Well it did indeed turn out to be a big day yesterday when Jerome Powell took the stage. Many were expecting a Powell cannon, but he did not deliver that. There is another group of market watchers who believed the Fed conference would be exactly like this. Since the elections are coming up, and the Fed is apolitical, they would not change much of their stance. It does get a bit tricky when the Fed needs to keep markets propped not necessarily to support a candidate, but one can argue, to prevent an entire system collapse.

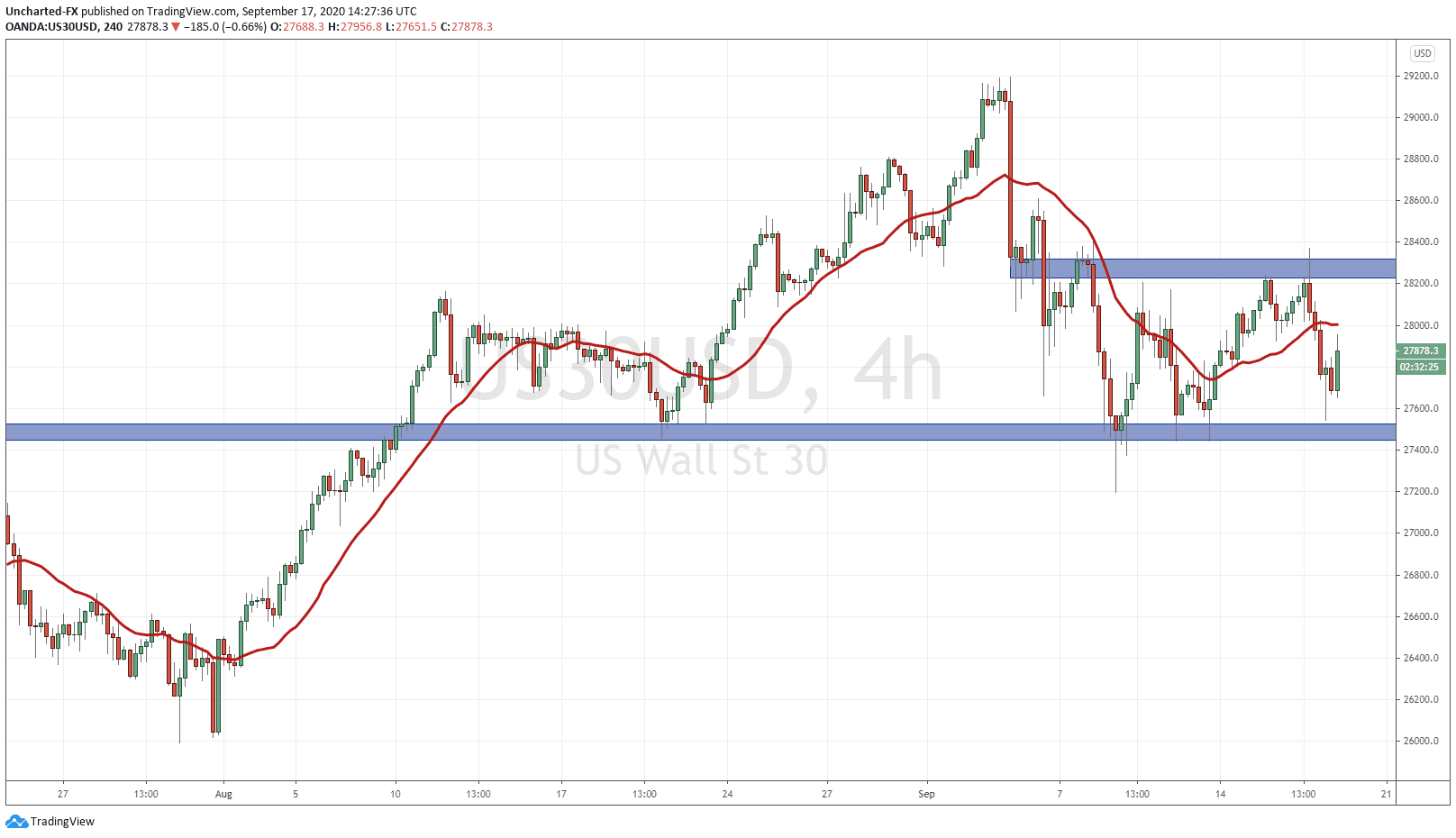

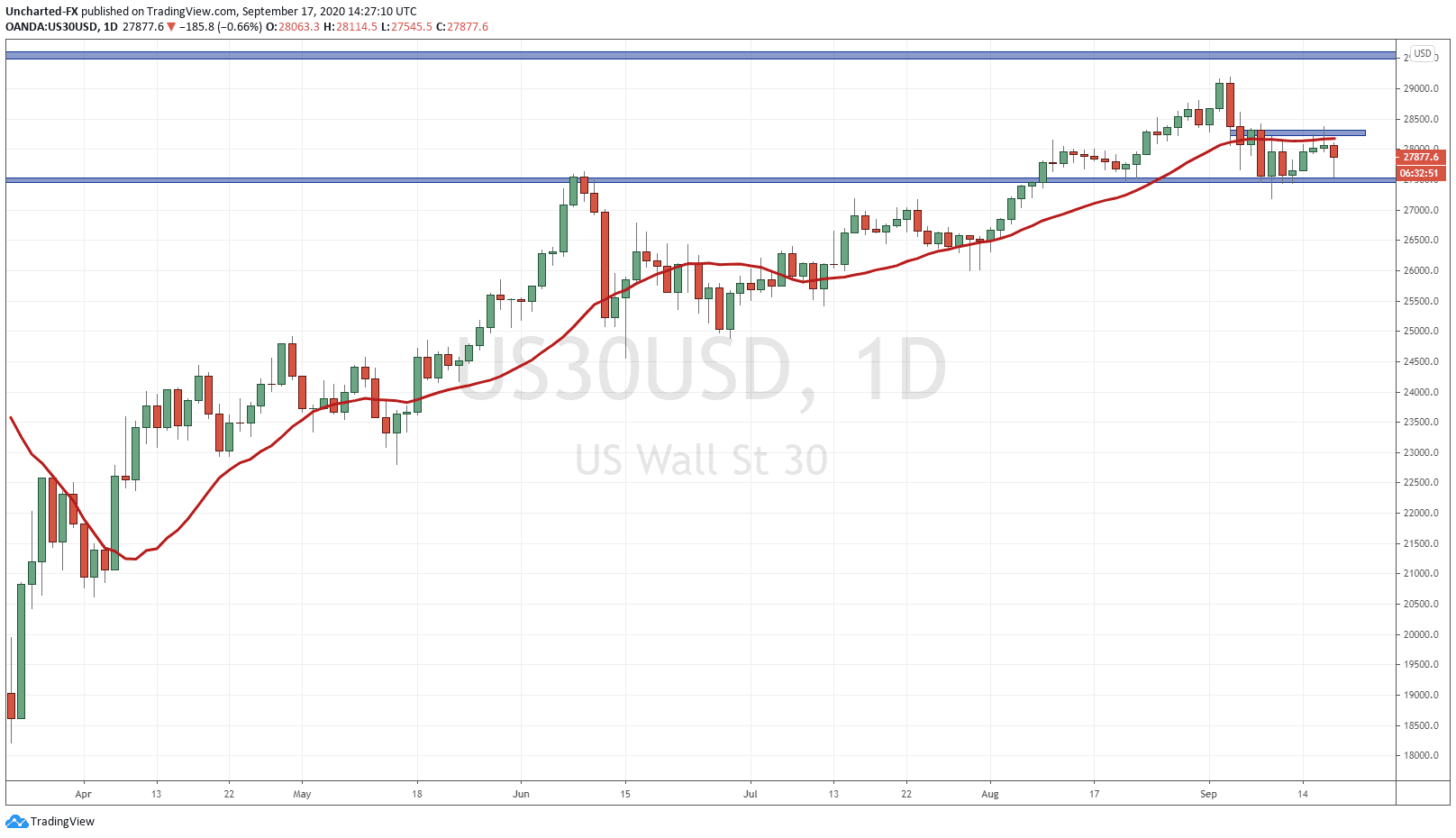

Before we delve into Powell’s comments, let’s take a look at the chart of the Dow. The analysis applies with the S&P 500 as well as the Nasdaq. The 4 hour charts of all these indices look the same, and the daily charts display the same market structure.

I have been speaking about the double bottom pattern on the 4 hour charts. We have been watching this since the beginning of the week. No new lower lows, and price instead bounced back.Well during the conference, markets were moving higher, and it seemed that we would get that break above resistance at 28200. I know I always stress that the trigger is to await the candle closes to trigger our trades. Another good example of that here. When we await the close for our trigger, sure we miss some of the move, but what we do is we increase the probability of our success for the trade. And that is all trading is: a business of probabilities.

Fast forward to current price, you can see that after an overnight market sell off, equity markets have opened back at the major support levels. While markets range here, I would not be doing anything, as it does not meet my trade criteria. We do need to either see that break above on the 4 hour chart, or…

See a break below this major support on the daily chart…which would then form a head and shoulders pattern. The trigger will be a daily candle close below the lows…which means that another leg lower is possible.

So let us take a look at Powell’s comments.

My readers know that interest rates will have to remain low for a very long time. In fact, it may not even be possible to ever hike interest rates anymore. With the amount of debt required to create economic growth, and a V-shaped recovery, a hike in interest rates would be enough to destroy governments and citizens. Jerome Powell reassured the markets that cheap money is here to stay. Well to at least 2023. But as many talking heads on financial media and market analysts have said, we do not expect any hikes through 2023.

The second major point was that the Fed will hold interest rates low until inflation goes above 2% for “some time”. This inflation is targeted for 2023, but the key point is that the Fed has targeted an inflation rate of over 2% for the first time ever. Still a little bit vague though as the Fed did not give us an actual target. Perhaps that is the ‘ammunition’ the Fed has left for a different meeting.

By the way, the Fed does see some hope. The GDP and unemployment forecasts for 2020 have been updated to now showing a smaller decline in GDP and a lower unemployment rate for the year. This tweak came from the stronger than expected economic data released recently.

Powell also mentioned that private forecasters are betting on more fiscal support from the government…something which may be on hold as the Democrats reject new stimulus bills. On a political level, any new stimulus bill will not be seen as President Trump doing it for the people, but as a way to gain votes for the election. The Democrats have an incentive to prolong any stimulus bill.

“So again, I would say the fiscal support has been essential in the good progress we see now and finally I’ll note just about all — the overwhelming majority — of private forecasters who project an ongoing recovery are assuming there will be substantial additional fiscal support,” Powell said.

This is in line with my analysis. More cheap money is required going forward from both the monetary and fiscal side. This will not stop and it cannot stop.

Finally, even though the Federal Reserve is close to 0% interest rates, and have said that they will not go into the negative (for now), the Fed reassured us that they still have plenty of ammunition left:

“First of all, we do have lots of tools, we’ve got the lending tools, we’ve got the balance sheet, we’ve got forward guidance. There’s still plenty more that we can do. We think that our rate policy stance is an appropriate to support the economy. We think its powerful….But again we have the other margins tat we can still use. So no, certainty we’re not out of ammo,” Powell added.

We know the Fed has been buying mortgage backed securities and now corporate bond ETFs. The Fed has said this will continue.

This is where the market may have been expecting a bit more from Powell. They did not see the statement as being dovish enough. Perhaps market participants wanted the Fed to announce they will buy more and increase their balance sheet…they just said that is an option and will continue to buy at the same amounts. Honestly, the next level would be copying the Bank of Japan, the European Central Bank, and the Swiss National Bank who actively buy stocks. Maybe that comes when negative rates become a reality.

So going forward, I do not think much has changed. Stocks remain the only place to go for yield in this macro environment. We know central banks will continue to keep markets propped. As per before, the only thing which can bring these markets down is some sort of black swan event. The elections are coming up and I do expect that whatever party wins, the other party will NOT accept the results. A very high chance of violence on the streets, and perhaps even months of trying to resolve who won the election. I have never traded in an environment like that, but markets hate uncertainties, and that scenario would be the most extreme form of the uncertainty of America’s future.