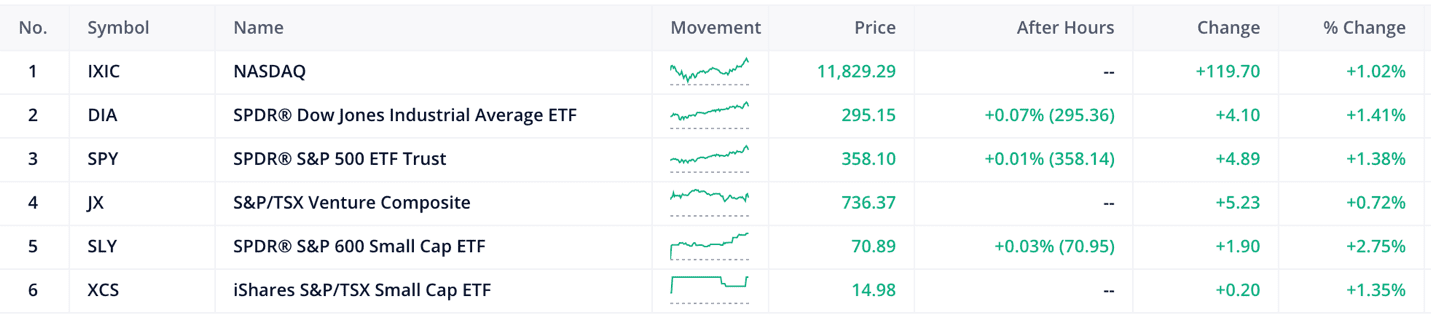

- The S&P 600 & TSX20 are up by 1.90% and 0.20% respectively

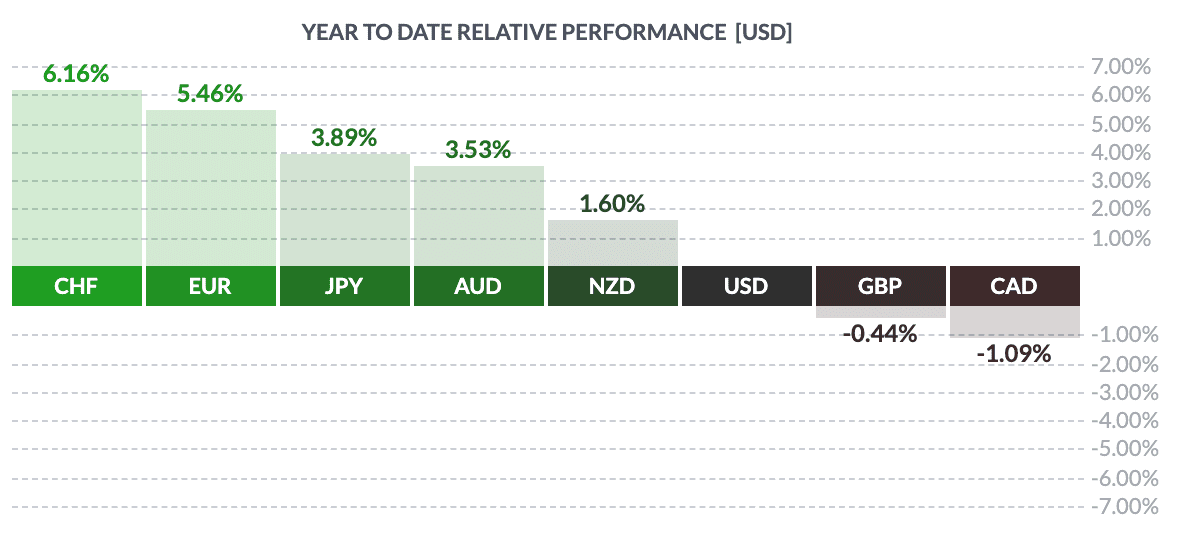

- Bonds see a rush of capital outflows as investors move into ‘riskier’ assets.

- The Canadian 10-year bond up by 0.01% and the US 10-year bond down by 0.01%

Friday’s market movers

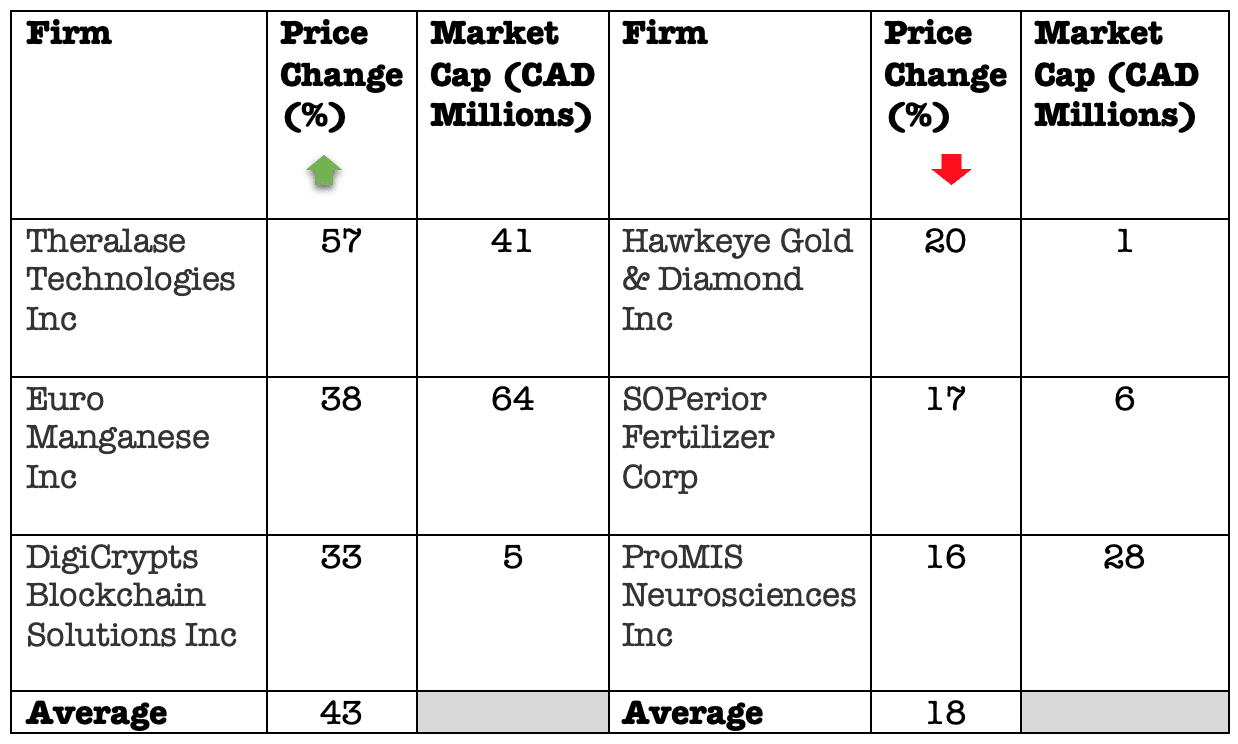

Investors should be aware that when they invest in the small-cap industry they are exposed to more market risk; this should not be seen as a reason not to buy the common stock of these businesses but as an indication that there is great potential to make great buying choices and accumulate wealth.

The saying goes on Wall Street:

“To gain higher returns the investor should take on more calculated risk”

How true this is depending on the person asked, but most would agree. The Small Caps this week did well for their shareholders, the top gainers increased in value on average by about 43% & the “losers” lost about 18% for the day. This shows the “bullish” sentiment going into the end of the week in the Canadian market.

Economic data points

- Canada Housing Starts on Tuesday, November 17, 2020

- Bank of Canada Governor Macklem Speech on Tuesday, November 17, 2020

- United States MBA 30-Yr Mortgage Rate on Wednesday, November 18, 2020

- The United States 10-Year Treasury Inflation-Protected Securities(TIPS) Auction on Thursday, November 19, 2020

Earnings

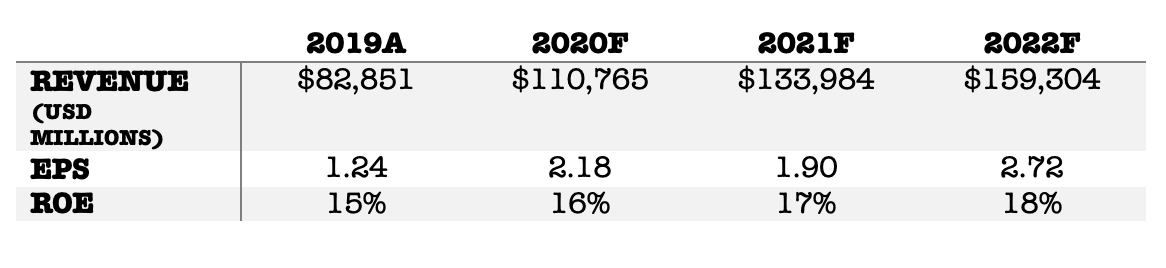

JD.com operates as an e-commerce company and retail infrastructure service provider in the People’s Republic of China.

JD’s earnings per share in 2019 were $1.24 per share and analysts forecast their earnings for the full fiscal year are expected to be 2.18 per share. This expansion in earnings is in line with the recovery that China’s economy has experienced since the COVID pandemic. The stock has been tearing up the market and is up 144% year to date and closed today at 92 up 6% for the day.![]()

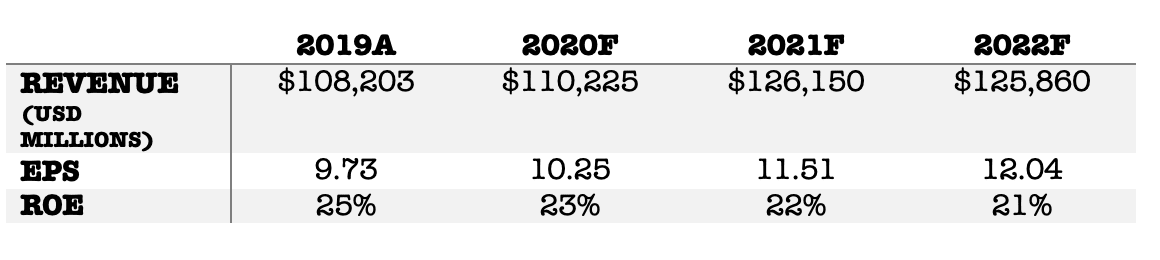

Home Depot is a home improvement retailer.  Home Depot earnings per share in 2019 were $9.73 per share and analysts forecast their earnings for the full fiscal year are expected to be 10.25 per share. This expansion in earnings is in line with the recovery that the industry has experienced since the COVID pandemic as more people spend time at home and take part in the DIY furniture trend. The stock has been tearing up the market and is up 26% year to date and closed today at 277 up 0.35% for the day

Home Depot earnings per share in 2019 were $9.73 per share and analysts forecast their earnings for the full fiscal year are expected to be 10.25 per share. This expansion in earnings is in line with the recovery that the industry has experienced since the COVID pandemic as more people spend time at home and take part in the DIY furniture trend. The stock has been tearing up the market and is up 26% year to date and closed today at 277 up 0.35% for the day

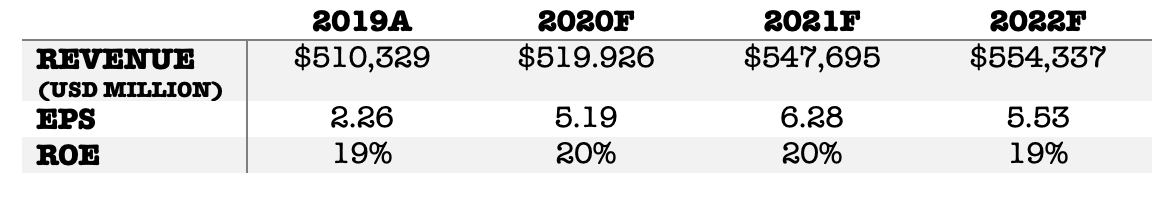

Walmart engages in the retail and wholesale operations in various formats worldwide. The company operates in three segments: Walmart U.S., Walmart International, and Sam’s Club.  Walmarts earnings per share in 2019 were $2.26 per share and analysts forecast their earnings for the full fiscal year are expected to be 5.19 per share. This expansion in earnings is in line with the recovery that the large discount chains have experienced since the COVID pandemic as more people spend time at home and adjust their budgets to something that saves money. The stock has been tearing up the market and is up 26% year to date and closed today at 150 up 1.56% for the day

Walmarts earnings per share in 2019 were $2.26 per share and analysts forecast their earnings for the full fiscal year are expected to be 5.19 per share. This expansion in earnings is in line with the recovery that the large discount chains have experienced since the COVID pandemic as more people spend time at home and adjust their budgets to something that saves money. The stock has been tearing up the market and is up 26% year to date and closed today at 150 up 1.56% for the day

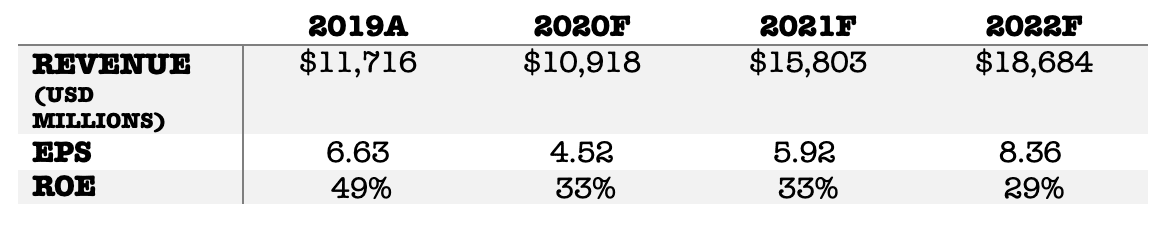

Nvidia operates as a visual computing company worldwide. It operates in two segments, Graphics processing unit GPU) and Tegra Processor which are used in smartphones. Nividia earnings per share in 2019 were $6.63 per share and analysts forecast their earnings for the full fiscal year are expected to be 4.52 per share. This contraction in earnings is in line with the reduction in discretionary spending on luxury products that the semiconductor industry has experienced since the COVID pandemic as more people put money away as they reach budgetary constraints. But the stock has been tearing up the market and is up 125% year to date and closed today at 531 down 1.19% for the day

Nividia earnings per share in 2019 were $6.63 per share and analysts forecast their earnings for the full fiscal year are expected to be 4.52 per share. This contraction in earnings is in line with the reduction in discretionary spending on luxury products that the semiconductor industry has experienced since the COVID pandemic as more people put money away as they reach budgetary constraints. But the stock has been tearing up the market and is up 125% year to date and closed today at 531 down 1.19% for the day

It goes without saying that analysts’ expectations are merely guesses and taking them at face value is a gambler’s game. But this information is not completely useless as it is a great indicator of where most of the securities analysts are expecting earnings to go in the foreseeable future.

The reality of the beauty contest that is the stock market is that if every stock is somebodies’ favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.