I gamble. I don’t bet a lot of money, never more than £40, mostly because I don’t have deep pockets. I cover FansUnite Entertainment (FANS.C) a decent amount here at Equity Guru, and every time I do, without fail, partway through the writing of my article, I find myself firing up the old VPN and setting my location to the UK to avoid the soon changing prohibition on single-event sports betting, and scanning the odds for various events, looking for odds I like, and putting a few quid on the line.

I am also an NFL fanatic. I’m the kind of person who watches Thursday Night Football games between Jacksonville and the New York Jets. During the football season, I watch NFL talk shows on YouTube while I eat my breakfast. And yes, I bet on many of the games. When I’m watching a video or reading an article making the case for this team over that one, I’ll find myself checking the spread, and, if that hubristic notion that I know better than everyone else bubbles up, I put some money down.

For me, sports coverage and betting are linked together. I’ve read many of Hunter S. Thompson’s old ESPN columns, republished in his book Hey Rube, where gambling plays a central role in his sports coverage. Much of the discussion of which team we should stick a fork in is in relation to whatever crazy bet he is making. His writing embodies the idea of putting your money where your mouth is, literally.

I know that Hunter S. Thompson was a unique writer, and that nothing and no one will ever capture his magic, but my affection for the marriage of sports coverage and gambling caused today’s news that Penn National Gaming (PENN.Q) is acquiring theScore to pique my interest.

Penn National is a gaming company which owns 42 gaming and racing properties in 20 states and aspire to be an omni-channel provider of retail and online gaming, live racing, and sports betting entertainment. Score Media and Gaming (SCR.Q) has sort of been trying to create the kind of gambling and news entertainment operational hybrid themselves, as they run the website theScore.com and theScore Bet, which allows users to place wagers in four states. Penn National absorbing theScore will likely be far more effective than Score Media’s current effort.

“We are thrilled to be acquiring theScore, which is the number one sports app in Canada and the third most popular sports app in all of North America. theScore’s unique media platform and modern, state-of-the art technology is a powerful complement to the reach of Barstool Sports and its popular personalities and content,” commented Jay Snowden, President and Chief Executive Officer of Penn National.

“We are now uniquely positioned to seamlessly serve our customers with the most powerful ecosystem of sports, gaming and media in North America, ultimately creating a community that doesn’t currently exist. Users will enjoy a unique mobile sports betting and iCasino platform with highly customized bets and enhanced in-gaming wagering opportunities, along with highly engaging, personalized sports and entertainment content, and real time scores and stats. We believe this powerful new flywheel will result in best-in-class engagement and retention.”

I’m not sure how the integration of mobile sports betting will look, but I look forward to seeing how they make a go of it. I’m personally not a reader of theScore, but I am clearly not representative, as Snowden noted that theScore is very popular in the US and is the top sports app in Canada.

theScore has 239 employees and annual revenue of $22 million, according to Owler.com. So it’s not as big as other competitors, such as The Athletic, but it is still a sizeable operation. Penn National didn’t just want Score Media for their content, however. They also wanted them for the tech.

“Importantly, the transaction provides us with a path to full control of our own tech stack. theScore has developed a state-of-the-art player account management system and is finalizing the development of an in-house managed risk and trading service platform. This should lead to significant savings in third party platform costs and allow us to broaden our product offerings – providing the missing piece for operating at what we expect to be industry leading margins. In addition to the synergies, we’ll be gaining access to theScore’s deep pool of product and engineering talent and data-driven user analytics which will help drive our customer acquisition, engagement, retention strategies and cash flows,” added Mr. Snowden.

“Operators that have achieved early online market share have done so primarily through first mover advantage, leveraging existing customer databases and significant marketing spend. We believe the long-term winners will be defined by best-in-class products, bespoke content, efficient customer acquisition, multi-platform reach and broad market access.”

The acquisition is not cheap for Penn National, with a reported price tag of $2 billion USD on the acquisition. The price is divided 50/50 between cash and stock, so each Score Media shareholder will be receiving $17 USD per share, as well as 0.2398 shares of Penn National. Based on the 5-day volume-weighted average trading price of PENN as of July 30, 2021, this would put the value of the purchase at $34 USD per SCR share.

Recently, when The New York Times was considering buying The Athletic, the discussed valuation was ~$500 million USD, and so it is interesting to see theScore sell for quadruple the cost, despite its lower revenue. Part of what this might suggest is that the media side of this deal is only one part of it, and that acquisition of Score Media’s tech is also a big part of what is driving this acquisition.

“This deal brings together two companies that share a vision for how media and gaming intersect, and we could not be more excited to join the Penn National family. I’m proud of theScore team and all of our accomplishments, and believe the time is right to take the next step and align with a company in Penn National with the resources and scale to accelerate our business. We are excited to join forces with Penn to form the most powerful media and gaming company in North America,” commented John Levy, Chairman and Chief Executive Officer of theScore.

“We’ve built an innovative, technology-led integrated media and gaming business that has us poised for success across North America, including the highly anticipated upcoming rollout of commercial sports betting in Canada,” continued Mr. Levy. “With Penn’s support, we will continue to invest in building our Canadian operations, growing our footprint and expanding our workforce. On a personal note, Benjie and I are very much looking forward to continuing to head up theScore as part of the new combined company.”

“We have been strategic partners with Penn National since 2019 and have come to realize that they have the same strong culture and appreciation for how to grow a business. Jay and his team have done a tremendous job building an exceptional retail business and online gaming platform in partnership with Barstool Sports and we are confident that by combining our leading sports media brand and proprietary technology, we will solidify Penn National as a market leader,” concluded Mr. Levy.

These two companies have a pre-existing relationship, so a fairly smooth transition should be possible. Integrating technology always takes some time, but having a head start could make a difference.

The goal of creating a vertically integrated media and omni-channel gaming business is interesting, and could be a real game changer if it’s done right. In their comments on the deal, both sides mention Barstool Sports, who Penn National own a 36% equity interest in and with whom Penn National have a strategic partnership. Barstool itself is an example of a one-stop shop, which combines sports coverage with popular culture and even has a political archetype – The Barstool Conservative – named after it. And while I’ve been critical of Barstool El Presidente Dave Portnoy, there’s no denying that by combining the right elements together, they’ve created something hugely successful.

So I’m interested to see where the whole “a vertically integrated media and omni-channel gaming business” goes. If they maintain the right beat reporters, bring a few star commentators on board, and create a good gambling set up, it could be really interesting.

“The combination of theScore and Penn National creates a first-of-its-kind vertically integrated media and omni-channel gaming business, which brings together world-class technology, highly engaging sports content and unparalleled reach. With our accomplished team in place, this deal bolsters our ability to grow our already strong North American presence from our base in Canada and primes us even further to capitalize on the huge upcoming betting opportunity in our home country. Over time, we’ve built our loyal user base and relationship with fans by authentically delivering deeply personalized products. That is an approach that seamlessly fits with Penn’s current strategy and digital offerings and will provide for material long-term benefits as we collaborate to even more deeply integrate across our platforms,” stated Benjie Levy, President and Chief Operating Officer of theScore.

“The transaction will provide theScore with immediate scale and resources, the benefits of which will enable employees to better execute on the combined companies’ business plan and deliver enhanced integrated product offerings to our customers,” continued Mr. Levy. “The transaction also provides theScore shareholders immediate liquidity at a substantial premium and an opportunity to participate in any future upside of the combined company.”

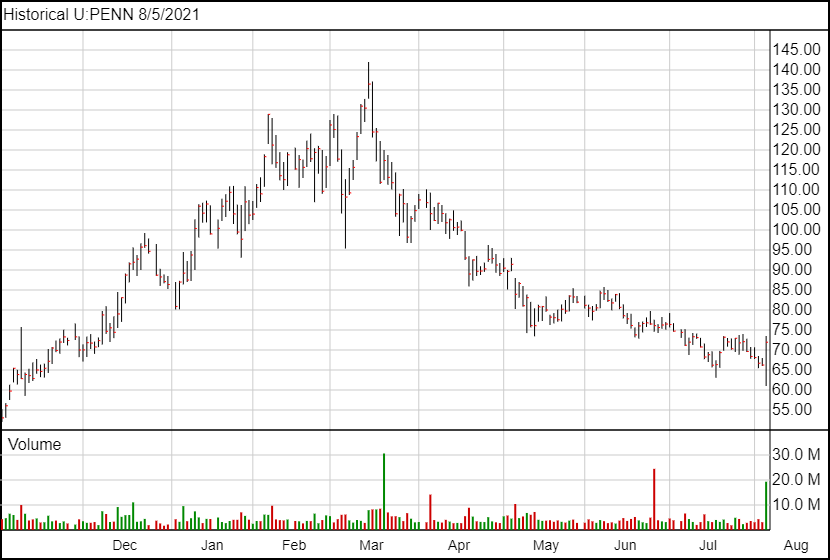

Following the news, Penn National shares are up $5.75 and are currently trading at $71.99.