So I am going to be honest. Over the weekend, I did have a “what the heck” moment, followed by an “oh my god” moment when I looked at the weekly closes of my charts. Maybe I was over reacting, but I was genuinely worried. As someone who reads up on geopolitics, and the battles going on behind the scene, Hong Kong popped up again. Hong Kong has been a key node for the CCP, as a way to get past US sanctions was to ship out from Hong Kong. This is why mainland China has been creeping into Hong Kong. There is also the matter of the bank HSBC…and rumour has it, the bank has been lending US Dollars to the People’s Bank of China. More on this later, as it ties in with the strategy to hit China.

First of all, readers should know that this currency war has been going on for decades, although it has been heating up dramatically in the past few years. When China was allowed into the World Trade Organization (WTO) in 1991, two major criteria, that ALL members share, were supposed to be met. One was that China would have a free floating currency, and secondly, would allow foreign money in and out of the country freely. Almost 30 years later, China has not met these requirements, and one can argue has taken advantage of other nations. This is a large part of America’s issues with China in this trade war. America argues the Chinese manipulate the Yuan lower to boost exports and import inflation from the US. Also, China forces American companies to build China up. A company like Tesla or Apple which does business in China is not allowed to take their money back to America. The CCP make it very difficult to do so. Hence, these companies either have the option to hold their profits in Yuan, OR use those funds to invest into the local economy to try and increase their business, which builds China up. The second part is crucial as it means American companies do not pay taxes to the US government on Chinese market profits, and that tax money cannot be used to build US infrastructure or aid the US citizen.

It is easy to forget all the US-China trade deal headlines and promises we have had since Covid hit. Remember how the markets would react to every trade war headline? And how we were told a phase 1 deal was close to being signed? Most traders and market participants knew things were not as rosy as they were portrayed behind the scenes.

Advisors such as Kyle Bass has come out saying China is a paper tiger, and the way we force them to the table is by preventing them access to US Dollars. Well, it seems his advice has been taken. The sanctions and tariffs were meant for this, but I believe the Americans may have taken this one step further.

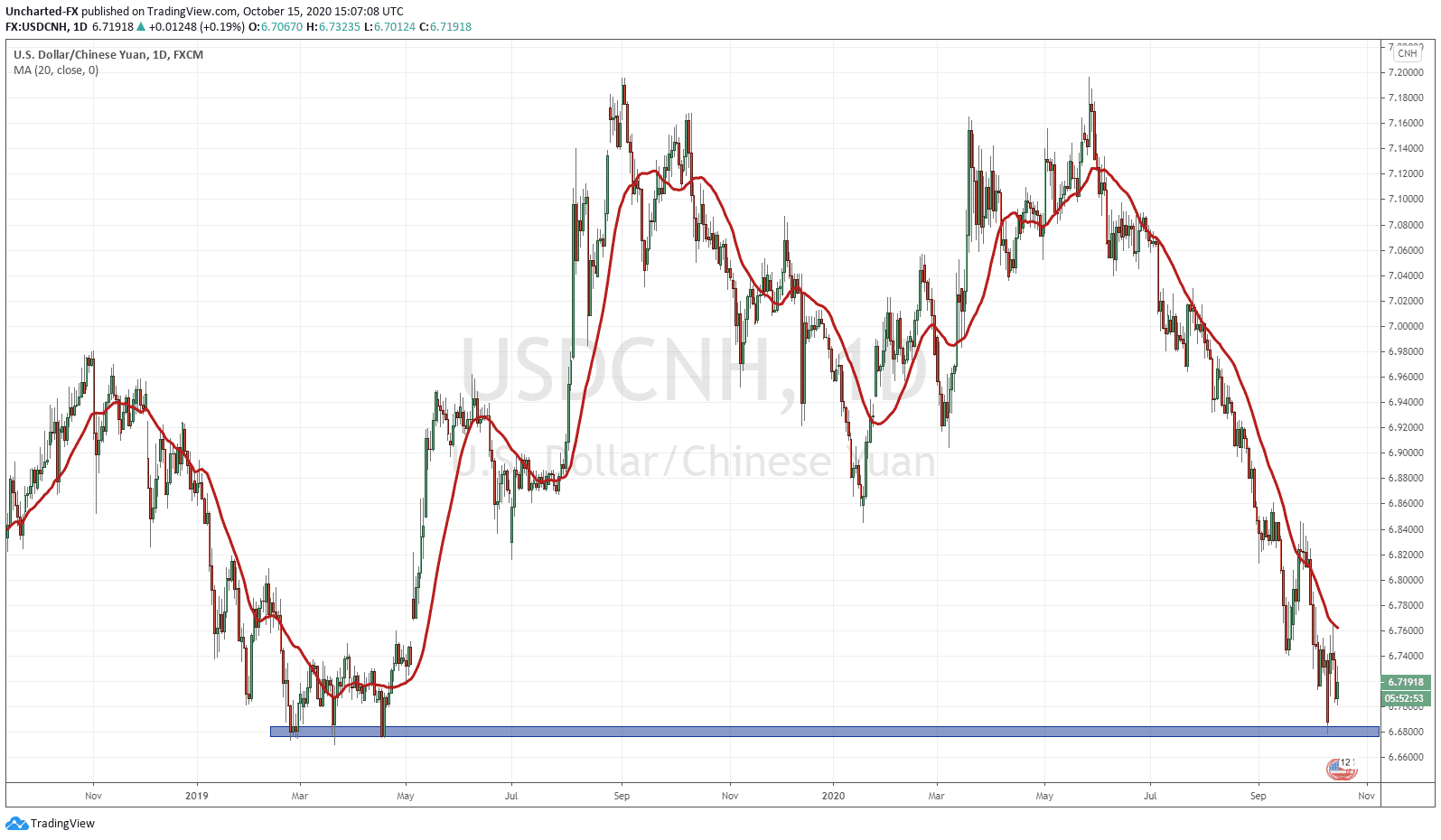

The Yuan has been strengthening…something the CCP does not want. In fact, at the beginning of this week, they took action to make speculation in the USDCNH much more accessible, by making it cheaper for traders to bet against it. Whether we bounce from this 6.68 zone or drop remains to be seen. But remember, China does not have a free floating currency. This means there is another reason the currency keeps on falling.

Enter the US Dollar.

We have seen the US Dollar fall. And I mean fall. The greenback has been in a major downtrend since summer, and many are saying it has to do with the stimulus and money printing the Americans are taking. The Dollar bulls believe that every western nation will be doing this. If they all are, what fiat would you want to hold? The US Dollar still is the reserve currency, and quite frankly, will fare much better than Europe, Britain, Canada, Australia etc. So for the Dollar bulls, this fall doesn’t make much sense, and many are predicting a large Dollar move higher. But what if the Dollar is being forced down by say the Fed?

Crazy I know, but a weaker dollar means that other currencies would need to be going higher. This is the dangers of the currency war. We have even heard Lagarde over at the European Central Bank, express some concern regarding the stronger Euro. Even hinting to eventual intervention.

So this drop in the US Dollar can be seen as an upping of the currency war against China, which is forcing the Yuan to rise. To me, this explains the Dollars decline.

Oh but wait. The real craziness and battle can be seen on the USDHKD. Before we look at that, I just want to post this article regarding the US’ “nuclear option” against China. Striking and breaking the Hong Kong Dollar peg.

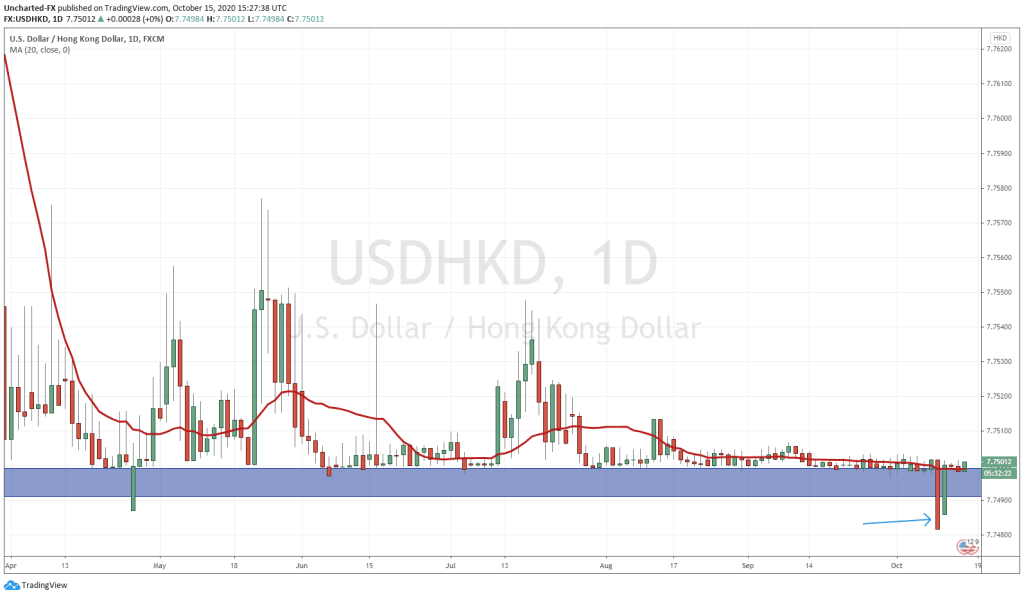

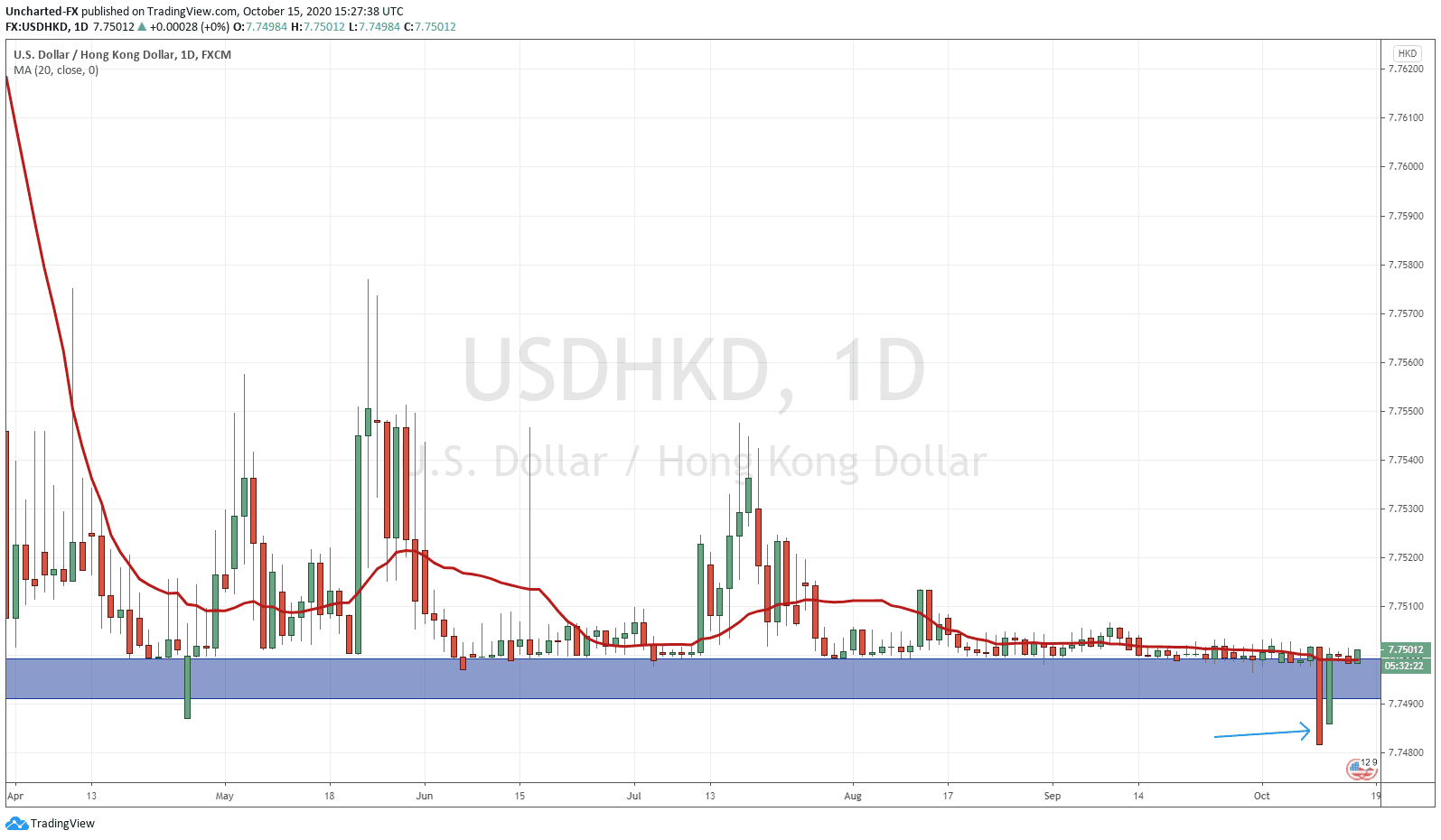

In the past, I have referred to the USDHKD trade as the free money trade, as we know the peg support will hold. However, look at the daily candle close on Friday! Big red which closed BELOW the peg support. Now it is not the lowest it has been, we have been lower way back in 2009, but I think the timing, and more importantly, the price action, plays a large part.

The USDHKD just cannot get a bid higher. It keeps getting stalled, and you can see the wicks indicating selling pressure. This begs the question: are the Americans making it difficult for the Hong Kong Currency Board to buy Dollars? If so, are they running out of Dollars? Furthermore, could a bank like HSBC also be lending Dollars to both the People’s Bank of China and the Hong Kong Currency Board? Things you must think about especially the way this currency has been acting.

You can see that on Monday, the peg was propped back up to its range. However, I think you should be watching this pair and the US Dollar, because it points to a war going on behind the scenes.

What adds even more drama to this, is the upcoming US election. If you are China, you have a motive to see the Democrats win. They will give you an easier trade deal, will probably roll over on the currency war front, and two major Chinese geopolitical wins came from Democratic Presidents. President Clinton was the one who got China into the WTO, and President Obama was the one who trusted the Chinese when they told him they were sending ships into the South China Sea for scientific purposes…just ignore the aircraft carriers and missiles.