Sugarbud (SUGR.V) announced they have been upgraded from the OCT Pink Open Market to the OTCQB Venture Market effective today.

They will trade on the OTCQB under the ticker “SBUDF”.

Qualifying for the OTCQB requires companies to be current on their disclosures, pass a minimum bid price test, and provide an annual company verification and management certification process.

“Being quoted on the OTCQB market will significantly enhance our visibility and make the Company accessible to a much broader range of U.S. investors. The quotation on the OTCQB market is expected to increase liquidity by providing current and potential investors with a transparent and easily accessible trading platform where they can find Real-Time quotes and market information on the Company,” stated Sugarbud CEO, John Kondrosky.

Sugarbud’s uplisting comes the day after they announced that they had received an order for their Craft Cannabis Collection from OCS.ca. Because OCS is Ontario’s only legal online retailer, receiving an order from them is an important step in expanding one’s reach into Canada’s biggest provincial cannabis market.

Sugarbud describes its Craft Cannabis Collection as the “cornerstone” of its brand, so increasing its reach to Ontario is important to them.

“We are delighted that our Craft Cannabis Collection will now be available to consumers in the Province of Ontario – Canada’s largest and fastest growing recreational cannabis market,” stated John Kondrosky. “The OCS continues to support and foster a rapidly increasing network of retail stores in an effort to accelerate consumer access to recreational cannabis. We look forward to serving the needs of Ontario cannabis consumers with our exceptional high quality craft cannabis products.”

Today, Sugarbud also announced they are entering into shares for services agreements for company directors and advisors, and will be issuing 2,650,000 SUGR shares at a price of $0.05. Fully diluted, the company has over 760 million shares outstanding, so the share issued today represents around half a percent of the company’s shares.

The company’s cheap share price combined with increased visibility from their recent could bring some new investors to SUGR, but their loose cap structure does mean new investors may not push up the stock’s price as significantly as they otherwise would.

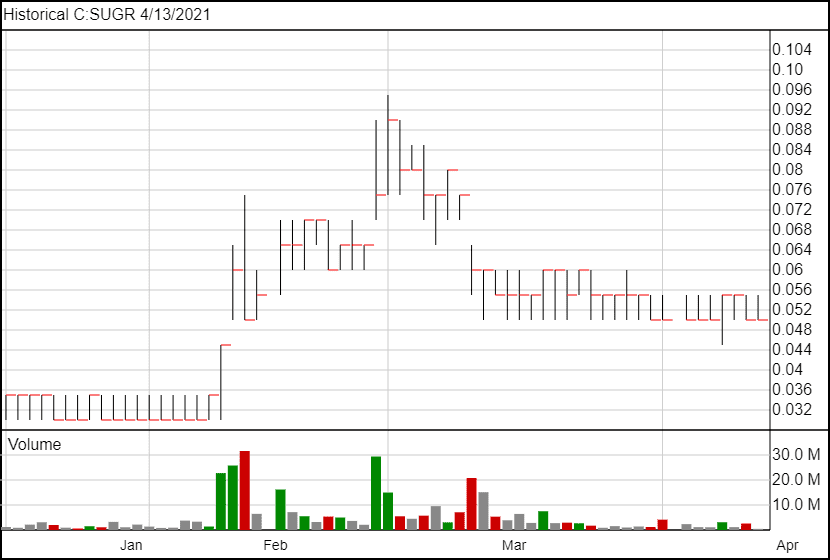

Following the news, Sugarbud’s share price has not changed significantly.