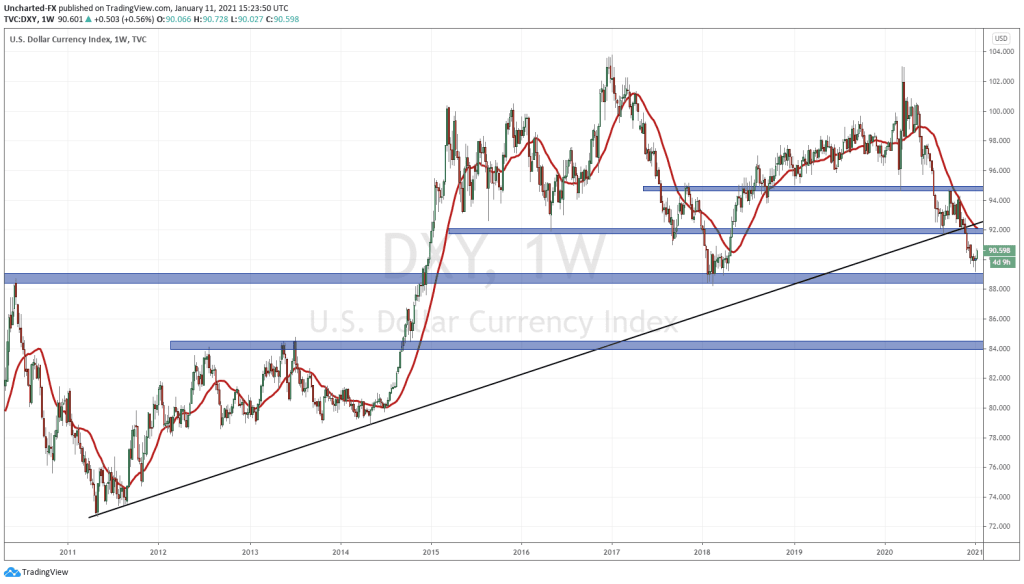

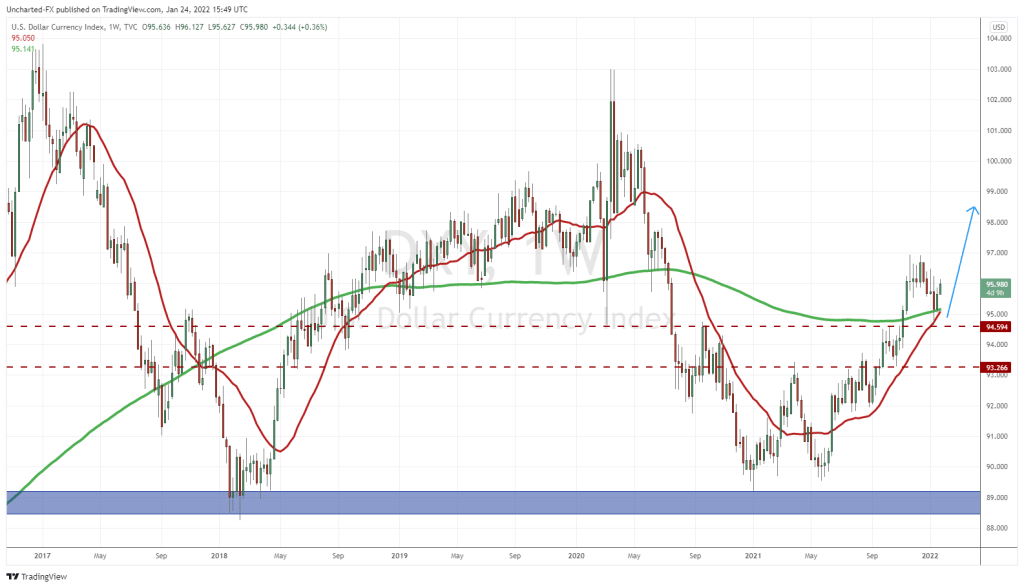

The US Dollar has been getting culled. The downtrend is apparent. We were watching the weekly support way back at the 94.75-95.00 zone. Penetrated right through it. Notice too how price came back to retest this zone before continuing lower.

92.00 was the MAJOR KEY support for the US Dollar. Not only was it a major support zone (price floor) but it is where the trendline back from 2012 met price. In order to keep the overall major long term uptrend, the US Dollar had to hold and remain above this zone. We had a price war here between the bulls and the bears for many weeks. Really was make or break for the US Dollar.

As you can see from the chart, price broke below 92.00 support and below this major uptrend line. The US Dollar was now officially in a major bear trend. I believe there is one more leg lower which will take us to the 84.00 zone.

BUT we know that according to market structure, nothing moves down forever. Instead, price moves in waves, in a downtrend these are called lower highs. I do think one needs to form, which does mean expect a relief rally or correction.

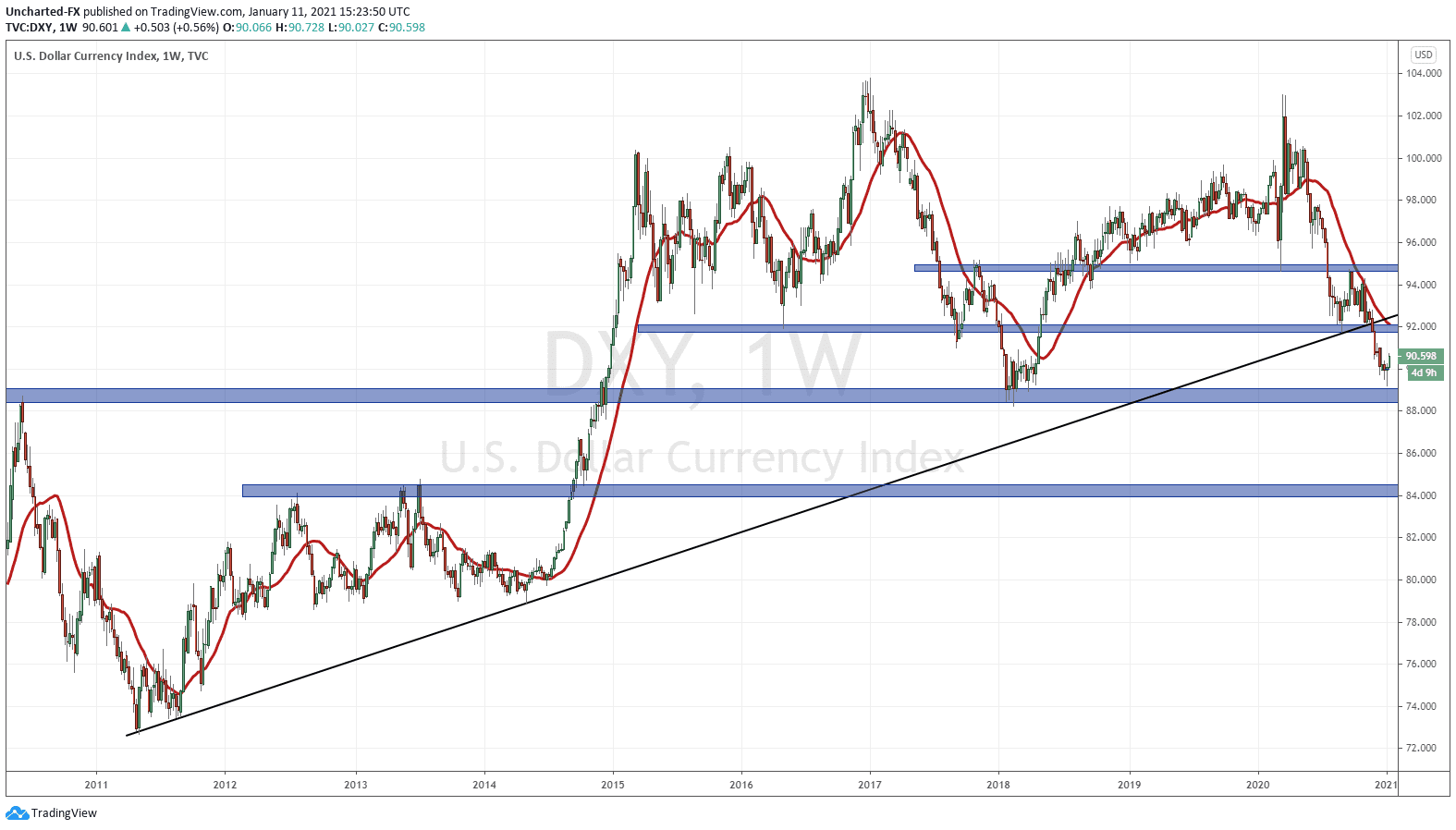

The Dollar has tested major support at the 89.00 zone. In the past two weeks, we have had major wicks on the weekly candles indicating that buyers are stepping in and holding this support. I expect price to pop here to retest the trendline break and resistance now at 92.00.

This might happen rather quickly. Why? A short squeeze is possible. Shorting the US Dollar has been a very popular trade. Not only has the US government passed a 900 Billion Covid bill and an over 700 billion defense bill, but MORE will be coming with a Democratic https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration. It was coming regardless of whatever party won the election, but the Democrats have a history of spending more.

Not only that, but the Federal Reserve will continue to print and maintain their asset purchasing program. To be honest, I am a bit perplexed because EVERY western nation and central bank is doing this. One would think the US Dollar would be the better currency to hold in this environment. But in the past, I have told my followers and readers that this is the currency war. Since every central bank wants a weaker currency to boost inflation and exports, the Federal Reserve is in the best position with the Dollar being the reserve currency. The Europeans and the European Central Bank are not, and have attempted to weaken the currency at all costs.

Remember, a weaker currency is the definition of inflation for classical economists. It takes more of a weaker currency to buy something which causes prices to move higher. This includes US stocks as well. Hence why a weaker Dollar is great for US stock markets, and sure, it means US companies can export more.

Do not be surprised to see some shorts squeeze here. In my currency war framework, if the Fed wants a weaker Dollar, we should expect a reversal at the retest of 92.00. I would take my long profits there. What will be interesting and exciting will be if the US Dollar closes ABOVE 92.00 on the weekly chart. This would get us back above the trendline break and would nullify the downtrend.

If 92.00 holds, then we make our lower high swing in the downtrend and the US Dollar closes below 89.00 before hitting 84.00.

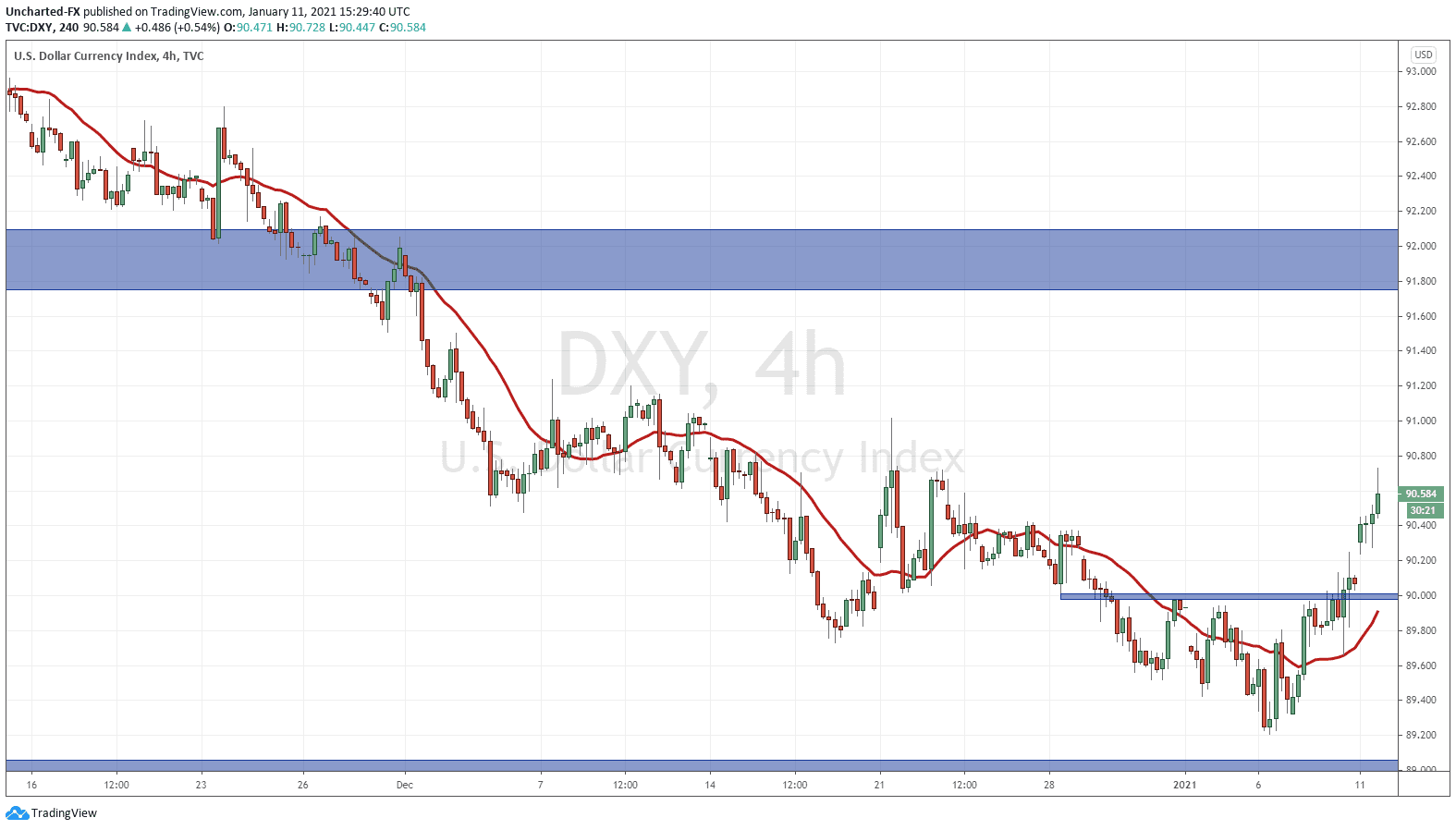

On our long trade currently, we have been watching the reversal sign on the 4 hour:

My favorite reversal pattern, the inverse head and shoulders which displays a transition from a downtrend to an uptrend. On Friday, we broke and closed above the neckline which triggered the reversal pattern. One could have entered a long then, but personally, I do not like holding trades over the weekend nor do I like to open a position late on a Friday which would require me to hold over the weekend. Just a rule that I abide by which has kept me alive in this game.

As Asian Markets opened on Sunday afternoon pacific standard time, the US Dollar gapped up. A very strong bullish move. At time of writing, the Dollar continues to strengthen during US market hours. Now we will wait to see what the daily candle close has in store for us! I am bullish the US Dollar above 89.50, but price could pullback to retest the 90 zone before continuing higher.

Tons of nice looking Dollar set ups that we have been watching over on the Equity Guru Discord Trading Room which includes: EURUSD, USDCHF, NZDUSD, AUDUSD, USDCAD, USDSEK, and USDNOK all showing signs of a reversal on the 4 hour charts. I have entered positions on the USDCHF and the USDCAD.

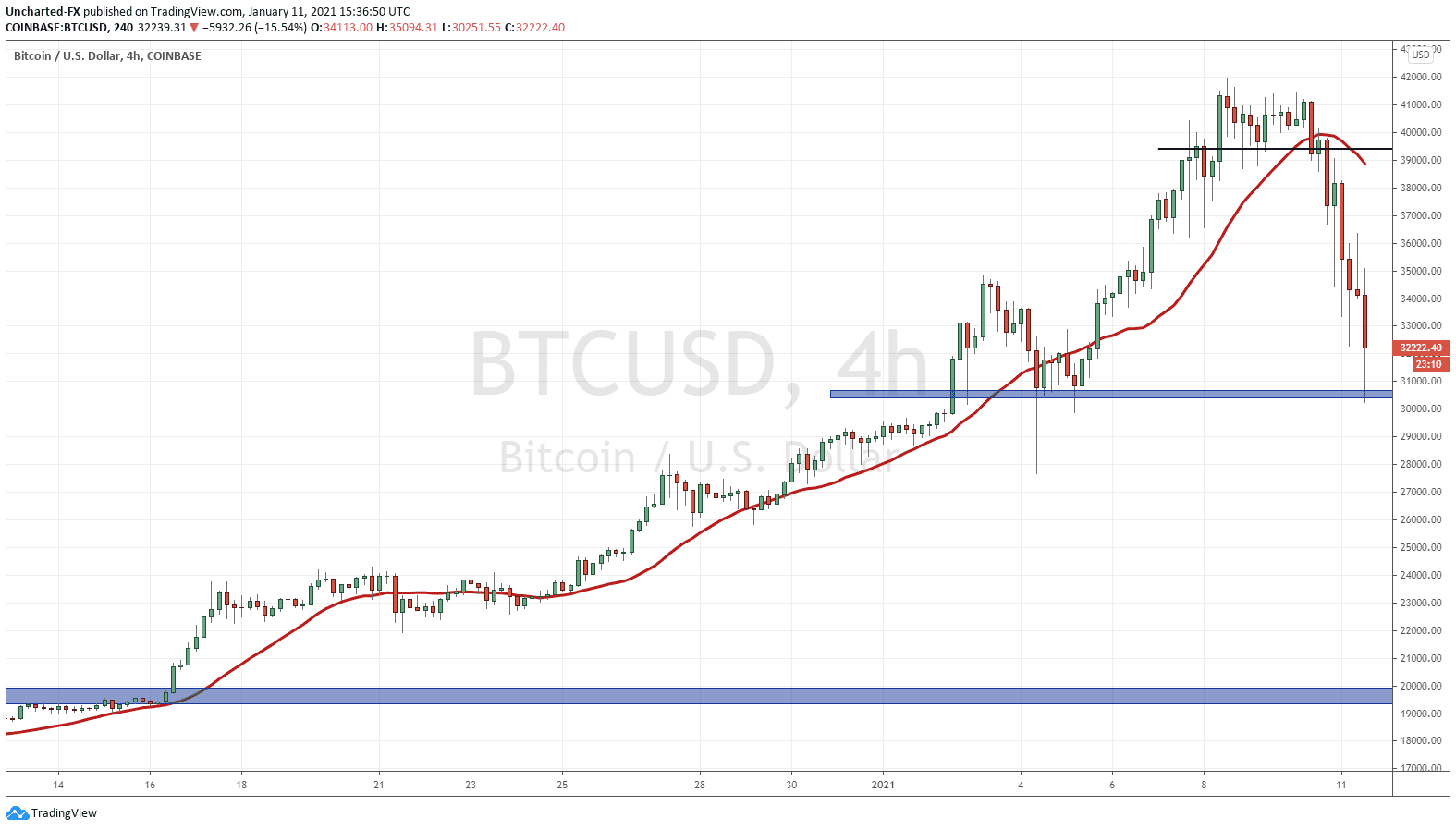

Some people have said that this Dollar strength is what caused Bitcoin to plunge. If this is the case, expect more downside going forward. In my opinion, Bitcoin has moved up too fast. Nothing moves up in a straight line, and is due for a pullback as people take profits. Just normal price action.

Just a reminder, this is Brent Johnson’s Dollar Milkshake Theory:

Over on our Discord Channel, members were notified on Sunday that Bitcoin finally gave us a reversal pattern to work with. The breakdown at 39,000 was an entry to short. We were targeting the support here at 30,000. So far so good, and in tomorrow’s Market Moment, I will go through what the IDEAL scenario would be in order to buy more Bitcoin.