Ego death for ex. mining & cannabis CEOs

Young and inexperienced Tony Robbins sociopaths are running about half of the current 37 publicly traded psychedelics companies.

They are raising a few million, putting on their LinkedIn smile IRL, and talking about shareholder value.

Some of these CEOs came from the cannabis sector, and while that strategy worked beautifully there, psychedelics is a much more cash-intensive space. Institutions are weeding out 75% of these cannabis 2.0 companies. I have personally seen at least 10 pitch decks that looked retrofitted from an old weed deal from 2015.

The last couple of years have been rough on the cannabis sector. One of the ways companies have been crawling out of purgatory is by pivoting into psychedelics, really leaning on that ‘cannabis is a gateway drug’ angle.

Here’s the problem, a lot more can wrong in psychedelics than cannabis, both in a business and medical context. You should be careful with ingesting these drugs, and investing in them should warrant a similar caution.

It’s like when you are enjoying a nice summer day on mushrooms and you add MDMA and 2CB to the mix because you are looking for some diversification. You end up sitting silent and motionless staring into the Salmo River wondering if you even belong on this earth.

The market bludgeoned many cannabis companies to death in 2019 and 2020. Some made a pivot into psychedelics, citing the whole ‘cannabis is a gateway drug’ theory. In the cannabis space most of the time this means buying a pitch deck from a millennial like myself.

Young opportunist psychopaths aren’t the only archetype of opportunists in this space either. I think we can all relate to the mining CEO who is looking for ego death after killing thousands of flamingos in their lithium mine in Chile.

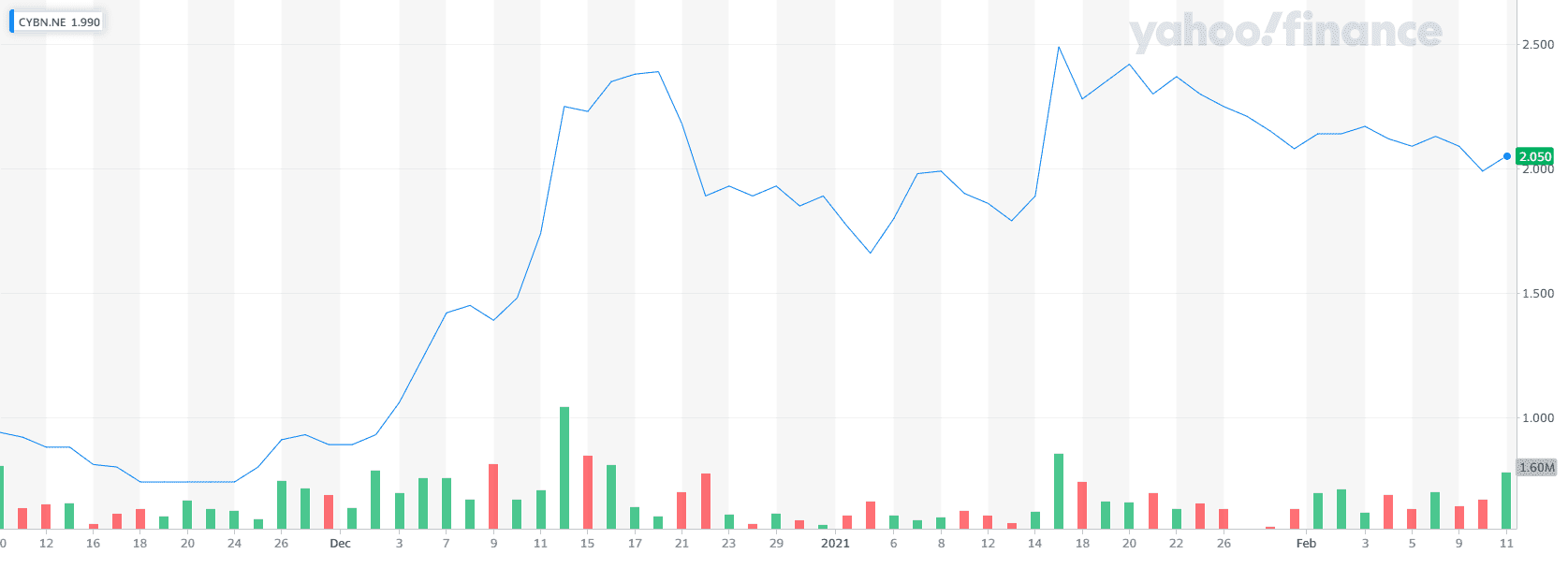

Cybin hits different

I remember being 21 years old in Stanley Park and taking my initial 3.5-gram dose and getting wildly impatient. My friends said they could feel it, and I tried to convince myself that I felt it too, but I didn’t.

Naturally, I took another few grams and about five minutes later the initial dose hit, and then around an hour later, I was seeing words on Cypress & Grouse mountain that no one else was.

If I didn’t have several mushroom trips under my belt at the time, things could have gone wrong.

Cybin (CYBN.NE) is looking to tackle that dreaded onset hour where you flip between ‘why is it not working’, and ‘I think I feel it’. It can be a stressful period of time, especially for new patients who may already be dealing with anxiety over the process.

This waiting period can also cause bad trips as the patient has to wait in suspense. Especially if it is their first time using the drug. Often times the anticipation of waiting for the needle is worse than actually getting it.

Even for people who have experience with the drug, this waiting period can be rather annoying. I find my brain often racing with thoughts and expectations around the upcoming trip, and reflecting on past trips, and wondering if this one will be any different.

It’s really hard to think about anything else in that hour.

Cybin is working on a delivery method where patients will ingest psilocybin under their tongue, hitting the bloodstream quickly and thus producing the desired effect almost immediately.

This is one of the more exciting products I have seen in the space as I am the anxious and impatient type.

Psychedelics are expensive

Anything involving clinical trials is going to cost a boatload of cash. Any company that raises a few million will probably be only looking for the recreation opportunity, which could take a while. Companies like Cybin who have raised an impressive $88M CAD will have the latitude to make moves and build up valuable IP.

Cybin is not exactly a penny stock either, the company closed a $34M CAD financing last week, with shares priced at $2.25 CAD per unit. If more psychedelics companies make a move onto the NASDAQ, which I do see happening, companies like Cybin who meet the minimum share price, and who appear to be doing all the right things from a regulatory standpoint could be prime candidates.

Once more institutional money from bigger firms flows into the sector, they will also be looking for the well known companies in the space who present the lowest risk. Cybin CEO Doug Drysdale has also been in charge of raising $4B CAD, again this is a cash-intensive sector.

Cybin also gained even more legitimacy recently when it was picked up by the first psychedelics ETF run by Horizons. They are joined by heavy hitters in the industry like MindMed (MMED.NE), FieldTrip (FTRP.CN), and Compass Pathways (CMPS.N) to name a few.

Cybin purchased Adelia Therapeutics in December 2020, and I really like this company. Founder of Adelia Brett Greene did an interview last year with Microdose, and it’s clear this is a very high IQ individual who has been researching psychedelics for over 20 years, he also has a track record of managing large amounts of cash, $80M in grant money to be exact. Again, a cash-intensive sector.

Their team has previously worked with pharmaceutical companies including Johnson & Johnson, GlaxoSmithKline, Sanofi, Roche, Pfizer, and Eli Lilly, and have academic research affiliations with MIT, Harvard, Stanford, Yale, and Northeastern University.

This seems like the perfect fit for a company that is scaling and moving quickly into a new space.

Cybin is vehemently not cannabis 2.0, these guys are purebred biotech.