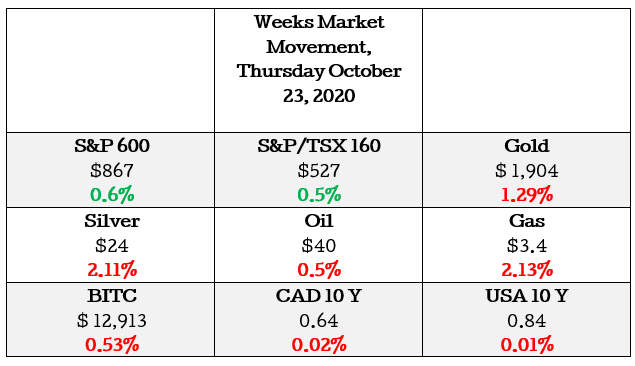

- The S&P 600 & TSX160 are up 0.6% and 0.5% respectively

- Bonds see a rush of capital as investors move into “safer” assets. The Canadian 10 year bond down by 0.02% and the US 10 year bond down by 0.01%

- Paypal news pushes BITC up momentarily as investors appraise this new information. It is down 0.53% for the day,

- Commodities experience a decrease in value as investors move to bonds and common stocks.

Market movers

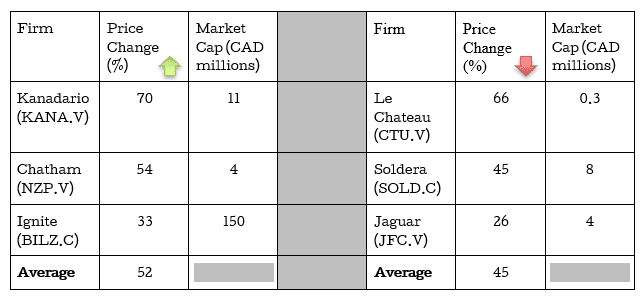

Investors should be aware that when they invest in the small-cap industry they are exposed to more market risk, this should not be seen as a reason not to buy the common stock of these businesses but as an indication that there is great potential to make great buying choices and accumulate wealth.

The saying goes on Wall Street:

“To gain higher returns the investor should take on more calculated risk”

How true this is depending on the person asked, but most would agree. The Small Caps this week did well for their shareholders, the top gainers increased in value on average by about 52% & the “losers” lost about 45% for the day. This shows the bearish sentiment going into the end of the week as uncertainty increases.

Kanadario Gold Inc is a Vancouver based firm that engages in the acquisition, exploration, and evaluation of mineral properties. The company has an option to acquire 100% interest in the Cameron Lake project that comprises 105 mineral claims located in the province of Quebec.

Kanadario to restructure management, the board of directors

2020-10-23 11:28 ET – News ReleaseMr. Dominic Verdejo reports

KANADARIO GOLD ANNOUNCES PROPOSED CHANGE OF LEADERSHIP, NAME CHANGE, AND PRIVATE PLACEMENT FINANCINGS

Le Chateau is a fashion company founded in 1959 in Montreal, Quebec, Canada that designs, imports, and retails a wide range of women’s and men’s apparel, accessories, and footwear.

Le Chateau obtains a court order for CCAA protection

2020-10-23 17:14 ET – News Release

Ms. Emilia Di Raddo reports

LE CHATEAU OBTAINS COURT ORDER FOR CCAA PROTECTION AND CANCELLATION OF THE ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

Up-and-coming news to watch out for and why?

Economic data points

- Canada Interest Rate on Wednesday, October 28, 2020

- Canada Average Weekly Earnings YoY on Thursday, October 29, 2020

- Canada Government Budget Value on Friday, October 30, 2020

Earnings

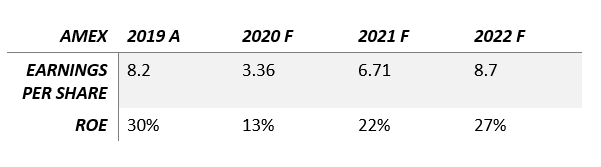

American Express is one of the larger businesses in the payments industry. Because it is exceptionally large and processes millions of transactions it is a great indicator of consumer confidence. The table above is a compilation of the consensus by Wall Street analysts on the direction of the earnings and return on equity of American Express.

As can be seen from the table earnings in 2020 are expected to fall short and there is also compression in return of equity.

This is no surprise as we have seen from some of the economic data points that have come out that retail sales worldwide have decreased in some economies meaning fewer transactions are being made. American Express is expected to recover in late 2022 with their earnings per share of 8.7 and a return on equity of 27%.

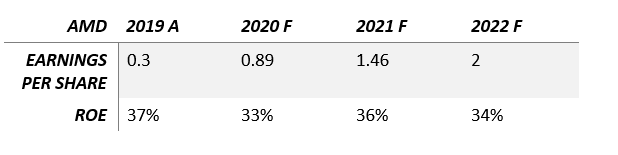

AMD is a semiconductor business and one of the larger competitors in the industry only behind Intel. The semiconductor industry is incredibly competitive and there are many firms failing to attain profitability because of the monopoly structures that have been implemented by the big players.

AMD is expected to beat last year’s earnings per share but feel the compression in return on equity. This compression is probably coming from an increase in the number of shares outstanding as the company uses this method of financing to raise capital. But will fully recover in 2021 by analysts’ expectations.

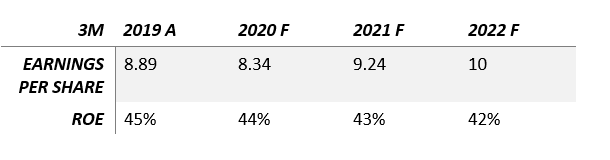

3M is one of the larger industrial manufacturing companies left in the 21st century. In the investment world, 3M known as a dividend King for its consistent growth in dividend distributions to its shareholders. It seems to have weathered the storm and earnings have only slightly dipped but the return on equity has kept steady above 40%.

With only minor reductions in industrial and consumer buying in 2020, a full recovery is expected in 2021 by Wall Street, and by 2022 it should be making close to $10 per share at a return on equity of 42%.

It goes without saying that analysts’ expectations are merely guesses and taking them at face value is a gambler’s game. But this information is not completely useless as it is a great indicator of where the majority of the securities analysts are expecting earnings to go in the foreseeable future.

The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!