What a week we had in the markets, the ebbs and flows of the stock market can be overwhelming at times and I am here to share with you the simplest advice I have ever received :

Stay the Course!

John C. Bogle

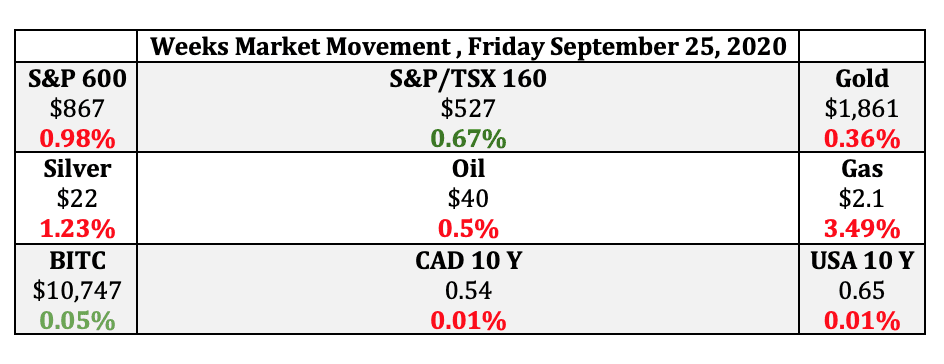

Market Movers

Market Movers

Investors should be aware that when they invest in the small-cap industry they are exposed to more market risk, this should not be seen as a reason not to buy the common stock of these businesses but as an indication that there is great potential to make great buying choices and accumulate wealth.

The saying goes on Wall Street :

“To gain higher returns the investor should take on more calculated risk”

How true this depends on the person asked, but most would agree.

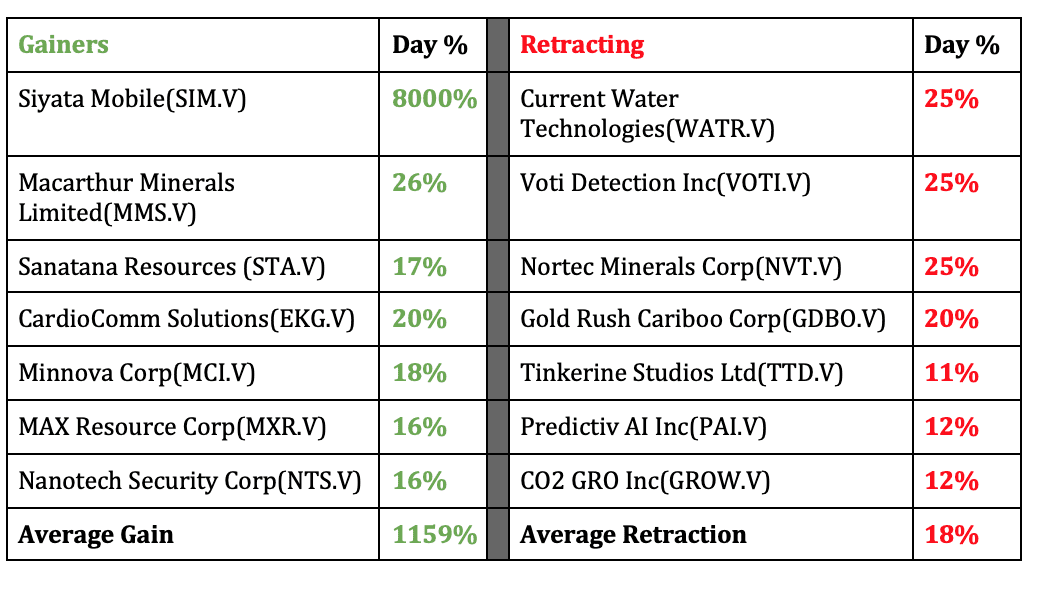

The Small Caps this week did well for their shareholders, the top gainers increased in value on average by about 1159%(keeping in mind how skewed this average is we can also use 18% removing the effects of Siyata) & the “losers” lost about 18% for the day.

This shows the sluggish sentiment going into the end of the week.

Today’s Big “Winner” was ( the reader should take note of the quotations used)

Siyata Mobile(SIM.V)

Siyata Mobile to roll back shares 1:145

2020-09-23 17:37 ET – News Release

Mr. Marc Seelenfreund reports

SIYATA INITIATES SHARE CONSOLIDATION AS PART OF RECENTLY ANNOUNCED STRATEGIC INITIATIVES

Siyata Mobile Inc., in support of its recently announced strategic initiatives, will proceed with the consolidation of the common shares of the company on the basis of one post consolidation share for 145 preconsolidation shares. The consolidation will become effective at the close of market on Sept. 24, 2020, and the post consolidation shares will commence trading at the open of the market on Friday, Sept. 25, 2020.

Today we take a step back from the stock market and accounting magic used by management and their helpers and really look at this recent news and take a deep dive into the minds of the Directors of Siyata, Marc Seelenfreund the CEO, and Gerald Bernstein the CFO who is in charge of the corporate financial choices of Siyata.

A quick lesson in corporate financial management: Stock Splits and reverse splits

All companies that are publicly traded have a set number of shares outstanding at any one point in time. The directors of the company are the only ones who govern when and how much new shares to issue or buyback, and usually, they cast a vote at Annual meetings to get current shareholder approvals.

This process is then left to the management team, specifically the CFO, to execute choices that would preserve shareholder value and keep the costs low.

This entire process has been debated for many years by academics. Some are on the side that it does not do much to form the intrinsic value of the business and others argue it introduces market risks(a more volatile stock price).

Stock Splits

The most common stock split is a 2-for-1 stock split, an additional share is given for each share held by a shareholder. So, if a company had 30 million shares outstanding before the split, it will have 60 million shares outstanding after a 2-for-1 split.

Apple(AAPL.NAS) and Tesla(TSLA.NAS) both went through the process of splitting their common stock recently.

Apple’s stock has split five times since the company went public. The stock split on a 4-for-1 basis on August 28, 2020, a 7-for-1 basis on June 9, 2014, and split on a 2-for-1 basis on February 28, 2005, June 21, 2000, and June 16, 1987.

The Board of Directors approved and declared a five-for-one split of Tesla’s common stock in the form of a stock dividend to make stock ownership more accessible to employees and investors.

Each stockholder of record on August 21, 2020, will receive a dividend of four additional shares of common stock for each then-held share, to be distributed after the close of trading on August 28, 2020. Trading will begin on a stock split-adjusted basis on August 31, 2020.

A stock’s price is also affected by a stock split. After a split, the stock price will be reduced (since the number of shares outstanding has increased)

Reverse Stock Splits

A reverse split is the opposite transaction and reduces the number of outstanding shares and pushes the stock price higher. A stock’s price is also affected by this split and increases the price.

Siyata Mobile(SIM.V) recently did this and the price change went up by 8000%. They did a 1-to-145 split and cut the number of outstanding shares. This increase in price does not change the intrinsic value of the business or market cap but is a reevaluation of the price to match up to the reduced number of the shares.

Most companies use stock splits to allow investors the ability to buy shares at a “cheaper” price, for example, Apple’s stock went from $500 per share to $150 per share.

Reverse splits on the other hand are less common and are done for many reasons such as:

- This procedure is typically used by companies with low share prices that would like to increase their prices.

- A company may do this if they are afraid their shares are going to be delisted or

- as a way of gaining more respectability in the market

Although the number of outstanding shares increases or decreases and the price per share decreases or increases, the market capitalization (and the value of the company) does not change. As a result, stock splitsreverse splits help make shares more affordable to smaller investors and provide greater marketability and liquidity in the market or allows companies to avoid delisting if their stock price was too low.

Up-and-coming news to watch out for and why?

Looking ahead for the week we have some very interesting economic news coming out that affects the manufacturing, general stock market, and business confidence.

- Raw Materials Prices Month to Month

The raw materials price index (RPMI) reflects the prices paid by Canadian manufacturers for key raw materials. Unlike the industrial product price index, the RMPI includes goods that are not produced in Canada. The announcement will be on Tuesday, September 29, 2020

- Canada GDP Month to Month

In Canada, the Leading Economic Index refers to GDP Growth MoM which measures the change in the value of the goods and services produced by the country’s economy compared to the previous month. The announcement will be on Wednesday, September 30, 2020