Last week was slow in terms of the economic data, but buckle up, that is all about to change. Markets are at major zones on the charts, and we have a lot of data and themes to get through this week. Earnings will be the big story as many analysts are predicting some of the worst earnings for companies we have ever seen. Once again, has all this negative earnings news already been priced in certain stocks? I tend to believe they have. We started off with a bang with Pepsi announcing stronger than expected Q2 earnings.

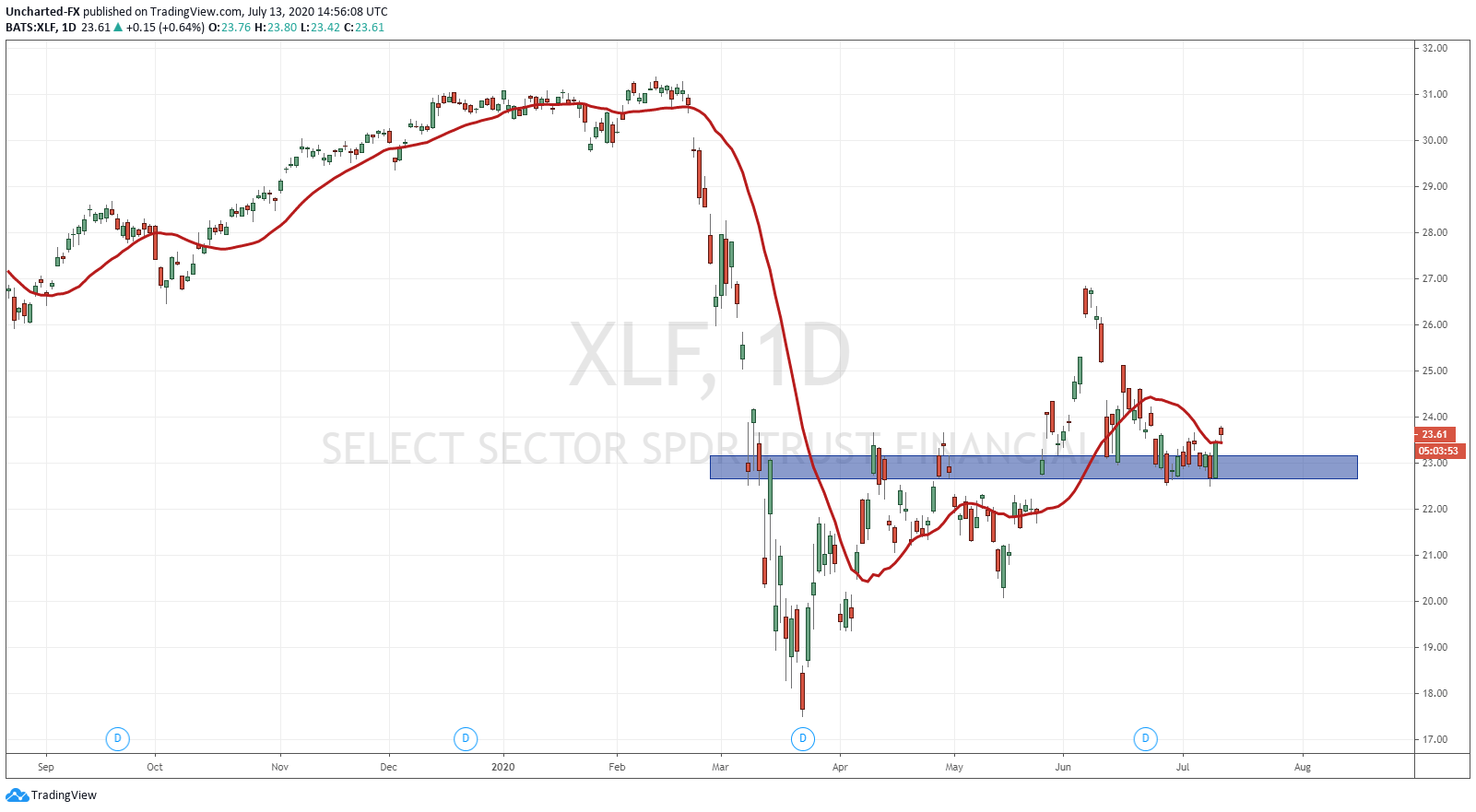

On deck we have major banks tomorrow like JP Morgan, Citigroup and Wells Fargo. Their earnings could get ugly…but the big story will be how the earnings shape up heading into Q3 when the Fed’s policies regarding bank dividends and share buybacks limitations kick in. In terms of the XLF, we are still retesting the support zone we broke out of back in May. We did pullback to retest on June 15th, but the move did now carry enough momentum higher. Critical juncture for the financial stocks.

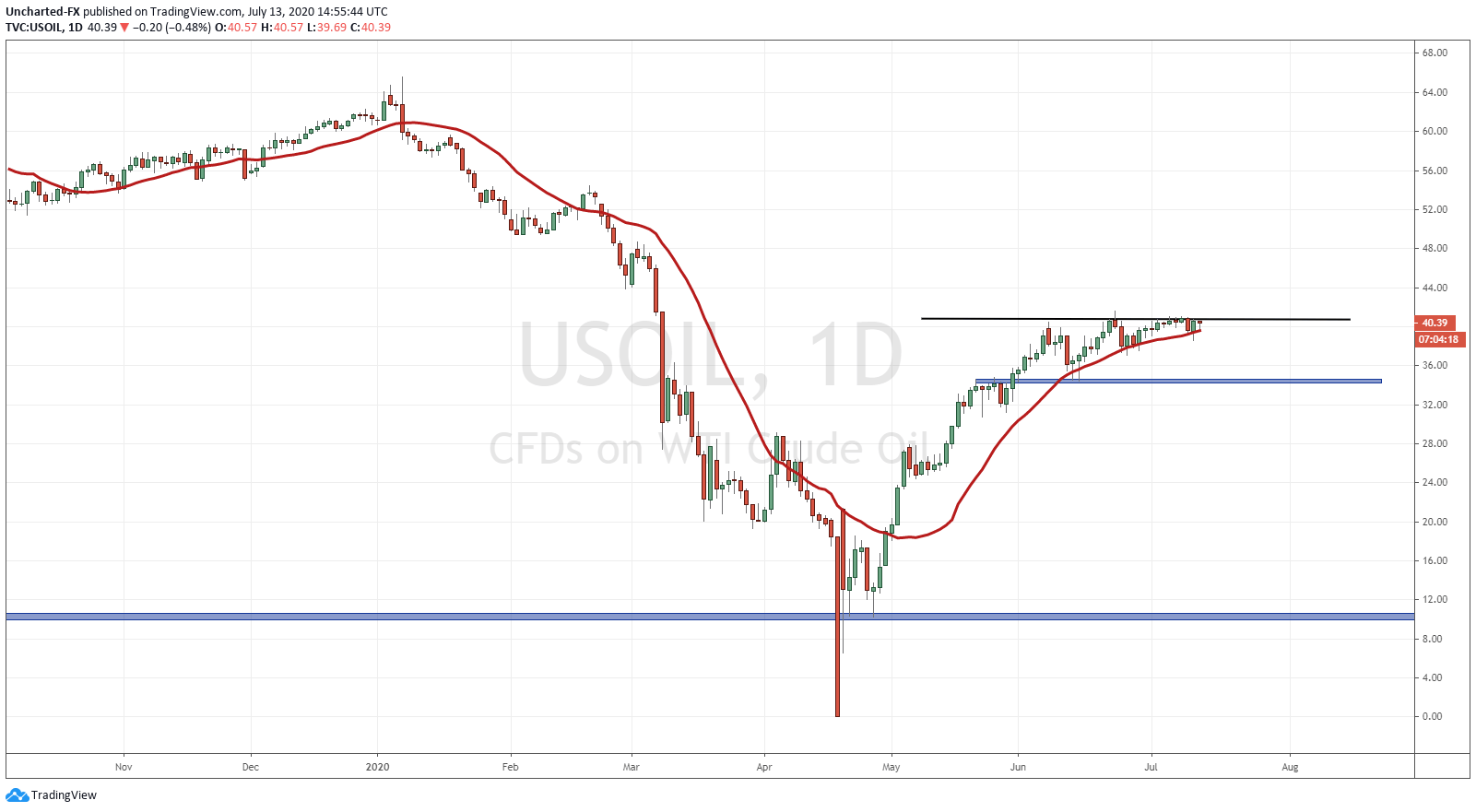

What could help the financials out? Oil. Keep your eyes on Oil and a potential breakout. OPEC is preparing to taper production cutbacks and ease output cuts as they anticipate demand recovery. So far, this is weighing in on Oil markets. However, it still has its eyes set on the 40.70 zone. We have not been able to break above this to continue to momentum, AND we have been trying to break above for the past week. Something to consider…but if Oil does manage to somehow move higher here, it would be bullish for the equity markets as it would impact both the energy and the financial sector. The financial sector because many banks did lend to Oil companies when Oil crashed in 2014, even when they did not want to, so they are heavily intertwined with Oil. Certain banks in Canada are REALLY heavy on Oil.

The economic data is packed as we have a few interest rate decisions this week:

Monday: British GDP (May), German Harmonized Index of Consumer Prices (June).

Tuesday: ECB Bank Lending Survey, German ZEW Survey (Economic Sentiment), USD CPI ex food and energy (June), British CPI (June), Bank of Japan Interest Rate Decision.

Wednesday: Bank of Canada Interest Rate Decision, New Zealand CPI (Q2), Aussie Employment (June), British Unemployment Rate (May), Chinese GDP (Q2).

Thursday: ECB Interest Rate Decision, US Retail Sales Control Group (June), EU Leaders Special Summit.

A very busy week indeed.

There are a lot of stories and themes that will continue this week. How will new virus cases and responses impact the markets? We have so far seen markets downplay a lot of this data which is obvious in how markets have rallied. Any news on vaccines or treatments will be positive. Today pre-market we heard that Pfizer and BioNTech have received fast track status when it comes to vaccines under Operation Warpspeed.

Followers and readers of my work know that I believe the black swan event is more likely to come from the geopolitical side. It seems like it is US China relations and trade deal talk which impacts markets more than Covid news. The drama will continue and the plot thickens as the President last week admitted that there would be no second trade deal. I am particularly focused on these types of headlines as they have a real chance to pressure markets.

In terms of themes, we need to look at the US Dollar, Gold and the 10 year yield.

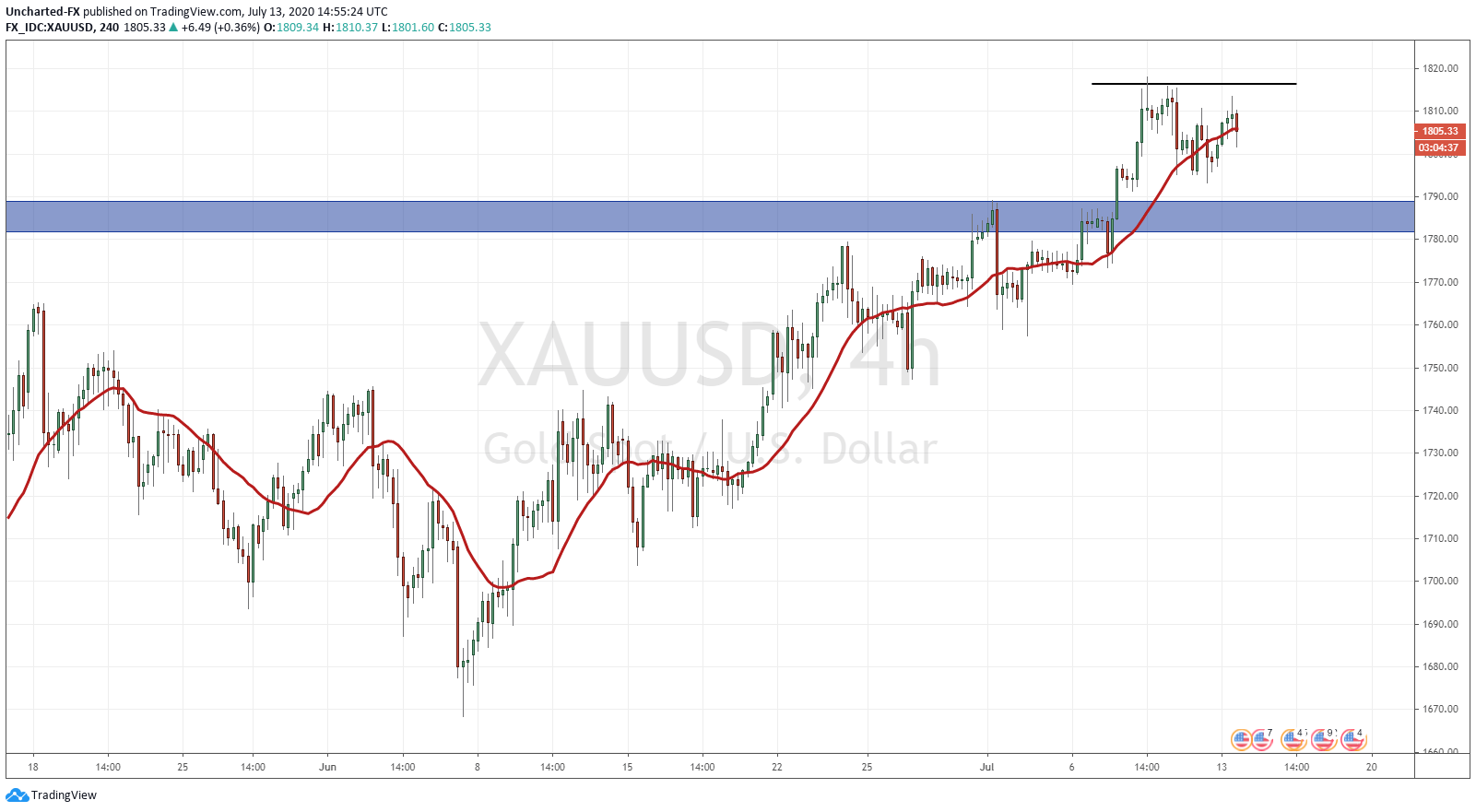

Gold has broken above my major resistance zone at the 1790 zone. Very significant. From here, it all depends on the retest and follow through. Will Gold be able to continue the uptrend by breaking above last week’s highs? If Silver is a way to gauge then it is likely. The white metal has retested its breakout zone at 18.50 and has broken above last week’s highs already!

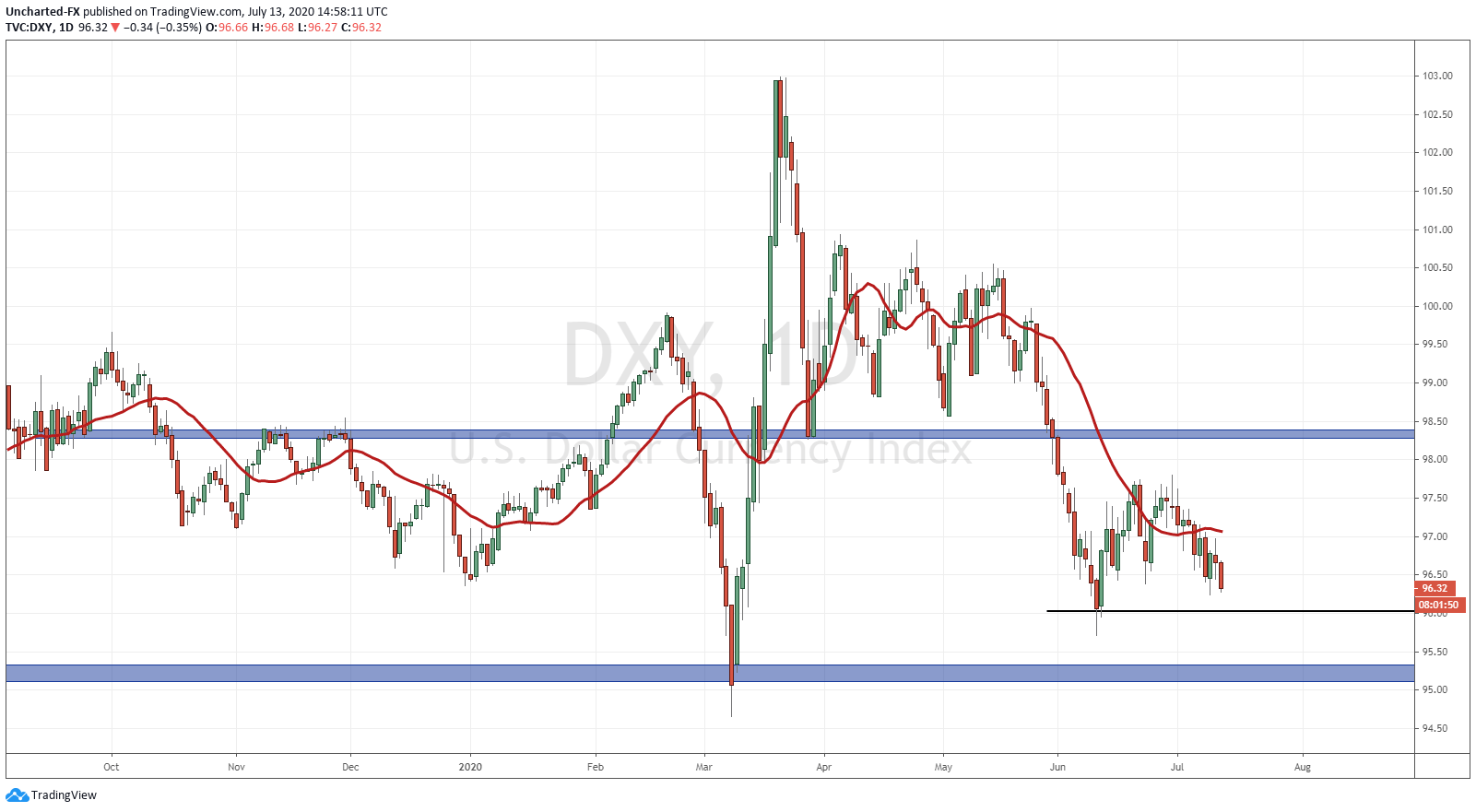

The US Dollar remains between two zones: 97.70 and 96.00. Just purely on a technical approach, the Dollar seems it wants to continue the downtrend it started when it broke below 98.30. Let’s keep our eyes for this, as a weaker dollar is also stock market positive. The Dollar is seen as a safe haven currency, so it could catch a bid if an event occurs. A good way to gauge fear in the markets.

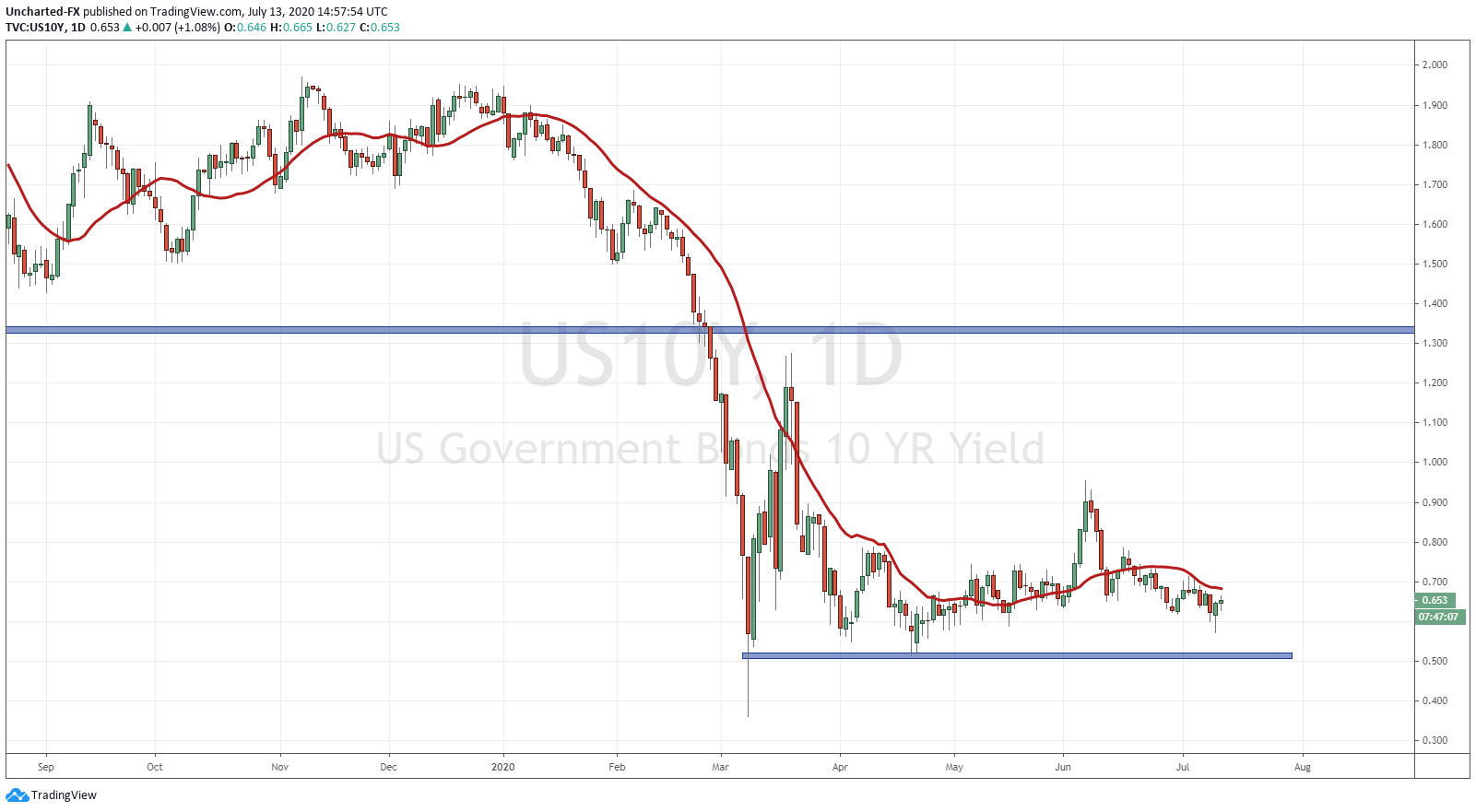

Speaking about fear, the preeminent risk off asset is of course bonds. Asset allocation models used by fund managers are all about stocks and bonds. The bond/debt market is the largest in the world. I know they can be a bit boring, but you must pay attention to them. My favourite is of course the 10 year yield. Yield is approaching the lower limits of 0.50, and we would want to see yield rise from here. Remember, a break below 0.50 indicates that money is running for the safety of bonds, and is leaving the stock markets to do so. This would indicate fear due to some sort of event or data. But it does seem like we could form a ranging pattern here. The stability would be stock market positive.

Finally, let’s talk about equity charts. There are 5 different equity charts I have my eyes on.

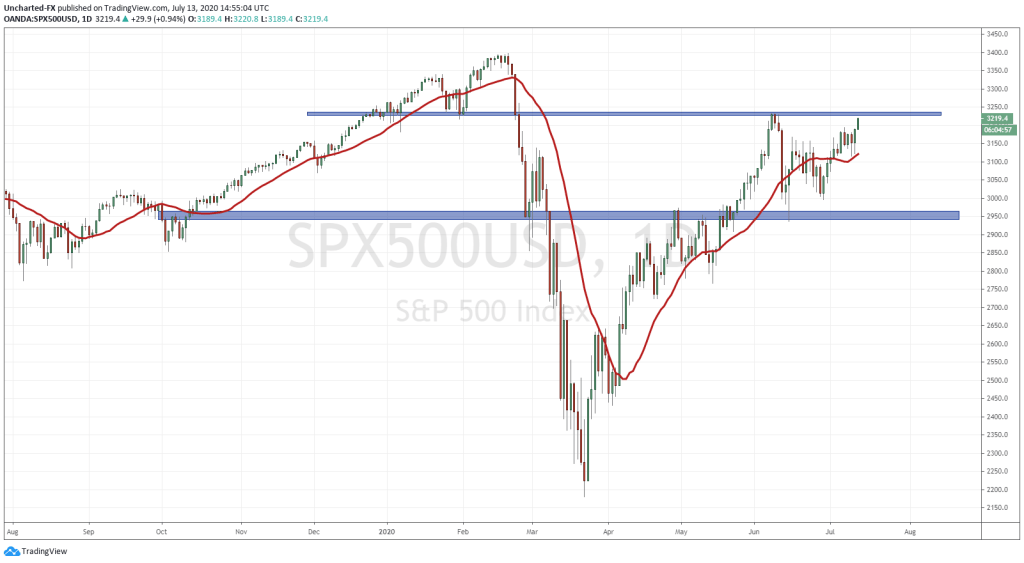

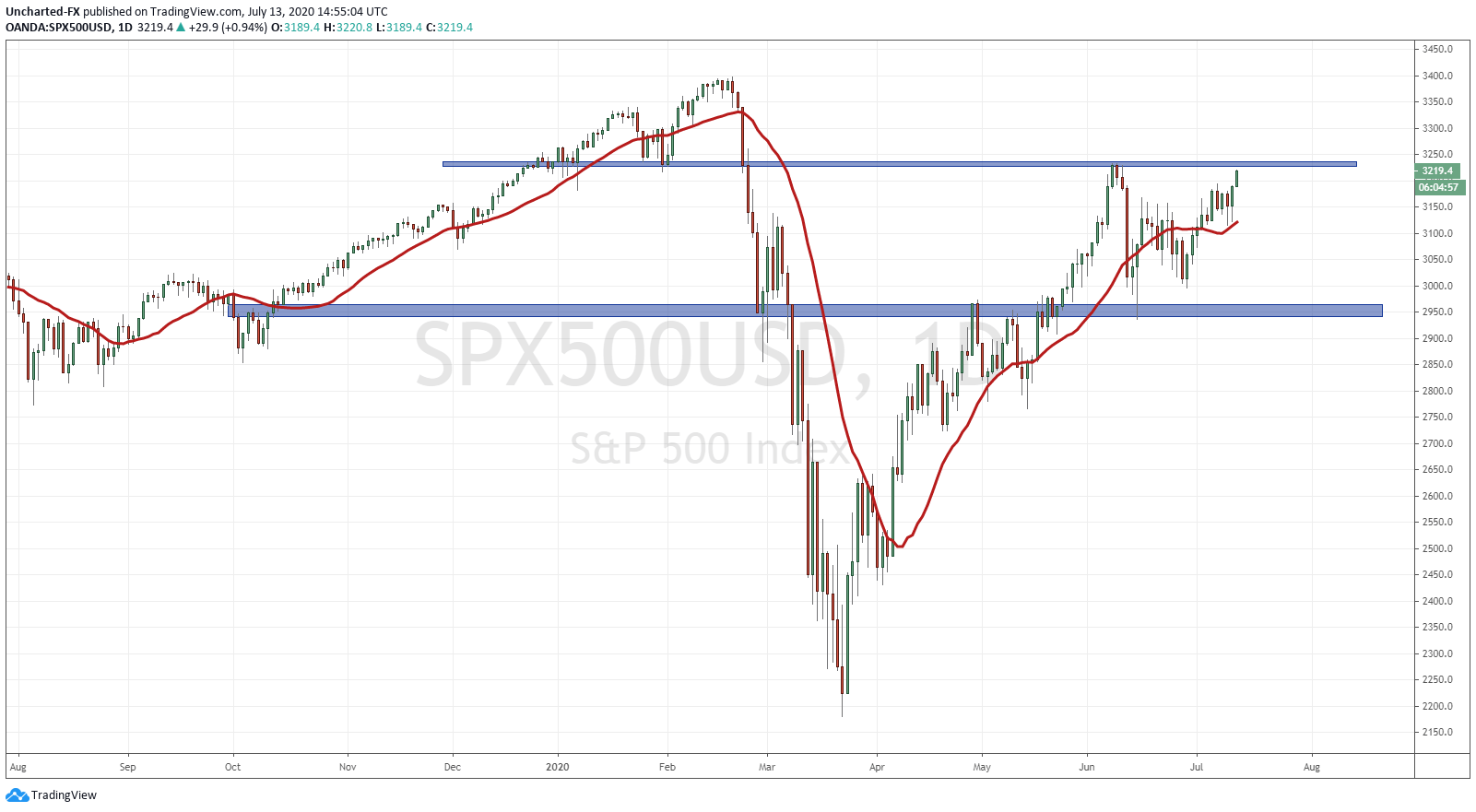

Right off the bat, it is the S&P 500. We are back at what some analysts call the “Wuhan zone”. The support we broke below back in February and led to the incredible sell off. What was once support, has now become resistance. Expect a battle here. We did test this zone once again on the rally back in June. I highlighted the importance of this zone back then and I am highlighting the importance of it once again. Key zone for the markets this week. If we break above, believe it or not but we are more likely to make all time record highs on the S&P. If we reject…then we could be watching for a double top pattern with a trigger at the break of 3000.

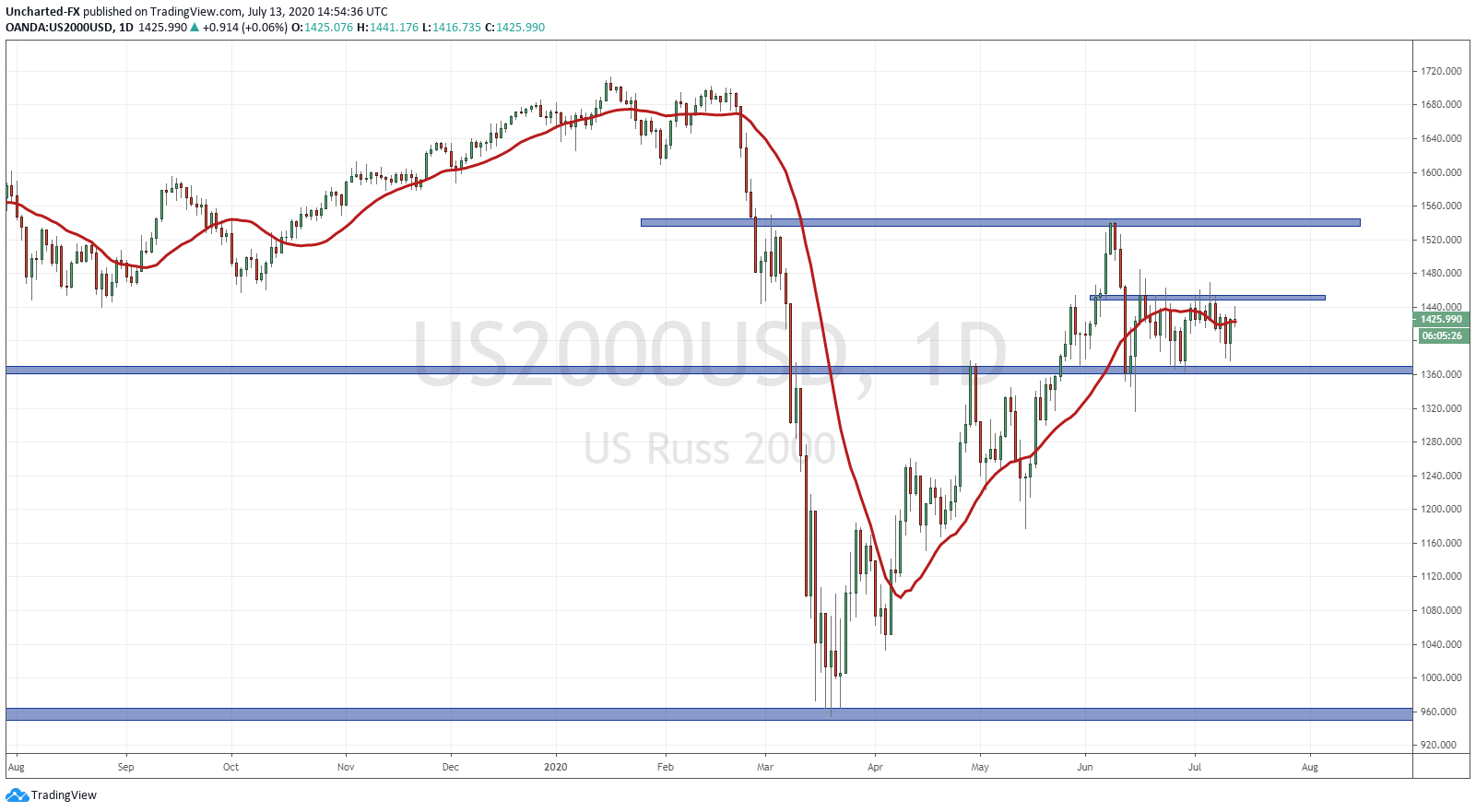

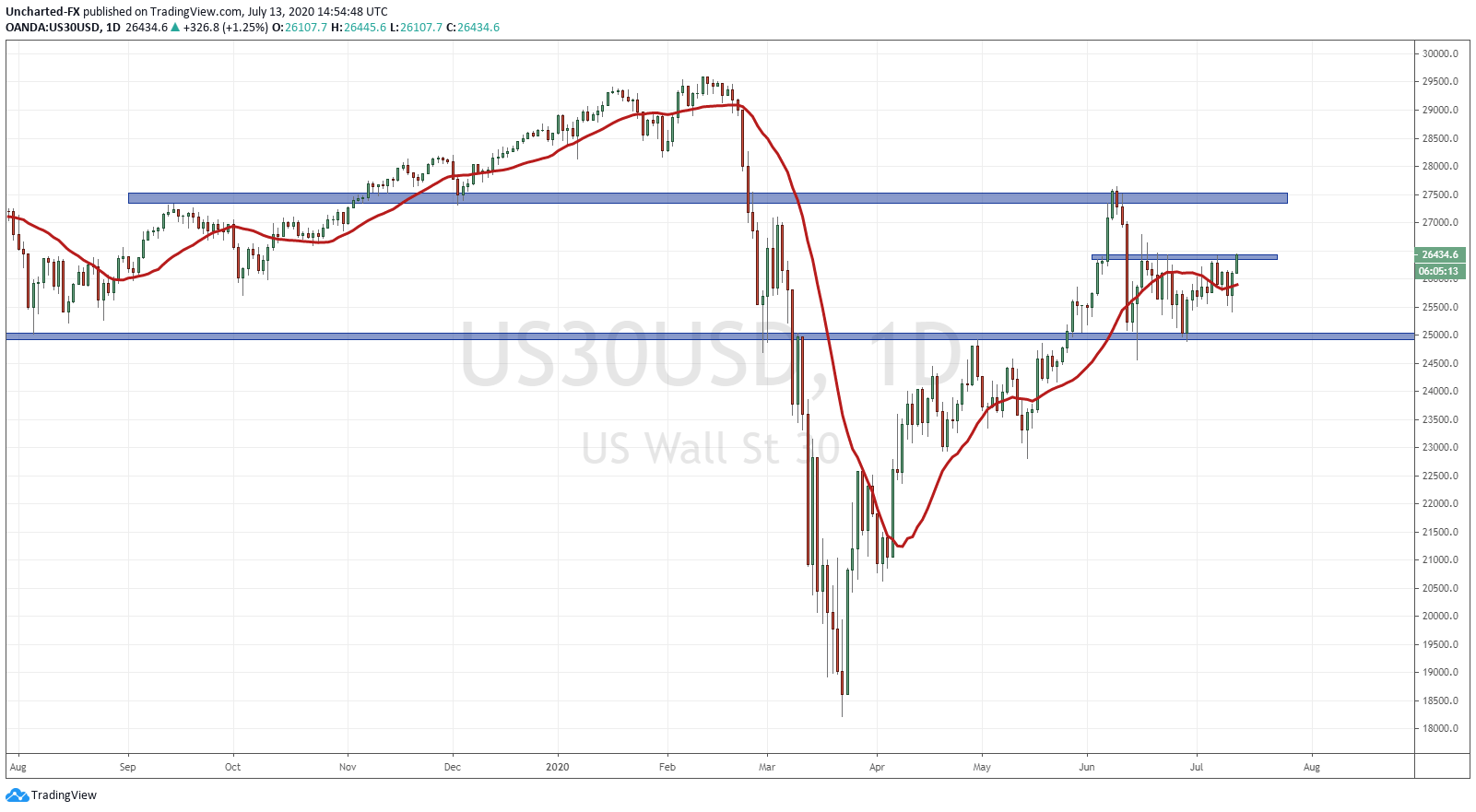

The Dow and the Russell 2000 remain the same as discussed per last week. We are bouncing off of major support zones as outlined by the charts. The Russell seems a bit more subdued as the Covid cases and pausing reopening impacts it more. However, I will be watching for a break either above…or yes, below for a trade. Currently, a lot of traders do have buy orders anticipating the break above. Their stop losses would be below the support levels. So if we were to break down, the move could be violent given all the stops we are cutting through.

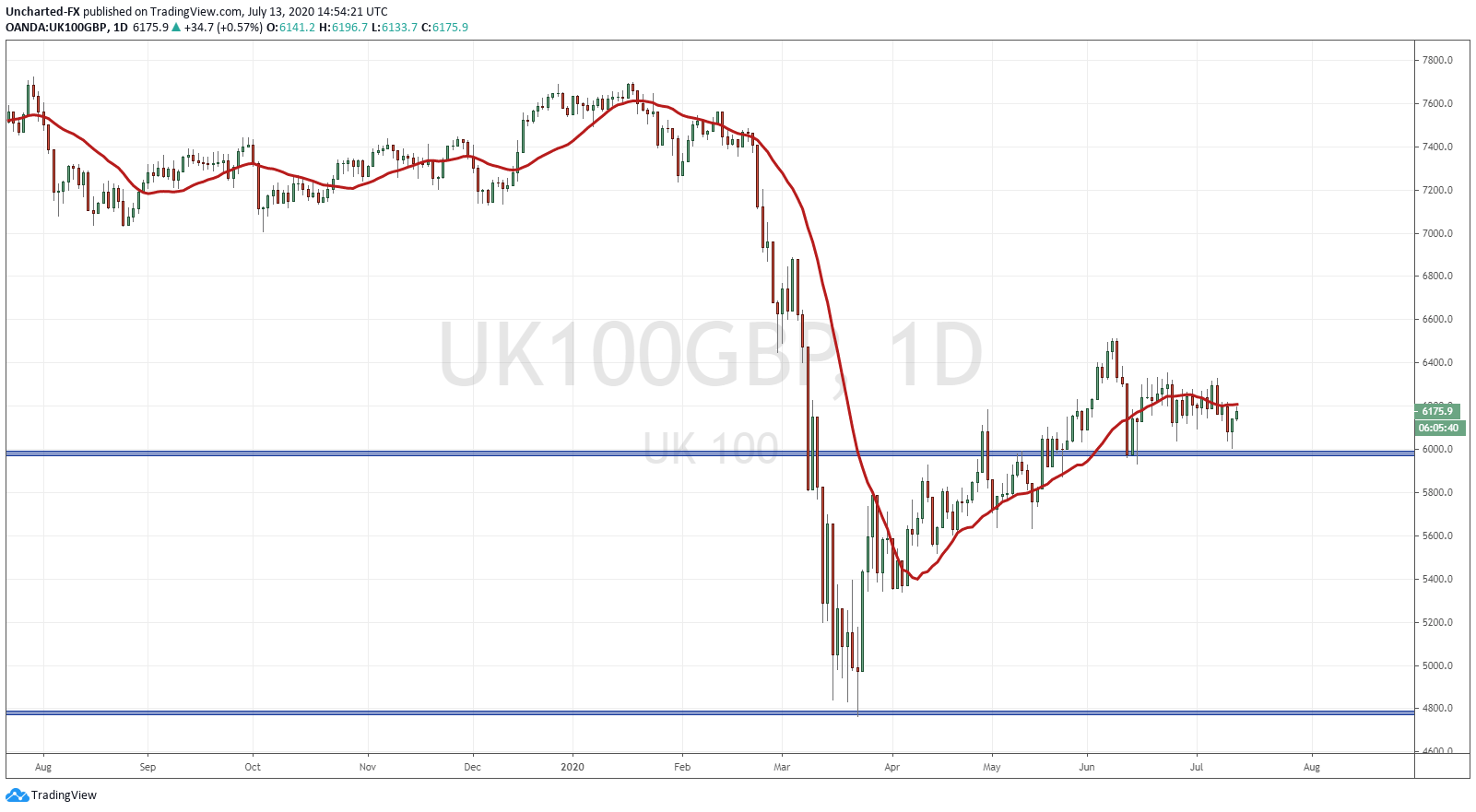

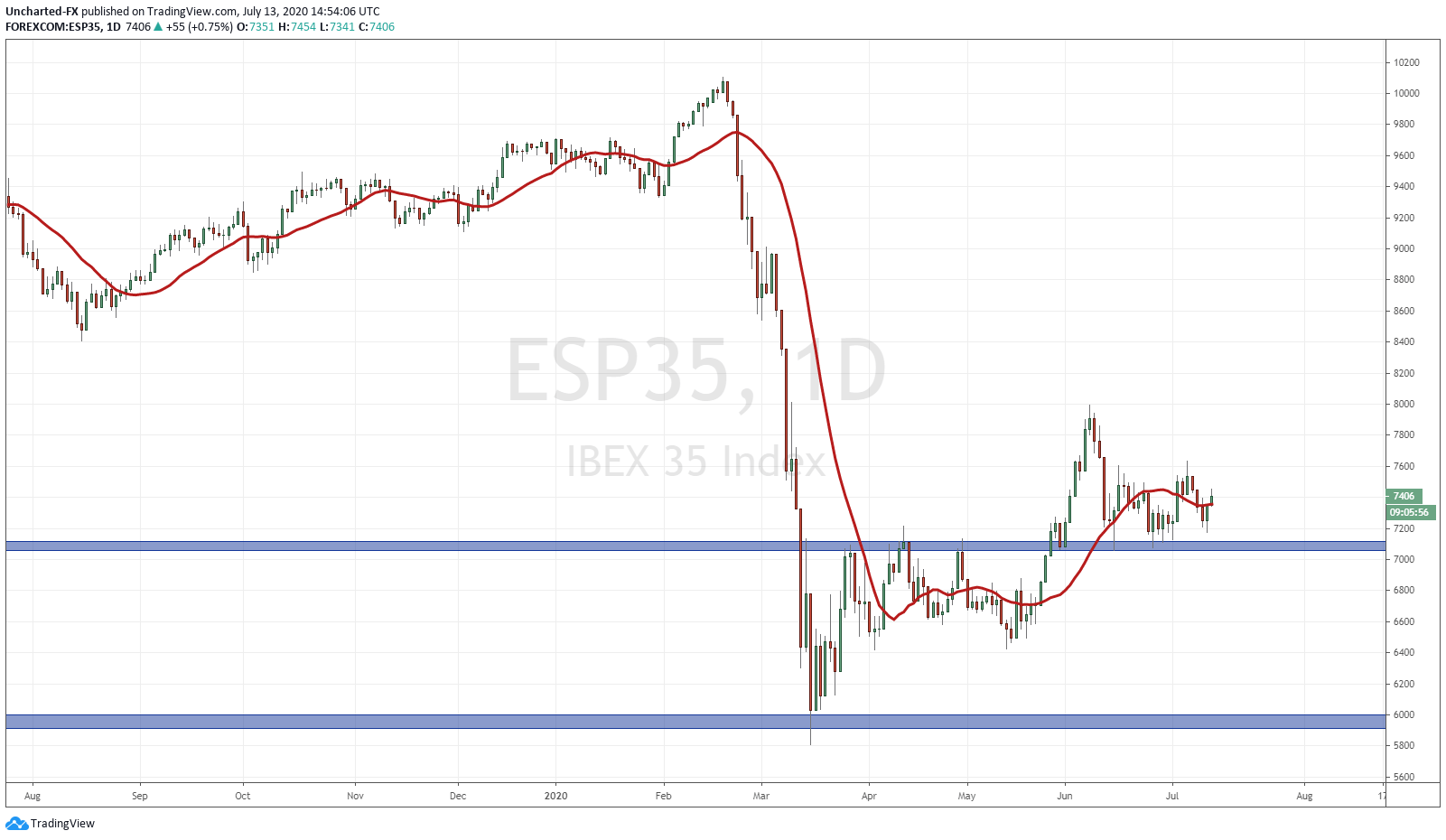

To end it off, the FTSE and the ESP35 remain European markets that I am eyeing. The German DAX has already moved much more than its European counterparts. It seems that a few European markets may be lagging. Discussed this in the past, but given how all world equity markets generally move in tandem, there may very well be a case where investors consider European equity markets to be lagging and undervalued compared to American and Asian markets. The FTSE may see some action with the BREXIT drama rearing its head again. However, technically, both of these markets have just retested key support points similar to the Dow and the Russell. Ideally, would want to see a break above the recent highs to confirm prices are moving higher.

A busy week with a lot of themes and data. If I were to narrow it down to just one, it would be the S&P 500. This zone is very important and we shall see if the second retest sees bulls beat the bears.

Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA