Mother nature

Am I a true hippy, or do I have an impulsive personality that morphs and changes due to a lack of identity?

My therapist thinks the latter. It’s a debate that rages on in my head.

However, there is a much more relevant and interesting debate happening in the psychedelics investment community right now.

Some folks think this industry is going the cannabis 2.0 route, this makes sense as there are many obvious similarities – most notably an opportunity to get in on the ground floor of an emerging sector where the substance is mostly illegal. “A once in a lifetime opportunity.”

Others will point out that psychedelics are vastly different from cannabis, the regulatory timelines, business models, and the importance of clinical trials all differ greatly. They are saying this is biotech, not cannabis.

I think there is an even much more interesting and less opaque debate out there, and that is synthetic vs natural.

It’s somewhat similar to how in the cannabis sector, we had the constant flower vs oil debate, and getting this wrong proved costly for companies. I toured a large cannabis facility back in 2018 and they said they had to alter their entire logistics to account for the increase in popularity of oil, rather than flower.

Originally they had anticipated a split of 70% flower, 30% oil, and two years into production they flipped it to 70% oil, 30% flower.

They had to spend millions on bigger extraction machines, designing new products, and changes to the layouts of massive growth operations.

Eua natural

Many people turn to natural medicines because they don’t trust big pharma.

The idea of taking something from mother earth herself vs. a laboratory concoction is an attractive idea, especially to folks in areas like the Pacific Northwest where nature is put on a deserved pedestal.

A rational counterpart to this is, you eat the wrong mother earth mushroom and you die.

That being said, natural mushrooms containing compounds like psilocybin have been used for therapeutic purposes for thousands of years, across many civilizations and continents. Even non-psychedelic mushrooms like Cordyceps were reserved for kings in ancient China as they were seen to give the end-user strength.

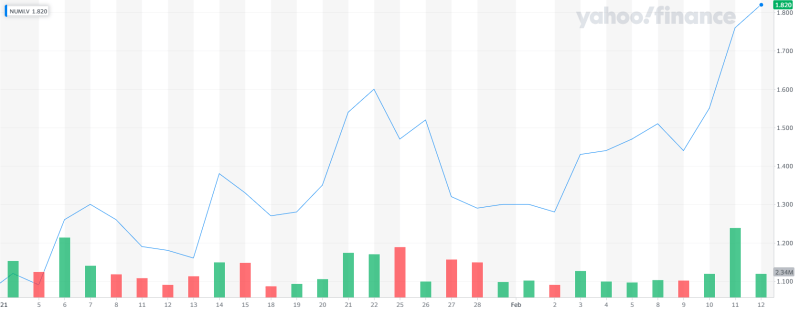

One company going all-in on natural mushrooms is Numinus (NUMI.V).

Last year they received the first license in Canada for testing and selling psilocybin mushrooms. This was a huge leap forward in the sector and really put Numinus on the map as a legitimate company in the space.

I’m not sure if there is a better advocate for natural mushrooms than Dennis McKenna, who sits on their board. Dennis and his brother Terence infamously discovered magic mushrooms on a trip to Colombia in the 1970s. They brought these mushrooms back to Berkley, California, and were key figures in the psychedelic movement in the US.

McKenna says Numinus’ decision to pursue the development of a natural product is one that’s long overdue in the space.

Mushrooms have been used in traditional medicine for literally thousands of years, and hence, they are just that much closer to these ancient traditions. Natural mushroom extracts are also likely to be far more affordable compared to synthetic psilocybin, and that is an important consideration when it comes to ensuring accessibility to this medicine which can be so beneficial to many people.”

I was acually in Colombia in 2019, hiking around similar rainforests as the McKenna brothers were. I had Huxley’s ‘Island’ on audiobook and was enjoying my surroundings, channeling some McKenna energy.

I do believe there is a considerable subset of the population who will only want to take natural mushrooms.

Numinus Wellness (NUMI.V) secures expansion into Quebec with Mindspace Psychology Services

There is definitely space for a company like Numinus, having that first-mover advantage on the mother of all compounds – psilocybin is a huge upside for investors.

Here’s where the debate gets interesting though.

Patents.

Synthetic

See one of the reasons people hate big pharma, and big business, in general, is the idea of squishing out the little guy so that the big fish can feed on profits, all while pressuring the medical community to overprescribe potentially harmful and addictive medication.

Stepping away from the morality aspect of big pharma, one thing is clear, they love patents. These even became a thing in the cannabis space for a little while. Remember when Isodiol tried to patent CBD?

There were fears that one of these pharma companies could come along and patent a key cannabis compound, however that never really came to fruition.

Patenting something like psilocybin will be impossible, and if a lot of the value of the future psychedelics industry is in IP, companies like Numinus may be missing out on this opportunity.

That being said, I don’t think Numinus should change its business model as they have an incredibly valuable first-mover advantage. Companies trying to follow Numinus may run into problems when it comes to value creation for its investors.

Revive Therapeutics (RVV.C) inks research agreement with NC State for synthetic psilocybin

That being said, I don’t think Numinus should change its business model as they have an incredibly valuable first-mover advantage. Companies trying to follow Numinus may run into problems when it comes to value creation for its investors.

If this industry is cannabis 2.0, you will start to see Numinus copycats flood the sector as they have been one of the most successful stocks in the space up to this point.

If this sector veers off from a cannabis 2.0 trajectory and into biotech, IP will become incredibly valuable.

Investors are worried about companies like Numinus in that hypothetically there’s nothing stopping Pfizer from watching companies like Numinus do all the leg work, only to come in to take market share down the line once laws and regulations become more lenient, or once we start approaching legalization.

People argue that companies inventing their own drugs and their own IP will be much more resilient to big pharma coming in and doing what big business always does.

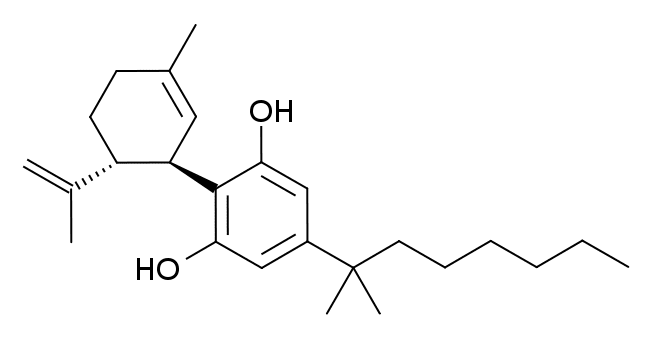

Companies like Revive (RVV.C), MindMed (MMED.NE), Cybin (CYBN.NE), and Mindset Pharma (MSET.NE) are taking the opposite route of companies like Numinus, and are making synthetic drugs to mimic compounds like psilocybin and DMT.

These companies believe that IP creation will hold long term value, and they also plan on making these drugs safer by stripping certain compounds that can interfere with a psychedelic experience.

https://equity.guru/2021/02/12/mindset-pharma-mset-cn-is-making-safer-drugs-to-combat-ptsd-anxiety-depression/

With new delivery mechanisms like breath strips, trips can be induced much quicker with fewer side effects.

Maybe an ETF?

So how big is that consortium of folks who wouldn’t touch any mushroom related product or therapy made in a laboratory, by big pharma or a medical psychedelics company?

It’s really tough to say at this point.

This is a really important question to ask when investing in a psychedelics company. If the binary decision is too difficult, Horizons has a new psychedelics ETF that gives investors exposure to a bevy of different business models in the space.

As you can see, they have holdings in several companies included in this piece like: Numinus, Cybin, Revive, and MindMed.

https://www.horizonsetfs.com/horizons/media/pdfs/productsheets/PSYK-Product-Sheet.pdf