Tesla is a company that people like to talk about. Tons of divisive opinions on the company, and for good reason. Year to date, Tesla stock is up 687.42%, and continues to squeeze the short sellers. We know the Robinhood crowd loves trading the stock, to a point where it has become the meme stock.

Lot of analysts say the price of Tesla is warranted because it is a disruptive company. They say do not value it as an auto manufacturer…Tesla now the largest automaker by value taking over Toyota, but value the company as a TECH company disrupting the status quo. Using this case, the value is warranted and the stock price will be moving much higher. Even surpassing $1000 per share.

As world governments continue to go down the green path, electric vehicles will play a very large part. Some nations even mandating all cars on the road must be electric within the next decade. The question is whether Tesla gets the manufacturing at levels to meet this demand…or do automakers like Volkswagen, who have the manufacturing capabilities, take the Electric Vehicle market share? In this case, Tesla probably becomes the ‘luxury’ EV vehicle.

The big news was Tesla joining the S&P 500 on December 21st 2020…today. Currently, on Tesla’s first full trading day on the S&P, the company is down 4.65%. Global markets tumbled overnight on the news of a new Covid virus strain in the UK. US markets opened lower this morning even with a $900 Billion stimulus bill being passed.

SO what does Tesla’s inclusion on the S&P 500 mean?

Previously on Market Moment, and in our Discord Trading Room, I mentioned this would be bullish for the stock because it means ETFs tracking the S&P 500 would need to buy millions of dollars worth of Tesla shares for the rebalancing.

From CNBC:

S&P estimates that approximately 129.9 million shares of Tesla will need to be purchased to add to the S&P 500. At the current market price of $655, indexers would need to buy $85.2 billion in Tesla stock at the close on Friday. However, there are billions more that will need to be bought by “closet indexers” that do not officially pay S&P, but nonetheless track the index. No one knows how much these “closet indexers” will buy, but it could be 50%-100% above the “official” $85.2 billion estimate.

Like all mega-cap stocks, it will not take much of a move in Tesla’s price to move the S&P 500: For every $11.11 Tesla moves, the S&P 500 will move 1 point.

Tesla volume was around 222 million shares on Friday which was more than four times the stocks daily average volume.

The company has the 5th largest weighting on the S&P, at 1.69%. Only Apple, Microsoft, Amazon and Facebook have a more powerful influence on the index than Tesla.

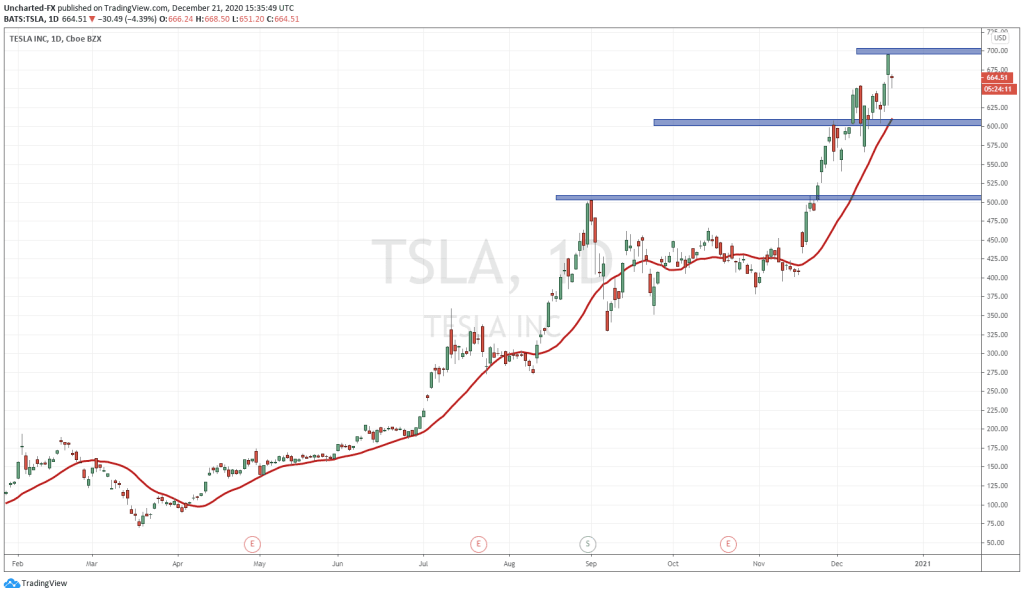

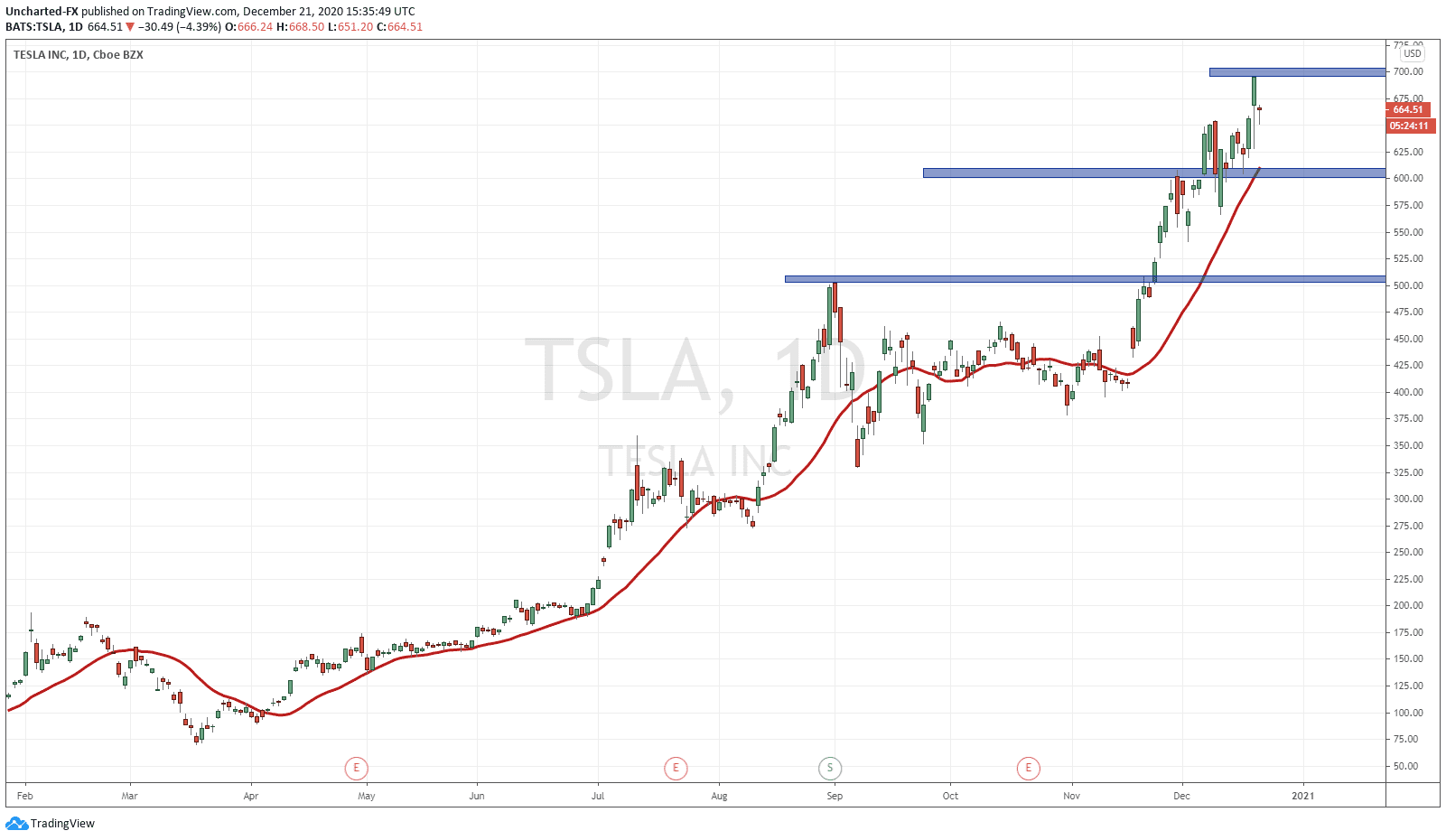

Above, I have the daily chart of Tesla. The big breakout occurred at $500. A major psychological zone, and the next would be the big $1000. Price never pulled back deep enough to retest $500 as new support.

The next major zone came in at $600. If you go down lower to the 4 hour chart, you will see that $600 is a major flip zone (being both support and resistance) with more than 3 touches at this price zone. On Friday, Tesla printed $695. This is the current resistance zone we are working with.

The price being down today has to do with the overall fear in the markets. But as I have said before, and will say it again, there is nowhere to go for yield in this world. Stock markets will continue moving higher until some sort of large black swan event occurs. Central Banks will be printing more money, it will not stop. Governments will be spending more money. It will not stop.

Tesla even at $658 per share is still seen as a growth stock. Governments spending on green infrastructure is coming. EV plays will be hot, but personally, I would prefer trading commodities like copper and silver for the green play. The question going forward is what I mentioned earlier: does Tesla use the capital raises to increase their production (can Elon Musk deliver on his promises) , or will it lose market share to auto makers like Volkswagen, GM, Toyota etc who have the production capabilities.

Or will any of that even matter? As the stock and the company retains a cult like following which will always see Robinhood/millenial traders and investors scoop up shares.