‘It literally cannot go tits up’

Trading stock options provide us with the opportunity to make big gains, hedge our investments, and for the sake of this piece – the opportunity to lose more than everything in an instant.

Really quickly to understand a stock option, a stock option gives the holder the right (though not an obligation) to buy or sell a stock at a specified price. This stated price is called the strike price. The option can be exercised any time before expiry, regardless of whether the strike price has been reached.

If that definition of options WTF just think of it as a baby stock that could potentially create infinite losses for you, it’s like a small demon a trader needs to understand before playing with it, but of course, there are those who just go for it.

/u/1R0NYMAN creating $300k of Robinhood Credit out of thin air from wallstreetbets

One of the allures to trading options is the ability to make large amounts of money without having to buy the underlying stock, especially to investors with little capital.

Traders can simply trade the options contracts without having to touch the stock unless the option is exercised. People can also hedge their investments while simultaneously de-risking their stock portfolio through some more advanced options trading strategies.

All sounds good.

So, what’s the catch?

Infinite losses.

With stocks, you can only lose your initial investment. Trading options exposes you to infinite losses… if you are buying and selling naked. With a stock, your $5k can only bottom out at zero. If an option contract is exercised and you’re not covered that $5k can quickly turn into $-57k, or $-200k as we will discuss in a sec.

Before we can understand how our Redditors lost so much money, we first have to understand the concept of buying and selling naked, meaning they did not own the underlying stock they were trading options on, and they didn’t cover their position by using a de-risking strategy like a credit spread. A credit spread caps your loss in case you do have to purchase the underlying shares of the stock to fulfill your option contract.

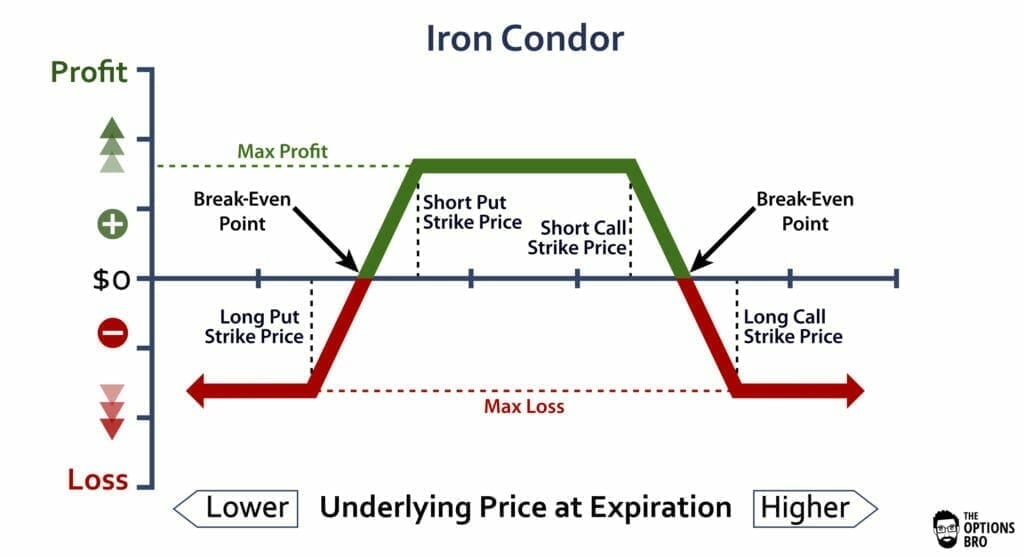

These out-of-the-money options have a low win rate and are often the trades more advanced options trading strategies like iron condors profit from.

The smartest traders don’t always win, but when they win they win big, and when they lose they lose small. These lower risk strategies take time to prepare, have no instant gratification, and often take months or years to become good at.

But not everyone caps their losses, and not everyone loses small.

/u/1RONYMAN

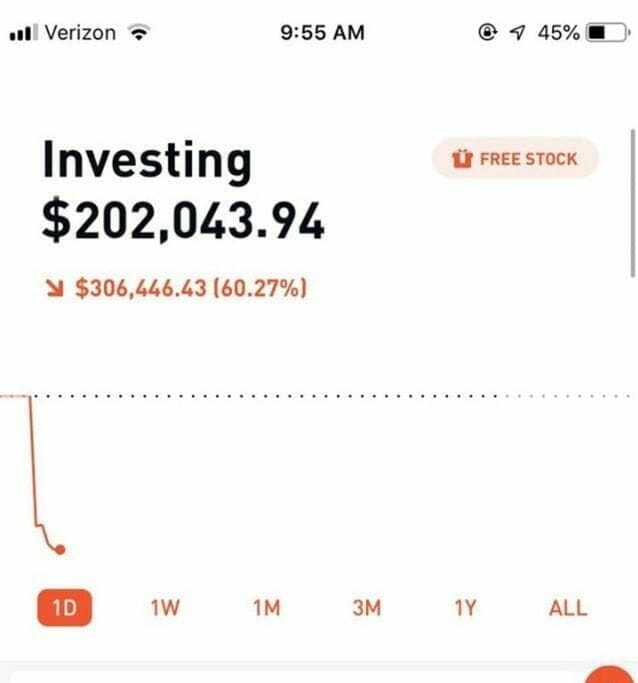

/u/1RONYMAN, a heavy equipment operator and WallStreetBets legend became infamous through his box-spread options trading strategy that saw a -1832% return.

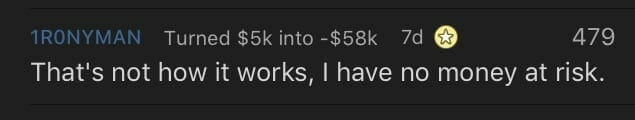

Part of what made this trade so funny was the confidence 1RONYMAN had in his strategy, infamously saying ‘it literally cannot go tits up’, and ‘I have no money at risk’, popular punchlines on the subreddit to this day.

He did something that is highly discouraged in beginner options trading – he got creative.

Building a successful trading strategy takes some creativity, but 1RONYMAN’s creativity was more about trying something outside of the box, being a trailblazer of sorts. There are hundreds of options trading strategies, but 11RONYMAN saw an opportunity to use one of the more obscure ones – the box spread.

Key takeaways from a box spread:

- A box spread is an options arbitrage strategy that combines buying a bull call spread with a matching bear put spread.

- A box spread’s payoff is always going to be the difference between the two strike prices.

- The cost to implement a box spread, specifically the commissions charged, can be a significant factor in its potential profitability.

He saw what he thought was an arbitrage opportunity with (UVXY.B) options, A VIX short-term futures ETF. He was confident that he set up a play that would net him a guaranteed total of $38K USD of profit in 2 years.

Robinhood didn’t pick up on the risk level of his box spread trade and actually echoed back to him that there wasn’t a big amount of risk on the trade. Much like our other users here, 1RONYMAN found a glitch/loophole in Robinhood which ultimately added even more fuel to the fire.

https://equity.guru/2021/02/10/will-shitposters-ever-defeat-the-mods-why-reddit-is-the-next-robinhood-part-1/

According to people much smarter than myself, his strategy could have worked if he was trading in Europe, however, American options don’t hold up to the strategy as European and American options differ in how they expire.

1RONYMAN’s trade was only risk-free if the options weren’t exercised, but unfortunately for him they were, and 1RONYMAN was on the hook.

To make the story even more significant – Robinhood banned box spreads after the fiasco and emailed its entire client base about its policy change as a direct result of what happened with 1RONYMAN.

Even though 1RONYMAN did his research (apparently) and used options calculators which don’t factor in events like this. He thought he was covered on all sides, but made a glaring error that saw him go down $57k USD from only a $5K US original investment.

If Robinhood didn’t intervene on the trade he would have been down $200k USD.

Robinhood’s users are supposed to hold a certain amount of cash as collateral for potential disasters like this because the max loss was 200k, Robinhood should have never let the trade happen in the first place as 1RONYMAN only had $5k in his account. It’s widely speculated that Robinhood ate the $57k from the box spread disaster.

1RONYMAN and his insane confidence and trading strategies changed the landscape of options trading in the modern world, and he will be remembered on the sub for it forever.

Where is 1RONYMAN today?

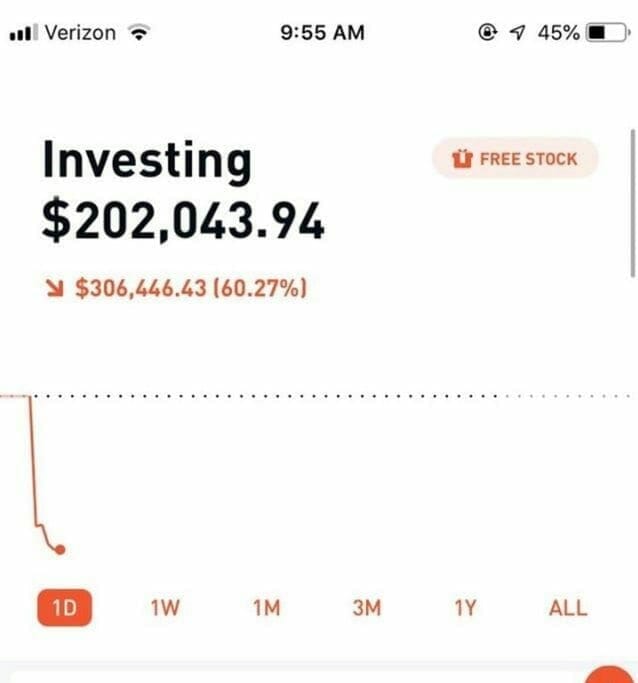

Looks like he’s still out there killing it.

/u/analfarmer2

/u/analfarmer2 is the king of YOLO bets.

This is a bizarre and true story of higher highs and lower lows. It begins with a mystery around how 19-year-old Redditor analfarmer2 got access to a $100,000 USD trading account, he described as ‘online biz and margin’.

Cool.

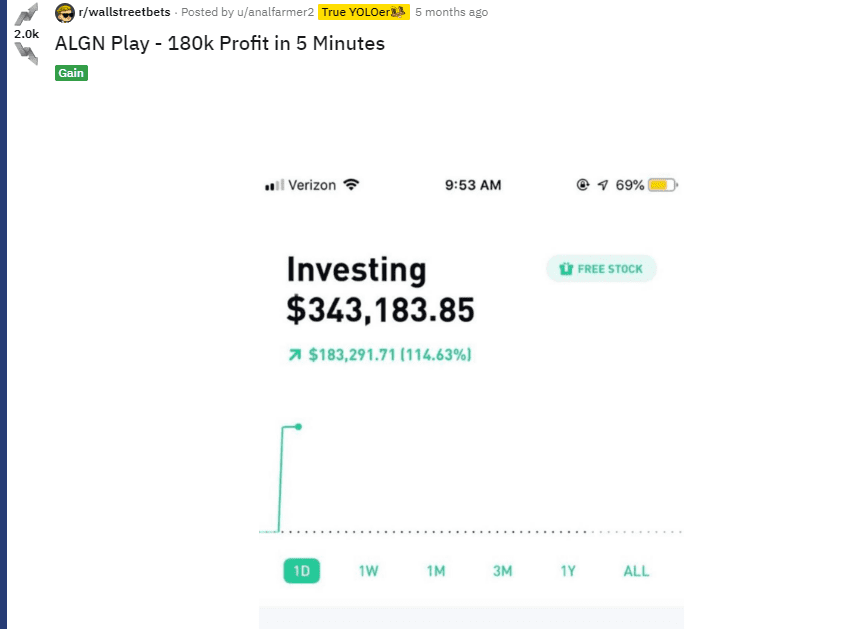

His first win was a $110k USD bet on Align Technologies (ALGN.N) calls 2 days out from expiration, an incredibly high-risk trade. Fortunately for analfarmer2, the company announced a share buyback, and shares rocketed the next day gaining him $180k USD, he now had a $343k USD trading account at just 19 years old.

And he would keep winning, for a bit.

A couple of days later our guy dropped $170k USD on SPY puts 1 day from expiration, and again got insanely lucky as the market tanked after a Trump tweet about the Chinese trade embargo, making his puts in the money. His trading account was up another $277k USD up to $646k USD.

He got incredibly lucky twice. I think most people would probably take their winnings and go home, or at least keep I don’t know 70-80% of the profit at least. Most of us will never be in this position as it takes a special kind of person to execute these trades, and analfarmer2 is that special person.

So, did he stop?

Did he take a look at his $600K+ account and realize he could really be set up for a while here?

Of course not.

He took another massive bet the following day, buying $600k USD worth of SPY calls $2 out-of-the-money and expiring the following day. analfarmer2 sold out of his position at a $500k loss.

There was hope though, he somehow made up for the loss with cash in his account, maybe from other trades, or of course a cash injection from ‘online biz’.

Anyways, he still had $200k to his name but…

He made a few more unknown trades and found himself down to $41k USD.

He decided to YOLO it one more time. A lot of people lost money in the Canadian cannabis industry circa 2018-2019, and our man analfarmer2 was about to join that party.

3 days later he bought $40k worth of out-of-the-money Canopy (CGC.N) calls in anticipation of earnings the following week. This was a more responsible trade than his previous next day out-of-the-money moves, he had an entire week until expiration, just imagine the possibilities!

Maybe he would start his climb back up Mt. Everest, back to $646k and beyond, maybe even a million!

With all that hope analfarmer2 put in the trade order and the stock…

My Final Yolo… 40k into CGC calls expiring next week from wallstreetbets

The stock went down.

Investors were unimpressed with Canopy’s earnings, analfarmer2’s calls were now worthless.

He could have exited his position with $8k before the options expired, but he had no interest in doing that.

He left with nothing.

A milli

Many newer r/wsb participants dive in headfirst and throw everything at out-of-the-money options with one day ’til expiration. With simple and sometimes favorably glitchy trading apps like Robinhood mixed with a basic understanding of options and a desire to make a million dollars, someone can really make some costly decisions. Pure trading like shit strategies from degenerates who wanted it all right away.

If we combine 1RONYMAN and analfarmer2’s losses, we get around $700k USD. I’ve read more than a few trading stories where folks see that elusive $1M dollar mark and want to gamble everything to get there.

In the words of analfarmer2,

the sensible thing to do would to withdraw that shit but tbh a milli sounds nice.

I love analfarmer2’s spirit, he definitely knows how to take a punch.

As a 19-year-old, I can’t help but wonder how his thoughts around the situation may change as he gets older. His story is obviously far beyond what any sane or rational person would do, and we can learn from it. analfarmer2 got incredibly lucky on those first few trades.

He fell victim to what is known as the gambler’s fallacy – the idea that a random event could be influenced by past events, it’s one of the most common ways traders lose money.

But as analfarmer2 reminds us, it’s only paper.

DISCLAIMER: don’t yolo options if you don’t know what you are doing, there are far better ways to become cool.

‘

‘

Aut-is-tic