My readers know that I love agriculture. The returns are going to be spectacular in the coming years (maybe even months with how things are going). I like to look for undervalued and underappreciated sectors. While investors chase hot sectors, I prefer things that are under the radar. Call me a contrarian. I wear that title as a badge of honor.

When I look at the agriculture/farming sector, I get really excited. Firstly, we have the market side of things. Not many people paying attention, and a very under the radar space. To be honest, lot of eyes are on technology and crypto’s. They don’t like this ‘boring’ stuff. Secondly, the fundamentals for the agriculture and farming all point to higher share prices. It sort of sucks because it will occur due to a food crisis, but humans will overcome this with new farming technology.

Going forward, I will be keeping you all up to date on what happened in the agriculture sector on a weekly basis. I will cover headlines, and being a chart guy…I will notify you all of some charts that are catching my attention. These stocks will be companies that deal with farming, farming technology, farming equipment, some cannabis companies with an agriculture story, and there is even a canola streamer company in the mix.

In terms of coverage, these are the company tickers I will be watching going forward, we have a nice list of 28 companies. Majority of them are on the Canadian exchange, but I added Agrify since I like what they are doing. And yes, most of these companies do also have a US listing as well. Here they are:

| NTR | OGO | BEE | ARGO |

| LEV | BUI | GROW | FDGE |

| AFN | NPK | WWT | FARM |

| IFOS | TGH | ERTH | AGFY |

| CERV | CSC | GRO | VFF |

| CUB | CSX | PACR | AJX |

| MGRO | EAC | KRN | INP |

So why am I bullish agriculture specifically? For this, I recommend you read my post from a few weeks back detailing why I am bullish agriculture for the long term. The article was aptly named, “Why I am Going Big on Agriculture“. It came out right when BC was experiencing a heat wave seeing temperatures hit above 40 celsius.

You are likely to hear me plug in this article piece a lot going forward. All the arguments are still valid and will be valid going forward. In quick summary, the reasons I am bullish agriculture are:

- Jim Rogers and his coverage on Agriculture. Oh and a Billionaire that you have all probably heard about, Bill Gates, is the largest private owner of farmland in the US.

- The Weather.

- Supply Chain Issues.

- Green/Clean Energy

In terms of big macro headlines pertaining to agriculture, we have two biggies. The first is that the US government has declared a water shortage on the Colorado River for the first time ever. Supply cuts will mainly impact farmers in Arizona starting in January. Multinational mining company BHP is also making ag related headlines with its investment in Jansen Stage 1 Potash project in Saskatchewan. Big money too. We are talking about $7.5 Billion Canadian Dollars ( $5.7 Billion USD). BHP states on their site:

“This is an important milestone for BHP and an investment in a new commodity that we believe will create value for shareholders for generations,” Mr Henry said. Jansen is located in the world’s best potash basin and is expected to operate up to 100 years. Potash provides BHP with increased leverage to key global mega-trends, including rising population, changing diets, decarbonisation and improving environmental stewardship.

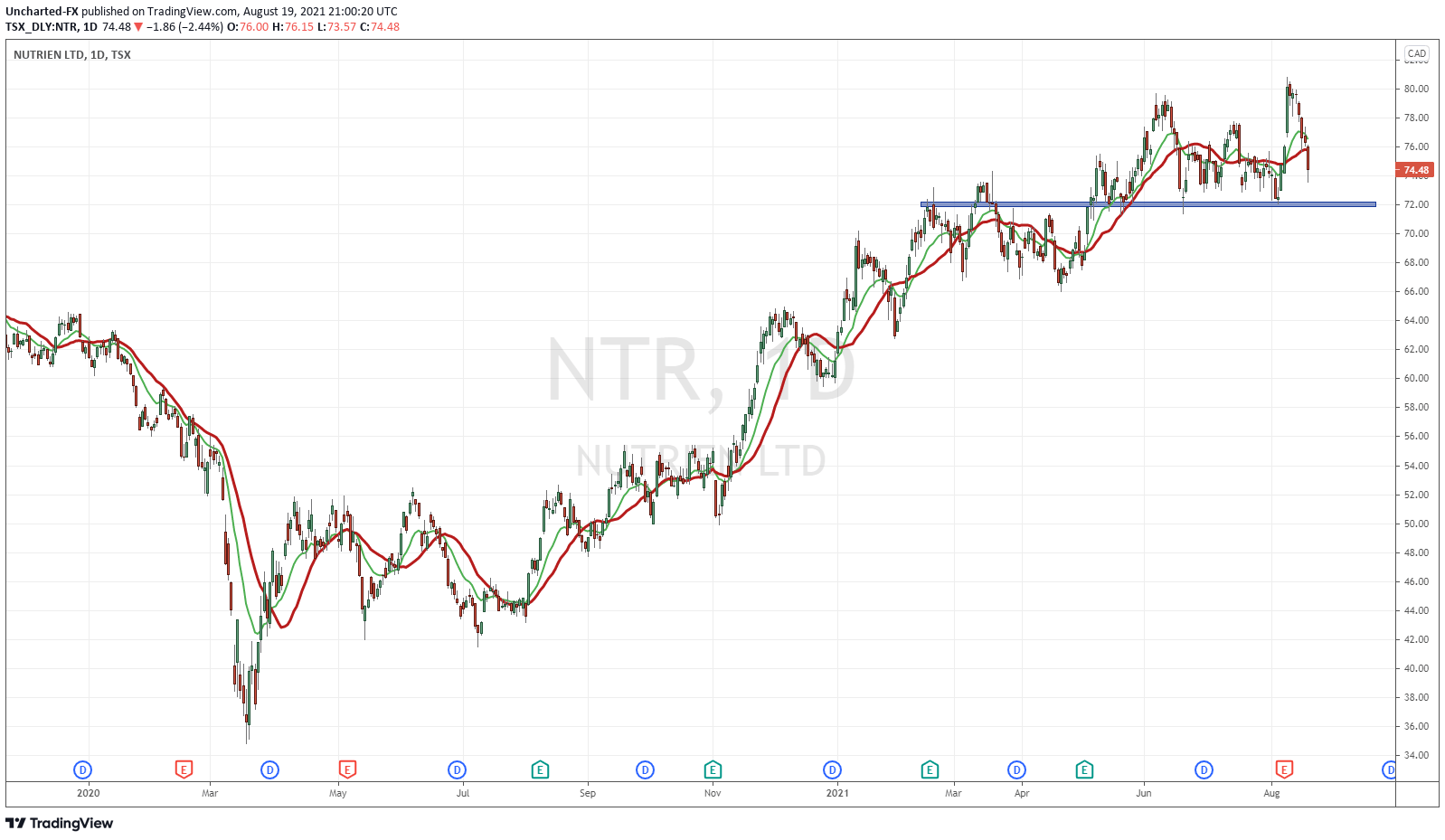

Nutrien Ltd provides crop inputs, services, and solutions. Offering potash, nitrogen, phosphate and sulfate products. They’re the big boys to play on Potash demand as they are Canada’s largest Potash producer. Even with BHP’s decision to press on with the Jansen project which will add millions of tonnes a year of Potash supply, Nutrien remains bullish on Potash.

“Nutrien expects global demand to grow by 2-3% per year until close to 2030. The company is also seen as an ideal partner to dilute BHP’s risk and development costs. BHP says it is open to but not in need of a partner, while Nutrien has said that any tie-up with BHP is not its focus.”

In terms of stock specific headlines:

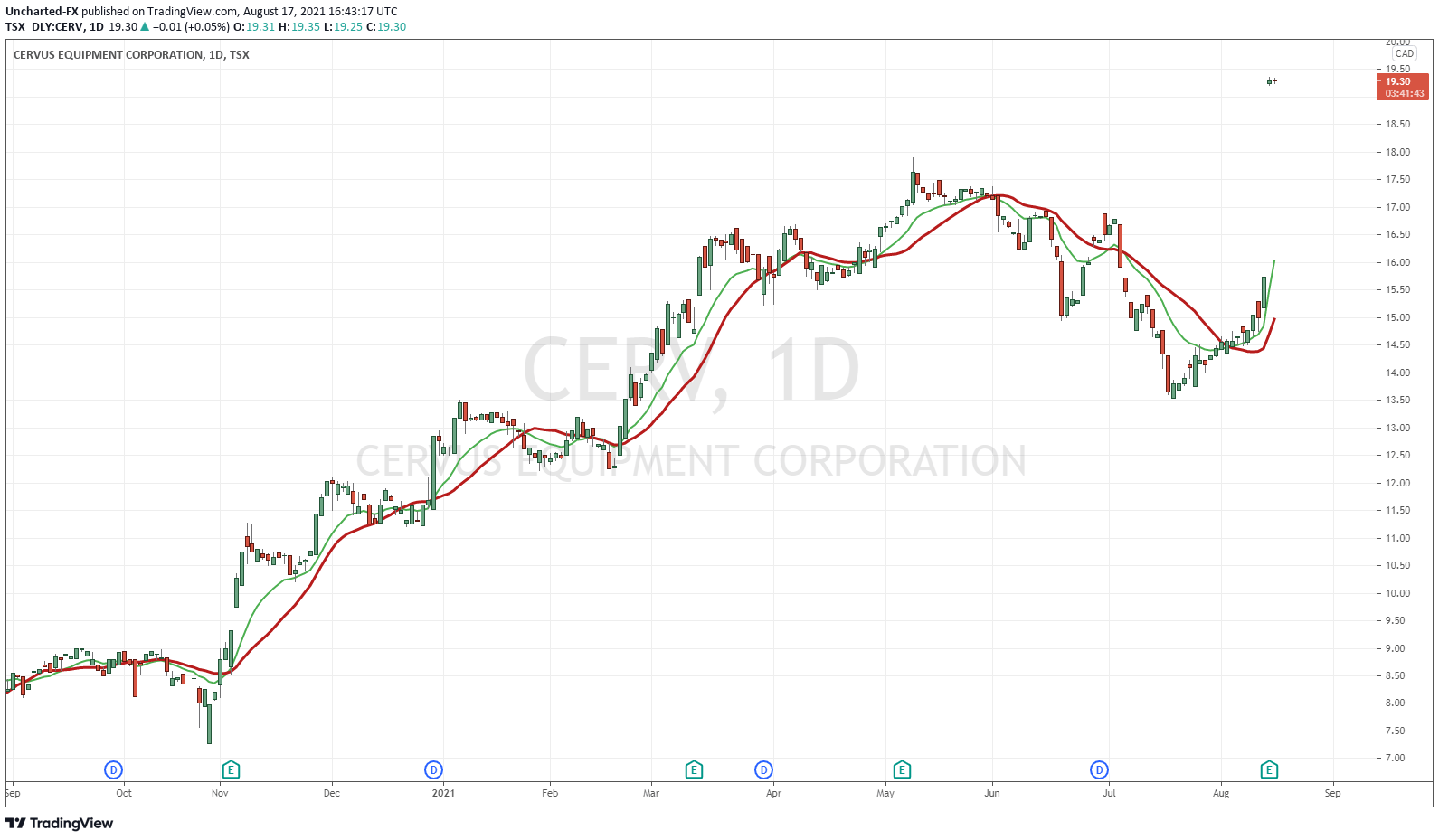

Cervus Equipment (TSX: CERV)

One of the biggest movers and news this week. Cervus Equipment Corporation is a world-leading equipment dealer, powered by iconic equipment brands and unrivaled support. It’s mission is to enable their customer’s success by providing practical and reliable equipment solutions and support. Customers count on Cervus to keep them moving forward, and Cervus meets that challenge with remarkable customer service and industry-leading brands John Deere, Peterbilt, JLG, Clark, Sellick and Doosan. Farming equipment is the story.

Cervus has been bought out. It will be acquired by Brandt Tractor LTD, a Regina based company, for $302 million dollars. A buyout of $19.50 per share and a 37% premium. The stock popped and gapped 22% on the news.

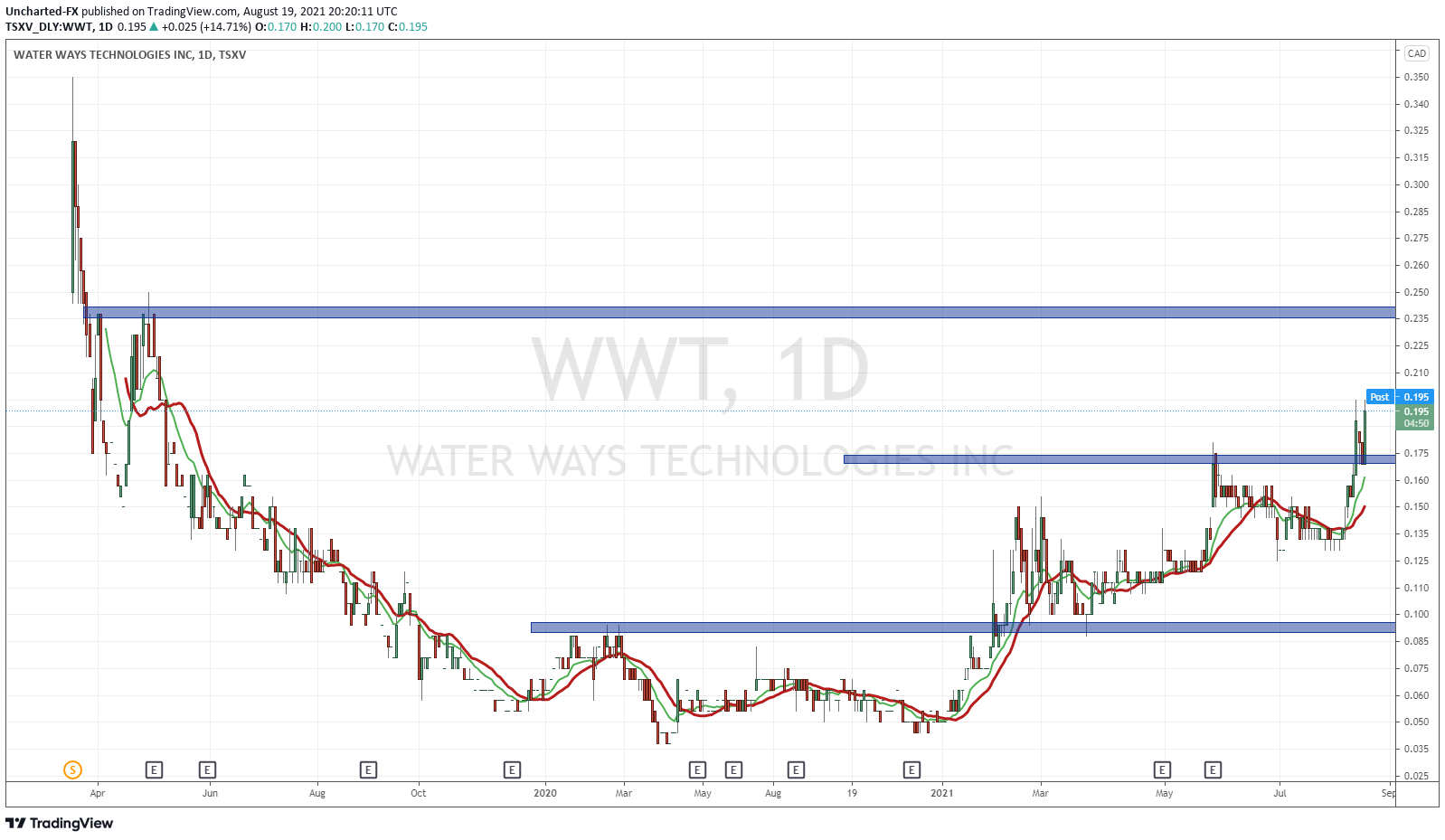

Water Ways Technologies (TSXV: WWT)

Water Ways technologies is an Israeli agro tech company that specializes in providing water and irrigation solutions to agricultural producers. Not only do they sell agro tech, but also irrigation turnkey projects (installing and maintaining irrigation systems), and irrigation equipment and component sales. They currently have projects in China, Mexico, Ethiopia, Georgia, Laos and Peru. Their customers span 40 countries.

2021 earnings saw highlights including:

Q1 2021 Sales of $5.5M, growth of 70% Vs Q1 2020

EBITDA of $550K, growth of 1,300% Vs Q1 2020

Announced contracts and orders in accumulated value of CAD $10.6 Million since Jan. 2021

Recent news saw a $4.44 million private placement, and then this week, Water Ways received a $900,000 CAD new project in Vietnam.

From the press release:

The agreement was signed with a Vietnamese company that will grow the Medjool dates. The Company’s expected revenue valued at CAD$900,000 and includes the following services:

- Planning the cultivation of the dates;

- Delivering the Medjool date young plants; and

- Designing the irrigation and fertilization system.

The stock jumped 15% on the news. Technically, we have broken a major resistance level. I first followed the stock back around $0.08. Technically we had a double bottom reversal pattern. The breakout at the beginning of this year marked a new bull trend. Since then we have been forming higher lows as we continue upwards.

We broke out above $0.17 on the Vietnam news. A strong breakout, and we are now retesting the breakout zone. If we can hold, then $0.25 becomes our next resistance zone to target. Thursday saw the retest…BOOM! A nice 14.71% pop on the retest, and we closed above previous body highs! Very strong technicals on this one.

A nice technical chart with a company dealing with farming and water. Keep your eyes on these guys.

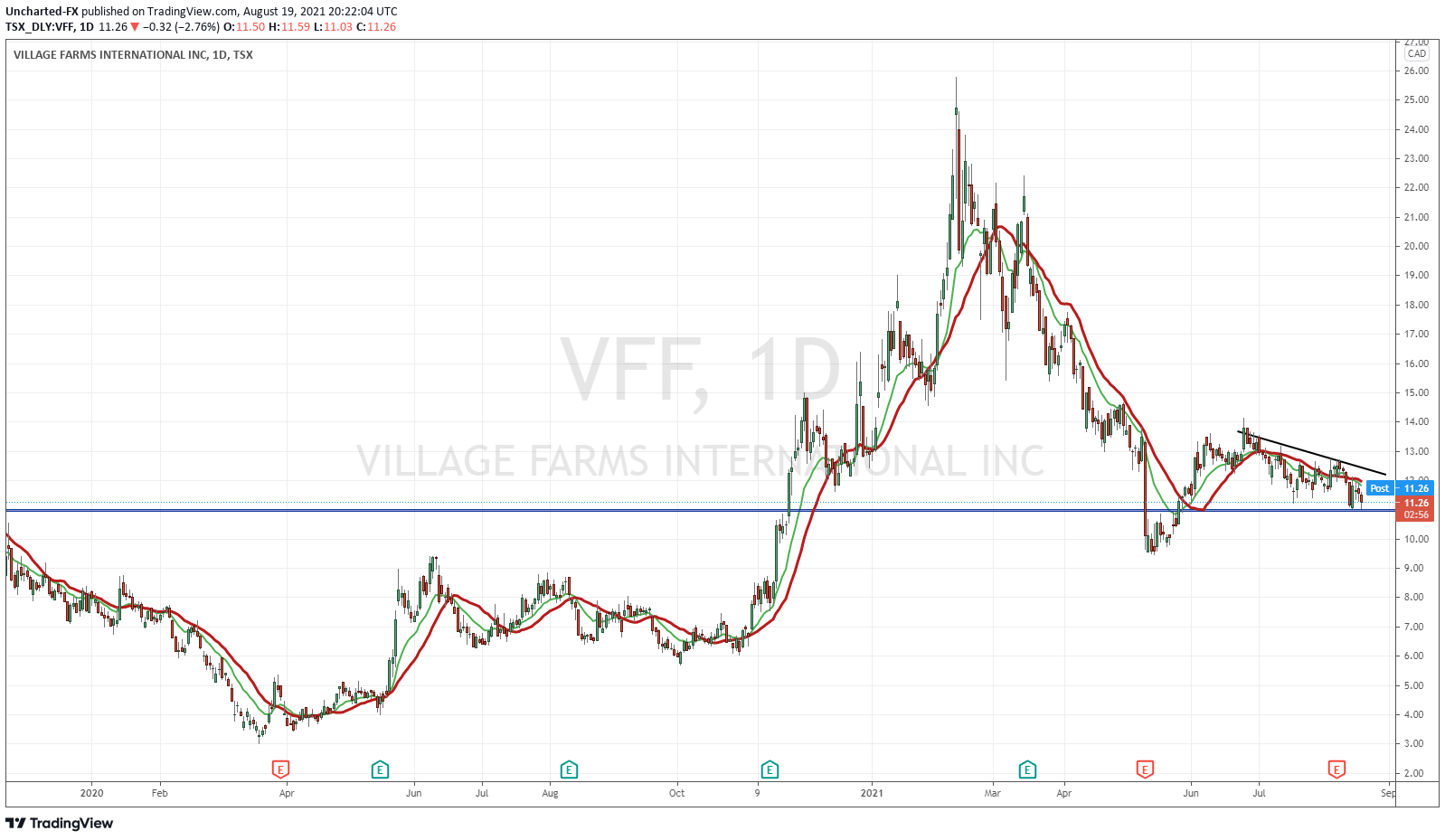

Village Farms (VFF.TO)

Village Farms was a stock I bought years ago under $1.00 for its agriculture components. No joke. I loved the produce of organic cucumbers et al. I actually live quite close to their farms, and their warehouse is just a few minutes drive down the street from me. Now they have a heavy cannabis weighting. Their greenhouses are being used to grow cannabis. The stock price, and early investors like me, loved it. This company is still one with great fundamentals for the long term. The stock price will move on Cannabis headlines and sector strength, but the agriculture technology and component still has me excited.

In recent news, Village Farms bought out one of the largest CBD brands in the market. Balanced Health Botanicals was acquired by Village Farms for $75 Million USD. The buy out includes their established e-commerce platform CBDistillery.

In terms of technicals, VFF is forming a triangle pattern. As a trader, you would wait for the breakout. We have support being held at $11.00. Buyers stepped in on the acquisition news, and the stock bounced 5.73% on the news. I like this one for the long term, so I would approach it that way. A solid company I have been tracking for years.

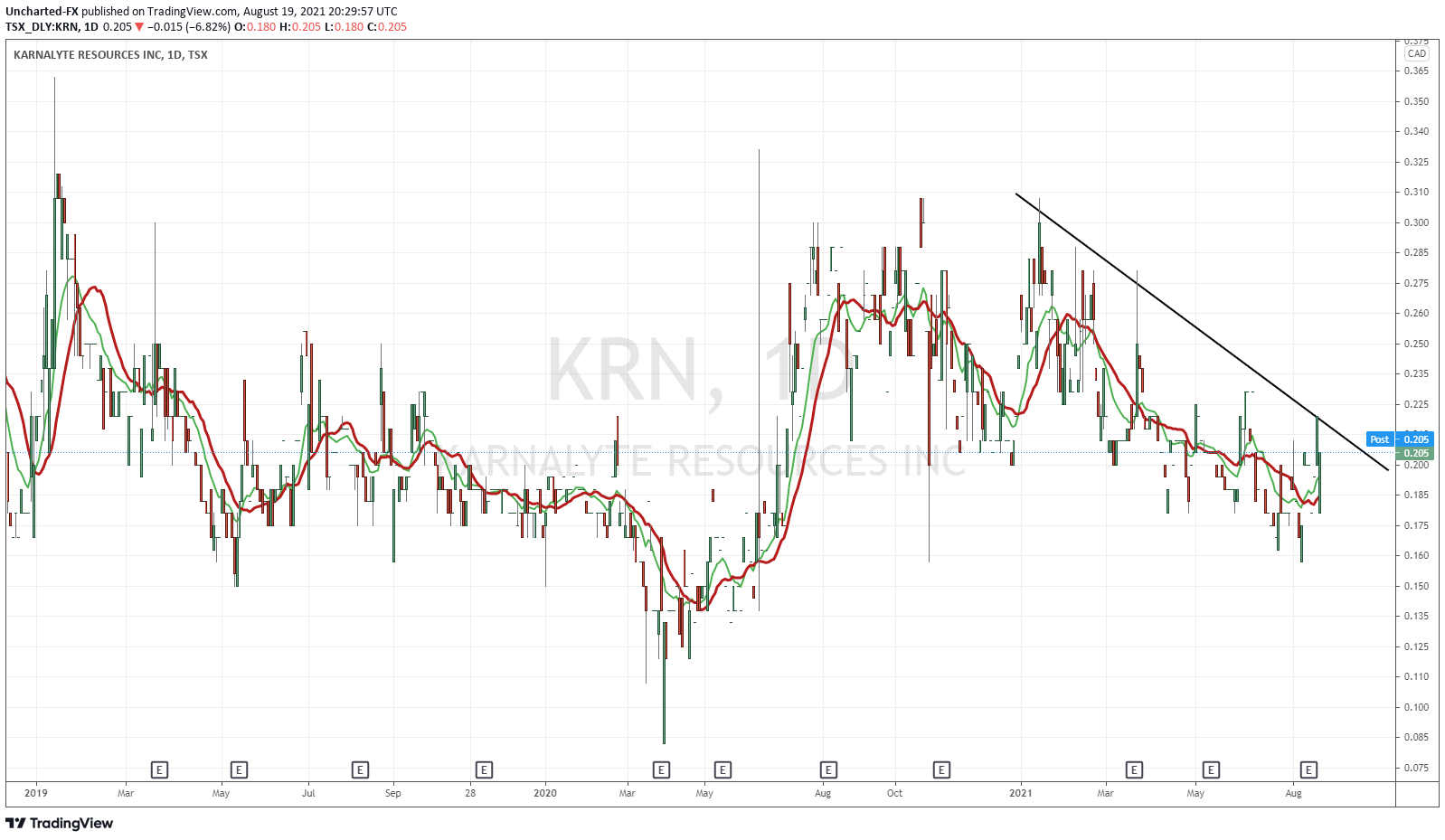

Karnalyte Resources (KRN.TO)

Karnalyte Resources is a development company focused on two fertilizers: potash and nitrogen. Their Wynyard Potash project located in Saskatchewan is construction ready. Their Proteos Nitrogen Project is an advanced stage development project. Karnalyte also has a strategic partner with Gujarat Fertilizers and Chemicals, an Indian Fortune 500 company which has been in business for more than 50 years.

The stock had a nice 12% gain on the 17th of August. Not much volume though, as you can see, the stock is thinly traded. However, 12,000 shares were traded on Thursday, which is a rise.

Technically, I am liking the trendline. We need a break and a new bull run can initiate. However, volume would need to accompany this breakout.

Recent news came last week. Q2 Earnings. Obviously they made no revenue since they are in the development stage, but the balance sheet position from June 30th 2021 states the company has $2.8 Million in Cash, positive working capital, and no debt.

Agrify Corporation (AGFY)

One of my favorite long term holds is Agrify. These guys are spicing things up on the Ag tech side, and in a way…are making investing in agriculture great again. With the stock gaining of 23.75% on the 18th, you can see why. Good volume on this one too.

Agrify is all about indoor farming solutions. Vertical integrated farming, cultivation software, and all other things that I am a fan of. Remember my large macro piece? These guys definitely fit the bill for what I am looking to invest in.

Recently the company put out earnings. Q2 revenue tripled to $11.8 Million USD. New booking were $30.7 Million meaning the total backlog is now a record $101.1 million. Wowza! Strong momentum on this one! Take a look at the chart:

Agrify printed new record highs this week, and technically, the stock is bullish above the breakout zone around $22 (the blue line I have drawn). This one could pullback, but honestly, these guys are a core long term growth hold in my books. I wouldn’t really trade these guys. Buy and hold.

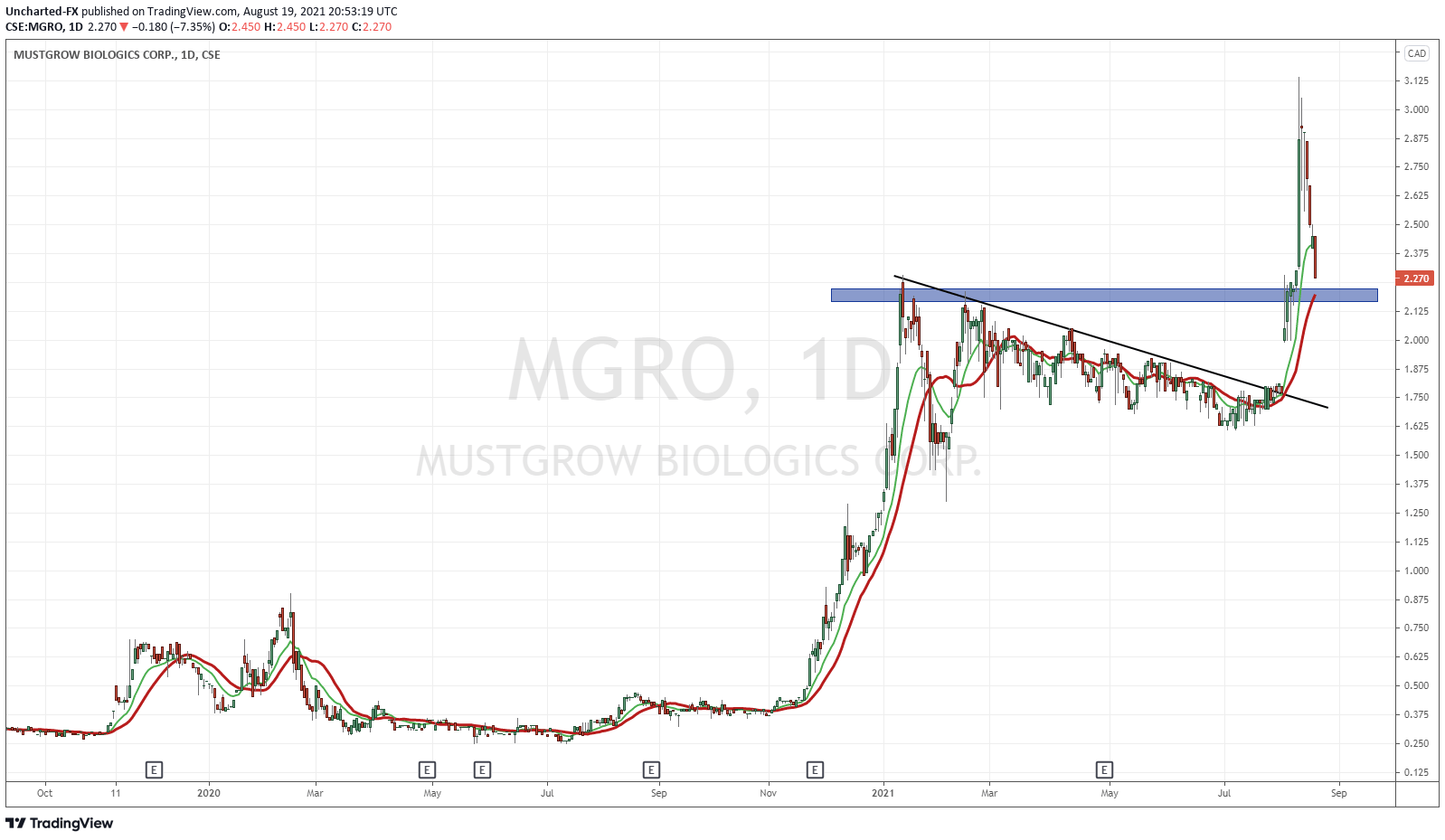

MustGrow Biologics Corp. (MGRO.CN)

One that keeps appearing on my radar this week with double digit gains and losses is MustGrow Biologics Corp (MGRO.CN). These guys are an agriculture biotechnology company focusing on providing natural and biological solutions to replace synthetic chemicals used in high value crops. In my macro piece, you guys know what I said about pesticides being used. This company is addressing this issue.

They have extracted the natural defense of the mustard plant to protect crops from diseases and pests. Their TerraMG product is a liquid product derived from food grade mustard seed and is used to help control key diseases, insect pests, and weeds. The technology is safe and not hazardous.

MustGrow stock has been on a tear since the beginning of August. News has come out that MustGrow and Sumitomo corporation have announced an exclusive agreement. Sumitomo will evaluate MustGrow’s technology to determine commercial potential, and then will have the option to acquire exclusive rights to MustGrow’s technology. This is a big one. With a potential bigger catalyst for the stock going forward. I am sure they will be featured on my weekly Agriculture round up going forward.

Oh and who the heck are Sumitomo you ask? They are one of the world’s largest general trading company. They are listed on three Japanese stock exchanges. What would be cool is if in the future, I will be sipping on Japanese Matcha that used MustGrow’s technology.

As you can see from the stock chart above, the move was huge. We have now pulled back and given up a lot of the gains. Watch this area here at $2.10. This support zone used to be resistance back in January. What was once resistance, becomes new support, and price tests before taking off. I will want to see how price reacts here, but I love the technology and the future catalysts on this stock.

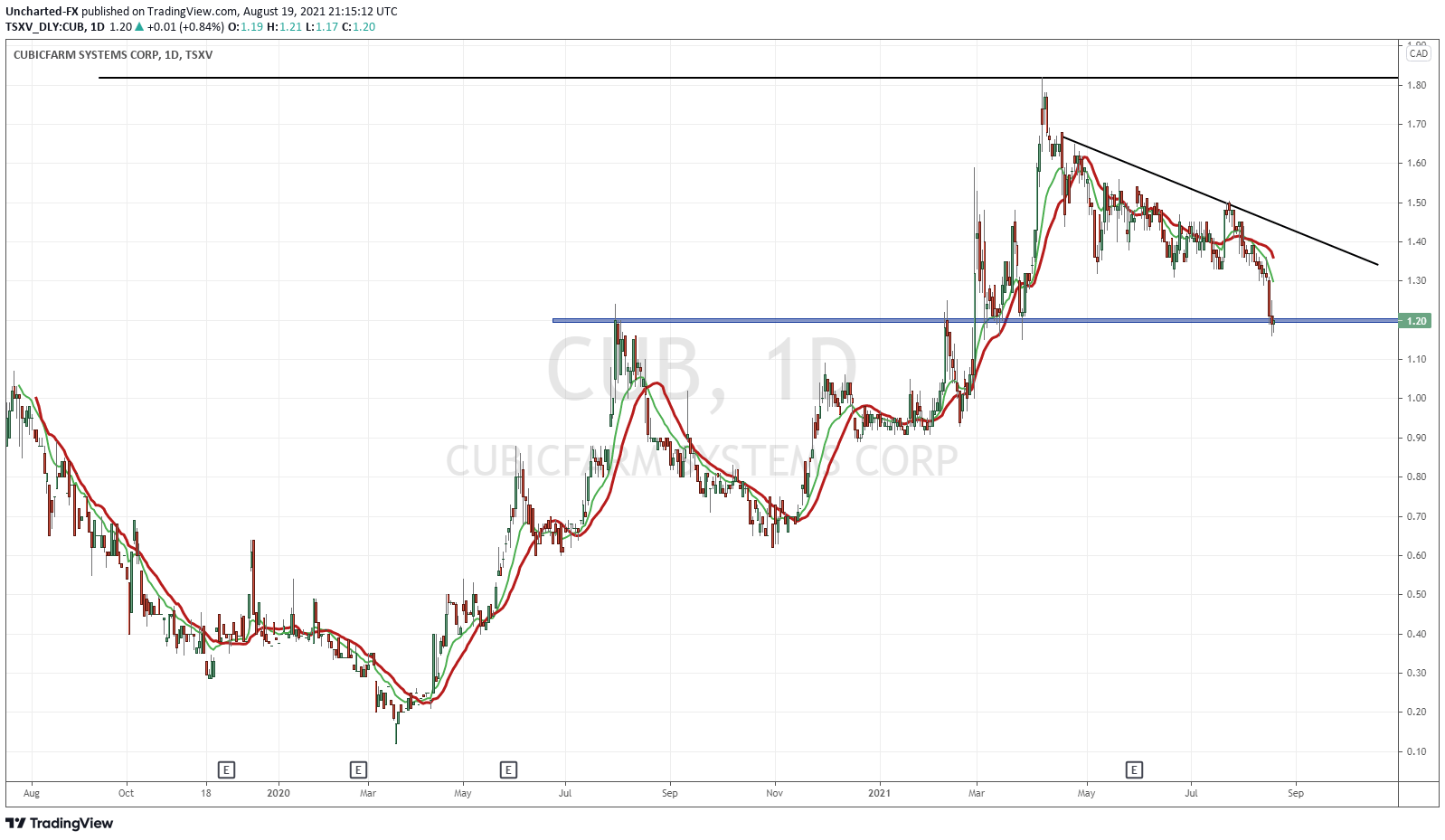

Cubic Farm Systems Corp. (CUB.V)

The company I featured in my large macro piece made headlines on Thursday. CubicFarms won the “Overall Indoor Farming Solution Provider of the Year” in the 2021 AgTech Breakthrough Awards. A big congratulations to the team!

CubicFarms provides automated, onsite commercial scale food and livestock feed technologies. Their indoor growing technologies converts wasteful long supply chain agriculture into local chains, enabling farmers to grow more with less land, water, waste, and physical labour all year -round! Once again, my macro piece breaks these guys down. Yes, I am a shareholder so disclaimer.

On the charts, CubicFarms is at a major support zone. A biggy. Buyers are stepping in which is a good sign evident by the wicks. However, if selling pressure continues, this one can head lower to the major psychological $1.00 zone.

I should also mention some unusual share activity. On August 13th 2021, 3.7 million shares were traded when average volume tends to be 135,000 shares.

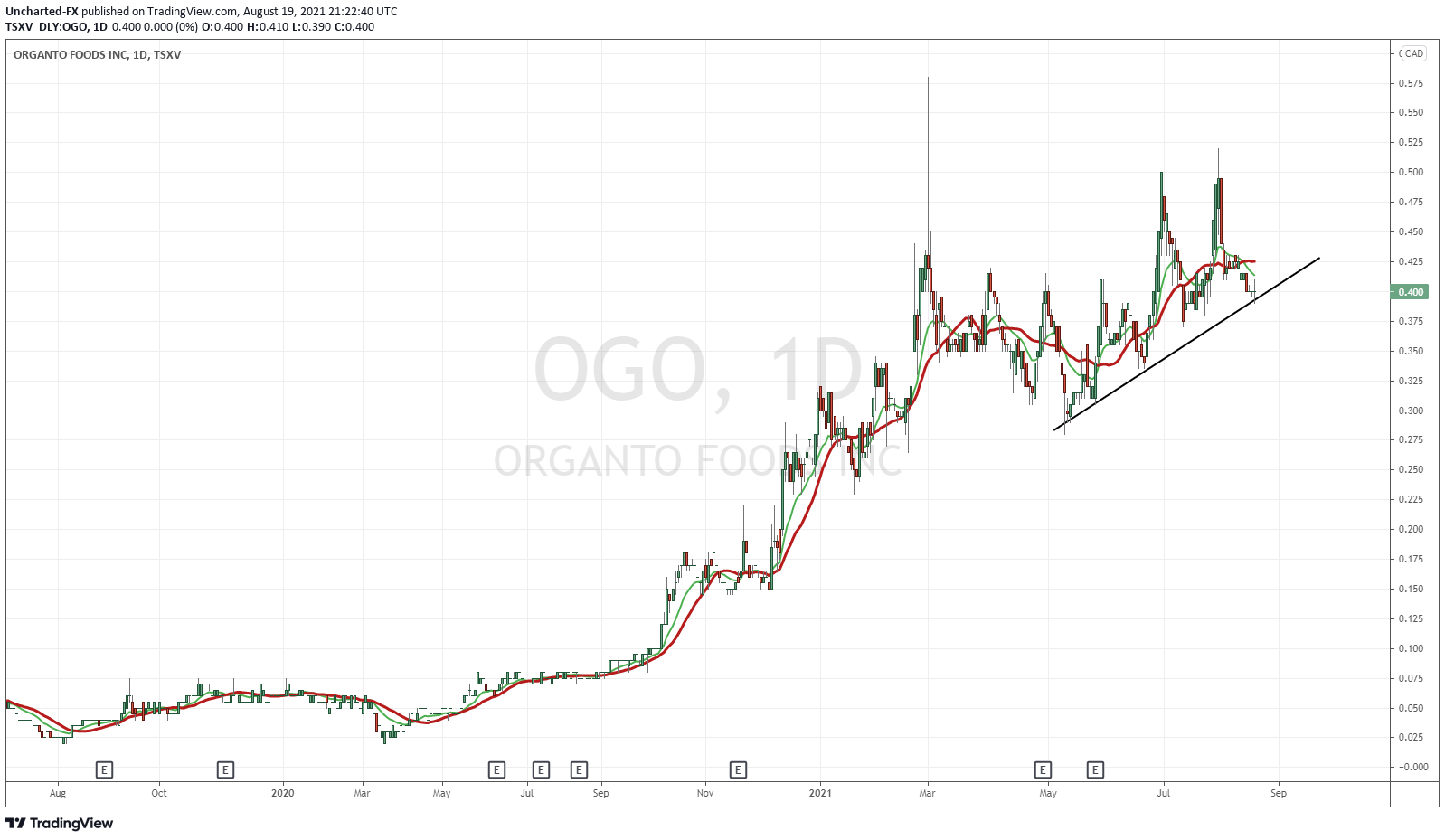

Organto Foods Inc. (OGO.V)

Organto Foods (OGO.V) is an integrated provider of branded, private label and distributed organic and non-GMO fruit and vegetable products using a strategic asset light business model to serve a growing socially responsible and health-conscious consumer around the globe. If you are into the organic food trend, these are the guys to watch.

On Tuesday August 17th, Organto Foods announced a strategic logistics relationship for key European Markets. This agreement was with The Greenery B.V, and the logistics includes product handling, quality control, and warehousing through value-added packaging and processing services and retail level distribution.

The stock did not react to the news. However, we remain in an uptrend. We will see if prices can hold the trend. If not, OGO will drop or consolidate.

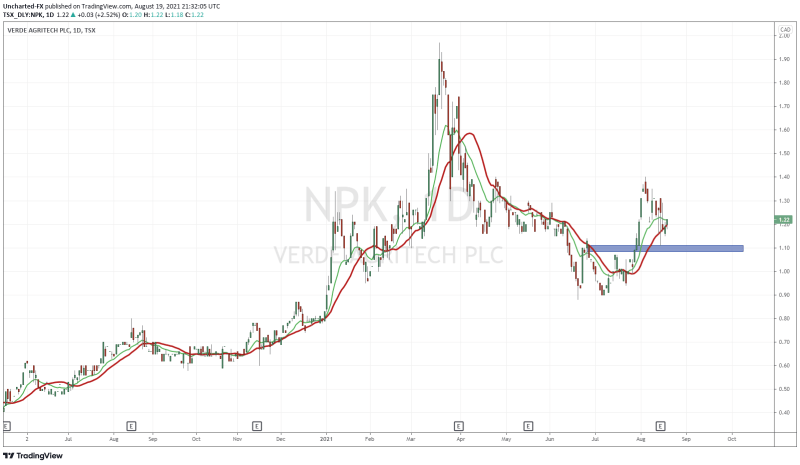

Verde Agritech (NPK.TO)

Verde Agritech (NPK.TO) is an agricultural technology company that develops and produces fertilizers. Their goal is to make agriculture healthier, more productive, and more profitable for farmers.

On August 16th 2021, Verde released Q2 earnings. Here are some highlights:

- Revenue increased by 116%, to $5,376,000 compared to $2,492,000 in the second quarter of 2020 (“Q2 2020“).

- Revenue in Brazilian Real (“R$“) increased by 159%, to R$23,215,000 compared to R$8,965,000 in Q2 2020.

- Gross margin increased to 72% in Q2 2021, compared to 62% in Q2 2020.

- Operating profit before non-cash events increased by 109%, to $1,220,000 compared to $584,000 in Q2 2020.

- Trade and other receivables increased 259%, to $6,020,000 compared to $1,675,000 in Q2 2020.

- Sales by volume increased by 35%, to 96,233 tonnes sold compared to 71,183 tonnes sold in Q2 2020.

- Verde recorded a net profit of $79,000, compared to a net profit of $444,000 in Q2 2020. A $887,000 non-cash charge from Verde’s long-term incentive programme for 58 employees was the main reason for the reduction in net profit for the period.

- Cash held by the Company increased by 214%, to $1,908,000, compared to $ 607,000 in Q2 2020.

The big points are revenues increasing by 116% and the gross margin of 72%.

The stock had a pre-earnings run up. In terms of the technicals, we actually printed a bottoming pattern. The trend shift is apparent by looking at the chart and my moving averages. Going forward, $1.10 becomes key support if Verde wants to maintain this uptrend. The company is headquartered in Brazil, who are agriculture giants. Recent headlines saw Coffee beans being impacted due to frost.

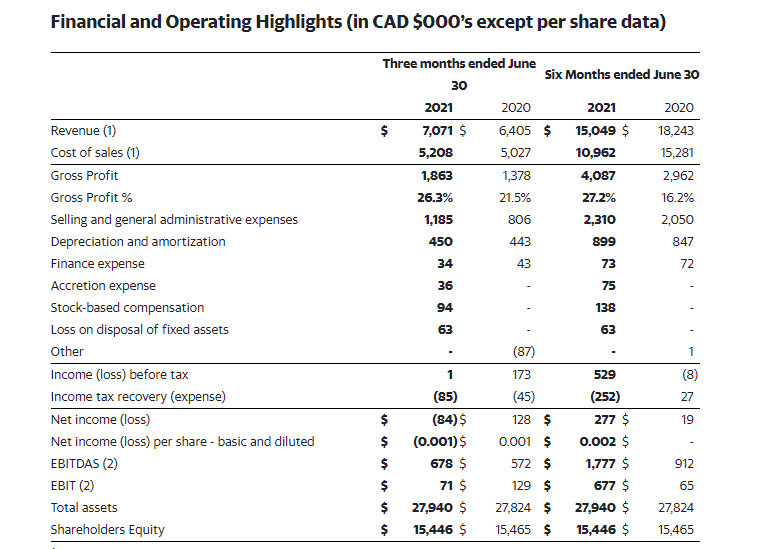

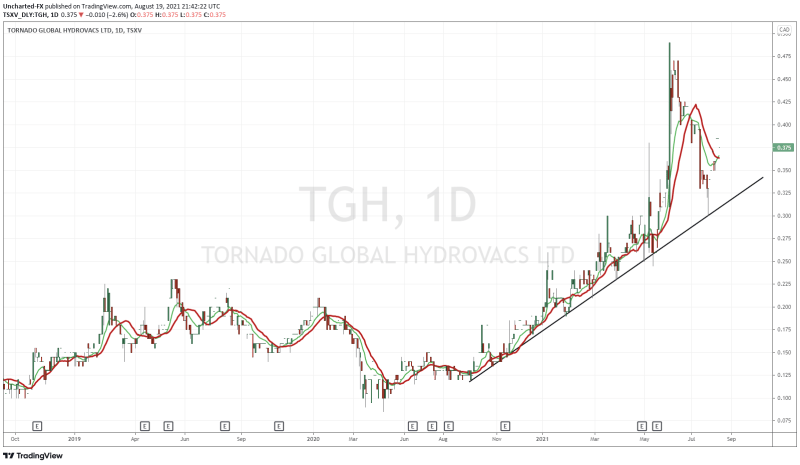

Tornado Global Hydrovacs (TGH.V)

Tornado Global Hydrovacs (TGH.V) designs and manufactures hydrovac trucks. These trucks feature highly mobile independent equipment which utilizes integrated high-pressure onboard water jets and a powerful vacuum system to remove all types of fills while excavating. Mainly used for construction and Oil and Gas, but are built to deal with agriculture too.

Yesterday, Tornado Global released Q2 earnings. Here are some highlights:

As described in the Financial Statements and MDA for the three and six months ended June 30, 2021, the 2020 comparative figures presented have been restated, with a reduction to both revenue and cost of sales of $1.2 million and $2.8 million respectively. There was no effect on basic or diluted net income (loss) per share and did not have any effect on the Company’s condensed consolidated statement of financial position or condensed consolidated statement of cash flows.

Not much volume or action on the stock on the earnings release, but the uptrend remains intact.

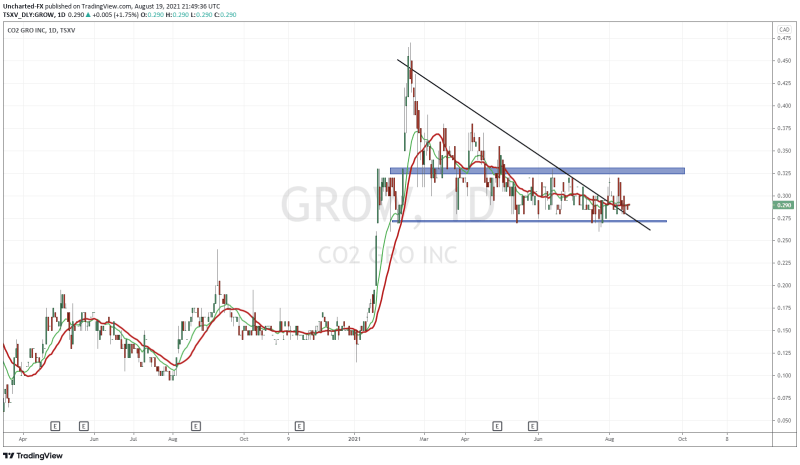

CO2 GRO Inc. (GROW.V)

CO2 GRO has its proprietary CO2 delivery system. Their saturated CO2 solution is misted on plants which provides growers the opportunity to increase plant yields by 30% and profits by up to 100%. Growers can maximize revenue and profits with their systems low fixed and variable costs as well as ease of system installation.

Yesterday, CO2 GRO announced the commercial feasibility of a CO2 delivery systems solution in an Arizona greenhouse that will operate for one year. The name of the client remains confidential.

Not much reaction on the news. The stock remains changed after a nice pop earlier this year. Just await the breakout of the range for further momentum.

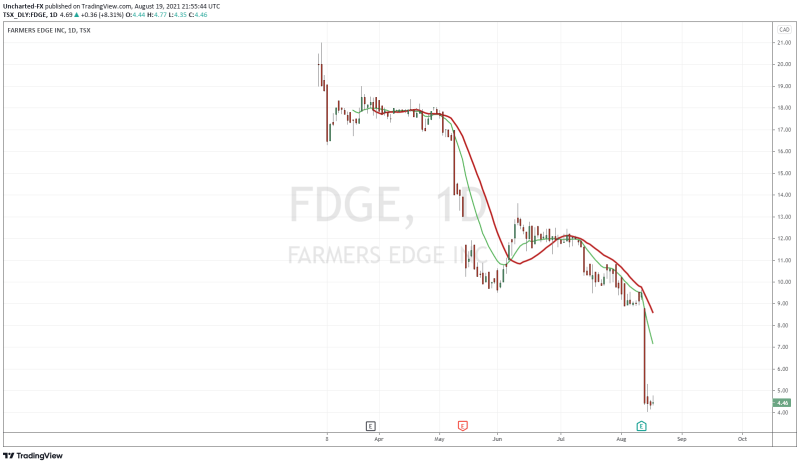

Farmers Edge Inc. (FDGE.TO)

Farmers Edge (FDGE.TO) is an agtech company offering digital farming solutions. This company made some headlines (well at least for us who follow agriculture) when it IPO’d. Similar hype to Agrify.

The stock is now making headlines, but for the wrong reasons. Q2 Earning came out on the 13th. Revenues were lower. You can read the numbers here. The market didn’t like the numbers. The day after earnings, the stock crashed 50%!. This is where I will be looking to pick up shares for a bargain price. Other funds have beaten me to it.

Prem Watsa, known as the Warren Buffett of Canada, scooped up FarmersEdge shares here. 200,000 shares to be exact. Prem Watsa states:

“Fairfax feels the current market price of the Farmers Edge shares does not reflect the intrinsic value of the company and believes in its long-term strategy as a disruptor in the AgTech space,”

I agree.

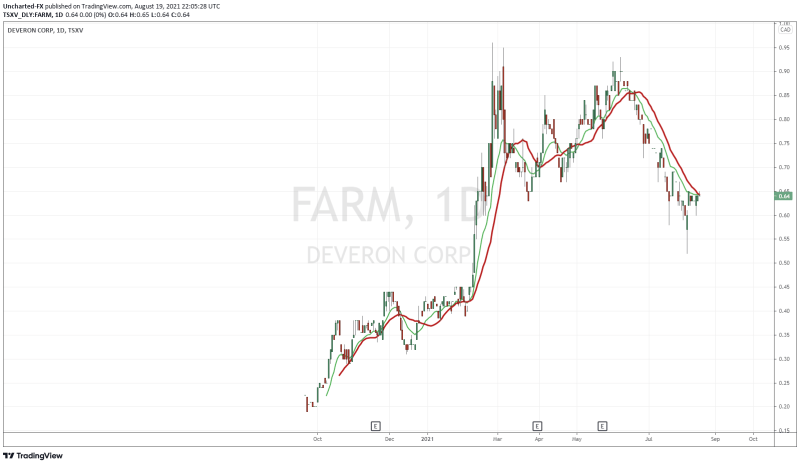

Deveron Corp. (FARM.V)

Deveron Corp. (FARM.V) is an Agtech company that uses data collection to get the best out of your soil. Initiatives include fertilizer and seed management, carbon programs, and yield estimates. Very tech heavy with the cloud, data collection and insights, and drones.

This is one ag stock many people have their eyes on. This is why:

A ripper ever since its IPO. Hit eyes of $0.96 before falling. Now I am watching support at around $0.45. Recent news includes the company raising cash. They have upsized their Private Placement Financing and closed the First Tranche.

Due to investor demand the Company has increased the size of its non-brokered private placement financing to gross proceeds of $8,210,957 through the issuance of 12,632,242 units in the capital of the Company (the “Units”) at a price of $0.65 per Unit (the “Offering”).

In addition, the Company is pleased to announce that it has closed the first tranche of the Offering through the issuance of 11,397,430 Units for gross proceeds of $7,408,329.

They have the cash, now it is about management using it to initiate a catalyst for the stock.

Any Agriculture stock or Ag Tech stock you think I have missed? Or want me to cover? Let me know in the comments below!