Over the past few weeks, if not months, I have been updating my readers and members of our Discord Trading Room on the US Dollar (DXY). It really is the most important chart for geopolitics and the macro backdrop of the world. There was an important support (price floor) and trendline going back to 2012 that the US Dollar was testing for weeks, and it finally broke down recently. Read more about that here.

We are at a point where nations are seeing great depression like unemployment and economic data, and central banks have been printing and buying like crazy. Can this ever stop? With all this debt, can we ever even consider normalizing interest rates? Likely not.

What this means is that central banks will continue to print money and become the buyers of everything and of last resort. QE infinity if you like. The U.S. Federal Reserve, Bank of England, Bank of Japan and the European Central Bank have already splurged $5.6 trillion this year alone on quantitative easing.

The number one way to boost the economy has been to manipulate the currency lower. A weaker currency means you can boost exports (because it is now cheaper to buy your countries products). Yes, imports become more expensive, but the goal is that businessmen in the nation with a weaker currency, will jump on this opportunity and create domestic industry. The problem is that maybe other nations are more efficient at this.

This is why Greece wanted to leave the EU. They had huge economic problems, and instead of borrowing more and getting bailed out, the Greeks wanted to weaken their currency. Only problem is that they cannot do that. Joining the EU meant nations had to give up their ability to devalue their currency. That power belongs to the European Central Bank now.

Fast forward to the macro environment today, and things are getting more wild. A currency war is brewing.

Many nations are attempting to weaken their currency in order to boost exports and to boost inflation. But there is another reason. A weaker currency means that the debt can be paid back with cheaper currency. With debt levels increasing, a weaker currency is not only helpful for corporations who borrowed, but also for governments.

I believe that Bitcoin, and commodities such as Gold and Silver are moving up, and will continue to be great long term holds because it is a move out of fiat currency. Central banks are racing to the bottom to weaken their currencies. Market participants are pricing in the currency war, and these assets are ways to protect one’s purchasing power. In fact, the same can be said about stocks and the hunt for yield.

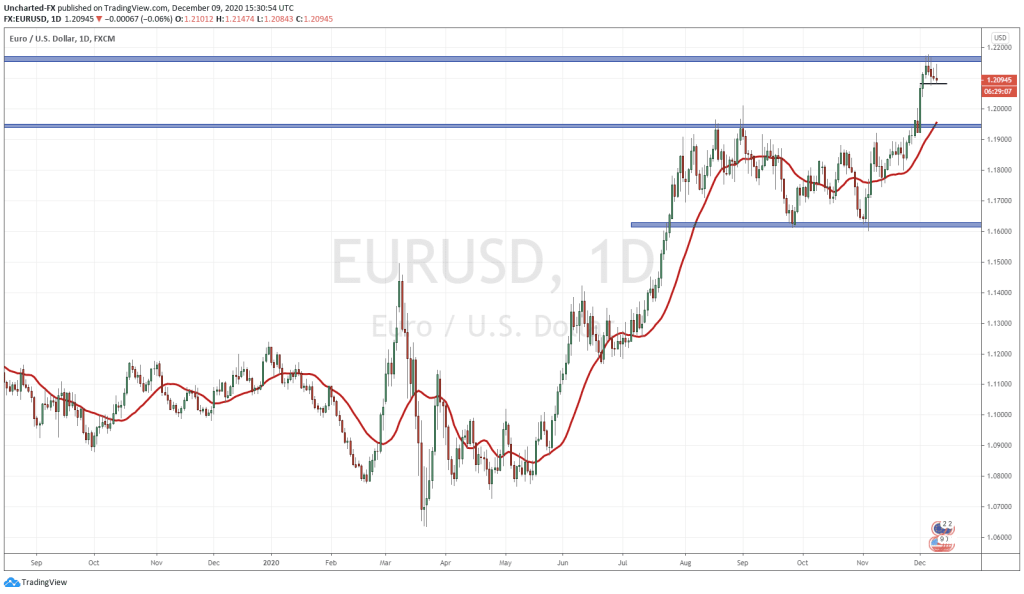

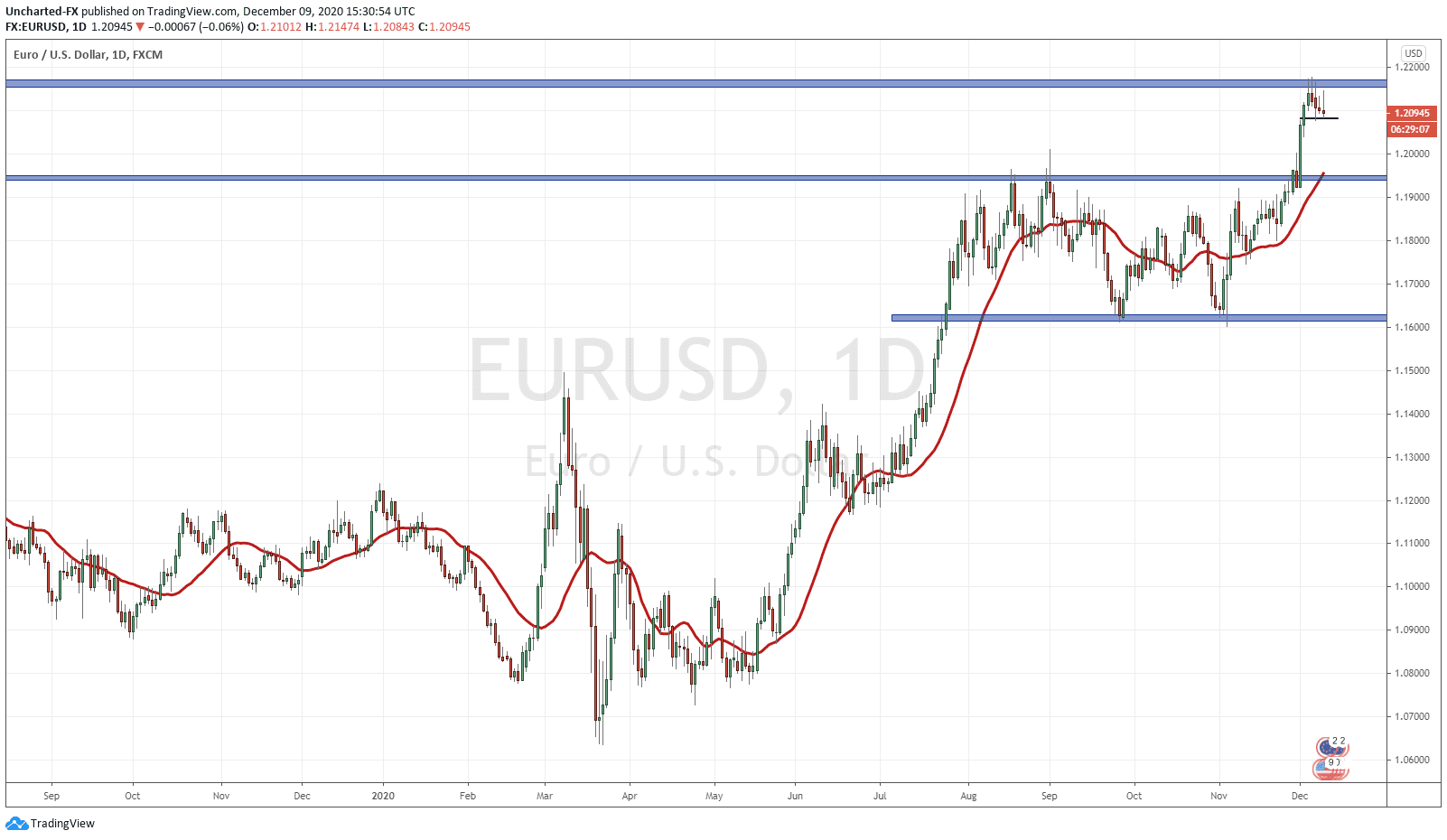

This brings us to the chart I want to discuss today. The EURUSD.

Europe is big on exports. Germany is one of the exporting super powers. A weak Euro is key for them. However, there is an issue, as you can see the Euro has actually been strengthening!

Why is this? The drop in the US Dollar (DXY).

In my Market Moment on Monday, I have an image of the composition of the DXY. The Euro has the largest component/weight in the Dollar Index coming in at 57.60%. Hence why the Dollar chart and EURUSD are inversely correlated. When the Dollar drops, the Euro (EURUSD) rises, and when the Dollar rises, the Euro drops.

The drop and decline of the US Dollar has been one of the biggest market stories of the year, but many have been focused on the stock markets. Some find the Dollar drop confusing, because generally investors run into the Dollar as a safe haven. The other side is that foreign money will need to buy Dollars to buy rising US stocks. But it seems the Dollar is declining due to Presidency uncertainties and more stimulus packages. But let’s face it, the Americans are not the only one printing money and unleashing stimulus. Most of the western world is.

European Central Bank (ECB) chairwoman Christine Lagarde has expressed concerns about a rising Euro. In September’s meeting, Lagarde said the ECB is monitoring the rise of the Euro and what it means for inflation outlooks, but said that the exchange rate is not a policy target.

Many analysts were surprised because they believe the ECB needs to act. It is expected they will act in tomorrow’s meeting. Currently, their emergency bond purchasing program is at 1.35 Trillion Euros, but analysts expect this to increase by another 500 Billion Euro’s tomorrow.

There are some analysts, myself included, that believe the ECB may in fact cut negative rates deeper into the negative in an attempt to weaken the Euro. All tools are on the table, and Lagarde did say this is a possibility.

Another surprising new story was the private calls the ECB made to banks and large funds. I think it went something like this: “Hi the ECB here, can you please short EURUSD? Thanks”.

So in summary, expect action from the ECB tomorrow to attempt to weaken the Euro. The first salvoes of the currency war are being fired.

I expect the EURUSD to pullback to at least the 1.1950 zone. If the Euro instead rises…expect more drastic action from the ECB in the future.