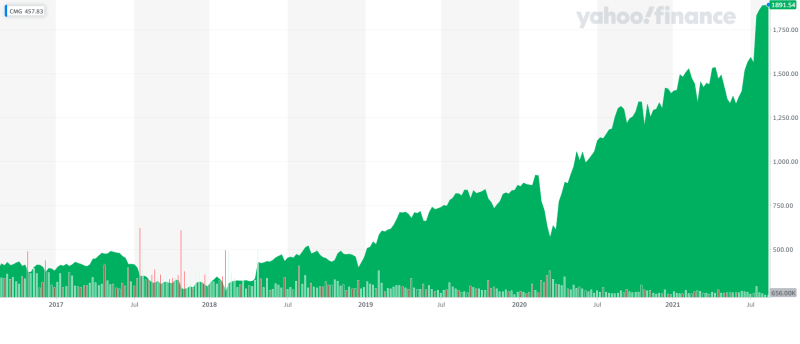

Delta’s story is interesting from an investment perspective as the company’s value has taken a big hit from something that has nothing to do with the company’s fundamentals. It reminds me of that E. coli incident at Chipotle (CMG.Q) a few years ago. Cases like these usually aren’t long-term as eventually, people’s mind slips about E. coli, and while it seems impossible now, the same thing will happen with the delta variant.

In 2015 more than 400 people reported falling ill after eating at a Chipotle in Ohio — the number later grew to more than 700 — resulting in multiple lawsuits filed against the chain. It was all over the news and the stock was getting absolutely killed.

While an isolated incident would likely have a negligible impact on Chipotle’s business, investors are understandably uncomfortable after a series of E. coli and norovirus outbreaks in 2015 sent Chipotle’s sales and share price tumbling. From the end of July 2015, when the first E. coli outbreaks occurred, to the end of July 2017, Chipotle stock dropped 53.2 percent.

If you really crunch the numbers the fear wasn’t rational, but that doesn’t matter in the stock market.

But, life goes on. Chipolte brought in Taco Bell’s old CEO and things are humming. Chipotle was able to navigate the restaurant industry hit brought on by the pandemic by quickly shifting to mobile ordering and delivery. Because its model was already takeout-friendly, closing its dining rooms didn’t have the same impact as it had on other chains without an established and robust off-premise business.

Delta and Chipotle have different roads to recovery. They are completely different businesses in different sectors, but their perhaps unfair perception destroying their own value is similar in nature.

I remember wanting to buy a bunch of Chipotle right when all of that E coli drama was happening and I am kicking myself for not doing it. These situations are usually a gift as the thing that’s hurting the company has nothing to do with the balance sheet or the fundamentals of the company, it’s strictly perception.

If Chipotle had come out with brutal earnings for example, and the stock took a massive hit, that’s not necessarily a good buying opportunity, rather that’s just a necessary market correction as a direct result of the company’s overall performance.

The company tanking due to one chain in Ohio giving 400 people E Coli when there are 2,768 locations worldwide really makes no logical sense, just as Delta’s stock taking an extra hit likely because of the name doesn’t make logical sense. It’s these scenarios where you can usually pick up a quick buck or two – it’s like when people load up Home Depot (HD.Q) and Lowe’s (LOW.N) every hurricane season.

Forecasters project people will return to flying at the normal rate within a couple of years. The recovery will likely be slow as the Delta variant has introduced a new level of fear into the Covid landscape. That said, trying to predict this virus isn’t easy, and new and more contagious variants could still pop up. But, if you are feeling bullish, Delta is down more than any of the other major American airlines, and it’s probably just because of the name.