Incredible move in the cryptocurrencies this week. Not only has Bitcoin moved, but we got double digit gains in Ethereum, Ripple, and Stellar Lumen just to name a few.

The question on everyone’s mind is why?

After news came out about Square accumulating $50 million dollars worth of Bitcoin, and Paypal saying they will allow for the purchasing and use of certain cryptocurrencies, we have been on a tear. So is this move because of adoption? Are institutions and whale’s buying Bitcoin? Cointelegraph seems to think so. They attribute this move to whale accumulation, decreasing exchange supply, and explosive volume trends.

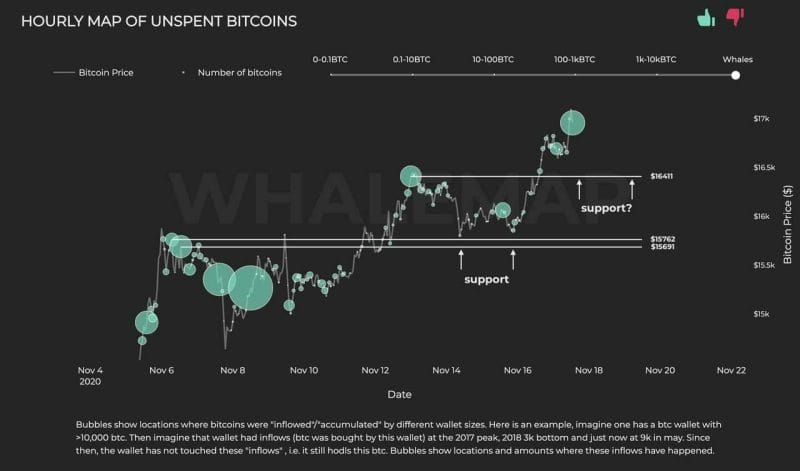

The evidence for whale buying comes from price clusters whenever Bitcoin was rallying.

These clusters emerge when Bitcoin whales buy BTC at a certain price point and do not move them. Analysts have interpreted this as a signal that whales are accumulating and that they have no intention of selling in the near term.

The difference between the ongoing Bitcoin rally and previous price cycles is that the recent uptrend has proven to be more sustainable. In fact, each whale cluster shows that every major support level BTC reclaimed was accompanied by whale accumulation.

Some predictions for where price heads next?

Leonard Neo (head of research at crypto index fund provider Stack Funds) forecasts bitcoin to reach $60,000-$80,000 by the end of 2021., but that pales compared to Tom Fitzpatrick, a strategist at Citigroup, who forecast earlier this month the token could potentially reach as high as $318,000.

Going from $18,000 to $100,000 in one year is not a stretch, Brian Estes, chief investment officer at hedge fund Off the Chain Capital, said.

My readers know my opinion on Bitcoin and other crypto’s. Along with Gold and Silver, you have wanted to accumulate crypto’s. Do I think this is a move due to adoption? Not necessarily. I do believe this is a play to get out of fiat currency, as a currency war, the central banks racing to the bottom to devalue their currencies to boost the economy, has already started. We know the European Central Bank will shake things up next month, and will have to do something to weaken the Euro against the US Dollar. The Federal Reserve will follow suit. The moves in the forex/currency markets will be spectacular in the upcoming months and years, and will question people’s opinions on stable fiat currencies.

Where I see the adoption is a bit different. Let’s face it. A central bank digital currency is coming. The Keynesians still cannot accept that negative rates and QE have not worked in places like Europe, Switzerland and Japan. The idea behind negative rates was that it would force people to spend money and take loans. Yes, due to the cheap money, but also due to the fact that saver’s were punished. The result? Totally opposite. People actually began to save MORE. People still wanted to send their kids to college and plan for large purchases and vacations. To the annoyance of the central bankers, people actually even started taking money out of banks. This is primarily why European banks are weak.

The solution? Wipe out all cash and go to digital currency so people are forced to keep money in banks during negative rates. Again, the idea is that when people see cash is being removed from their accounts monthly, they will spend money which would boost the economy. Central banks and digital currency is not a secret, most central banks have a digital currency ready to go. It is all about how do you get the people to accept it. Governments love it because a digital currency allows them to track and tax all money. Taxation is the key word given all the spending governments have done to combat Covid.

So in this type of economy, a world with centralized digital currency, does Bitcoin and other cryptocurrencies become the new gold? A way to hide money or protect purchasing power from a government run digital currency?

It is something to think about. The idea that big money and the wealthy are frontrunning a government digital currency. To be honest, I still prefer Gold and Silver in that type of environment, but I will cover the previous metals in tomorrow’s Market Moment.

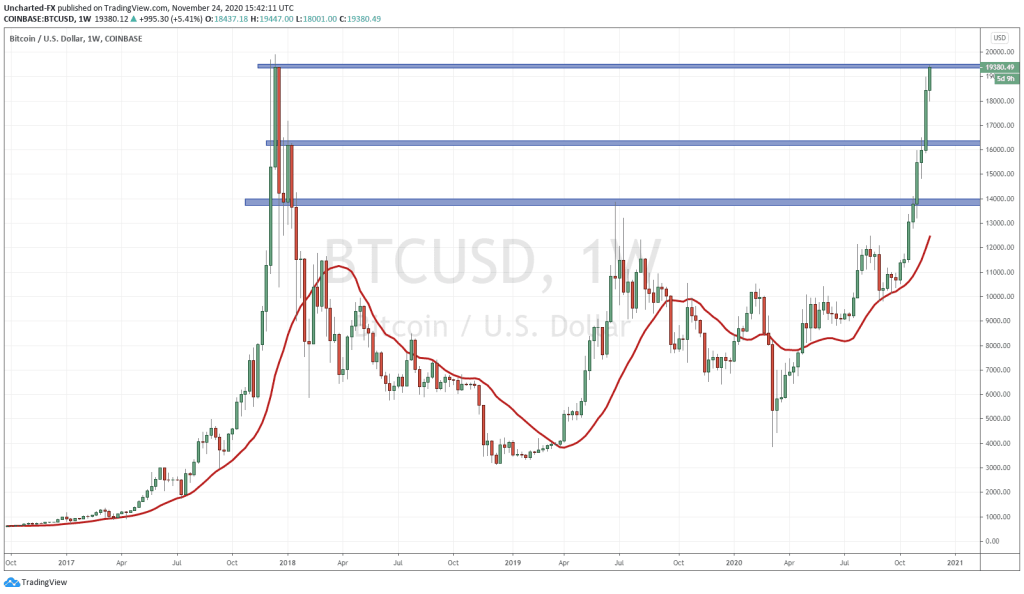

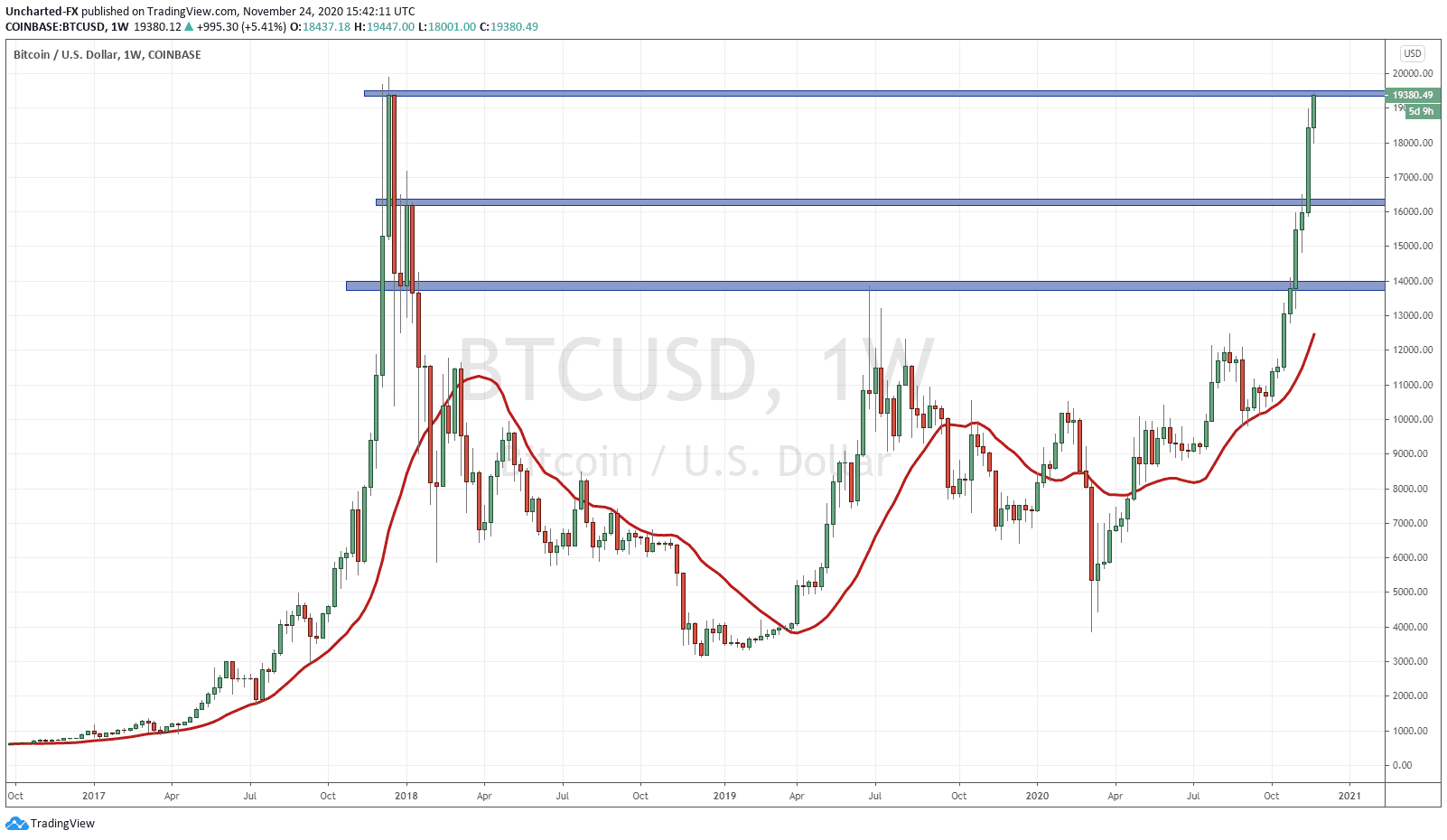

Last I covered Bitcoin, we were testing a resistance around $16,000. We flew right past that.

Naturally, the next resistance zone is previous all time highs. As you can see from the Bitcoin chart, we are testing the candle body highs of late 2017! Bitcoin seems to be on the verge of making all time record highs!

If I do a fibonacci on the weekly chart covering the entire move of Bitcoin, the next targets I get are $24,600 and $32,000. Those are the next targets on a confirmed breakout.

Many of you have noticed the 8 weeks of solid green. My readers know that nothing moves in an uptrend or downtrend forever and in a straight line. Trends make swings or waves, which are composed of a move higher then a pullback which sees buyers step in and take price to new highs in the trend. Bitcoin seems way overdue to a pullback. But, one can argue that no one is selling Bitcoin for profits hence why we see no substantial pullback. People are holding Bitcoin for safety. As a way to preserve wealth.

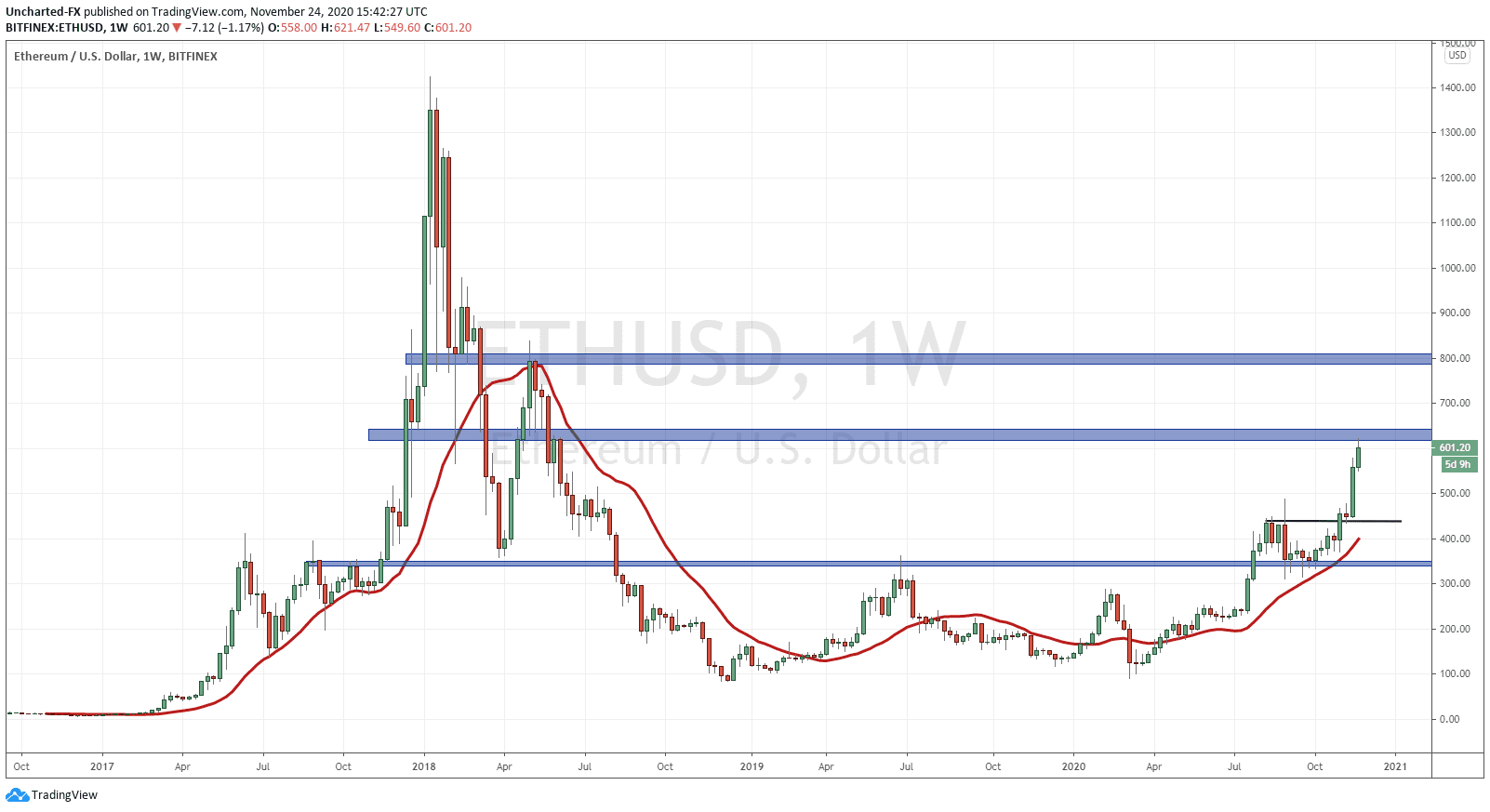

While Bitcoin is seen as the safe haven, Ethereum is touted as the money of the internet by crypto enthusiasts. With Ethereum 2.0 set to release on December.1st, we have a catalyst which could take price higher.

Chartwise, Ethereum has been one of our top picks on the Equity Guru Discord Trading Room. We called the breakout above 300 months ago, and then were waiting for the higher low swing to form. It took over two months to get that swing, but the patience paid off. A new breakout took price to our first resistance/flip zone target at $620. If we get above this, then $800 is next.

Once again, ideally we would like to see the pullback. Ethereum remains in a bull trend above $300 and pullbacks will be bought.

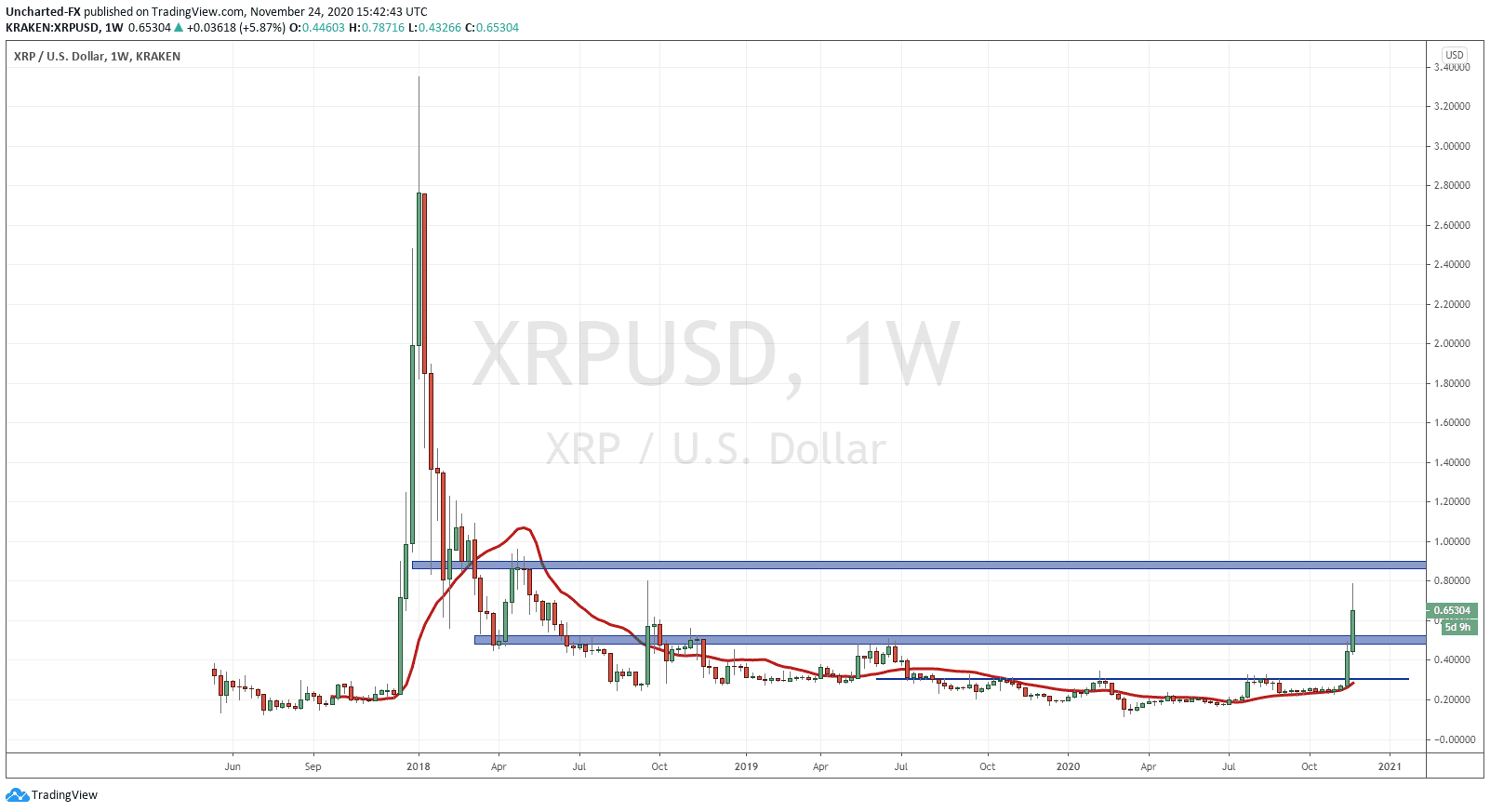

Perhaps the most controversial of the crypto’s is XRP. The Ripple project is one that divides the hardcore crypto enthusiasts vs the average Joe trying to make money playing crypto’s. Ripple is seen as the centralized coin due to its deals with the banks. With what is coming with centralized digital currencies, I see this as a plus for XRP.

XRP was called out on our trading room too with the head and shoulders pattern break above 0.25 last week. In fact on Friday. Over the weekend, XRP took off seeing double digit percentage gains. We sliced through our first resistance zone at 0.50, and are pretty close to my second resistance zone at 0.90.

If Bitcoin makes new highs, which then drags the other crypto’s higher, XRP is definitely one to put on your radar. Due to the price of it, and the possibility to go over $3.00 again, I can see XRP being popular with many retail traders.

So in summary I do think we are beginning to see the confidence crisis in fiat currency play out. With every central bank cutting rates and implementing QE to try to weaken their currency, the US Dollar drop means that the Euro, the Pound, the Loonie etc are stronger against the Dollar. Something the central banks and governments of those countries do not want. Drastic actions will take place to attempt to weaken the currency, and look to the European Central Banks first come December.

In my previous Market Moment posts, I have said how the most important chart for markets and the macro environment is that US Dollar (DXY) chart. It still is. And if the Dollar pops from the major support and trendline I have highlighted in those posts, it can give us that pullback in crypto.