23andMe Holdings (ME.Q), the California-based personal genomics and biotechnology company, made headlines on Thursday after announcing that it has begun trading on the NASDAQ through an SPAC, sponsored by Richard Branson’s Virgin Group.

“23andMe was founded to revolutionize healthcare by empowering people with direct access to their DNA…Over 11 million people have joined 23andMe and are part of the community that is using genetics to transform how we diagnose, treat and prevent human disease. As we enter the next phase as a public company, we have the opportunity to expand our impact by bringing personalized healthcare directly to everyone,” said Anne Wojcicki, CEO and Co-Founder of 23andMe.

An SPAC refers to “special acquisition company”, a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO). Through raising capital, the sole purpose of an SPAC is to acquire an existing company. SPACs are also known as “blank check” companies or shell corporations and are attractive options for companies looking to go public without having to go through the initial public offering process.

With this in mind, 23andMe went public by merging with VG Acquisition, an SPAC sponsored by Richard Branson’s Virgin Group. The transaction was formally approved on June 10, 2021, and valued 23andMe at $3.5 billion, including debt. For anyone who remains blissfully unaware of 23andMe, allow me to enlighten you. 23andMe is recognized for providing direct-to-consumer (DTC) genetic testing services where consumers supply a saliva sample. This sample is then sent to a laboratory where it is then analyzed, ultimately providing a breakdown of a customer’s ancestry and genetic predispositions.

Personally, genetic tests aren’t my cup of tea, however, the DTC genetic testing market was valued at USD$1 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 12.8% between 2020 and 2028. With this in mind, according to BIS research, the DTC genetic testing market could reach a massive $6.36 billion by 2028. Considering the cheapest 23andMe testing kit is priced at $129, I can’t say I am too surprised…

“As one of the earliest investors in 23andMe, I’ve long believed in its vision to transform the future of healthcare…I’ve seen first-hand the transformative impact 23andMe has in paving the way for many more people to be proactive about their health and wellbeing. There are huge growth opportunities ahead, and with Anne and the rest of the incredible management team at the helm, I’m confident they will continue to innovate and disrupt the industry, creating a lasting impact on many people’s lives. We look forward to continuing our partnership as 23andMe begins life as a public company,” said Sir Richard Branson, Virgin Group Founder.

In addition to its recent merger, 23andMe raised approximately $592 million in gross proceeds to fuel growth and expansion in the company’s consumer health and therapeutics businesses. Capital from the transaction will also be used to invest in the Company’s unique genetic and phenotypic database to help accelerate personalized healthcare at scale. The combined company is called 23andMe Holdings Co. and is traded on the NASDAQ under the ticker symbol ME.

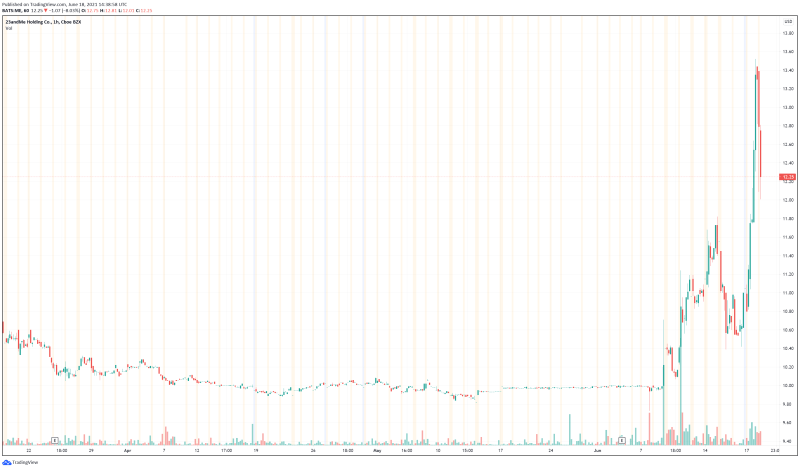

23andMe’s share price opened at $13.31, down from a previous close of $13.32. The Company’s shares are down -7.96% and are currently trading at $12.26 as of 10:41AM ET.