The first week of July tends to be a bit slow. Not only are funds rebalancing to end Q2, but we of course have the 4th of July. Lower volume in markets in the trading days leading up to the American holiday is a normal occurrence. US markets are important because they are the largest and US traders/banks provide a lot of liquidity. With this situation today, I thought I would do a more psychological piece. I have always been asked about how I started to trade, and what lessons I could provide for new traders. So in this Market Moment, I will detail my past and my trading journey.

I will highlight key lessons I have learned along the way. Some of you may not agree with them, but these are things I have learned from nine years of trading and following the markets pretty much on a daily basis. We talked about the 4th of July, and here comes the first lesson: know when NOT to trade.

Nothing groundbreaking, but important. A lot of new traders feel the urge to pull the trigger, but there are times when liquidity is not there. This means that a trade can move violently in any direction, or momentum on breakouts and breakdowns may not continue. Things tend to remain in flux, or in a range. The first week of July is a period like this, but so are the last two weeks of December heading into the New Year. This might sound weird, but when you watch charts for years, you just know when not to trade. Choppy charts.

So let’s start at the very beginning. Believe it or not, my background is in Anthropology and Archaeology, but many of the electives I chose were economics. So much so that I did third year macro and microeconomics. Even courses on financial markets. Did any of my post secondary economics courses help me in my trading and investing? Nope. This is why to this day, I have people with their CFA’s and even MBA’s asking me for advice and help to decipher stock markets.

My archeological field school was in China way back in 2012. In a city called Anyang in Henan province. I was in China for two months and visited Beijing, Xi’an (probably my favorite city being a history nerd) and many other ‘smaller’ cities in the country. I say ‘smaller’ because many smaller cities in China have populations of up to 5 million people. Lot of that time was digging sites and molding pottery, and attempting to recreate metalwork used by the Shang dynasty. This meant that I spend a lot of time mixing cow dung with dirt…by hand, to create the type of molds to be put into hand made kilns and tested by fire and heat.

Some cool facts about Anyang provided by Wikipedia:

Around 2000 BC, the legendary sage-kings Zhuanxu and Emperor Ku are said to have established their capitals in the area around Anyang from where they ruled their kingdoms.

At the beginning of the 14th century BC, King Pangeng of the Shang Dynasty established his capital 2 km (1.2 mi) north of the modern city on the banks of the Huan River. The city, known as Yin, was the first stable capital in Chinese history and from that point on the dynasty that founded it would also become known as the Yin Dynasty.

The capital served 12 kings in 8 generations including Wu Ding, under whom the dynasty reached the zenith of its power, until it was wiped out along with the dynasty that was founded by King Wu of the Zhou in 1046 BC.

The coolest thing to hear when I was there was the possibility of Cao Cao’s tomb. In 2018, the general’s tomb was found in Anyang. Pretty cool for someone whose first foray into Ancient Chinese warfare was not Sun Tzu and the Art of War, but the cinematic blockbuster Red Cliff.

Right when I got back, I got my first job out of post secondary. I guess I was a fortunate one, but I learned something else. It is all about connections. It’s about who you know. If you want to be more involved in finance and trading go out and network at conferences, or join MeetUp groups (when restrictions lift of course).

Before I went to China for my field school, I joined a mentorship program at UBC. Fate paired me with the head of archeology with a major engineering and environmental services here in Canada. I got to visit their main offices here in Vancouver, and also shadowed him for work. Before I left for China, I asked my mentor if the company was looking to hire. He put my resume at the top of the list, and I was hired as an assistant archeologist.

I was involved with the Site C project up in Fort St. John. Still a hot topic today. Back then, we were supposed to lay low as David Suzuki was up there rallying support to stop the project. A bit of a hostile environment for us. Not many people know the importance of archeology and cultural management here in BC. Before a major project is built, the archeologists come in to dig holes, with first nations helpers, to see if they find anything of cultural significance. A major cultural find or site can cause the entire project to be cancelled…or the project would have to work around it. So in a way, we were the good guys because if we found something major, it would help in calling off the project.

This is where I began my first foray into investing. I was fortunate to get this opportunity. As many of you know, the money up North in both BC and Alberta is big. The amount I was making was unfathomable to most students just graduating. So I decided to grow it. The first books I bought at a local bookstore in Fort St. John was the ever popular “The Wealthy Barber” by David Chilton, and a book on Dividend Reinvesting (DRIPs). I decided to go the DRIP route. Opened up a Questrade account and the first stock I EVER bought was the Bank of Montreal. I added the Bank of Nova Scotia, Agnico Eagle Mines, Fortis (what was Terasen back then) and Imperial Oil. DRIP investing is popular and very simple: buy the stocks of companies that pay a dividend and have a solid business. Tell your broker to take the dividends and instead of paying out, use them to purchase more shares (DRIP). Every month, you purchase more shares. In a few years time, when you have a larger share position, the dividends will be able to purchase more stocks. It keeps growing, and when you are about to retire, you will have tons of shares and can even take dividend payments. There are a lot of Canadians who have retired with millions using this strategy. Another lesson: have a long term! You do not need to trade, but be sure to have a long term portfolio. Even if you do trade, still have a long term portfolio.

I wish I listened to myself back then…but the day trading bug hit me. I was like why settle for my long term being up a few hundreds of dollars, when I can make that much in a single day! I then joined a few day trading chatrooms and paid subscription. If you are into trading, you likely know who these people are, as they reach out to you through Twitter or Instagram even today.

It began great. Some call this beginner’s luck. For some reason when you begin trading, you tend to win a lot. And then reality sets in and you give it all back. Back then the hot stocks were Chinese stocks. There were tons of Chinese penny stocks selling things from mushrooms, to paper, to chestnut products. The amazing thing was that they had incredible P/E ratio’s. Just using the P/E ratio, you would be a fool to not invest in them for a long time. But the Chinese have their own way of accounting, and many of these Chinese stocks turned out to much different than the financial statements said they were. I recommend the documentary “The China Hustle” for those interested in this.

Even though I was getting smashed on the daytrading side, I never gave up. Over 95% of daytraders fail, and many just give up. They don’t try to better themselves, or improve. This is another key: Trading is not a job, it is a lifestyle. I am basically thinking and talking about markets 24/7. But I love it. It is a continuous journey where one is always learning and improving. Reading was key. I ended up taking one more year of university to get a minor, and everyday on my 40 minute bus ride to UBC and my 40 minute bus ride back home, I was always reading. I literally took out every trading and stock market book from the Vancouver Public Library. Everyone has the same amount of time, and it is how we use it. I remember people staring at me and snickering at me when they saw me reading on the bus. Most students were on their phones or listening to music. A waste of time in my opinion. That one year of daily travel allowed me to learn some basics. To this day. if I have to commute on public transit, I will take my Kobo along.

Now I am not saying you can learn trading from a book. I was reading trading books, but the key was implementing them and back testing what I learned. I still failed. Many of the books were also on geopolitics and psychology. I always had an interest in History (albeit the ancient one) and geopolitics growing up. I just had a fascination with different countries and cultures, and why certain nations rose and fell. Economics plays a major role in this. Cycles play another role. I recommend reading books on History, Geopolitics and Current Affairs. Read about things you enjoy.

I decided to go all in on day trading. I joined a proprietary trading company here in Richmond, BC. A prop firm is where you use your capital or the firms capital to make money. In this case it was my own money. For the first few months I was not making any money. The head of the prop firm put you on a demo until you were consistent. So essentially I was waking up at 6 am or earlier, driving when peak traffic is beginning, just to work for free. I never complained because I enjoyed doing it. I got to meet up with people who were into financial markets.

I actually started trading Brazilian markets rather than US. Petrobras was the only stock I traded. It was all on level 2. F4 and F5 were my hot keys to buy and sell instantly. We just were playing less than 5 pips. The benefits of joining a prop firm, is the platform that you use can help you save fees on daytrading. It cost us pennies to transact.

Most of the traders there were Taiwanese, and the rest were from mainland China. There was some big money there too. A lot of the Chinese students were going to UBC, and were getting allowances of up to 30k per month. It was more as a way to get money out of China. They told me things about China that not even our media was discussing. Let’s just say they were very bearish on China. Some of those from mainland China with economic backgrounds said that all the economy data is made up. I wasn’t too surprised given my experience with Chinese stocks, but when I went to China, the infrastructure was incredible.

It was a fun experience being with like minded people. But I started to see the truth of daytrading. Everyday, the head trader would ask us whether markets are moving up or down. I realized that daytrading just didn’t give great signals…and the mental fatigue was crazy. We focused more on level 2, supply and demand, to get in and out quickly rather than charts.

The experience was great, and I made great connections. It was around this time in 2014 where I began to think trading was not for me. I began prepping for Law school. International Law to be specific. Wrote the LSAT two times, and was ready to go indebt by 100k. And then I was introduced to the Forex markets. It seemed like a match made in heaven. I really enjoyed geopolitics and history, and this could be applied in the Forex markets. At that time, 3 Trillion was traded in a single day. Today, the number has doubled to over 6 trillion. I was now looking at interest rates and CPI rather than earnings.

The Forex market is a whole different beast. The markets are open 24/5, and the moves are incredible. A full forex lot is 1.0. That’s a $100,000 but leverage allows even the smaller traders to take full lots. 1 pip of movement say 1.2001 to 1.2002 nets you 10 bucks per pip (this is a bit different on GBP and JPY pairs). With forex pairs moving 200-300 pips a day, one can make a large amount of money in a short time.

I began doing trades for a forex prop firm out in Cyprus. I would contact the trader, and he would input my trade with the stop losses and take profits. I was red for the first two months. I needed to flip positive in my third month to stay with them. They thought it would not be possible. I was just like most of the new traders to them. But as I said, I kept learning. I learned that major banks and corporations trade the currency markets. They only look at larger (weekly chart) support levels. Simple stuff. So I began just taking support trades on the weekly chart. Here is another lesson: Trading is a business of probabilities. Risk vs Reward is key in determining whether you grow your account or blow it. Taking trades at major support had a higher probability for success. Years later, I would develop more confluences to increase the probabilities of my trades.

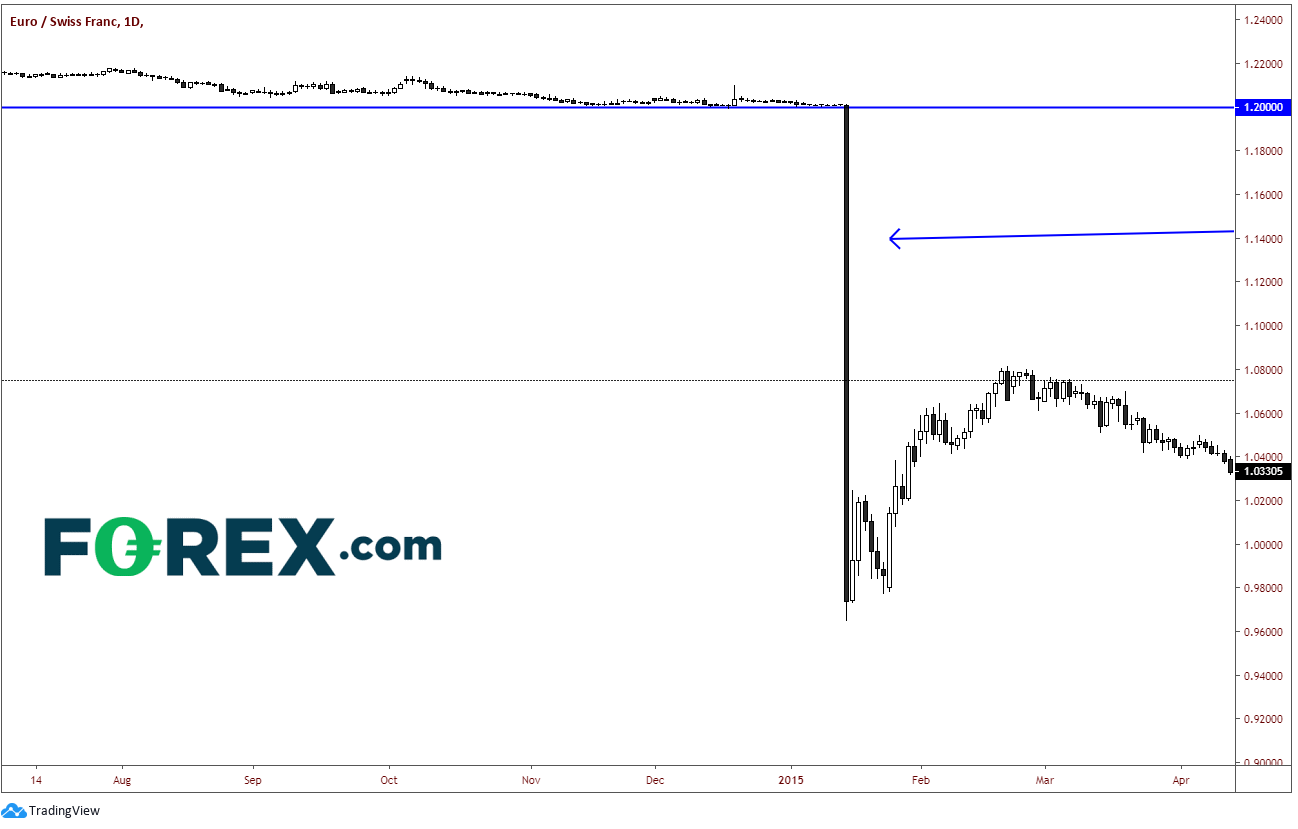

By the end of the third month, I had an incredible turn around. I made up all my losses and broke even with the firm. They were ecstatic. Being young, my ego was still not under control. I decided not to continue and venture off on my own. At first, this went well. I witnessed some incredible events such as the Swiss National Bank breaking their peg. Some of those traders did not have stop losses and had to pay back big time. I wouldn’t see a currency move of this magnitude again until Brexit and the British Pound.

My largest trading win in my career occurred in the Forex market. I took a trade on EURGBP, placed a tight stop loss, got up and saw I made $2200 USD overnight. At the time that was close to $3000 Canadian dollars. While I was sleeping, I made more money than many Canadians would make working in a month. This was a big moment for me. I learned how quick it can be to make large amounts of profit…and to be honest, it scared me. I was literally scared of the success. Making this amount in less than a day was not normal in my mindset. Mentally, I didn’t think I could make this type of trade again. This is when I realized trading is MORE about psychology rather than skill.

Another major lesson: Develop an abundance mindset! Do not be afraid of success. You have probably heard this, but many lotto winners who win boat loads of money actually end up losing it all, and end off in a worse position than they were before they won the lotto. These people are scared of the money. Scared of success. A scarcity mindset made them lose that cash. Trust me, I have seen this play out many times. I have seen many people sell real estate here in Vancouver, only to lose all their profits, and not knowing where the money went. You must want success, and feel worthy of having it and growing it.

Books I recommend for building this mindset are two popular books mentioned by all financial guru’s. They are Napoleon Hill’s Think and Grow Rich, as well as Wallace Wattles The Science of Getting Rich. The latter was the work that inspired the book “The Secret”. Some of this might sound new age-y, but it really is not about that. There are no blood sacrifices, or moon prayers here. It is about taking action while BELIEVING you are worthy of success. This change in perception was a turning point for me. In fact, this whole idea of abundance mindset is becoming BIG now. People are realizing the power to do is within them. YOU must take action.

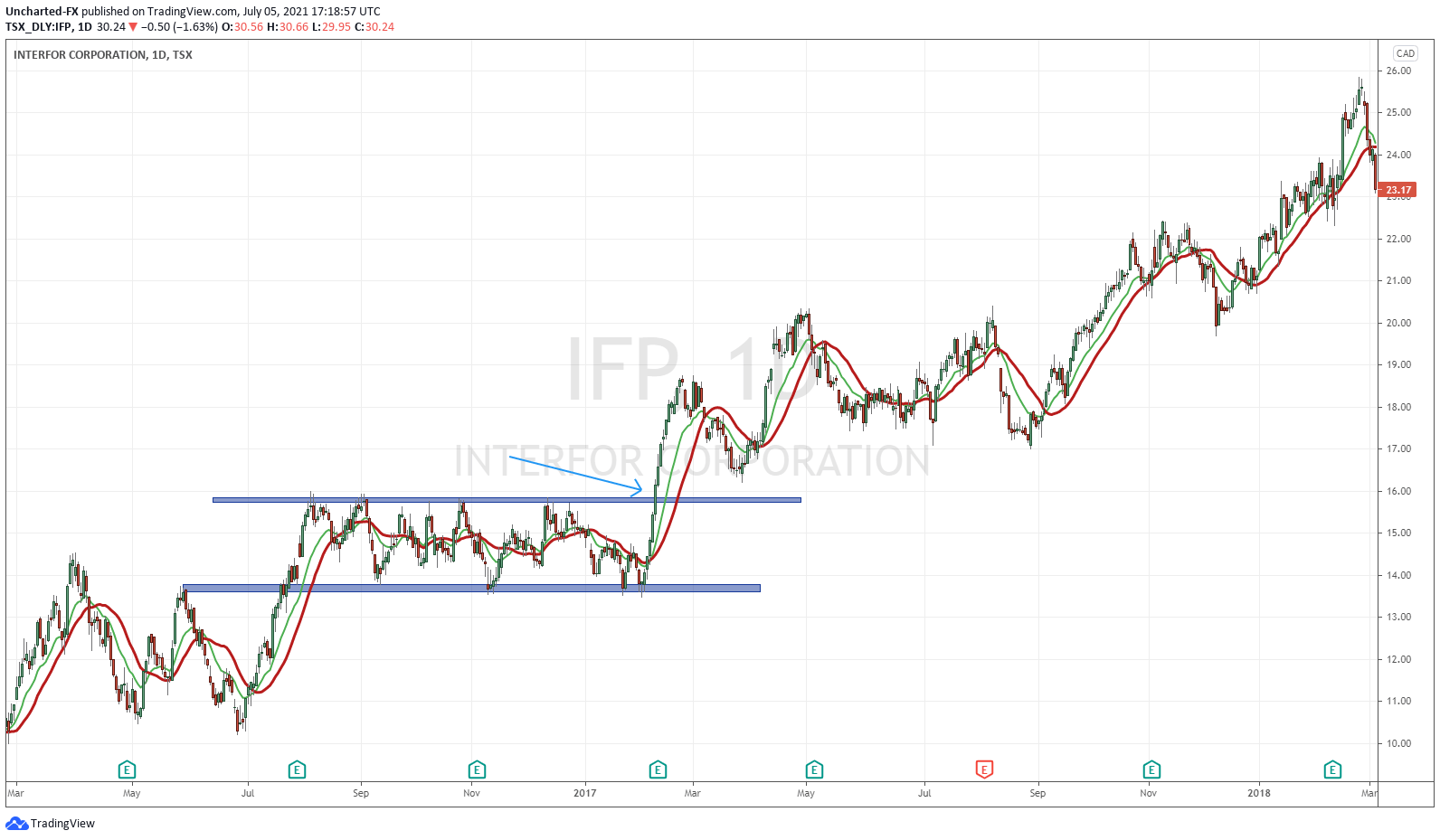

I have been rambling on too much so I will try to cut things short. The final experience I had was with a Boutique Investment Bank here in Vancouver. We only played Canadian stocks. It was a top down approach. Charts were important, but we built financial models and called management. My top trade came during the President Trump lumber issue. Another lesson here: Do NOT follow the crowd! They are wrong most of the time because financial media is REACTIONARY.

While everyone was scared of holding lumber, I found a company called Interfor which had most of their mills in the US. They did not have to send lumber across the border into the US, and their profits were in US Dollars. I called up their investor relations and we had a nice chat about this and the markets over reacting. Financial media has a large role in this, so I don’t suggest trading based on the news.

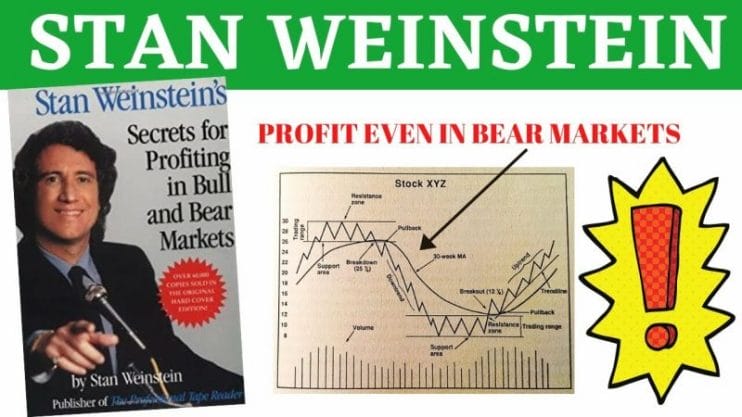

I played the range on Interfor, accumulating shares and then adding more on the breakout of the range. Little did I know but I was practicing my market structure method on trading. While I was working with this Boutique bank, I began reading the ONE book that would change my entire trading career. Stan Weinstein’s Secret for Profiting in Bull and Bear Markets.

This cycle and market structure work was the missing element to the puzzle. I knew the technicals, the fundamentals as well. But things move in cycles. Every asset does. Uptrend, range and then a downtrend. Weinstein calls them Stage 1,2,3 and 4. Very powerful stuff. Figuring out these cycles made everything click, and I hope regular readers of Market Moment see this. Many of my charts look the same. This is key. I have a strategy that has a high probability of success. All I do is scope for these charts, take the breakout and then repeat. Everything is automated. I just ensure it meets my criteria and then I pull the trigger on the break.

As I said earlier, trading is more psychological than skill. It is all about controlling habits and taking trades ONLY when they meet your criteria. A lot of people FOMO into trades. If you have Fear of Missing Out (FOMO), you have already missed out! Do not chase moves! There will be an opportunity to play the asset again, and there will be plenty of other opportunities out there. Generally when you chase, your risk vs reward becomes lop sided.

What is big in trading today is developing oneself. It really is about what you do in your free time when you are off the charts. Once you develop good habits for trading, you do become better in everything else you do. Habits such as discipline, patience, perseverance, and taking proper risk. Less is more. Many hedge fund managers actually spend most of their time reading books rather than trading. Sure, they might have the luxury to do so with the amount of money they have, but less is more. I have seen a stark difference when I began swing trading. I am not hostage to every tick or headline from the markets. I let my trades play out for days or months based on cycles. It seems like social media and Hollywood have built this misconception of traders reacting emotionally to everything and being gamblers.

In my experience, the technicals can actually predict future events or data prints. I don’t think we live in a world of perfect information. Big money and insider’s know what’s coming, and some of them find ways to profit from this. The candles and technicals indicate this. Watch for this days before earnings or before a data print.

So in summary, develop and work on yourself. To this day I still read regularly on Economics, Geopolitics, Psychology and History. My trading is simplified where I have a routine to look at the charts every 4 hour for entries. I also run a separate long term portfolio just buying DRIPs and value stocks. My goal is to eventually start a fund and provide macro outlooks for the world and markets, and I believe the foundations are being laid down here on Equity Guru. Market Moment readers can attest to the outlooks and moves I have called in the past.

I want to stress that you do not need to be a trader to make it big with financial markets. I encourage everyone to take control of their financial destiny and start a long term portfolio. Invest! Start off with things that interest you. Write down where you spend most of your money in a week or a month. Then consider buying shares of that company. Keep it simple, and have a LONG TERM outlook. Let’s keep growing and learning my friends!