SEO

I’ve stayed pretty positive with regard to the psychedelics space so far, and while the company I am going to be talking about here isn’t a psychedelics company yet, but it definitely thinks it is.

Over the past few months, I’ve taken more of an optimistic approach to covering the space as there are so many exciting things happening. Then, this morning I heard of a ‘new psychedelics IPO’ happening tomorrow morning on the CSE from a company called Levitee Labs (LVT.C) and got excited as I hadn’t heard of it before. After reading through this company’s marketing materials I am astounded at how different they market themselves on their website vs. what it’s in their filing statement.

Their Chinese SEO strategy had me asking questions before I even started.

For starters, if you are a psychedelics company (have trials planned/novel compounds/ketamine clinics etc.) and you are selling functional mushroom powders as one pillar of your business for early revenue generation that’s all well and good. And if you are selling mushroom powders as a ‘wellness company’ that’s cool too. But, having the main part of your business be functional mushroom sales, but the bulk of your messaging being around psychedelics, that’s just lame as hell.

Levitee is set to go public on the CSE under the ticker (LVT.C) tomorrow following a $10M CAD private placement earlier this year. The company has around $10M CAD in working capital.

The website vs. the filing statement: a tale of two companies

The difference in messaging from the website to filing statement can’t be understated. An overview on their website clearly says they are a psychedelics company.

So I read through their 223-page filing statement and saw no mention of psychedelic compounds, or novel psychedelic therapies, or anything related to psychedelics really. If you download the document as a PDF and search ‘therapies’ there are zero results, ‘therapy’ heeds 1 result which was unrelated to the business. The term ‘novel’ appears 4 times, only referring to the Coronavirus.

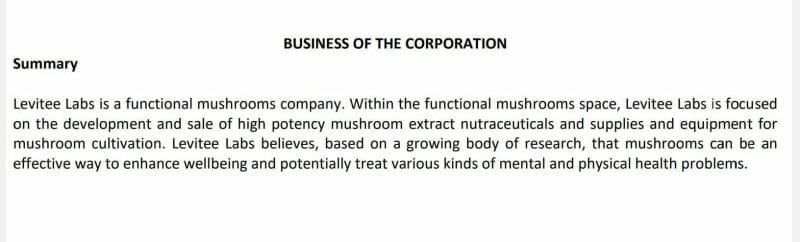

The business description in the filing statement is a lot more accurate:

They have high-dose mushroom extract products like 10:1 reishi and an 8:1 lion’s mane made through their brand Monk-E who did a separate private placement last year outside of Levitee. They also make gear for mushroom growing and extraction through their recent acquisition of Sporeo Supply. I have talked about extraction as being one of the big ‘ picks and shovel’ elements of the psychedelics space. And if this company was marketed honestly I would say I think extraction is a smart move.

High dosage mushroom products are cool, I’ve done 20gram reishi doses, which is 10x the recommended dose – I felt pretty good but I can’t qualify it as a psychedelics experience. They plan on being a global leader in the mushroom powder space with the likes of Four Sigmatic, and they are of course building out a platform.

Levitee Labs intends to sell its Monk-E products first in the US and then in Canada. Within the US, the company’s initial focus will be on the states of California, Arizona, and Washington, as the company has determined that those states have the highest proportion of residents with interest in functional mushrooms and mushroom supplements. Once sales in the United States have gained traction, Levitee will target the Canadian market.

https://equity.guru/2021/06/what-are-the-picks-and-shovels-of-the-psychedelics-industry/

Finance guys

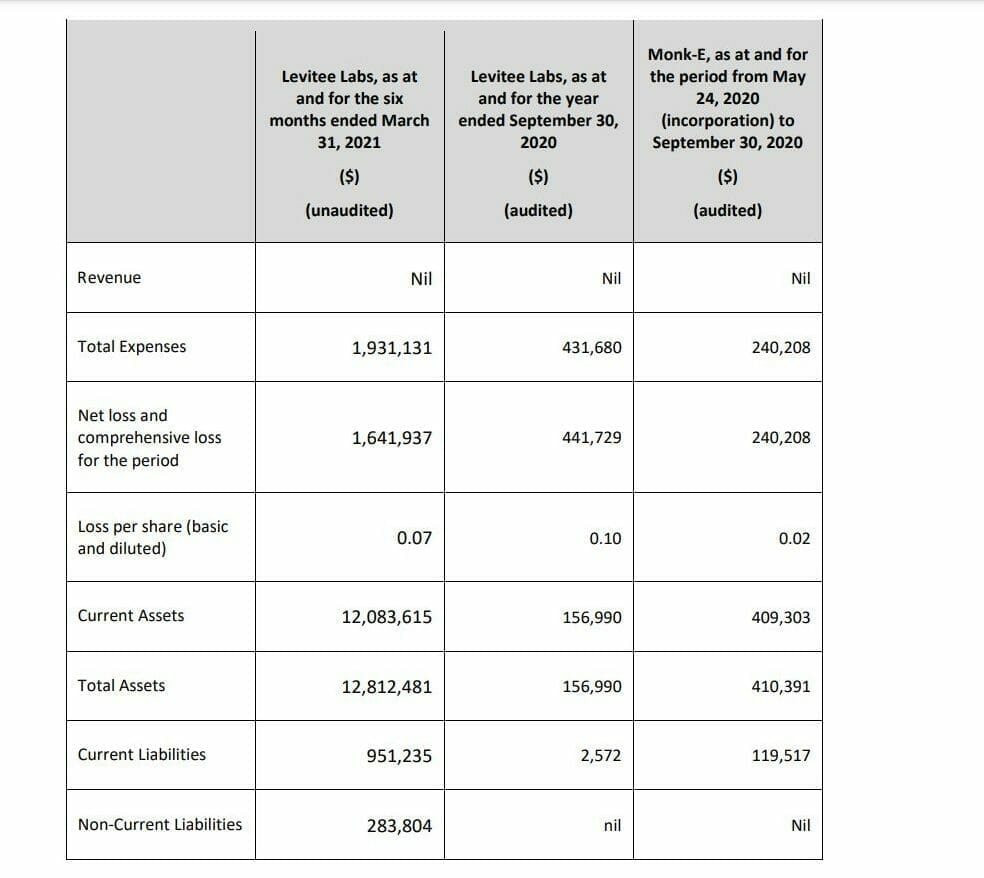

The company put out a story last week titled ‘Levitee Labs approved to list on CSE with proven revenue and cash flow in the psychedelics market’. There isn’t a single revenue figure in the piece. Their filing statement also shows no revenue for any of their mushroom-related businesses.

On their website, it states they are targeting Phase 1 & 2 drug candidates for a potential acquisition target, but they are going to need to raise more cash to buy a winner and continue to run operations. In regards to acquisition, the filing statement says

Levitee Labs is looking to accelerate its growth by acquisition. Acquisitions will initially primarily be focused on

nutraceutical and dietary supplement brands, with the subsequent goal of expanding the scope of acquisitions to

include medical clinics and other assets with a focus on mental health treatment through natural means

They list four potential targets for acquisition, two are other mushroom powder companies, one is a numbered corporation applying for a dealer’s license, the other is ACT Medical – a small chain of methadone clinics in Alberta. According to Levitee, ‘ACT Medical could bring over 20,000 yearly patients to the Levitee platform’, so is the company going to be giving out methadone? With no talks of NCE’s either through M&A or in-house R&D, I’m pretty lost here. This all feels very random and spackled together by finance dudes without a background in biotech or health science. In an interview on their website with CEO Prouya Farmand, he states,

Well, myself, I’m not a healthcare professional or a scientist, I’m a finance guy, an investment banker by background.

So maybe they can raise the dough to make them a real psychedelics company, but they aren’t one yet. They’ve done pretty well to date in their capital raises so I wouldn’t be surprised if they do undergo some M&A activity but at this point, it’s unclear which direction they are going in, which makes getting in on a public offering hard to predict in the long run. They are also outsourcing a bunch of their tech to an agency in the Ukraine which doesn’t really sit well with me, and the SEO keyword Chinese character stuffing is a pretty wild first impression coming from search. The whole thing just feels off.

As an investor I have no idea where this company is headed, it’s so broad at this point. I like their ability to raise capital but I need to see some moves a psychedelics company would make.