Cheap financings

Startups, both private and public have a myriad of options when it comes to raising capital. One method that’s gained a lot of traction over the last decade is convertible debentures or convertible notes.

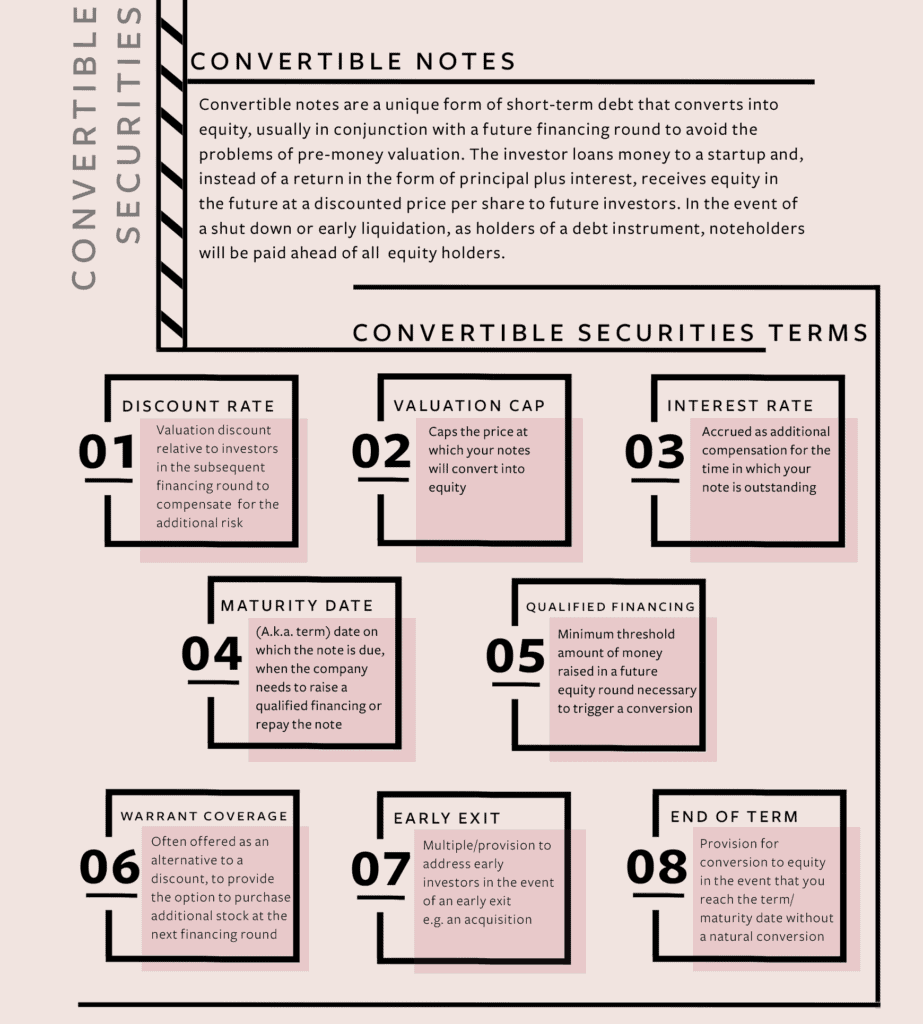

A convertible debenture is essentially a loan to the company in exchange for equity down the road. Each agreement is structured differently with many factors like coupons, maturity dates, and interest rates for the company and its investors to consider. Convertible notes are found across all sectors. Psychedelics giants like Atai (ATAI.Q) and Compass Pathways (CMPS.Q) relied on small convertible note financings in the early days before they were able to prove themselves and thus complete larger financings.

This is exactly why startups love convertible notes.

Unlike a traditional equity raise, a convertible note is cheap and easy to set up on the front end. A startup could potentially close a convertible note round in a day or two by issuing a 2-3 page promissory note, which could cost as little as a couple of grand in legal fees. On the other hand, the issuance of stock is complicated, and it can take weeks or months to negotiate all the terms and documents, meaning you’re also looking at 10-20 times more spent on legal fees.

Going the convertible note route as opposed to equity allows the company to delay placing a value on itself. This is attractive to seed-stage companies that have not had time to post solid revenue numbers, complete clinical trials, or whatever KPI’s are most relevant to the industry the company operates in.

Startups also don’t need to worry about making payments to investors as they grow, which can support stronger daily cash flow.

Anatomy

When the convertible note converts to equity in the company, not only do the noteholders get credit for both their original principal plus accumulated interest to determine how many shares they will receive. They also usually get a discount to the price per share of the new equity set by the company as an enticing add-on to potential investors. For example, if the discount is 20% and the new equity in the qualified financing is sold at $2.00 per share, the convertible note will convert at $1.60 per share.

In addition to the conversion discount, convertible notes also typically have a valuation cap, which is a hard cap on the conversion price for noteholders regardless of the price per share on the next round of equity financing.

The maturity date of a note indicates the date when the note is due to be repaid to the investor along with any accrued interest if it has not yet converted to equity.

When the underlying stock price of a company increases, a convertible debenture investor’s position is “in the money” because they have the opportunity to convert at a lower conversion price and ultimately sell the equity at the higher market price.

Psychedelics examples

Atai has utilized convertible notes maybe more than any other psychedelics company, beginning in the startup phase.

Between November 2018 and October 2020, Atai issued 1,000,000 convertible notes at a purchase price of €1.00 per share, with an exercise price of €17.00 per share, for an aggregate subscription price of €1,000,000 and proceeds of €17,000,000. In January 2020, Atai issued convertible notes that converted into 2,186,720 Series C shares of ATAI Life Sciences AG for €10,263,000. In August 2020, the company issued convertible notes that converted into 3,296,440 Series C shares of ATAI Life Sciences AG for €16,703,000.

In August 2019, Compass Pathways entered into convertible note agreements for a total additional principal amount of $18.4 million USD with a 3% interest rate and a 12-month maturity date.

In December 2021 Seelos (SEEL.Q) closed a $12M USD convertible note financing with a 0% discount. The note converts into shares of Seelos common stock at a fixed conversion price of $1.60 per share and has a 2-year maturity date.

In January 2021 Wesana Health (WESA.C) closed a $4M CAD convertible note financing. The convertible notes bear interest at 5% per annum and mature 18 months from the date of issue. The principal amount and any unpaid interests on the convertible notes will be converted into common shares of the company.

In December 2017 Pharmadrug (PHRX.C) closed a series B debentures round for proceeds of $600,000 CAD at an interest rate of 12% per annum.

Failure is always an option

Convertible notes fall short when companies can’t raise subsequent capital and pay off the debt. Repaying the amount borrowed, plus interest is one option; though that is unlikely because the startup is likely cash poor. If the note is not guaranteed by any of the principles, it is treated just like any other debt. If the company has funds it pays its liabilities, if there is any cash left it goes to the equity holders. The majority of Canadian convertible debentures issuances are not rated by credit rating agencies.

Companies with near-term maturing convertible debentures will often see a depression in their share price as the market prices in the risks associated with maturity. The closer to maturity, the fewer options a company has.

Companies who find themselves unable to amend, extend or refinance their near-term maturing convertible debentures may be forced into a formal restructuring arrangement. If the company fails, the noteholders will get usually nothing. Holding a note can be good if the company has a small exit in the future. Noteholders will get first dibs on that exit cash.

The most typical type of debt is a loan with a set schedule for repayment of principal and interest. Assuming the company can make the payments, the investor knows what return they are getting in advance. Given the uncertainty of early-stage startups, debt is not very typical when it comes to funding traditionally risky ventures like a start-up.

In their early days companies like Compass Pathways and Atai completed convertible note financings of $15 million USD – $30 million USD range. As the companies have grown, gotten onto reputable stock exchanges and legitimized themselves they have been able to raise considerably more money. In May, Compass Pathways completed an equity financing for proceeds of $144 million USD. In November 2020 Atai completed its series C round for $125 million USD and raised a total of $362 million USD before its IPO in June.

See also: How did Atai’s (ATAI.Q) Nasdaq IPO go? Not as expected