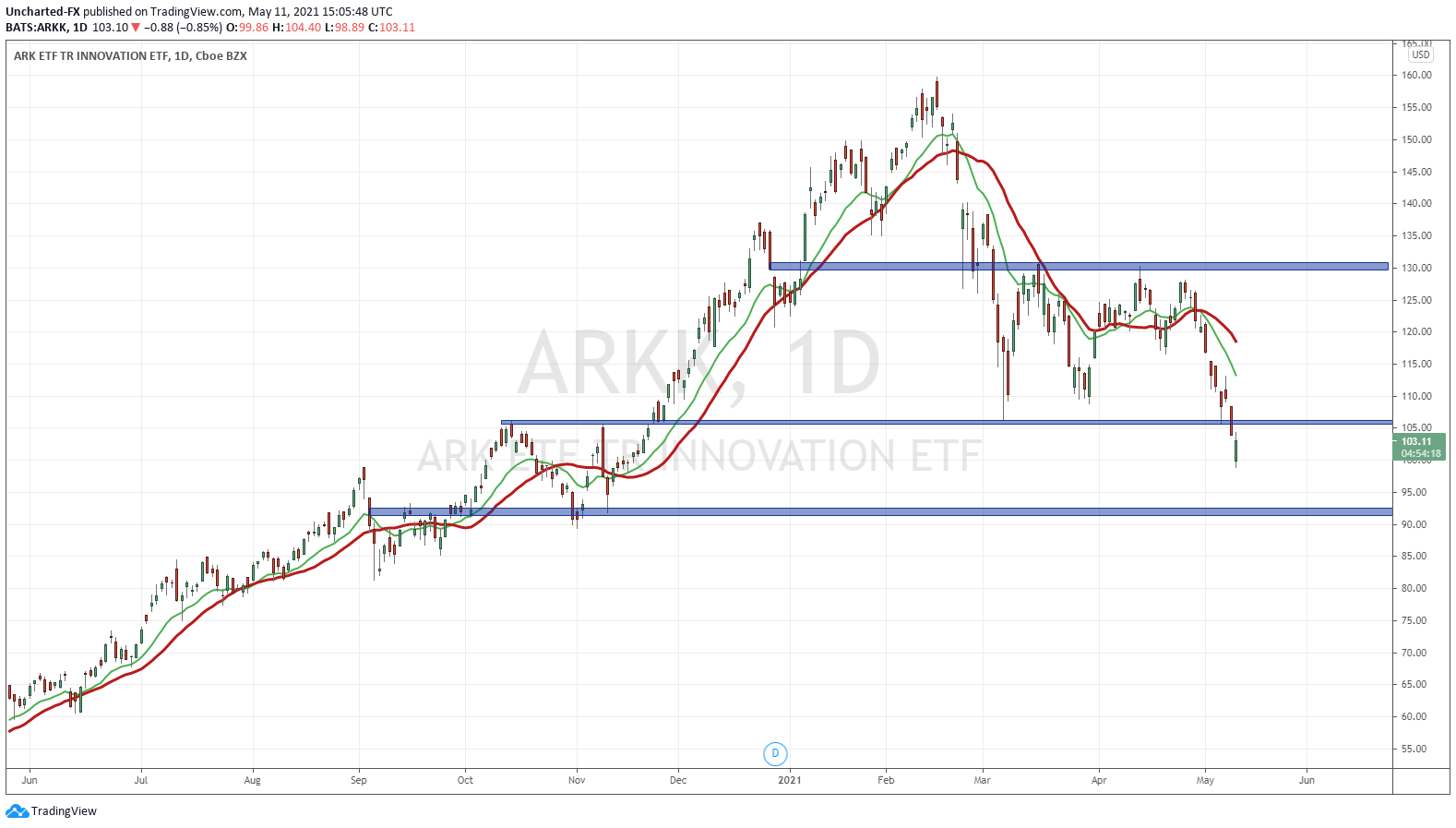

The Nasdaq was down over 2% during overnight futures trading, leading the major stock indices. At time of writing, the dip is being bought up and we have made up half of those losses. Regular readers of Market Moment knew what levels to watch on the Nasdaq from last week. We’ll take a look at the updated charts under the Technical Tactics portion of this article.

Financial media is saying that rising inflation fears is what is weighing down on stock markets. However, I do not think that necessarily explains why many major world indices are taking the plunge. Sure, the American markets could be leading hence why other markets are selling off, but there was a significant news piece out yesterday.

The World Health Organization (WHO) stated that the Indian variant is a “global concern”, with some data showing the variant is vaccine resistant. Been awhile since we heard news like this, but it is reminiscent of WHO headlines during the major everything sell off back in February and Spring of 2020. World markets were spooked.

The question going forward now: is this the stock market top? I don’t believe so. In fact, we can already begin to predict what the Federal Reserve will say. And what they will say, will make the markets very happy.

“Yea so remember us telling you all that the economy was strengthening, and there has been a debate among some Fed Presidents on whether we should taper and hike rates? Well ain’t happening now. The NFP data came out worse than expected, indicating a recovery will still take some time. Monetary policy will remain in place. We aren’t even thinking about thinking about raising rates”.

In a way, it allows the Fed to walk back their “strengthening” and tapering comments. The Fed saves face, and the cheap money continues to prop assets.

So as of now, I am treating this move lower as a well needed pullback. If certain major support levels are taken out, I will warn my readers.

Technical Tactics

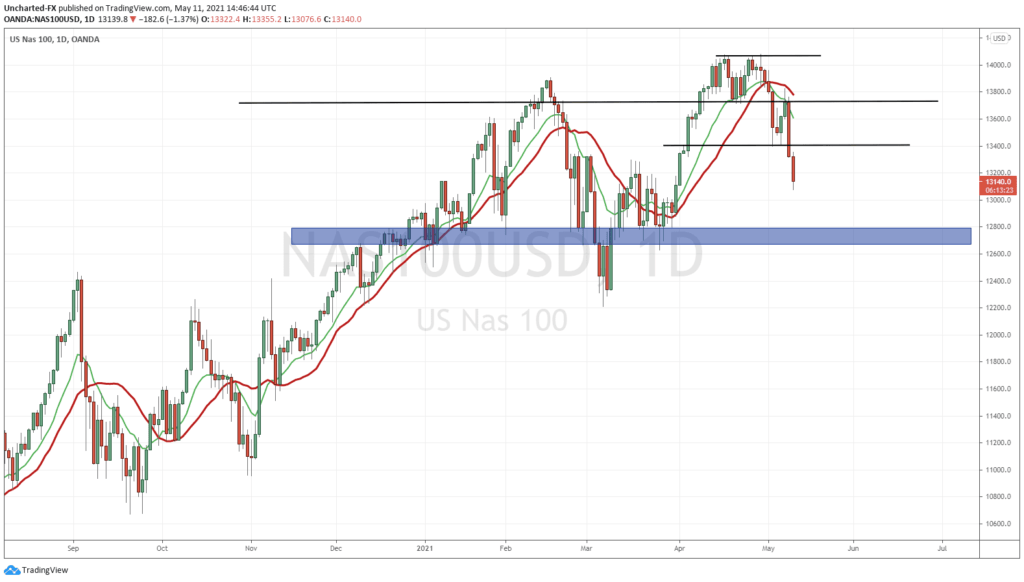

The Nasdaq got the close below 13740 and then pulled back to retest the breakdown zone as resistance (price ceiling). Once again, pullbacks and retracements to retest breakdown and breakout zones is perfectly normal price action. In many instances, it is better to not chase the breakout if it has moved too quickly. It is better to await the first pullback for an entry.

Look at the Friday candle on the Nasdaq. Notice how price breached above 13740, before sellers piled in, taking prices back down. A way to take out the bears by taking out their stop losses. Be careful with these type of things. Many people like to place their stop losses above or below the breakout trigger candles, but in this case, you would have been stopped out. I like to place my stop loss below or above my 20 day moving average (the maroon line). I find it works the best for swing trading.

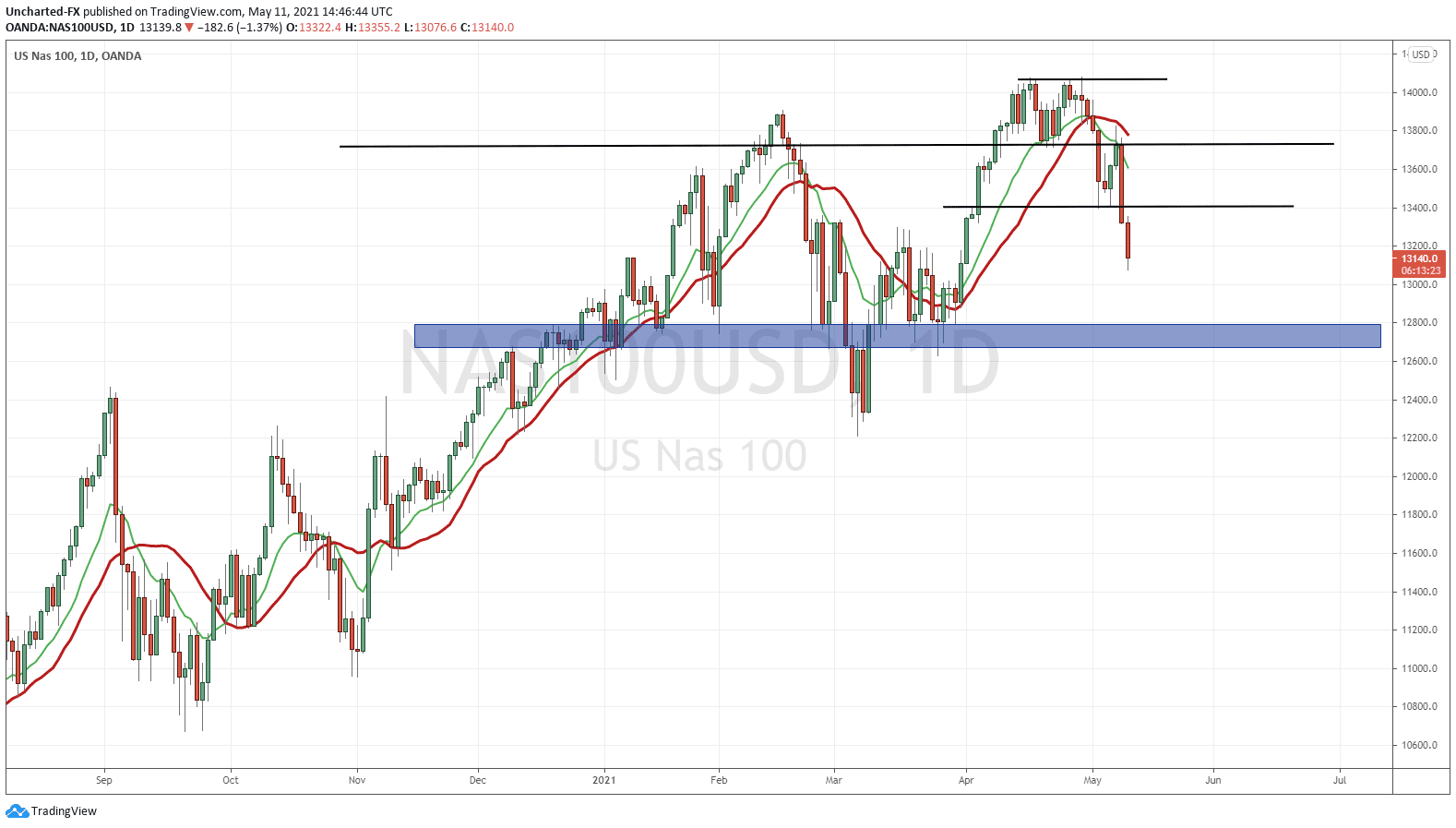

Anyways, the Nasdaq has confirmed its first lower high yesterday. Can we still make another leg down? Technically yes. As long as we remain below 13740, we are still in the downtrend. Once price closes back above this level, we can write off lows and expect new record highs. I would also watch the 13,400 zone just to see how price reacts if we pullback. Depending on the strength of price action, it can tell us whether we are likely to reverse and close above 13740 or not. To the downside, 12800-13000 would be the targets.

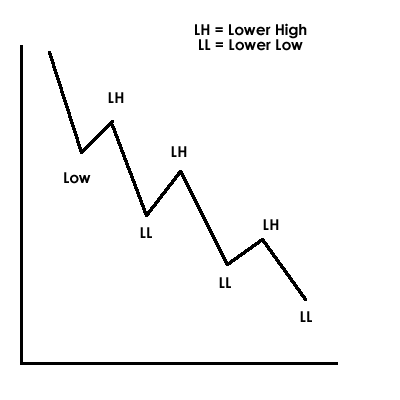

When talking about the Nasdaq and technology falling, we have to talk about Cathie Wood and Ark. I looked at Ark back in March. My worries are still valid. How does Ark hedge when tech falls? Pray for Cathie Wood and ARKK (Insert prayer emoji here).

It seems we have an answer. Cathie Wood has sold one third of her Apple shares to buy more of their own ETFs to prop the price.

Zerohedge does a nice dive into the numbers looking at positions in Palantir, Roku, Tesla and Teladoc…and also mentions the link with Archegos Capital’s Bill Hwang. Worth the quick read.

ARKK is has finally broken below the support zone I mentioned back in March. It took a few months, but the break happened. Recall I mentioned we needed a close back above 130 to nullify the downtrend. Did not happen, hence why another leg lower was in the cards.

The breakdown saw ARKK hit the major psychological level of $100, in fact prices of the ETF dropped slightly below $100 ($98.89 to be exact), before seeing buyers defend this price point. It really depends now on if the Nasdaq and other indices reverse, or make another leg lower.

For ARKK to get back into safety, prices need to close back above $105.00. If not, another leg takes us to the $90.00 zone.

With Tesla, and Palantir below their resistance levels (more on PLTR tomorrow), ARKK can see more downside, and perhaps Cathie Wood will have to close more positions to raise funds to buy up her own ETFs.

To summarize, I do not think this is the BIG crash. Just a well needed retracement. Really, all the data points and news about new variants will allow the Fed to continue its monetary policy which means money will continue flowing into stocks for yield.