Blackberry (BB) stock is overdue for another major pop. Many important technical levels have been reached, and a certain technical pattern is pointing to a bottom and another leg higher. Hold the line!

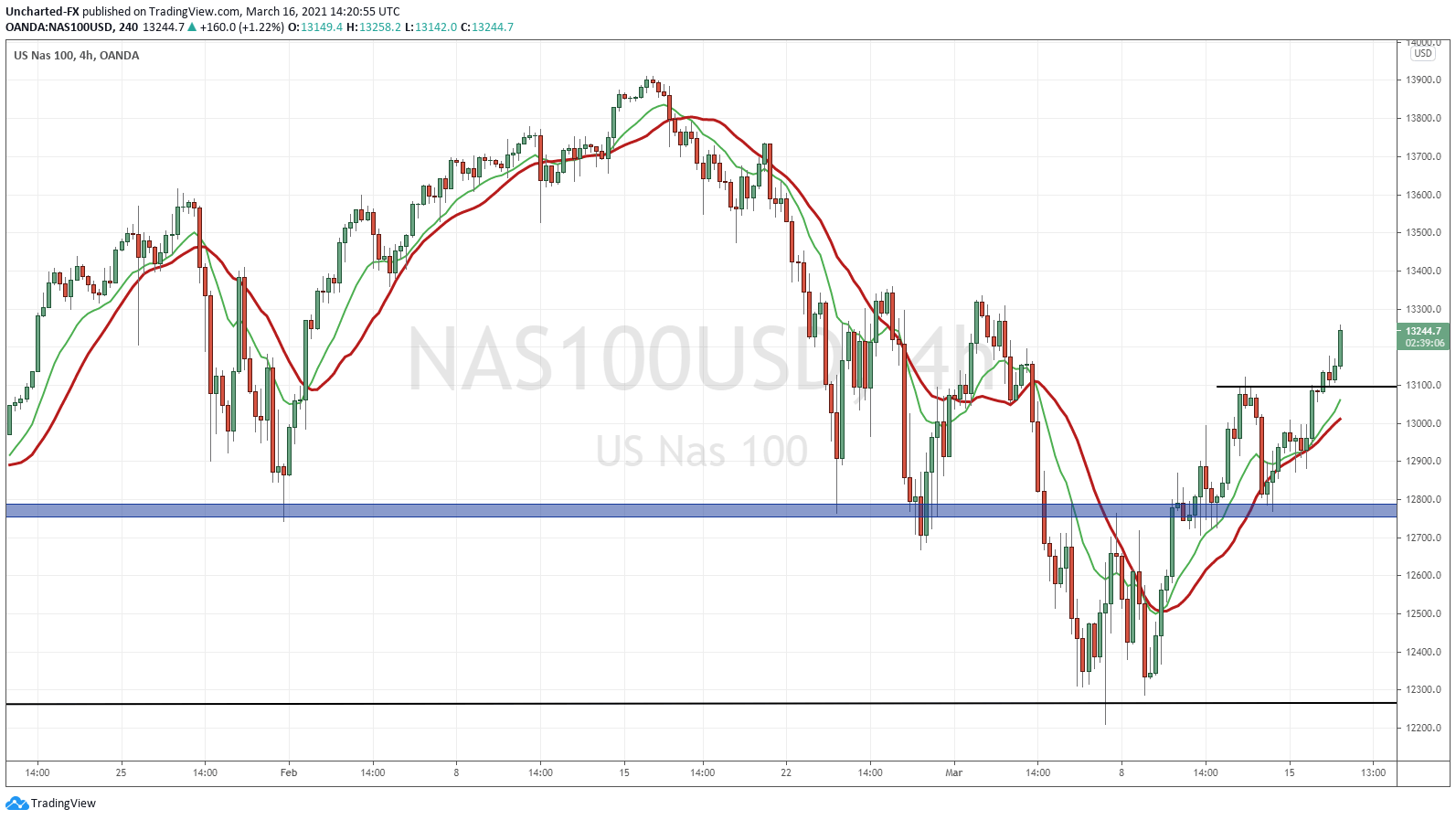

All eyes are on the Fed meeting and press conference tomorrow, so it is possible that today’s trading action could be summarized as a holding pattern. Traders waiting to hear from Fed chair Jerome Powell.

However, we have seen the S&P 500 make new all time record highs, and the Nasdaq is popping over 13,100.

One other news piece worth that is worth speaking about is where people will be spending their stimulus checks. This is something I have mentioned in the past. Many are spending it for necessities. They cannot really spend as places are closed (by the way, retail sales data from the US cratered today: -3% printed vs -0.5% expected). Regardless of what you think about the lockdowns, over 70 Million Americans have lost their jobs. A recovery is not likely to occur soon. People are trying to get ahead. They are turning to the Stock Markets.

And behold! Marketwatch reported that Americans are ready to pour $40 Billion, or 10% of their stimulus checks, into Bitcoin and the Stock Market. More money flows are incoming which can sustain these breakouts into record territory. People are chasing, and will continue to chase, yield.

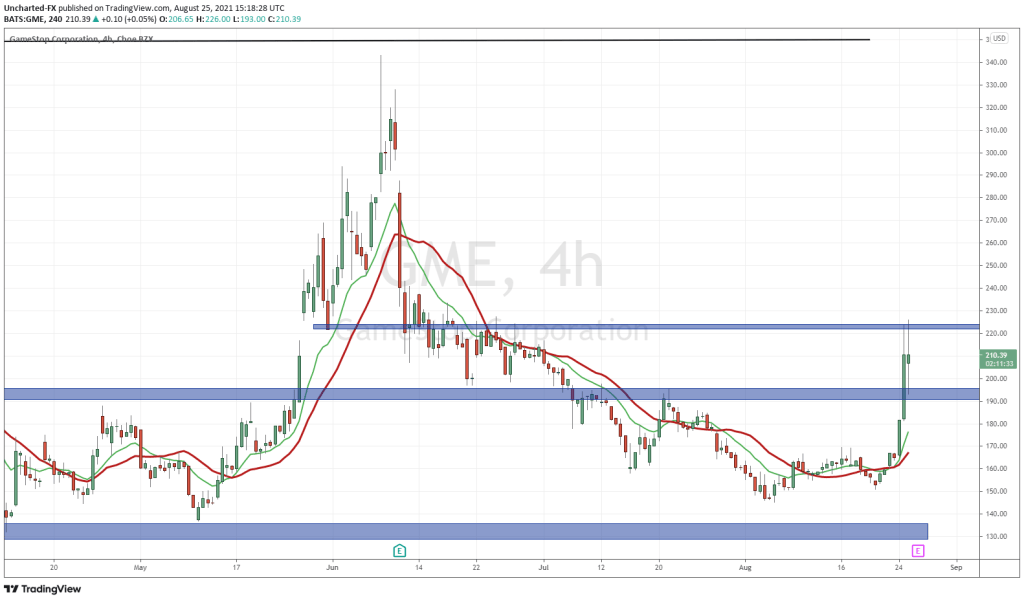

Some of this money will flow into the ‘meme’ stocks such as Gamestop (GME), AMC Entertainment, Nokia (NOK), Rocket Technologies (RKT), and some put Blackberry in this category.

Blackberry has been covered extensively on Market Moment. I was one of the first to suggest the stock before its major pop. Members of our free Discord Trading Room (to join, click the Discord icon among our social media links at the top of the page), have done very well on the initial leg since we bought well below $10.00.

The fundamentals still remain the same. The Amazon Web Services (AWS) deal is huge, and the QNX operating system remains key.

For those interested in the fundamentals, check out my article titled, “Why I am Buying Blackberry Stock for the First Time“. Keep in mind this article came out before the AWS partnership was announced. Make note of the technicals. The technicals do not lie, and were indicating perhaps insider’s entering to frontrun this news. Or you can check out our Market Moment stream to mark the occasion:

Technical Tactics

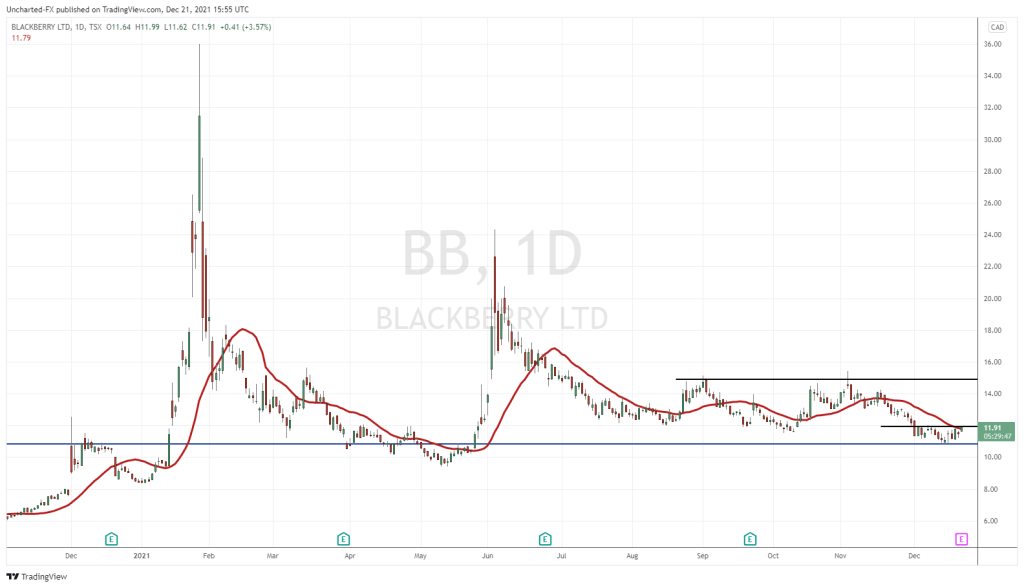

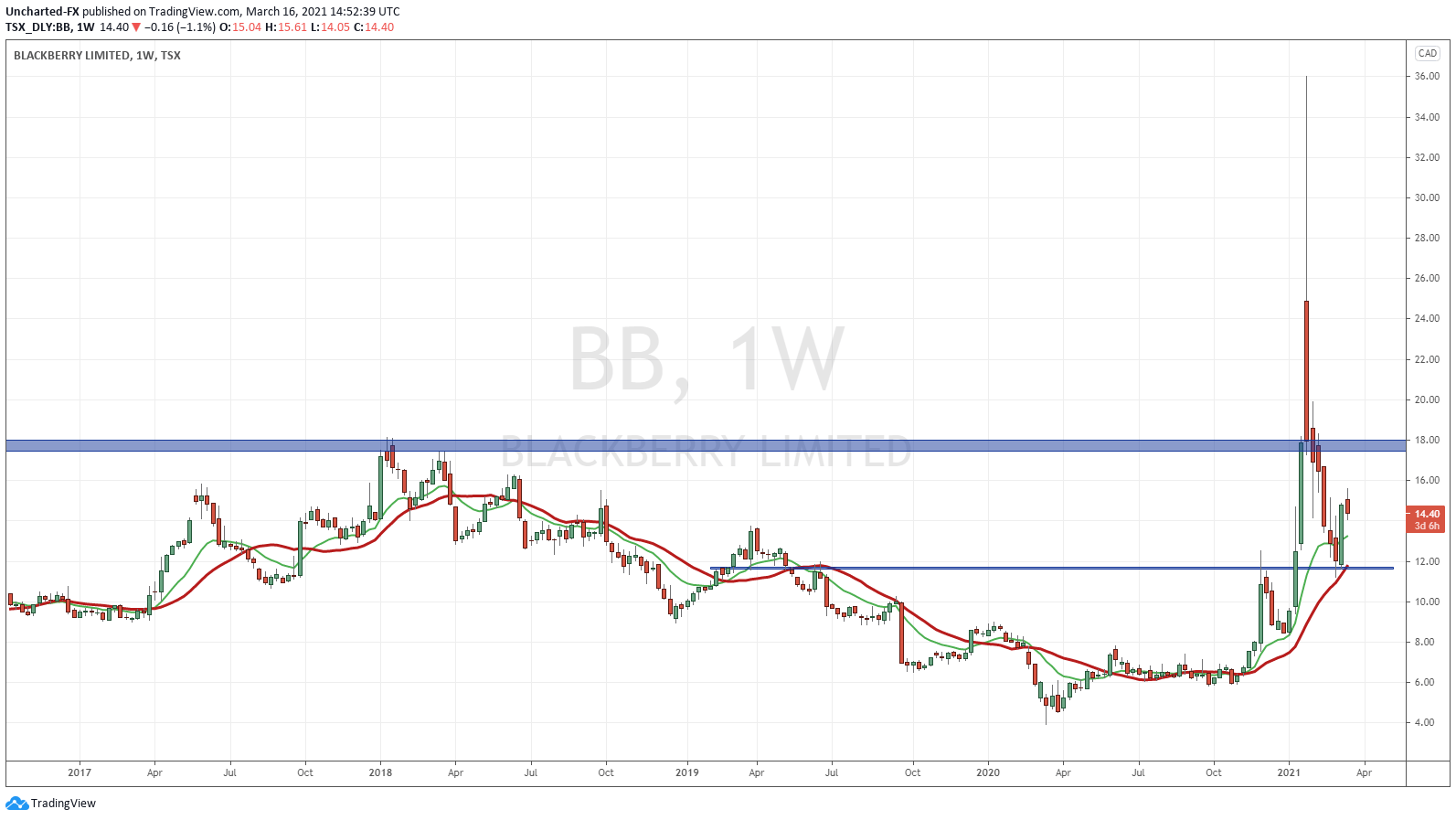

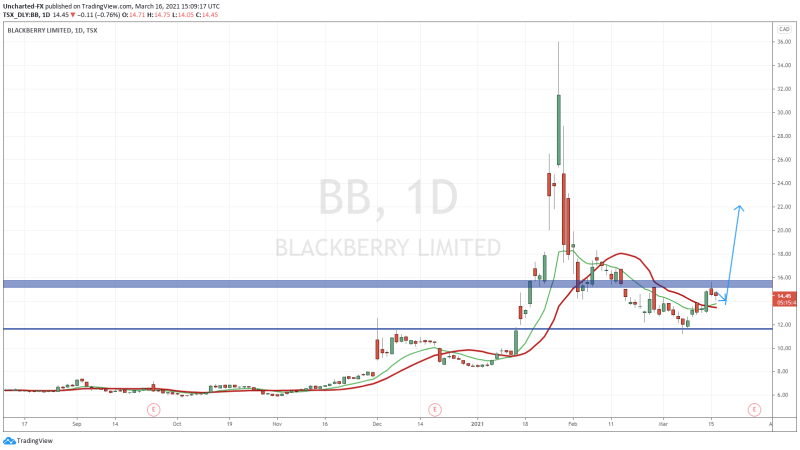

In the past, I spoke about Blackberry holding the very important $18.00 (on the Canadian listing) support zone on the weekly chart. How it had to hold to sustain further momentum. It did not hold, so we expected a drop lower.

BUT there is a positive now. We have held major support at $12.00 on the weekly chart for the Canadian listing, and $9.00 support on the US listing.

This is where things are getting interesting.

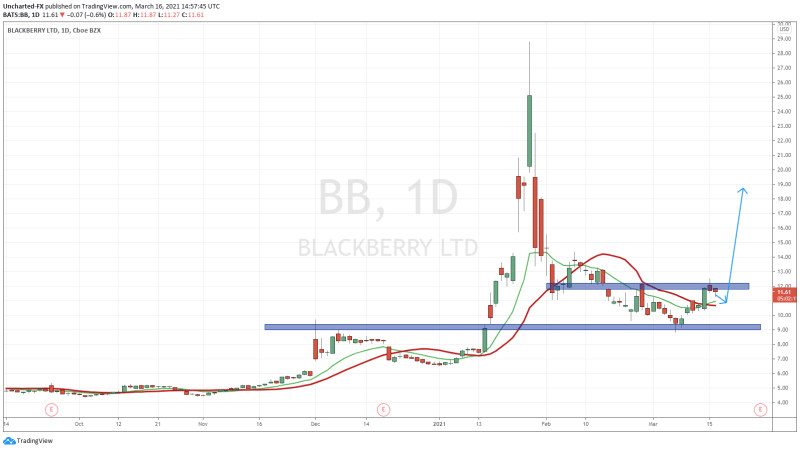

Scrolling down to the daily or the 4 hour chart…and things are looking very promising. Another leg higher seems to be in the cards.

Do you see it? I know regular Market Moment and Discord Trading Room members can. We have used this same pattern many times to lock in some major gains.

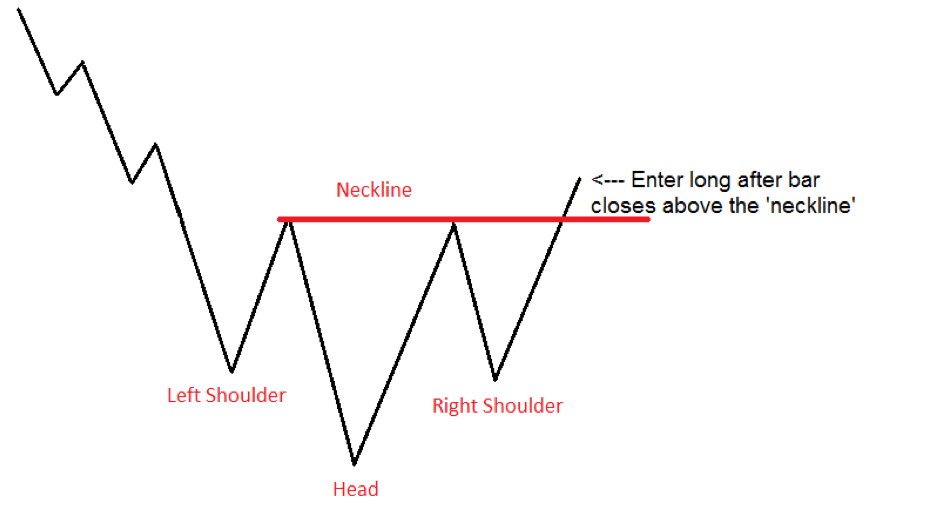

I am of course talking about the inverse head and shoulders set up. In layman’s terms, what you really need to know is that this pattern prints when price is about to reverse. It is a bottoming pattern. If this pattern triggers, the bottom is in for Blackberry.

Looking at the US Blackberry listing chart above, what we need is that right shoulder. In my humble opinion, this is forming now. Our trigger for an entry will be when price breaks and closes above the $12.20 neckline.

Can one enter now frontrunning the eventual breakout? Sure. I just like to play it safe. A breakout means I don’t catch the bottom, but the probability for the trade being successful greatly increases, as the breakout is the trigger for the pattern. If you front run, your risk vs reward ratio greatly increases, but the possibility of success is not as high since the pattern can fail ie: we do not break above the neckline to trigger the pattern.

Trading is the business of probabilities hence why I prefer to await the trigger.

On the Canadian side, things are similar. Same looking chart. Just different prices due to the currency. The neckline on the TSX listing comes in at $15.20.

In summary the fundamentals still remain positive for the stock. But the retail crowd, and Blackberry being one of the darlings of the WallStreetBets crowd will see price volatility. Has Blackberry bottomed? The inverse head and shoulders pattern says it has. We just need it to trigger. It can fail due to an overall broader stock market sell off if Jerome Powell does not say what the market wants to hear. Now it is just a waiting game.