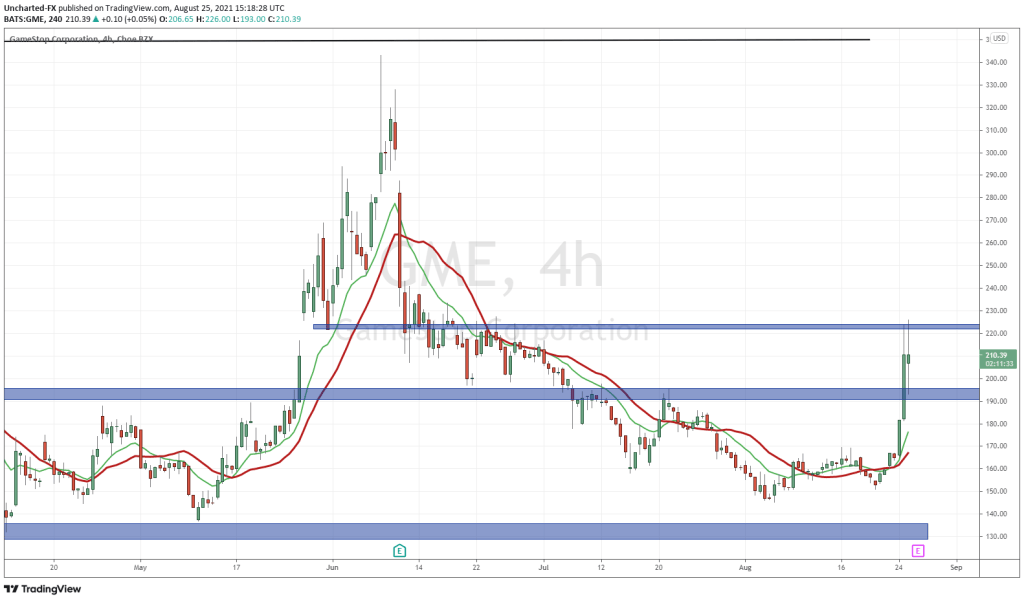

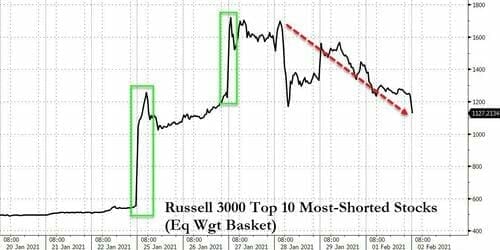

This morning, the WallStreetBets short squeezed stocks are falling. A clappage. Gamestop (GME) is crashing back to double digit price levels, and is fulfilling some major technical levels indicating more downside. Something I will cover in tomorrow’s Market Moment. But Gamestop is not the only one. BlackBerry (BB), AMC theatres, Bed Bath and Beyond (BBBY), Koss (KOSS), Genius Brands (GNUS), Naked Brands (NAKD) and even Silver are seeing big drops. It seems like the WallStreetBets short squeeze plays are dying out. Some are even saying that the stock markets are back to normal.

(Images sourced from Zerohedge)

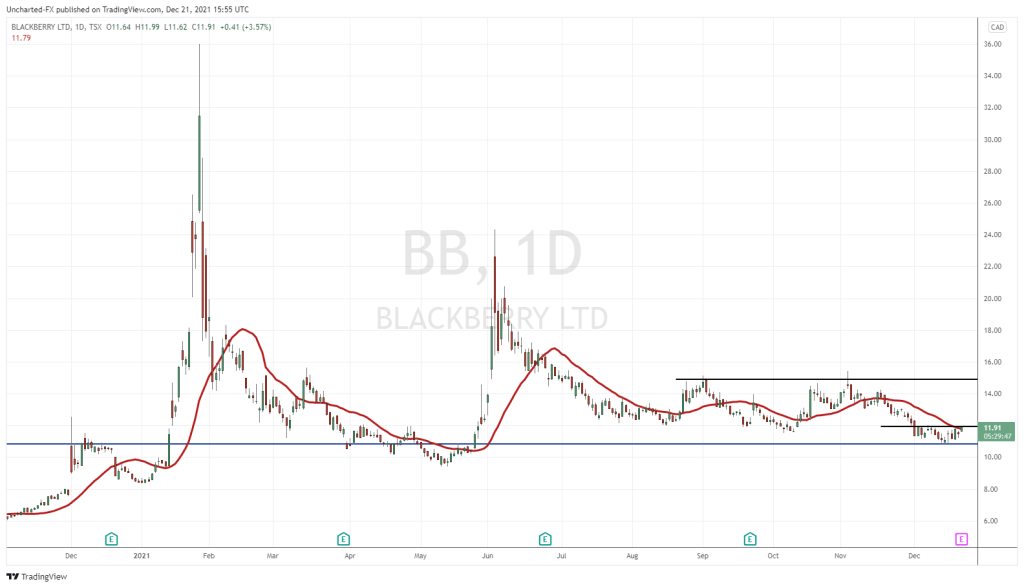

Back in December, I wrote a Market Moment post titled “Why I am Buying BlackBerry Stock for the First Time“. In that post, I highlight all the fundamentals and catalysts which are bullish for BlackBerry. All those catalysts are still upcoming, and remain bullish for BlackBerry stock. On the technical side, we began entering our position at $7.50 on the trendline, and then resistance breakout.

Then on January 20th, I wrote about how I expect BlackBerry to join the short squeeze we are seeing in Gamestop, and what we have seen in the past with Tesla (TLSA). In that Market Moment, I discussed the appeal of BlackBerry stock to the retail traders, specifically those on Robinhood. On the technical side, I spoke about the major weekly level breakout incoming for the week ahead.

We did not need to wait that long for my weekly breakout to trigger. The epic short squeeze occurred, and this takes us to the technicals for today’s Market Moment.

BlackBerry stock is now at the technical line in the sand. The stock price MUST hold above a major zone for the week.

Before looking at the chart, I want to highlight this mania. In my previous Market Moment post on BlackBerry, I cautioned traders that even though the fundamentals going forward are positive, a lot of the price action will be dictated due to the new money in the stock. Basically, if all these people who are holding BlackBerry stock now dump, the price will be impacted negatively regardless of the positive fundamentals. Broker restrictions on the number of shares people are buying and selling, as well as increased margin requirements for the WallStreetBets targeted stocks does not help either.

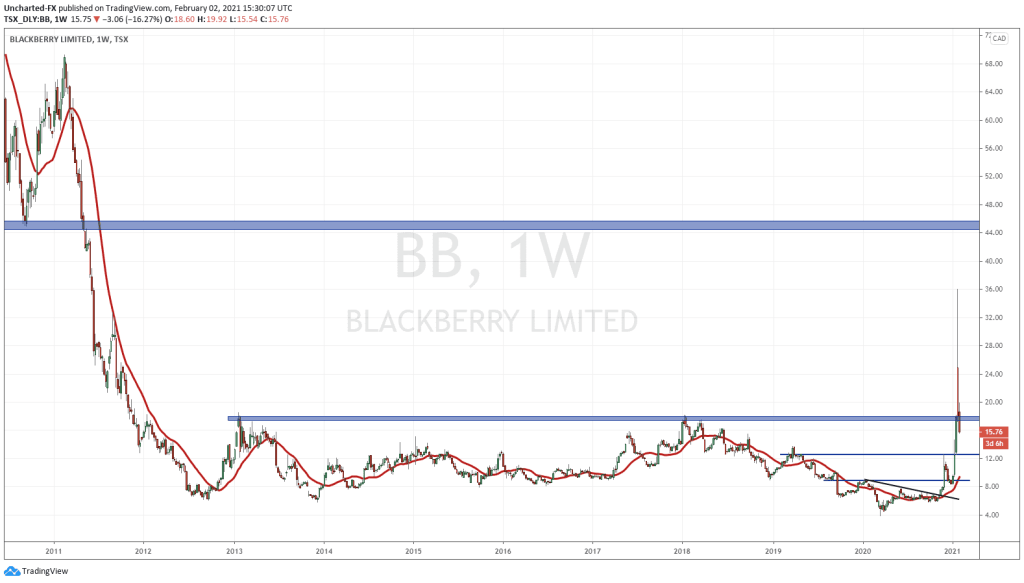

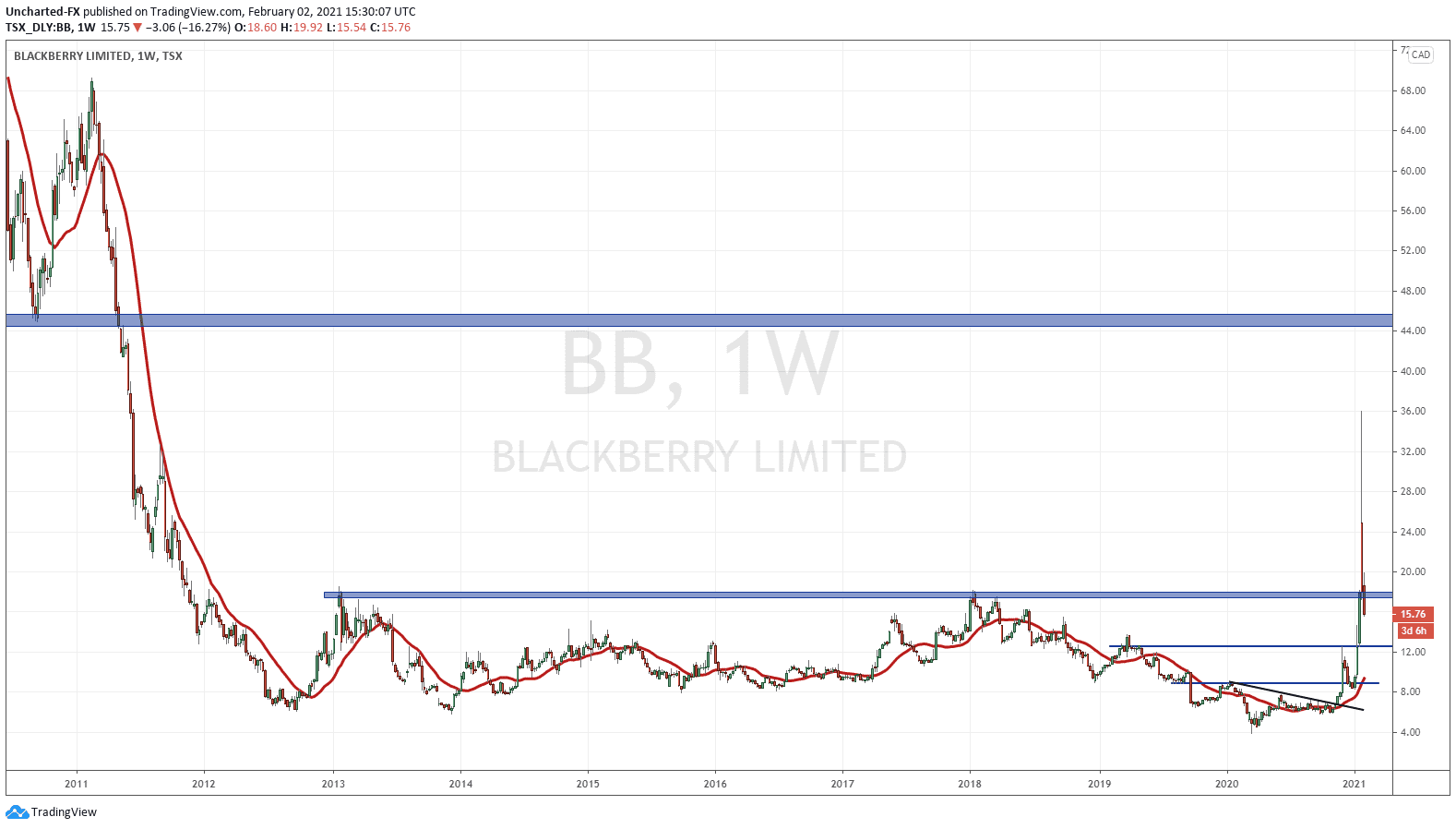

This is the weekly chart of BlackBerry on the Canadian (TSX) market. I will look at the US listed chart below.

We discussed the major weekly breakout in previous posts. The breakout above the $18.00 was key. Last week this happened, with shares hitting highs at $36.00. I also discussed that breakouts tend to see pullbacks. My regular readers know this. We have been expecting a drop back to $18.00, and hence why I closed half of my position close around the $30 zone.

The weekly candle close from last week closed directly above our $18.00 support zone. In the first two days of this week, the weekly candle is not looking great. Currently, price has dropped below $18.00. The next support zone would come in around $12.00. BUT we still have a lot of trading hours and days until the weekly candle closes on Friday. The possibility for a reversal and a weekly close back above $18.00 still exists.

$18.00 must hold for further gains. If it does not, then the breakout, which would take us to $44.00 in the long term, has failed and is now considered a fake out. If we close below $18.00, there could be sometime until we climb back above $18.00, but the stock would react better to fundamental news after the WSB clappage.

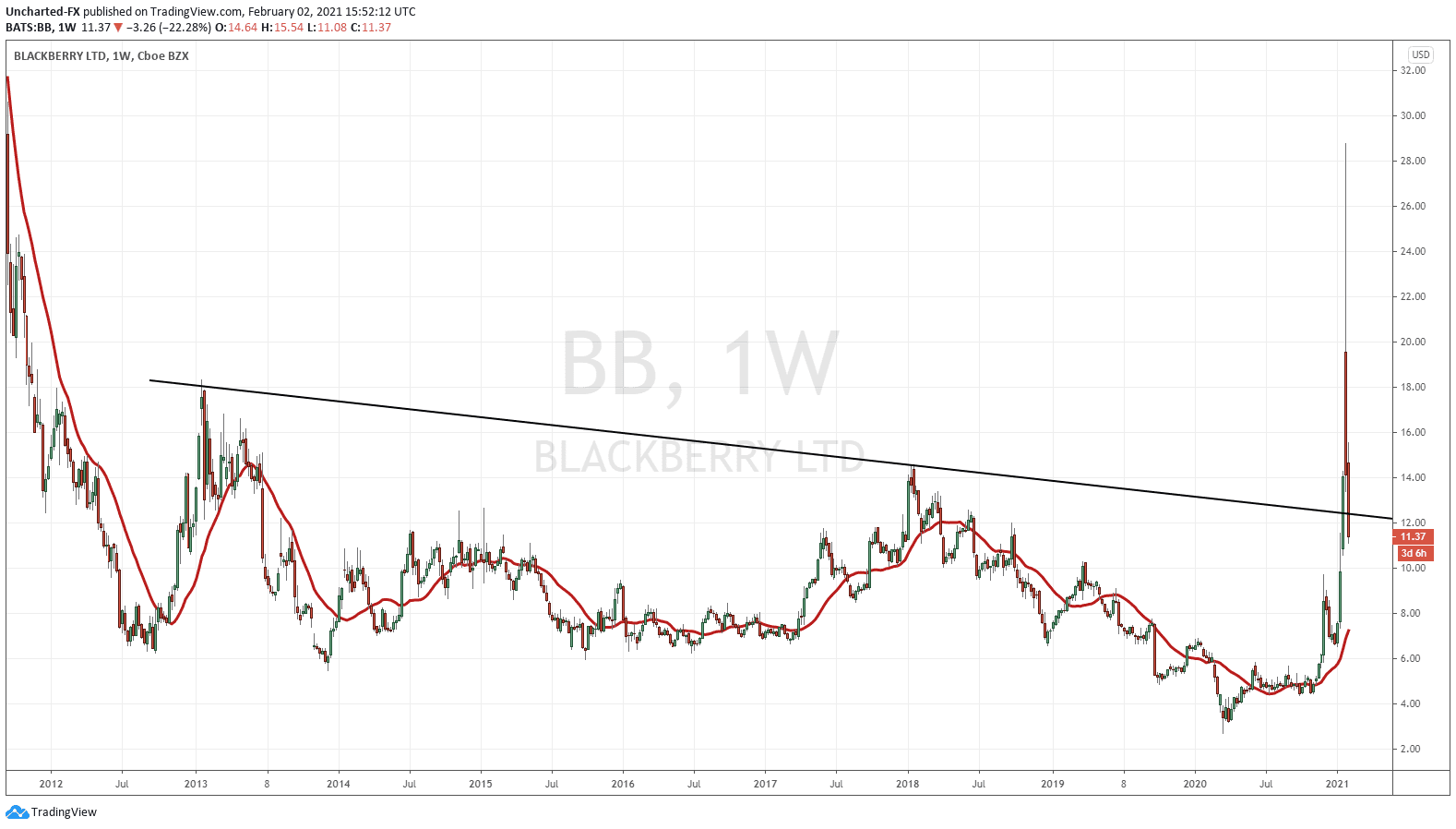

On the US side, things are not much different. The difference is the weekly trendline, and price failing to hold it on the retest. But again, we have many more trading hours and days until the weekly candle closes. The $12.50 zone is the price zone to watch for the weekly close.