After a very eventful last week with the Fed Rate Decision and the massive Friday Oil drop, US Stock Markets open up slightly green but remain mixed. It is worth noting that the futures (overnight trading) was also subdued.

The Nasdaq is the strongest thanks to Tesla’s (TSLA) over 4% pop. I am sure you will hear more regarding this stock this week, and I will cover a bullish case in another Market Moment article this week. Ark’s Cathie Wood did announce a $3000 Tesla stock price target by 2025, and it seems traders are hyped.

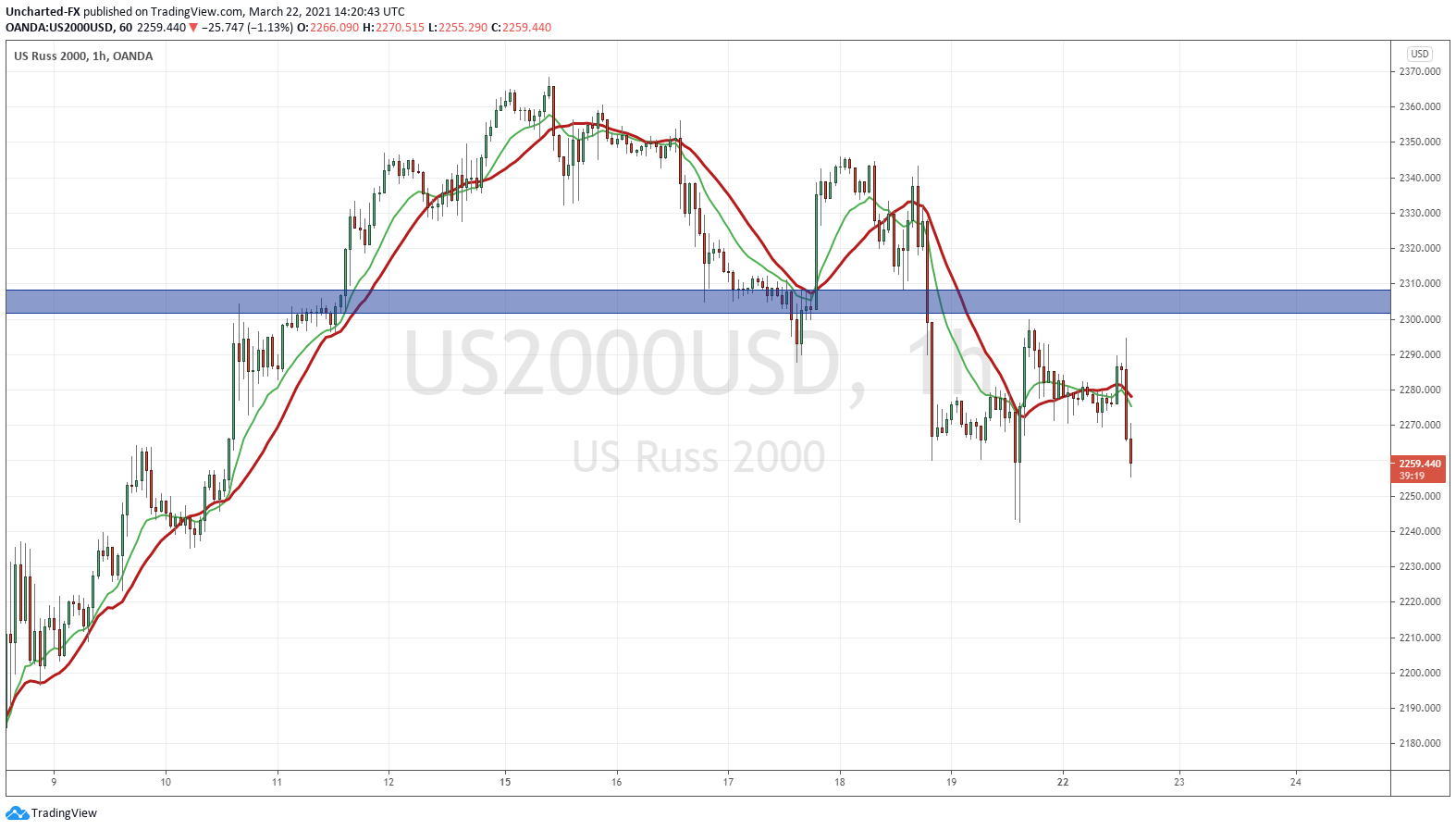

We have usually seen all US equity markets move together, but today we have a case of divergence. The small caps index, the Russell 2000, is the odd market out. While the S&P 500, the Nasdaq and the Dow Jones remain green, the Russell 2000 is testing the lows of Friday. Definitely something to keep an eye on because we tend to see the Russell 2000 LEADING the other markets.

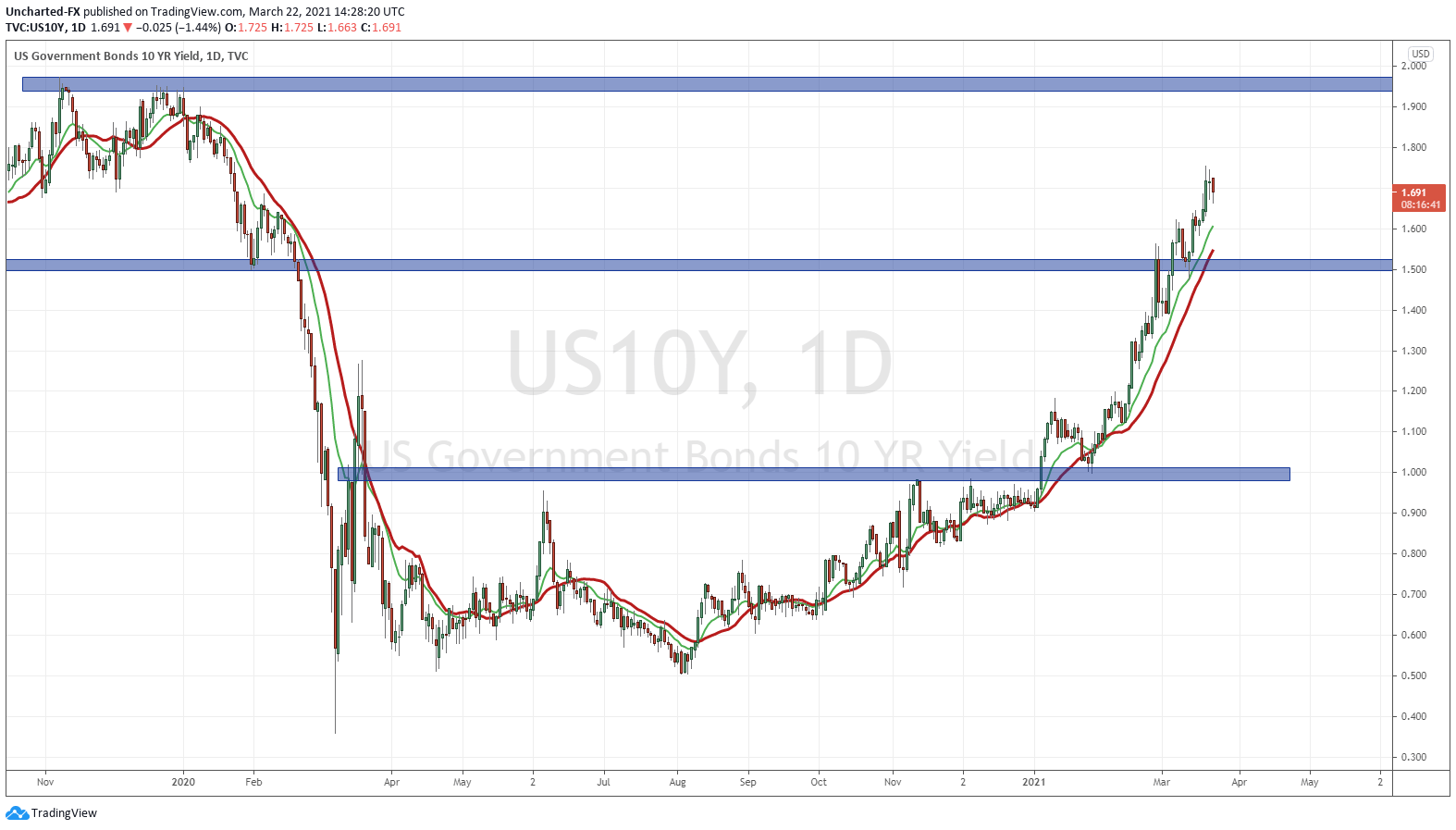

Last week was action packed. The Fed meeting was highly anticipated, and the Fed reassured markets that there will be no interest rate hikes for 2021. In fact, there will not be any until inflation steadily remains above 2%. Steady, and not transitory, is the key word. This is what it will take for the Fed to reverse policy and begin to hike rates.

One would think that this would be bullish for equities. The Fed has remained dovish for this year. Yes, some Fed committee members see an interest rate hike either in 2022 or 2023, but that is because of an overall real economy recovery.

But the question remains: can the Fed even raise rates given all the debt out there? Considering all the new debt created to fight off the pandemic. Would government even be able to service the debt with higher rates?

These are important questions to consider, and rising rates have been putting pressure on this market.

As discussed last week, the Fed did not address the elephant in the room. The elephant that most people wanted to hear about heading into the Fed meeting. The 10 year yield.

Expectations were high since the European Central Bank increased their asset purchasing program to buy bonds to deal with rising yields. The Fed did not follow, but perhaps this is something they will address in the future if rates climb higher.

Rest assured, if US Stock Markets get too choppy, we do have a Powell trifecta this week that provides a chance for him to ease fears and buoy markets. The key for me still remains the mentioning of yield curve control.

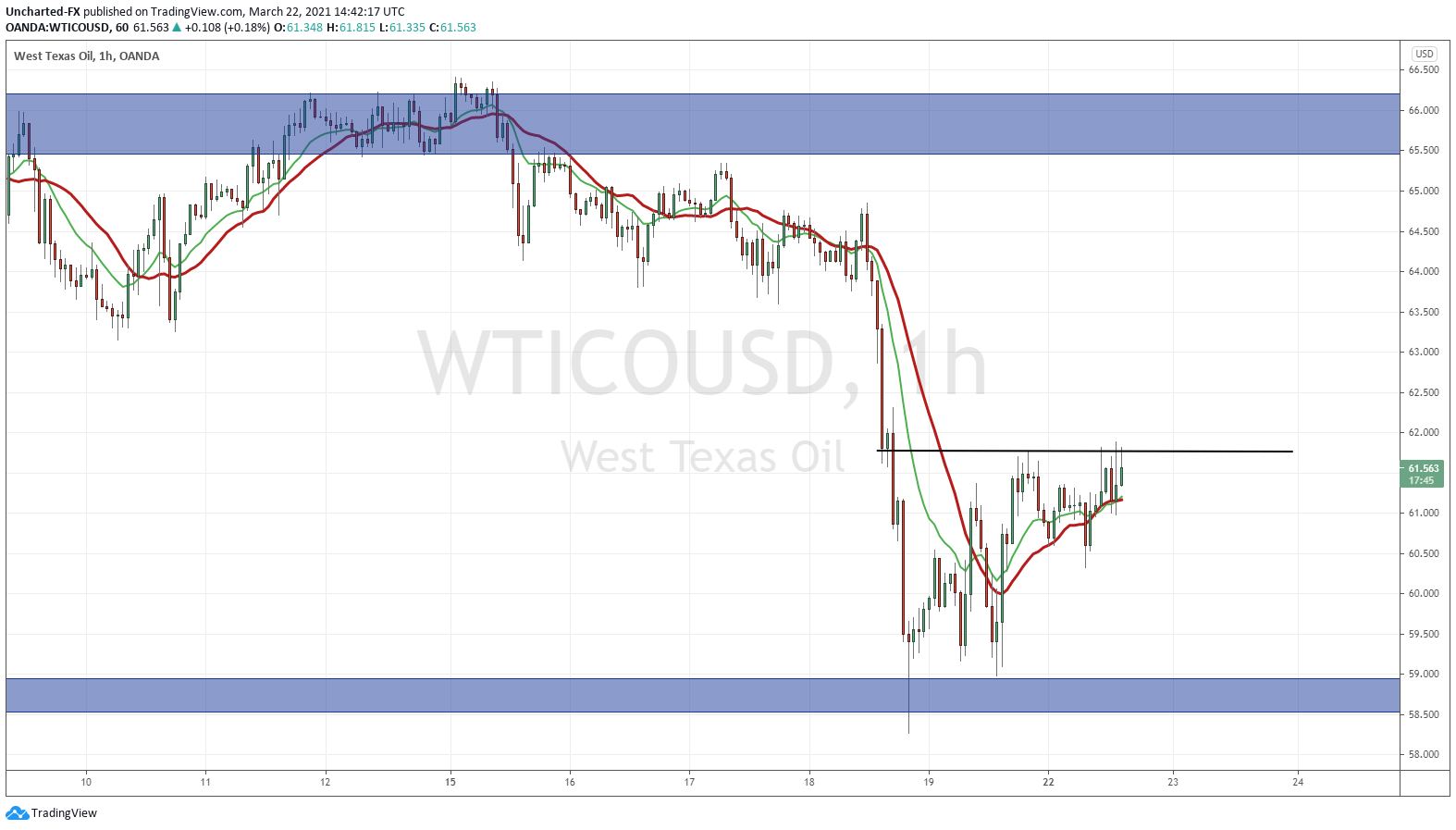

Another theme to watch for this week is Oil. After the near 8% plunge, which I believe was based on technicals as discussed last week, traders are anticipating its next move. A continuation? Or do the Houthi attacks in Saudi Arabia provide a catalyst for Oil prices to rip higher?

Oil currently is attempting to breakout on the intraday chart. Attempting to climb back over $62.

Oil is still the lifeblood of the economy, and not only affects the energy sector, but also the financial sector since some banks loaned heavily to Oil companies. If Oil pops, those two sectors pop, which aid in keep stock markets green.

Technical Tactics

Knowing that the 10 year and Oil still remain the keys for these stock markets, I want to focus our attention to the Dow Jones.

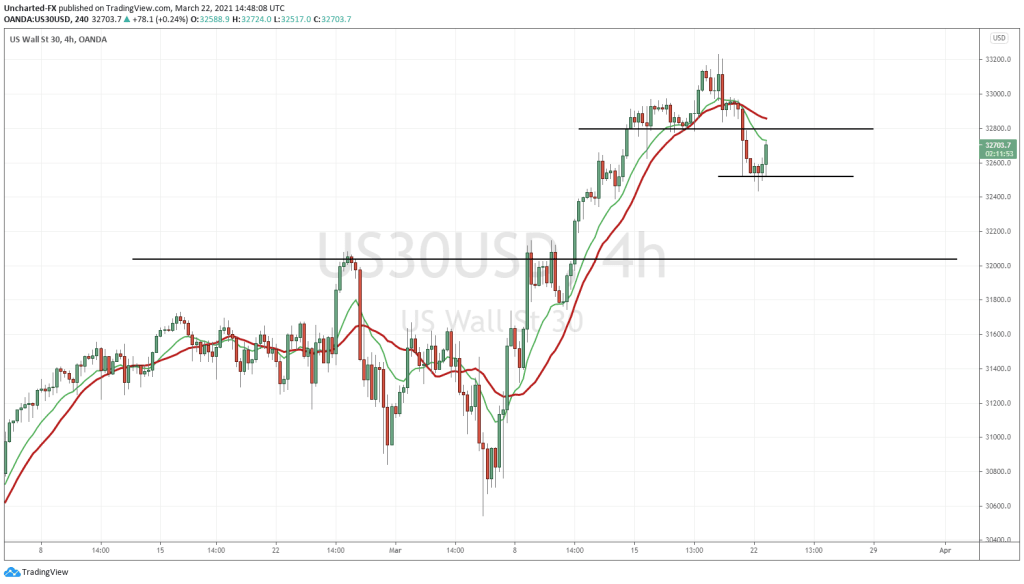

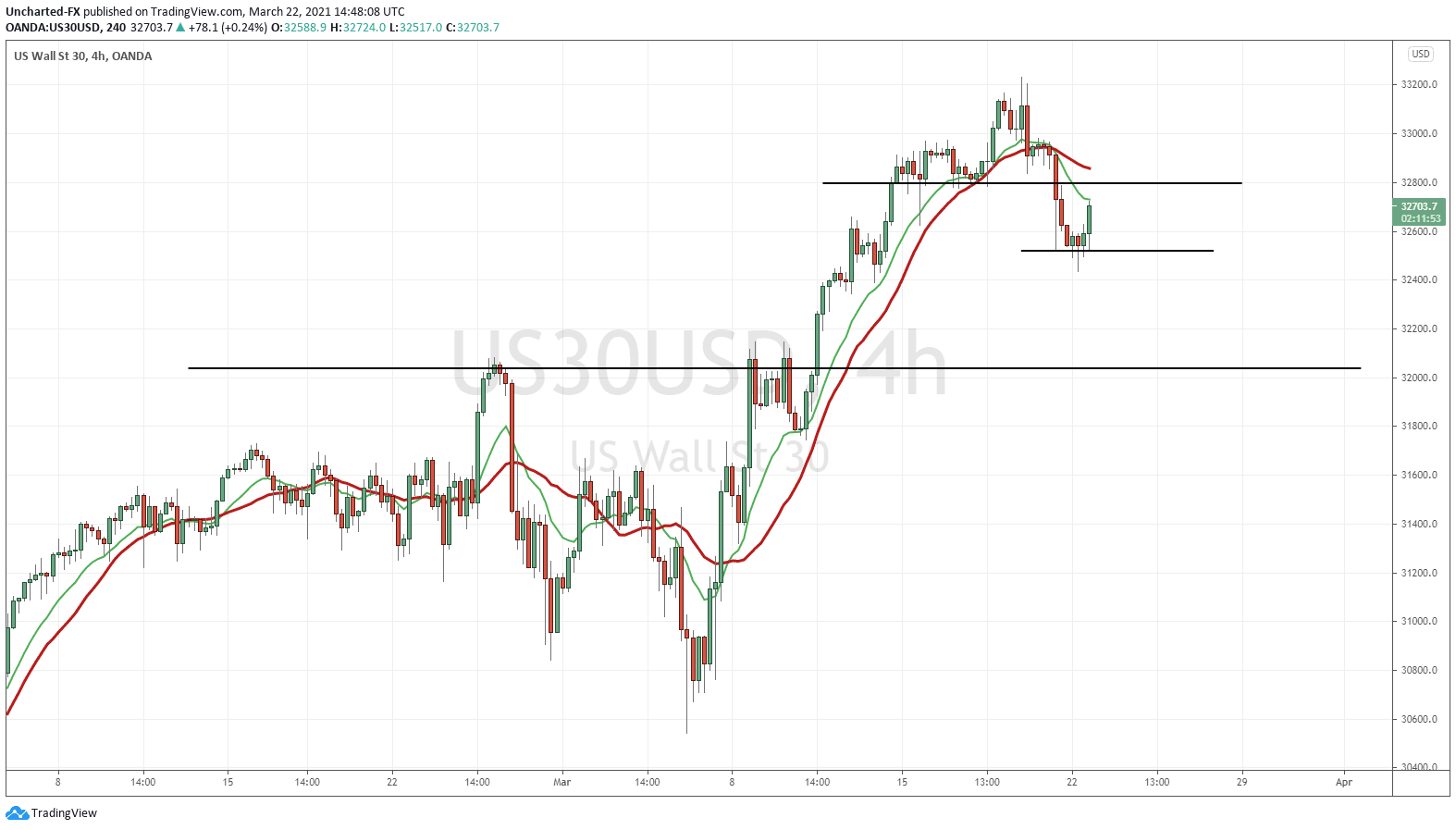

The Dow Jones has been resilient while other markets dropped, hinting towards a rotation into value stocks. We hit highs of just above 33,200 before seeing a pullback. Last Friday, we took out a support zone that I have been watching, and there is a possibility we see more downside on the Dow purely from a technical basis.

The breakdown zone I am referring to is the 32,800 zone. Some might even say we printed a head and shoulders reversal pattern. It might not be a textbook example, but rarely anything is. We just need to take note of the structure.

If we are to turn bullish on the Dow (perhaps from an Oil spike, a 10 year drop, Fed Powell comments or a combination of all three), we would like to see price break and close back ABOVE 32,800. This would nullify a downtrend continuation.

What do I mean by a downtrend continuation? Well I expect the Dow to make a lower high and make another leg lower.

We are not out of the danger zone just yet. As long as we remain below 32,800, the Dow can still print a lower high.

If one wants to short the Dow, one could enter a short on a 4 hour red candle. This would indicate some weakness. An entry like this would be aggressive. A more safer approach would be to just await the break lower, meaning taking out Friday’s lows at 32,500. Personally, I will be doing the latter.

The downside target I have to the downside for the Dow is essentially the 32,000 zone. It is a major support zone and I expect bulls to attempt to defend that zone.