What a week we had in the markets, the ebbs and flows of the stock market can be overwhelming at times and I am here to share with you the simplest advice I have ever received:

Stay the Course!

John C. Bogle

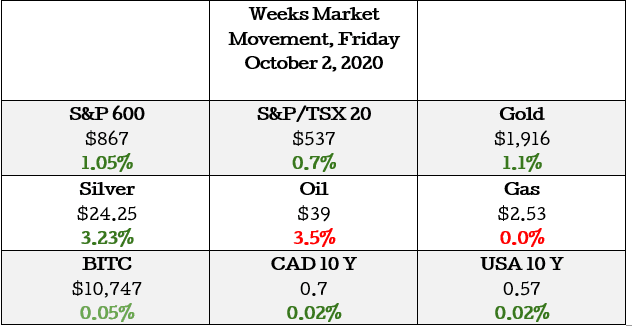

Market Movers

Investors should be aware that when they invest in the small-cap industry they are exposed to more market risk, this should not be seen as a reason not to buy the common stock of these businesses but as an indication that there is great potential to make great buying choices and accumulate wealth.

The saying goes on Wall Street:

“To gain higher returns the investor should take on more calculated risk”

How true this is depending on the person asked, but most would agree.

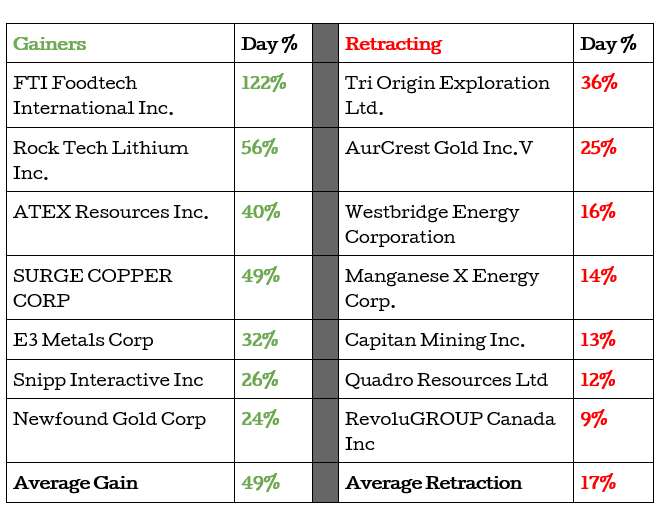

The Small Caps this week did well for their shareholders, the top gainers increased in value on average by about 49% & the “losers” lost about 17% for the day.

This shows the bullish sentiment going into the end of the week.

Today’s Big Winner was: FTI Foodtech International Inc. (FTI.V)

This stock is up 122% as they are coming off the back of a monumental announcement.

But before we rush to their most recent news release let’s take a few seconds to look at what the business actually does.

The primary business of the Company is the resale of liquidation merchandise. The Company exchanges goods on Barter Exchanges for which transactions are tendered using Barter Exchange Dollars.

There are few things in there that need a little more explaining. This is an incredibly unique business model and is not as easy to decipherer as dominoes pizza who make and deliver pizza.

Liquidation refers to the process of selling off a company’s inventory, typically at a big discount, to generate cash.

Revenue from the resale of liquidation merchandise is recognized at the time of shipment and transfer of title to the customer has occurred (primarily to wholesalers and retailers) and collectability is reasonably assured. Sale of liquidation merchandise through the Barter Exchanges results in the earning of barter credits which are measured at the fair value of the barter credits received or receivable.

Now the press release:

FTI Foodtech International Inc. to Market Rapid-Result Serological COVID-19

Antibody Test Kit

TORONTO, Oct. 02, 2020 — (TSX Venture: FTI) — FTI Foodtech International Inc. (“FTI”) has obtained a letter of authorization from Rapid Virus Detect Ltd. – a medical device importer and distributor in British Columbia – for marketing, sales and aftersales services of their rapid-result, serological COVID-19 Antibody Test Kit, worldwide.

This COVID-19 (SARS-Co-V-2) IgM/IgG Antibody Test Kit is manufactured by Wuhan EasyDiagnosis Biomedicine Co., Ltd of Wuhan, China. The kit, which provides qualitative detection of anti-SARS-CoV-2 IgM and IgG antibody in human serum, plasma, and whole blood, is a nucleic acid extraction reagent test for use by health professionals. The test kit will detect the b immunoglobulin IgM (the fast-acting antibody) and the immunoglobulin IgG (the long-lasting antibody) within 15 minutes and will function as a screening test for COVID-19. Health Canada’s review for approval is in progress. CE IVD Certified. ISO Certified. Approved by China National Drug Administration.

FTI continues to market a variety of products, including disposable and fabric face masks, face shields, goggles, hand sanitizers, and thermometers to meet the need for personal protective equipment (PPE) and safety supplies aimed at minimizing the spread of COVID-19. Certification is indicated by the product.

Up-and-coming news to watch out for and why?

Looking ahead for the week we have some remarkably interesting economic news coming out that affects the manufacturing, general stock market and business confidence.

- The United States 3 Month Bill Auction on Monday, October 05, 2020

- The United States 6 Month Bill Auction on Monday, October 05, 2020

- United States Government Bond 10Y Auction on Wednesday, October 07, 2020

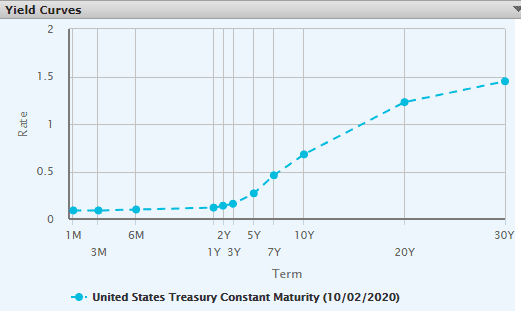

It will be nice to watch the yields on the bonds being sold on Wednesday and Thursday to see how much the market feels the government needs to compensate them for the expected inflation.

Bonds fascinate me, because it is like buying fire insurance from the very entity who will cause the fire.

The yield curve above shows that investors feel the economy will revolver in the next few months. This shape is what we would expect in “normal” times or an economic recovery.

Earnings

- Delta Airlines on Thursday, October 08, 2020

![]()

Airlines continue to struggle and most analysts on a wall street feel this will persist for a few more years as they wait for taxpayer’s money in the form of government bailouts.

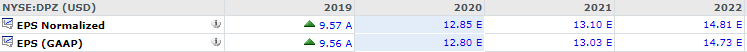

- Domino’s Pizza on Thursday, October 08, 2020

Domino’s on the other hand are expected to do well, showing its ability to be “COVID recession-proof”.

It would be nice to watch over time how the bonds being sold affect the demand for the risky stock market and how earnings for companies in capital-intensive industries vs noncapital intensive industries are holding up.

HAPPY HUNTING!