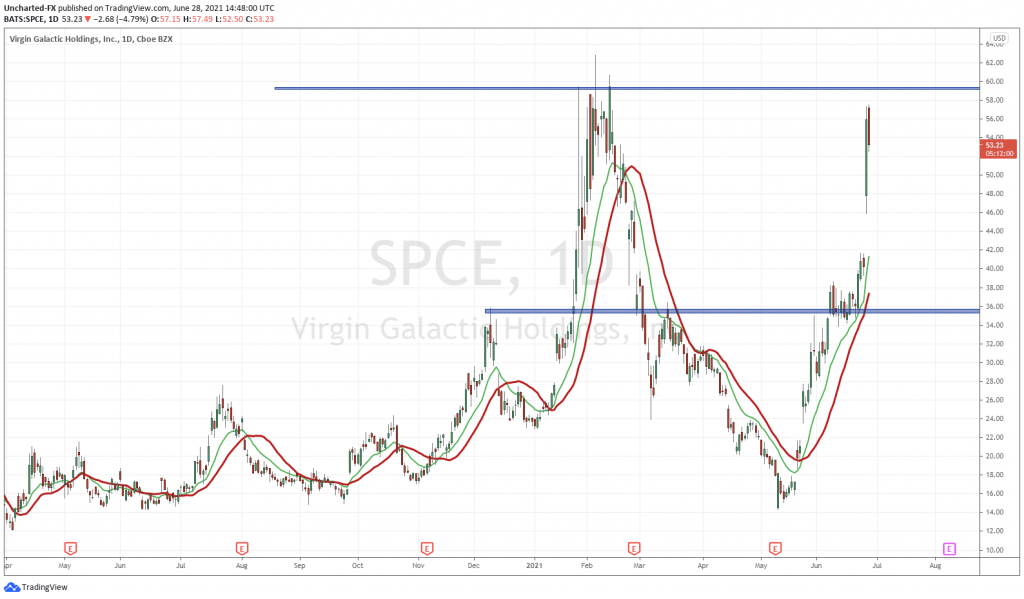

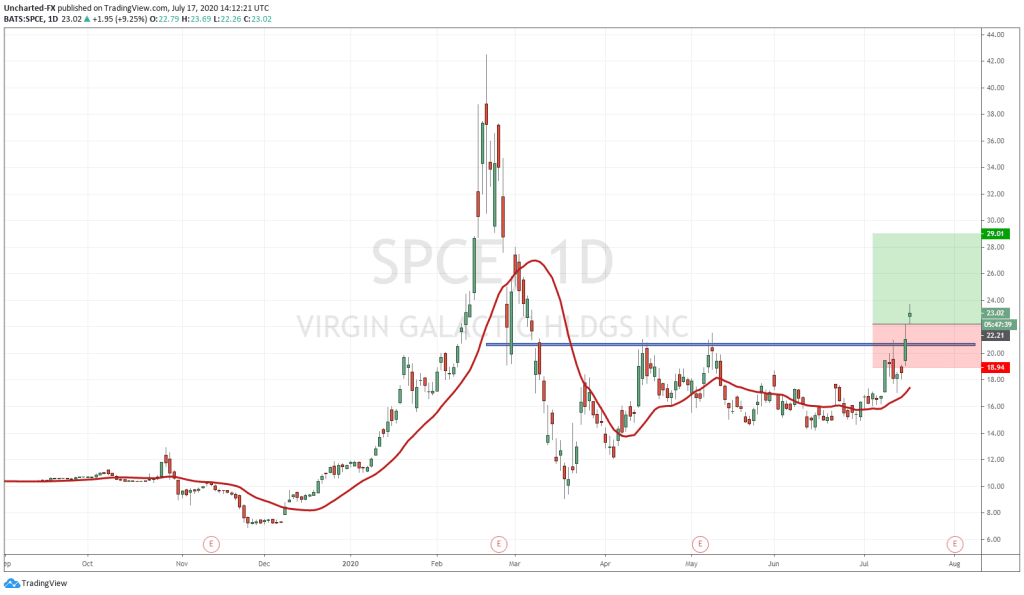

Virgin Galactic (SPCE) last appeared on Market Moment back in July of 2020. This update has been long overdue. We left off with Virgin Galactic breaking above $20, taking out a major resistance level, and confirming a breakout. The stock price would continue higher to hit all time record highs of $62.80 before selling off beginning in February of 2021, and seeing lows of $15 in May of 2021. Not too long ago. Our story begins from here.

Over on Equity Guru’s Discord Trading Channel, we have been following SPCE. The stock began basing around $15, and met our criteria for a market structure guided reversal. Price did liftoff and retest the high $50 levels just last week. Under technical tactics, I will discuss some important charts levels, but for now, let’s discuss why the stock is hot.

SPCE had its best day ever on Friday June 25th 2021. The stock jumped 39% after receiving a license from the Federal Aviation Administration (FAA) approving passenger spaceflights. Virgin Galactic now has the license it needs in order to take passengers up to space on future spaceflights. Big news.

The ones who are dubious of this news, state that space travel is still very far away. I will admit, I was in this category before. However, with recent circumstances, I am willing to admit that I am wrong, and space travel might be much closer than I have anticipated.

In order to obtain this license, Virgin Galactic had to obviously clear FAA guidelines on spaceflights. They cleared these milestones with test flights back in May. This actually came as a surprise to me. It seems all we hear about is Space-X test flights, so I did not know Virgin Galactic was trudging along.

For those on the fundamental side of things, cashflows are coming in. Yes, it is nowhere near to making revenue, but it’s a start. Virgin Galactic has around 600 reservations for tickets for future spaceflights, which have been sold between $200,000 and $250,000 each.

What Comes Next?

For future catalysts, Virgin Galactic is planning three more spaceflights before completing development. The next test flight will carry 4 passengers in order to test the space flight cabin. The second test will carry Billionaire founder Sir Richard Branson himself. While the third flight will carry members of the Italian Airforce up into space for astronaut training. The question now becomes when does Virgin Galactic plan to carry out these tests?

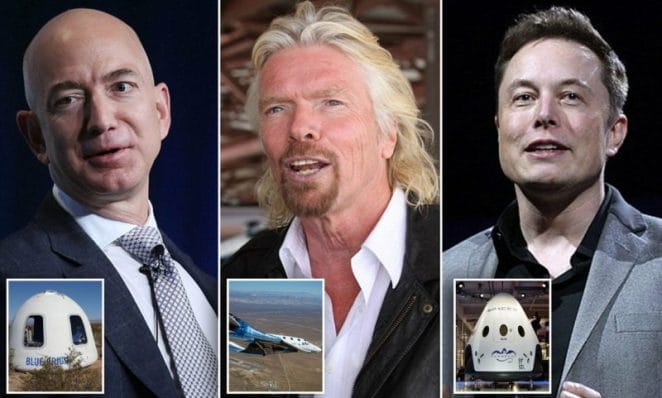

To add some drama to this story, just a brief introduction to the battle of the billionaires in space. I am sure you are all familiar with this.

It is Jeff Bezos vs Sir Richard Branson vs Elon Musk. The latter seems to take all the headlines with Space-X and more recently…crypto pumps. But I want to focus on the former two.

Jeff Bezos is set to be the first billionaire in space. Blue Origins first passenger spaceflight is set to take place on July 20th 2021. July 20th 1969 is a major date in space exploration, when two American astronauts by the name of Neil Armstrong and Buzz Aldrin landed and walked on the lunar surface. So the date marks the 52nd anniversary of Apollo 11 moon landing. It is also my birthday, but I doubt that has any reason for timing the launch on that date.

Bezos’s upcoming flight has caused some stir. From auctioning a seat to fly with him for $28 million, to a petition with more than 133,950 signatures to not allow Jeff Bezos to return to earth.

In this battle with billionaires trying to best each other, there are rumors that Sir Richard Branson might reorganize Virgin Galactic’s flight schedule in order to fly himself up into space over the July 4th weekend. This rumor came out on a blog post after Bezos announced he would be flying out on July 20th. Seems like Branson wants to beat him to the punch.

Regardless of whomever gets to space first, this will be a major step forward for space tourism. When billionaires are supporting their tech and products this way…and are landing back safely, it will impact the markets. It will indicate that perhaps space tourism is much closer than the majority of the market believes(d) it is.

Technical Tactics

And I think this has already happened, or is beginning to happen. The market was surprised on the FAA approval. Throw in an upcoming successful test flight on July 20th, and the market begins to price in sooner than expected space tourism.

The Bezos flight (or Branson if he beats him to it) will be big. Obviously a Virgin Galactic test would impact the stock price of SPCE, but I believe Bezos’ test flight will do the same. Because of what I said before: the market begins pricing in space tourism, and playing SPCE is not just the best way, but is cheaper than Tesla and Amazon.

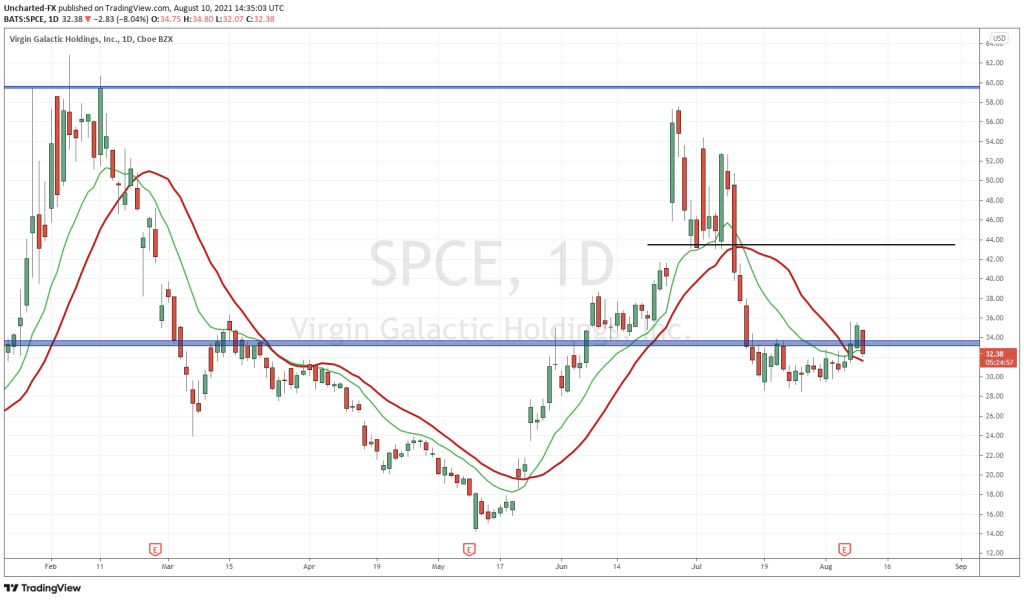

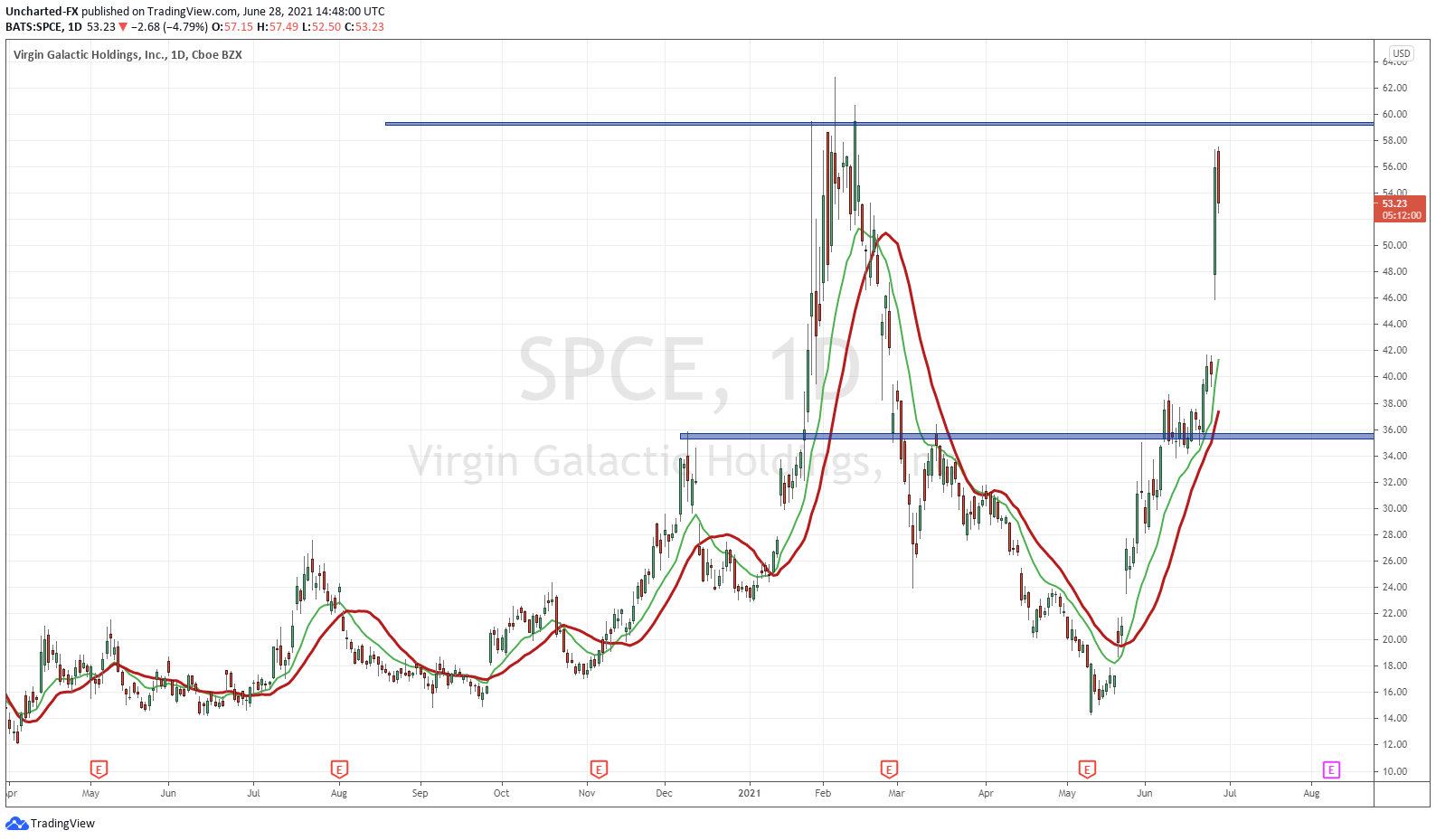

Shares of SPCE are down 5% today. Not too surprised as we are near a major resistance zone. For more upside, we want to see SPCE break and close above the $59 zone on the daily chart. A close above $60 would be even better. We would then have a record all time higher close. Momentum will follow, especially with the spaceflight catalysts. If the spaceflights are delayed, or God forbid, the test flights with occupants are not successful, they would significantly impact the stock.

In terms of support or price floor. First I would consider $50. A nice psychological important level. But what catches my eye is the gap between $42-$46. When a stock gaps up, the gap becomes support. If price manages to close back below the gap level, or below $42 in this case, it would be extremely BEARISH. So we should expect a wall of buyers around the gap area waiting to buy the dip.

Finally, the large support, or flip zone (an area that has been both support and resistance in the past) comes in at $36 bucks. A very major technical level, and personally, I would love to buy there if price retraced.

So there you have it, the FAA approval is big news, and more catalysts are incoming with passenger spaceflights. It caught me by surprise, and I believe the market will start pricing in space tourism sooner rather than later. There is also one other major momentum card. Yup, that’s right, the meme traders over on Wall Street Bets. Already beginning to see members post about SPCE. Checking on shortsqueeze.com, SPCE does currently have 34,320,000 shares short…