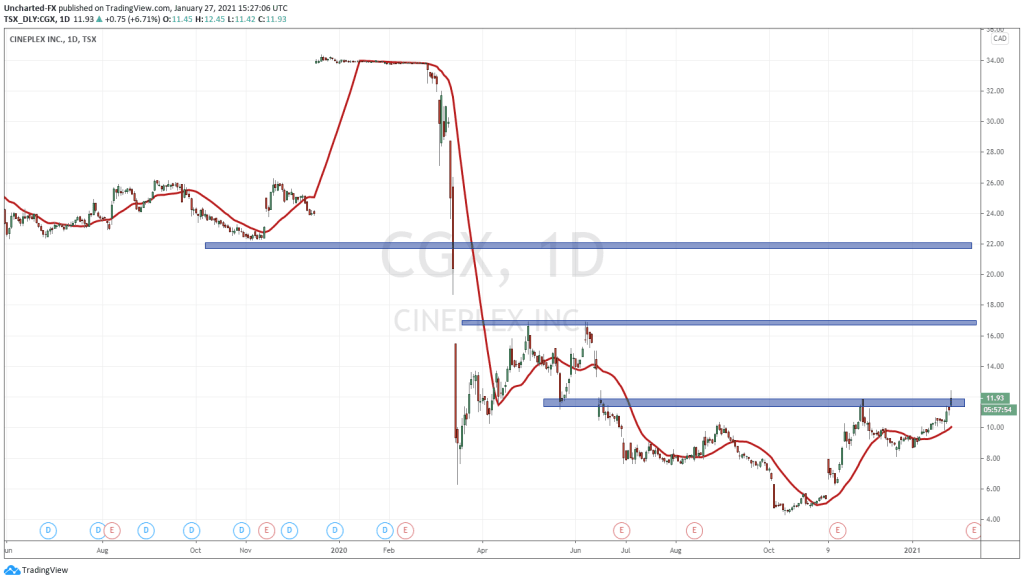

Everyone and their mother was talking about going long on AMC. The struggling movie theatres was trading under $2 per share in the first week of 2021, only to hit highs of $20.36 this morning. The WallStreetBets train keeps on moving with the retail crowd continuing to upset the institutional shorts. Began with Tesla, then Gamestop and Blackberry and now AMC. Heavily shorted stocks, beware.

By the way, we at Equity Guru’s Discord Trading Room were looking and trading AMC around $2.00.

Just basic market structure which we use on all our trades to increase the probability of success. Confluences included AMC at major support, and then one of our favorite reversal patterns: the cup and handle. That’s it. Simple but effective. I know I sound like a broken record, but all markets move the same way. Our job is just to look for good set ups and then execute. Emotions taken out of our decision making.

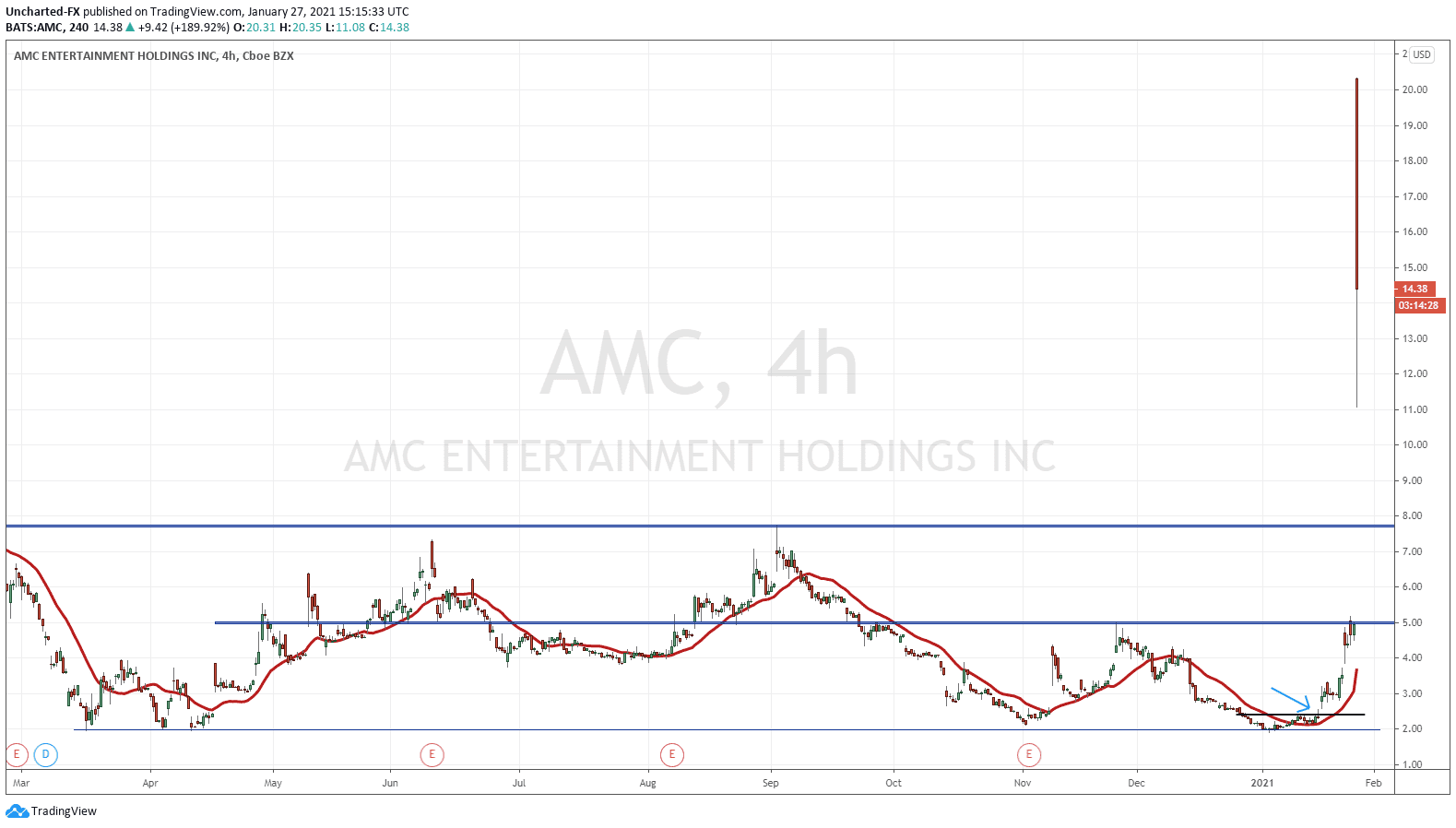

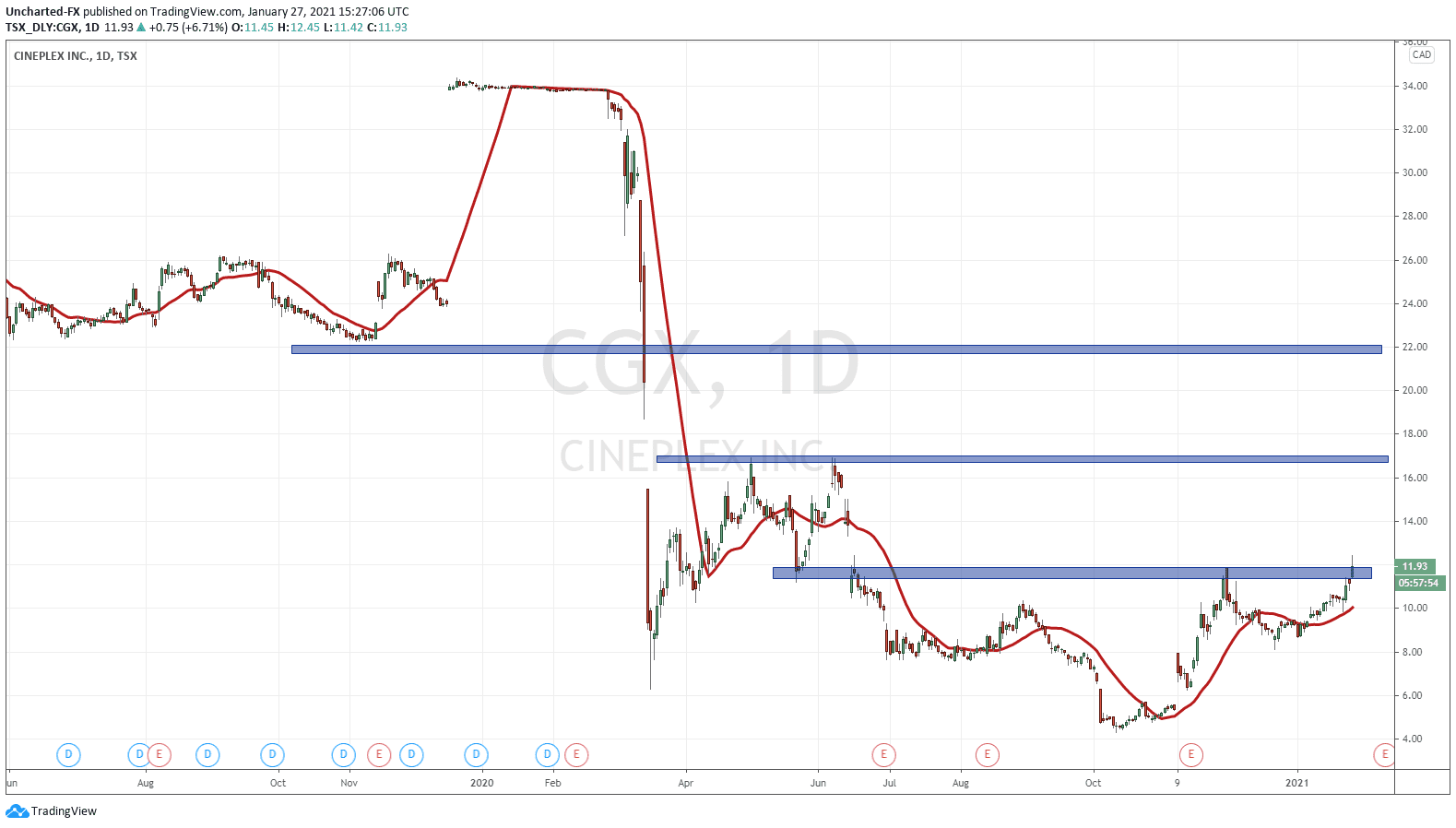

Knowing that AMC theatres is hot, a Canadian companies chart caught my attention last night. And it can be seen as the sympathy play to AMC. I am talking about Cineplex (CGX.TO).

In terms of the fundamentals, the same applies for AMC. Most movie theatres remain closed. If they are open, they are showing older films as new film releases have not been coming out frequently. Some have said the cinema industry will get hit hard as studios will opt the streaming route such as Mulan and Wonder Woman 1984 (the latter was released in cinema’s as well). However some studios remain patient. The James Bond movie continues to be delayed as they are awaiting for cinema’s to reopen.

This brings up the whole case of why be bullish cinema stocks. Sure, streaming services are very popular due to the pandemic. Personally, I believe the whole experience of going out to a movie will still stand. The nice reclining seats, the popcorn, the soda etc. It will still be a thing which tops the “Best First Date Ideas” lists.

Now onto the juicy stuff. The technicals.

Do you see it?

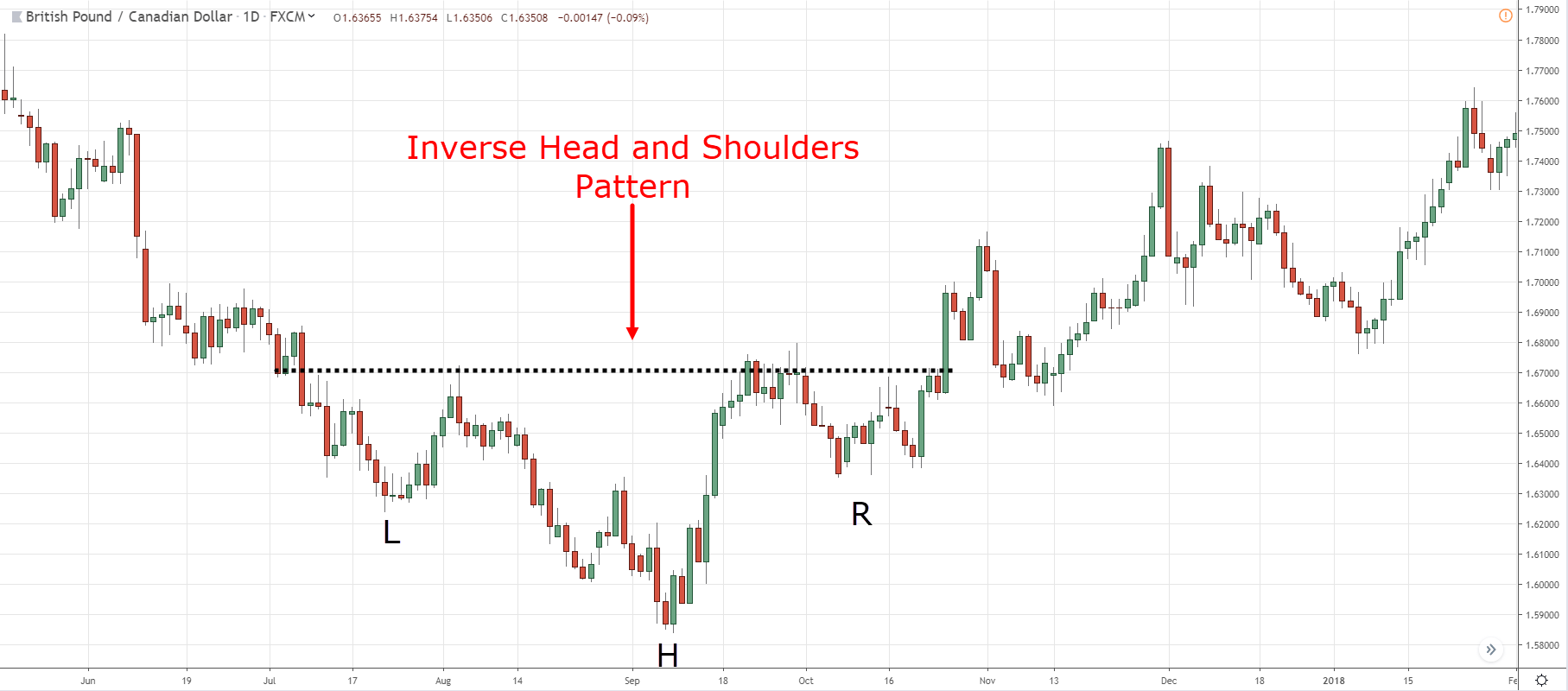

Our favorite reversal pattern: the inverse head and shoulders.

It is one of our favorite reversal patterns that we rinse and repeat on a lot of our set ups.

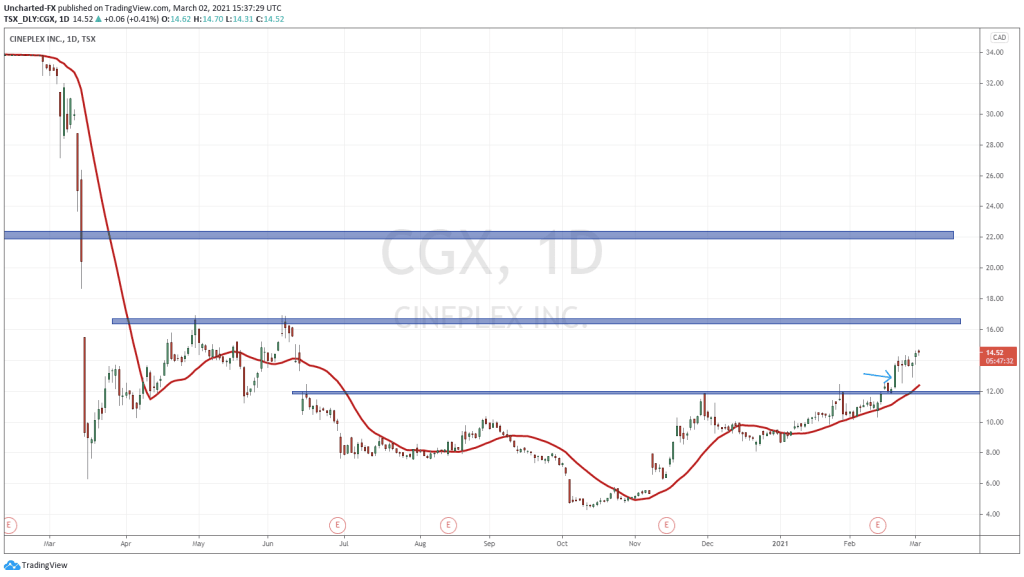

The key though is the breakout. Currently at tie of writing, the stock is trading at $11.83 and is up 5.81% on the day. What we would like to see is the daily candle today to close above $11.92. $12 would be very bullish. The trigger for these reversal patterns is the breakout. So this is what we will watch for today. As you can see from my example above, price does tend to pullback to retest the breakout zone before continuing higher. So we should expect a break out on Cineplex and then a pullback before continuation.

What could be the catalyst for this breakout in Cineplex? Perhaps AMC popping and eyes on movie theatres? This is setting up to be an AMC sympathy play.

In terms of upside targets, there is a first target at the resistance just above $16.50. From there, price can continue the momentum but be wary of the gap. There is a large gap to be filled, but if it does, it is super bullish for the stock. $22.00 would be next, but the gap fill momentum would take prices higher.

So there are a lot of short squeezes occurring but I want people to be careful. A lot of traps will be set by Wall Street as they know there is a lot of new money day trading AMC and GME etc. I just want to remind people that there are other stocks out there which have good looking technical sets ups and are going under the radar due to the WallStreetBets.