A wild day on Wall Street yesterday. Stock markets had their worst day since June of 2020. We were expecting this type of volatility heading into the high risk event that is the US election. My take is that big money does not want to predict who will win, so would rather allocate money into the safety of bonds. At the beginning of this week we saw evidence of this. Money was leaving stocks and heading into the bond market. Again, something I was expecting to see. This would obviously add pressure to the stock markets so a drop is normal.

Things have changed. Big time.

We had another pan sell off. Everything was selling off yesterday: stock markets, gold, silver, bitcoin, oil. This is price action similar to the fear we saw at the beginning of the pandemic/lockdown sell off back in February/March. It seems the stock markets are now pricing in something totally different.

Let’s take a step back before we delve into what’s being priced in. A relief rally in the stock markets post US election has been predicted by many analysts, including me. More cheap money and easy money is the commonality between the two Presidential candidates, although Biden would increase this at a faster pace. This type of macro environment ensures that stock markets become the only place to make real yield in this world. This hunt for yield really is what has been keeping stocks propped. Hence why we see the real economy worsening, but the stock market rising.

Something unexpected came out just today. To be honest, this seems like a way to prop markets up given at the major support zone they are at, but more on that when we get to the charts. US Q3 GDP had a record print. US GDP boomed at 33.1%, while analysts predicted a 32% print. This comes after a Q2 GDP plunge of -31.4%. As per usual, since it is a Thursday, we were treated with US Jobless Claims data. Initial weekly U.S. jobless claims came in at 751,000 for the week ending Oct. 24, down 40,000 from the previous week. Economists were expecting this to come in at 778,000 expected. The most important thing to note: this is the lowest levels printed for Jobless Claims since the pandemic began. Both of these data prints point to a US economy recovery. Whether the market and the people believe them is a whole different story. Do expect President Trump to use these data points heading into the US election.

Keeping all this information above in mind, why are markets still dropping? Because the market is now pricing in a second lockdown in the US. This is why the pan sell off appeared similar to what we saw earlier this year. Nations in Europe including Germany and France are imposing second nationwide lockdowns. Mind you, this occurred even when those nations had the most strict mask and social distancing rules on the entire planet. We saw European equity markets tank. Germany is saying this lockdown will be limited to one month, but other nations seem to be taking their lockdown through the winter into next year. How they recover economically I don’t know. If you can let me know how the economy recovers without mentioning big government and central banks buying up everything, we will nominate you for a Nobel prize in Economics.

By the way, the German Dax was a trade we took over on our Discord Trading Room. We did not know Germany was going to announce a ‘limited’ lockdown, but the technicals on the chart were indicating a bear trend on the Dax.

This fear made its way to US stock markets. But there is one other chart which provides evidence the markets are pricing a second lockdown in:

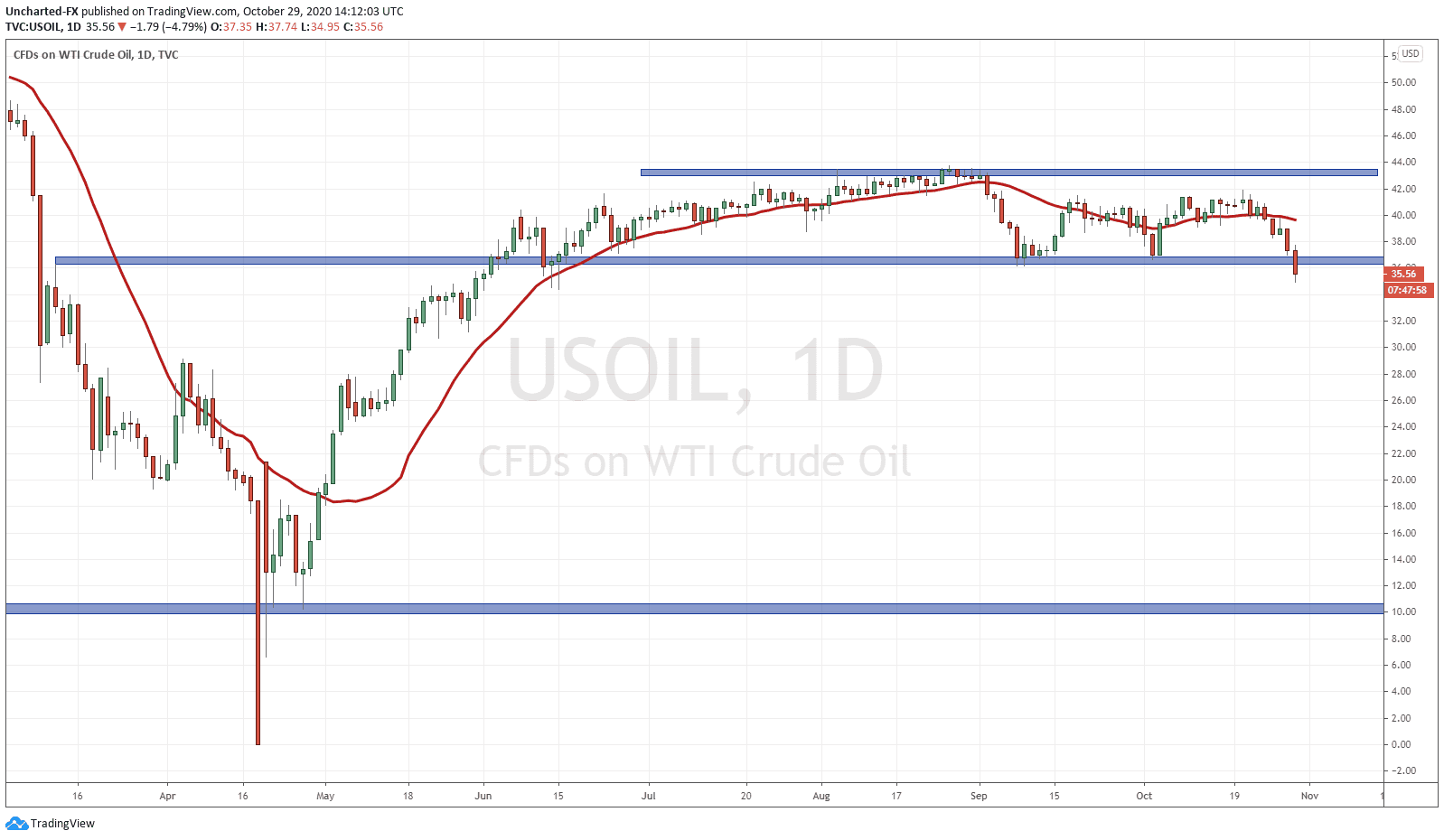

Oil has been tanking the past few days. Over 4% yesterday and now today. I bring this chart up because it ties in well with the stock market charts. Oil is looking ready to roll over once it breaks down this support. Today’s price action becomes VERY important. Can they get price to close above support? We shall wait and see.

If we are heading to a second lockdown, we can expect oil to repeat the same type of price action in Spring of this year. Supply gluts and no room for storage as demand plummets.

And then finally, the potential cuckening for the bulls:

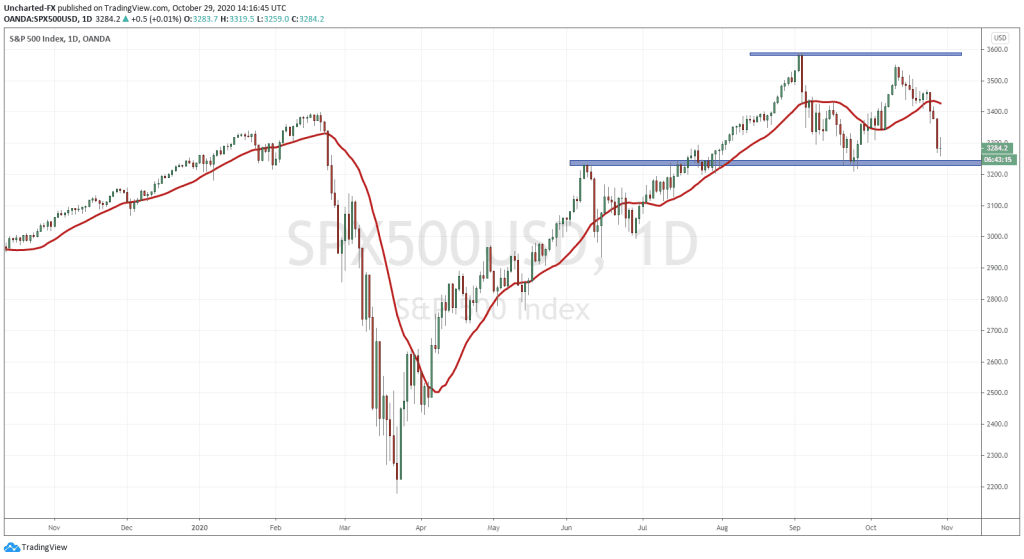

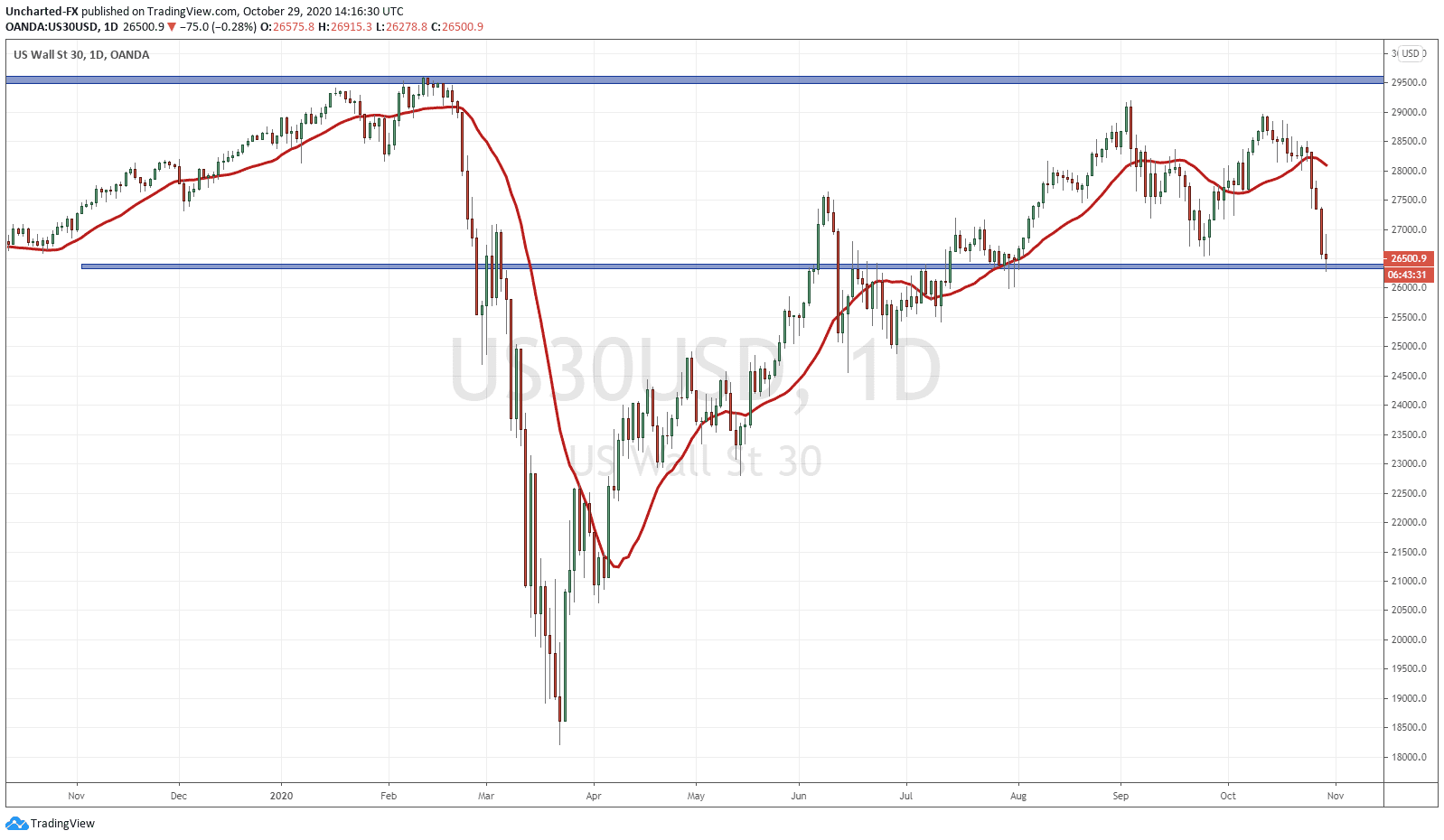

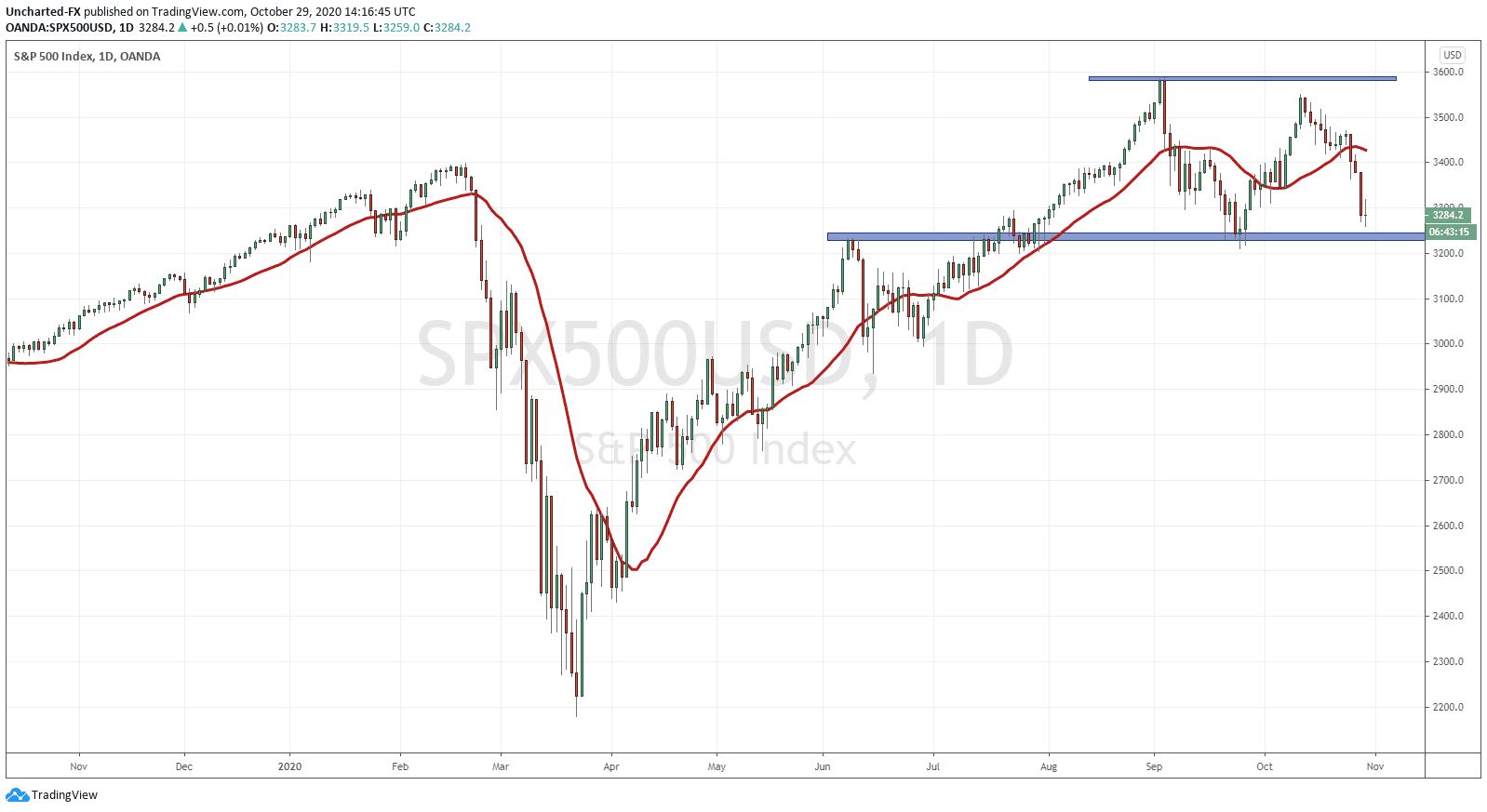

Above I have the charts of the Dow and the S&P 500. Both are looking similar, but the Dow is higher in the danger scale for a potential cuckening.

Many of my followers understand market structure. Nothing moves up or down in a straight line. Price moves in cycles and the three way ALL markets move can be summarized by: an uptrend, range and downtrend. I look for topping patterns which indicate an exhaustion of one trend, and the possible beginning of a new trend. One of those topping patterns is being displayed quite prominently on the daily charts of these equity indices.

I am of course talking about the double top pattern. What this pattern displays is that price attempted to continue the uptrend by making new highs. Attempted being the key word. It did not happen, and instead, price topped either near previous highs, or slightly lower.

The trigger for the pattern is the break below support (price floor). Once again, you can see that price is testing these support zones today, and why price action here for the next few days will be very important.

Currently, at time of writing, stock markets are bouncing from this support. So far so good, but with the high risk event next week, and this lockdown stuff, there are plenty of catalysts for price to drop lower.

If we do get the daily candle close below, we trigger our pattern, and then are officially in a new bear market trend. We should expect lower highs and lower lows to the downside, unless they immediately reverse and cause a fake out break down.

Watch oil, see how it reacts. If oil continues lower, we can say markets are pricing in a second lockdown, and are in danger of seeing price action similar to that of February/March of this year.

I really like the Houndstooth drink.