This week has been immense for Roblox (RBLX) stock. Yesterday saw a 9% move taking the stock into new record high territory. What comes next is the big question. I will answer this from a technical perspective, as currently, the stock is down over 5% and gapped down on the open.

Before we do, let’s first jump into the fundamentals to answer the question on many people’s mind: can we justify this share price?

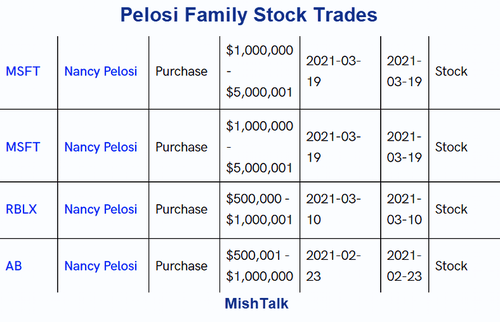

Just two days ago, Roblox stock was making big waves on social media platforms. A lot of trading channels and guru’s on Youtube and TikTok posted the image of House Speaker Nancy Pelosi’s husband, Paul Pelosi, financial disclosures. He is quite the trader. And it seems that is okay for members of Congress to trade on inside information (government contracts) before deals are announced.

Paul Pelosi exercised call options and paid $1.95 million to buy 15,000 shares of Microsoft at a strike price of $130 on March 19, according to an April 9th filing with the House clerk. That same day, Pelosi, who owns and operates a California venture capital investment and consulting firm, paid $1.4 million for 10,000 shares valued at $140 apiece.

Since Pelosi made the purchase, Microsoft share prices have climbed from about $230 to roughly $255 – an increase of close to 11% – after the company secured a lucrative government contract worth nearly $22 billion to supply U.S. Army combat troops with augmented reality headsets. The deal was announced on March 31.

As you can see, the Pelosi’s purchased 10,000 shares of Roblox paying between $500,000-$1,000,000 on the day RBLX launched its shares on the NYSE.

Roblox stock was also buoyed by other major news. A partnership with Hasbo. The partnership will include Nerf and Monopoly products, which will include codes to redeem virtual goodies online. A Nerf experience will also be launching on Roblox’s platform. This is definitely big news.

But is the Stock Price Justified?

As I am writing this, the highly anticipated Coinbase IPO should begin trading in a few hours. IPO’s have been hot. But many analysts say that these markets don’t really care about fundamentals. It is all a chase for yield and hype. This has led to some eye-watering valuations.

For example, Roblox’s market cap is $45 Billion. This is all pricing in future growth and revenues, but for a company that has not even released any earnings, you can see why some analysts are dubious about the price surge. Roblox’s first earnings come out on June 2nd. This will be highly anticipated.

For those that are new to the company, Roblox develops and operates an online entertainment platform. It offers Roblox Client, an application that allows users to explore 3D digital worlds; and Roblox Studio, a toolset that allows developers and creators to build, publish, and operate 3D experiences and other content. The company also provides Roblox Cloud, a solution that provides services and infrastructure to power the human co-experience platform.

OR summarized nicely: a children’s video game company with a ‘metaverse’ which allows players to create their own avatar’s and environment’s to play in.

[youtube https://www.youtube.com/watch?v=AXRQ8R6Wvuo&w=560&h=315]

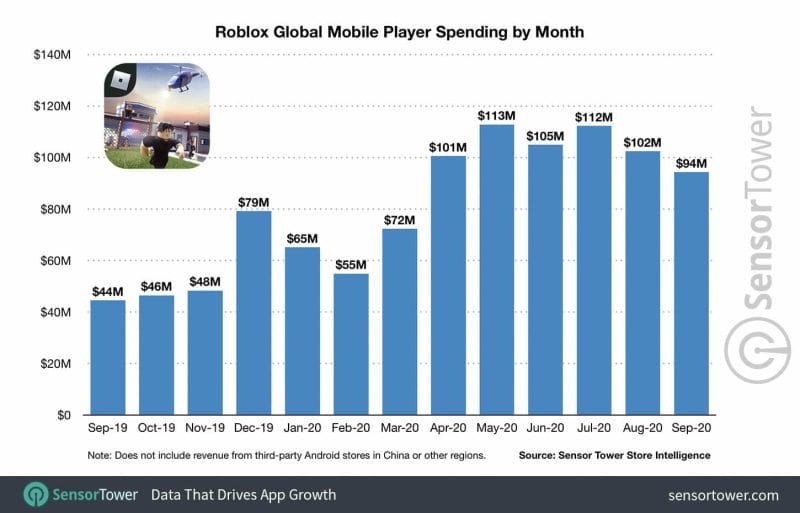

The company generates nearly all of its revenue from the sale of its Robux currency, which can be used to purchase in-game virtual objects. More than half of those sales are through the app stores of Apple and Google.

Roblox posted revenue of nearly $925 million last year, up 82% from 2019. Revenues rose to $924 million in 2020, but rapid growth resulted in an increase in operating loss. This is driven by higher developer fees, as operating losses came in at $266 million last year.

The company also said earlier this month that it now expects sales to rise about another 60% this year to a range of $1.44 billion to $1.52 billion.

Roblox had 32.6 million daily active users at the end of 2020 and the company is predicting that it will have 34.6 million to 36.4 million by the end of 2021. The majority of the company’s players are kids 13 and under, but the company states that the group of 17-24 year-old Roblox users is growing very rapidly.

The company will look to generate more sales from advertising. Some even call this a new era of branded gaming. This will be organic, for example users can pay to wear Nike shoes in the game as opposed to seeing big Air Jordan billboards in Roblox.

These are some things I would keep in mind:

Is the valuation too high? Will revenue keep streaming in to justify a 40 plus Billion dollar valuation? June 2nd will provide some insight.

The company has done well due to current pandemic conditions. What happens when things re-open full? How about schools? Their user base is largely 13 year olds and younger. How much time will they spend on Roblox? Will revenue drop off? Can the strong growth in the video game industry off set this?

Technical Tactics

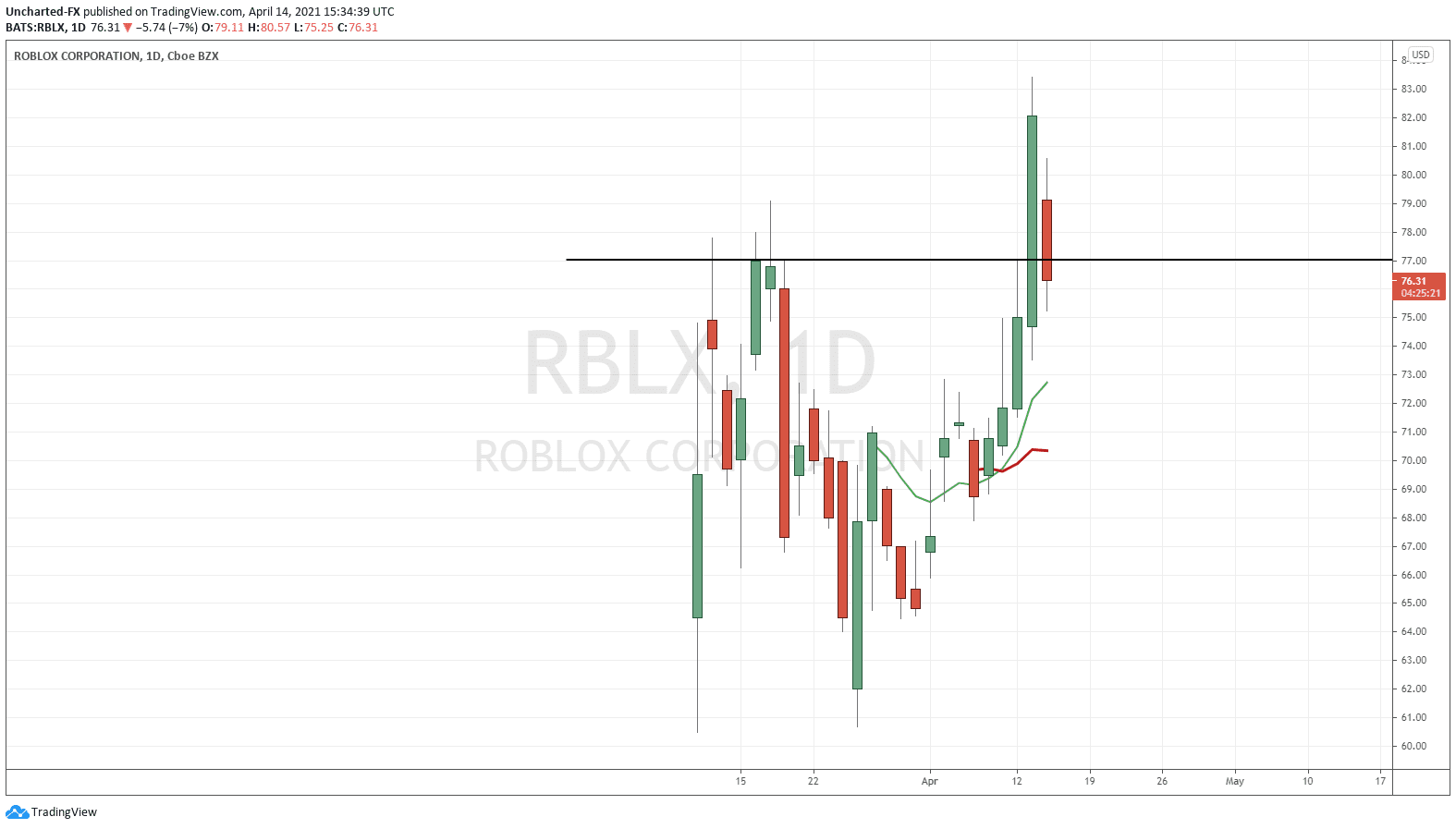

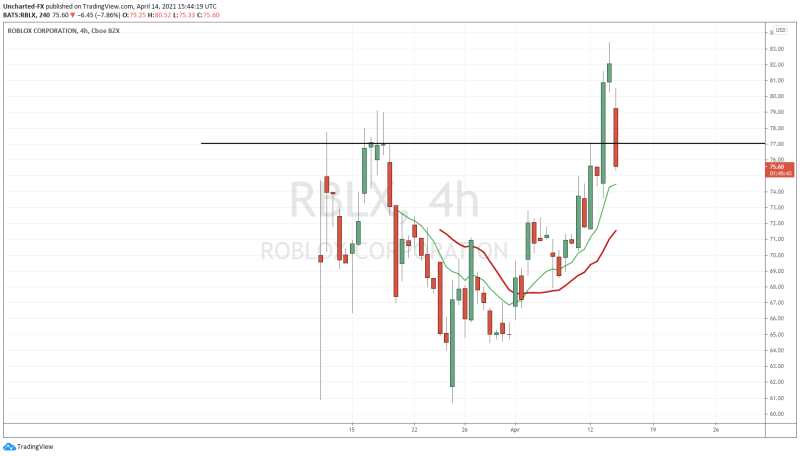

Roblox broke out and closed to confirm new record all time highs hitting a peak of $83.41.

It seems that many are taking profits, perhaps from even holding since the first day of trading, and Roblox gapped down this morning. Not really what you want to see the day after making new highs, but profit taking is the culprit.

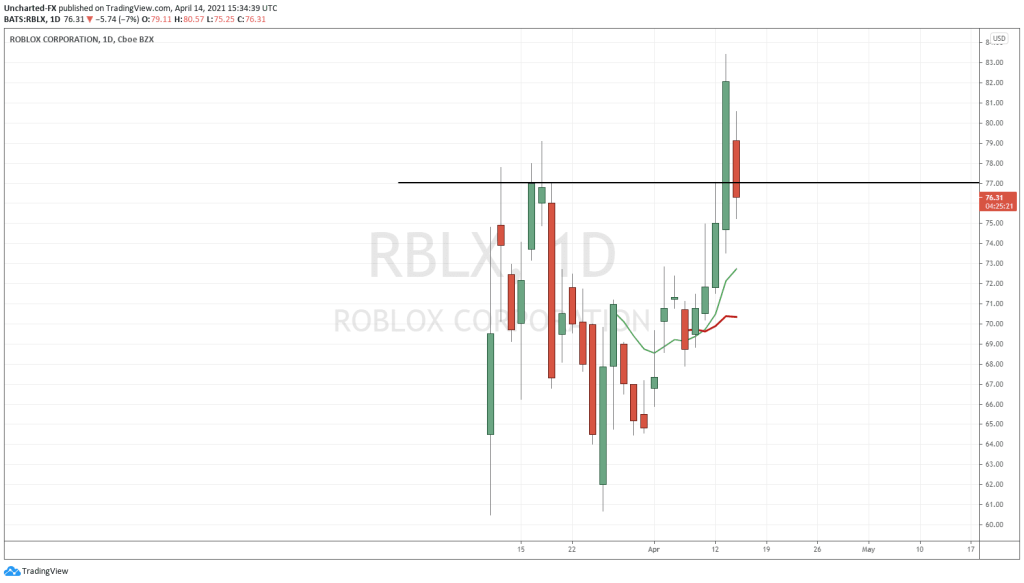

As you can see, my resistance now turned support (price floor) comes in at the $77.00 zone. I would like to see today’s daily candle close ABOVE this zone to see any further momentum on the stock.

Taking a look at the 4 hour chart, and you can see this zone more clearly. We still have over 4 hours left to go on the trading day. Enough time for buyers to step in and get a close above $77.00.

If we do not close above $77.00, price can just stall and even head back lower to the $71.00-$72.00 zone. That would be the next support to the downside.

The technical break was immense for the stock yesterday, but earnings and expectations is what will drive further momentum. $100.00 becomes the important psychological resistance target to the upside. June 2nd is the date you should circle on your calendar for those first released earnings.