Last week was all about fear vs greed. Which side would win. By the end of the week, we can see that the fear side has gotten the edge. What do I mean by fear vs greed? Well first off, those are the two primary emotions which affect markets. Those that are technical look at price action as the accumulation of these emotions. That is what is really being displayed on the charts: human and mass emotions. This is why many things which are seen as the future (3D printing, crypto etc) usually have a rise up due to the greed aspect and then generally have a substantial drop . Take a look at the charts of DDD and Bitcoin and look at the similarities. Now this does not mean that that tech will eventually be implemented, it is just the market does not really care in the short/medium term. Emotions is what dictates the price.

In terms of these emotions currently, we are seeing the fear sign, with the obvious headlines that I will cover in my 3 points, versus the greed side, which is based on monetary policy . The fact that central banks will keep printing money, will keep interest rates low for longer…it just means that the stock market will be the only place to go for REAL yield in the future. I have argued that many fund and money managers, who have been hiding in Bonds for the past 2-3 months, are now in a different world. They have seen interest rates cut quickly, and you just cannot be in bonds when your job is to make yield. That money will be driven into the stock markets. However, fear is weighing in on markets in the short and medium term here.

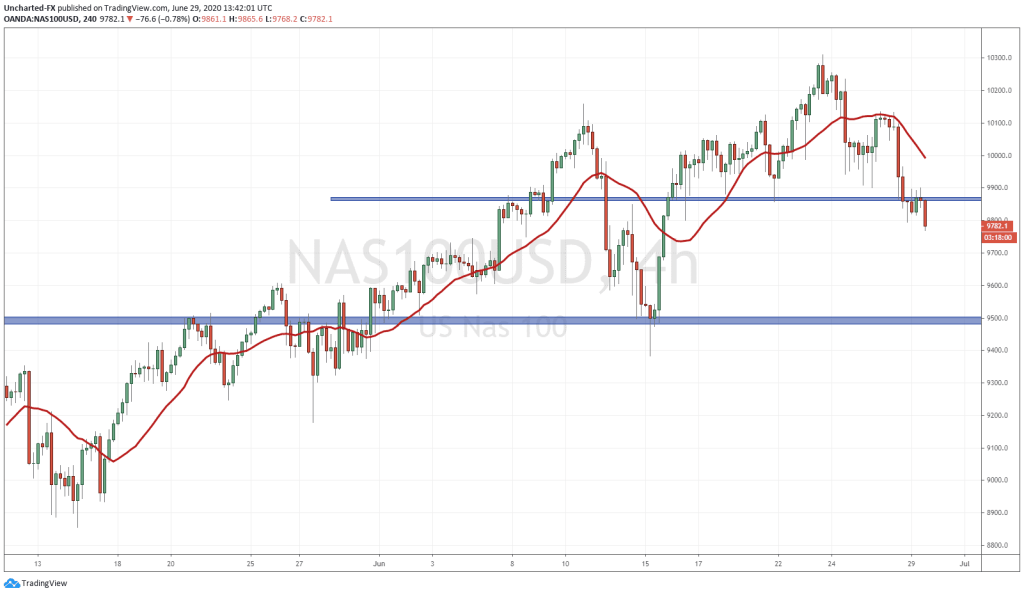

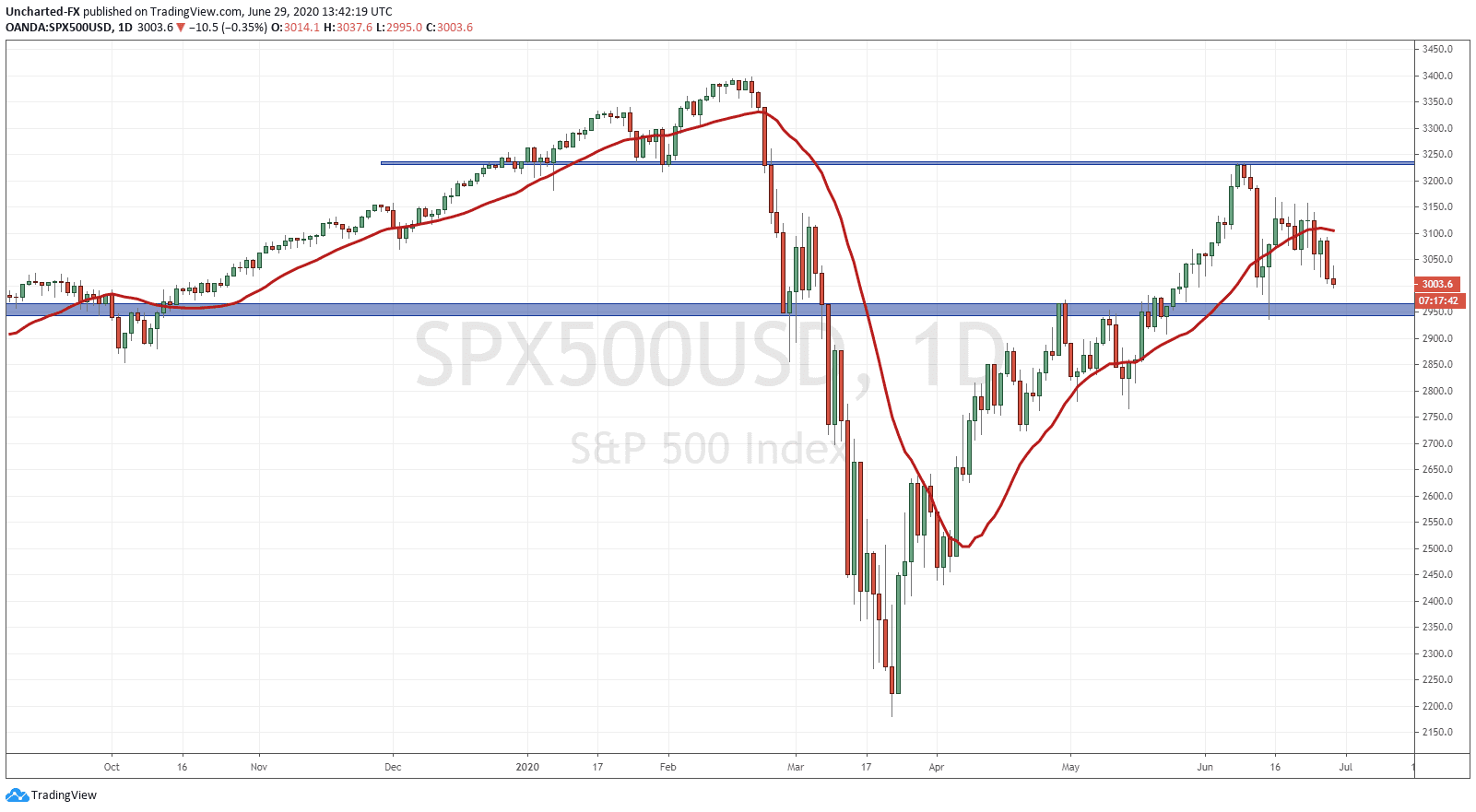

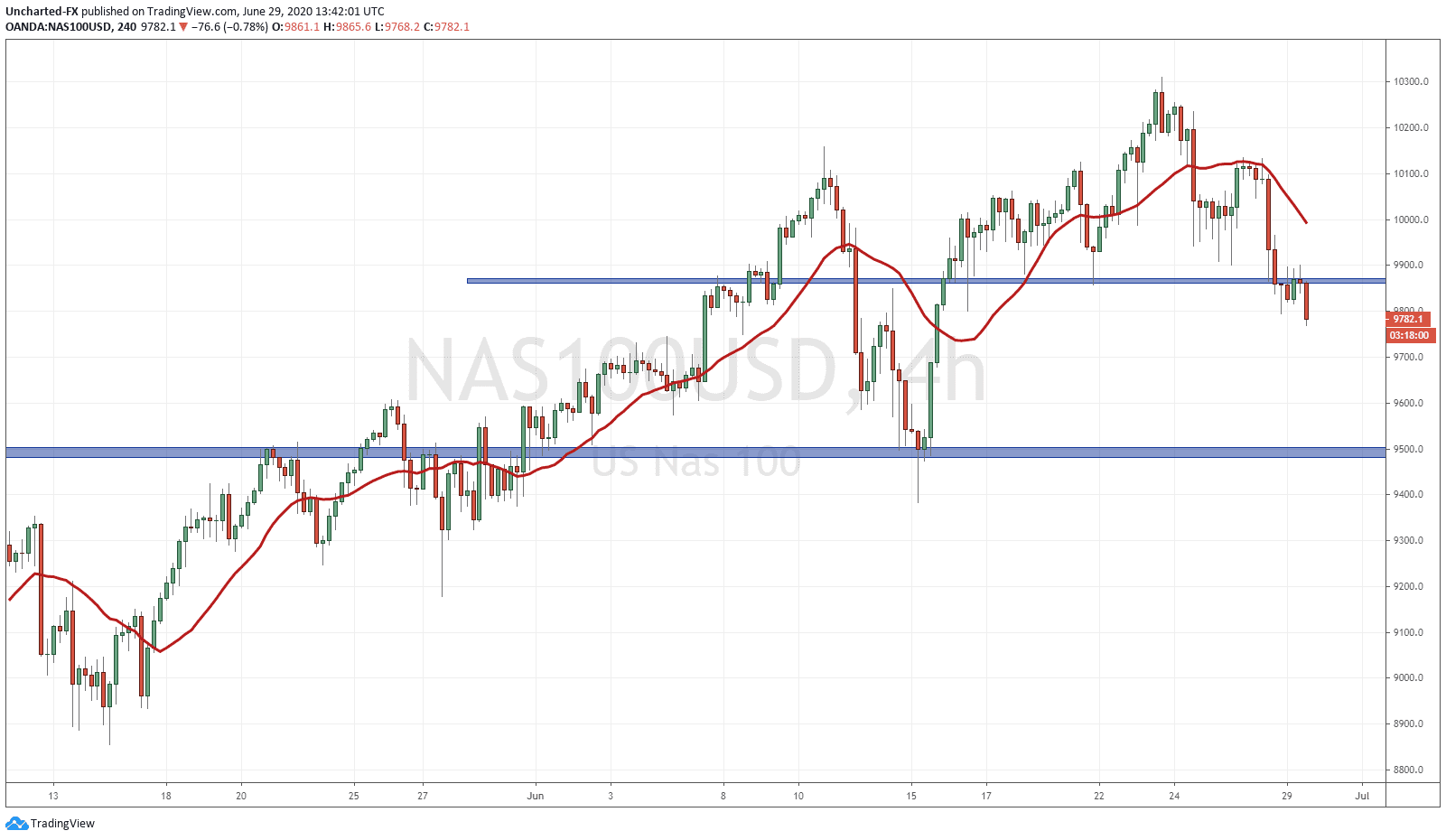

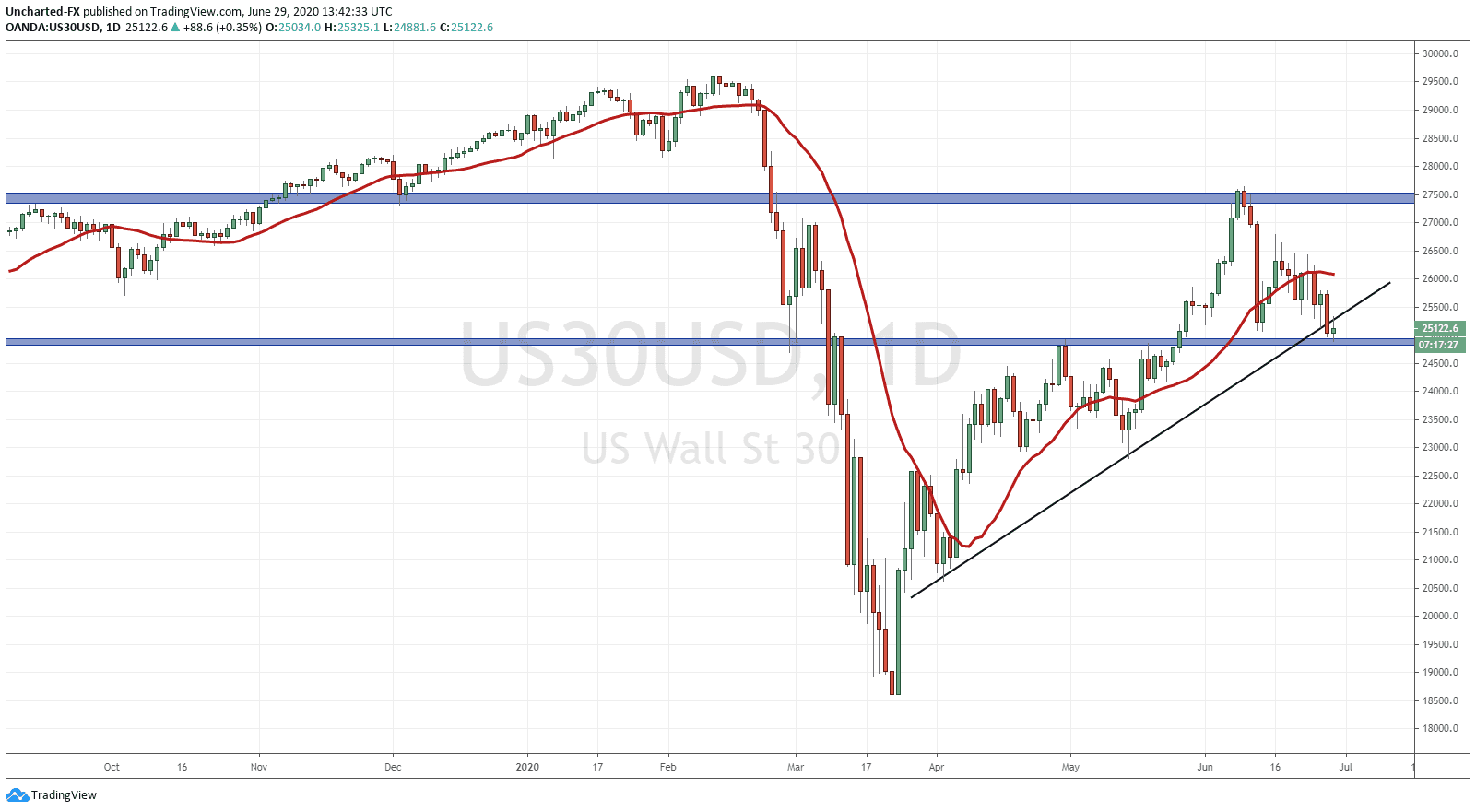

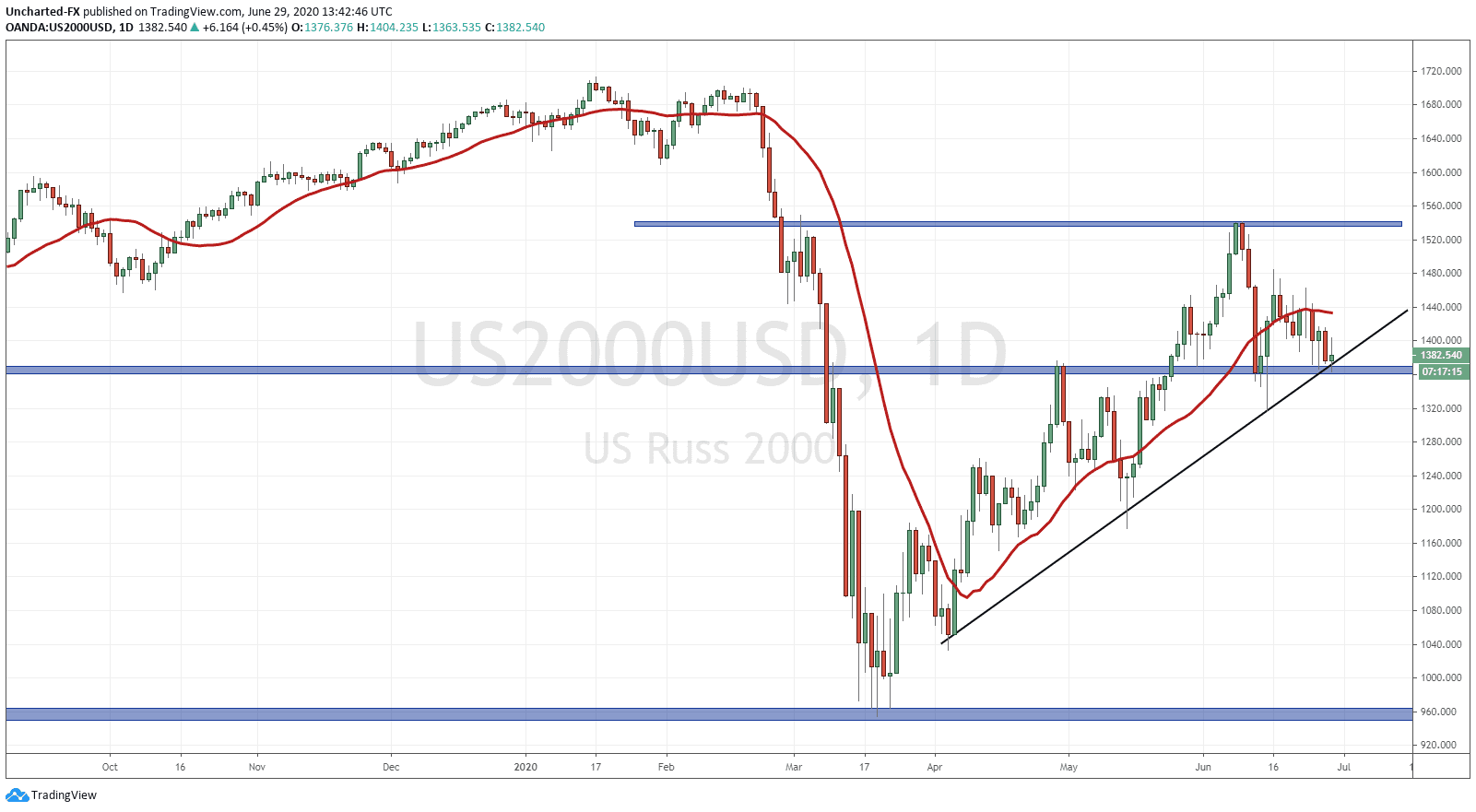

Let’s take a look at the charts of US equities. The markets did have a whip saw of a week last week. Up one day, then down the other. It really wasn’t until the end of the week that we made a more concrete move down lower. Just want to mention that this upcoming week could see price ranging, or breakouts not carrying momentum. It is a week full of holidays as we have Canada Day on July 1st, and then the 4th of July Market closure on Friday. It will definitely be a shorter week and there won’t be much liquidity.

The S&P is still holding the higher low on the daily chart at the 2950 level. There is a trendline you can draw, but it does not look as good as the trendlines you can draw on the Dow and Russell 2000 so keep that in mind. It does look like price wants to make a lower high here and retest then break below 2950. However, according to market structure, we can technically move higher as long as the 2950 zone remains valid. We need to see it break, and the fear aspect will be huge in making that happen.

I really like the Nasdaq for this week. On the daily chart , price momentum did not carry higher after making record all-time highs. It seems that at least a pullback is due. Going down on the 4 hour chart, I love this reversal pattern potential. We have our head and shoulders pattern. Notice how on Friday close we did NOT break below the support/neckline. Our trigger is a break and CLOSE below this neckline. Ideally, I would want to see markets pop up a bit, create a green candle or a doji , before falling and closing below the neckline for an entry. This is my favourite chart pattern currently. and guess what folks, it has triggered. We have had the break, and now are retesting the neckline as resistance. The next 4 hour candle close will be telling, but you can see the sellers are stepping in right now.

Both the Dow and the Russell are daily chart plays. Almost similar to the S&P but they are very close to their daily support levels. Another interesting aspect here are the trendlines . I don’t really use trendlines for entries because they can be very subjective on how you draw them. I do look at them more for slope of change, and to connect higher lows in an uptrend. The key point is that if a trendline has at least 3 touches, it is quite a strong level. Many traders do watch trendlines and they will definitely be observing this retest and in the case of the Dow, break, of the trendlines . However, I prefer the aspects of pure market structure. Meaning as long as we remain above the higher lows, we are still in an uptrend. The bottom of these trendlines that we are testing also coincide with the large support zone we are holding to confirm the recent higher lows. This means that these zones are VERY important. Game plan is to await for a daily candle close below these levels. This would mean that we would not short these until Monday close. I am very strict on entries on breaks and closes because we have seen many examples of fake outs. We have seen price break down and looks like it will continue. The FOMO traders chase it and price reverses trapping them. A fake out. Patience here is key and we will await the break and close.

So will we get these breaks this week? Yes of course it is possible. The only reservation I have is the shortened week due to holidays and the lack of liquidity this might provide. It would mean another choppy week and breakouts not carrying momentum forward. But there are plenty of risks here that are weighing in on the markets.

1) Covid Case Resurgences

We have been hearing about record covid case resurgences, but apparently this is not the second wave. We have seen states like Florida, and Texas pause their reopening process and reinstate restrictions. Now there are even talks of making masks mandatory if one leaves their home. The fear headlines have been unbelievable. It is almost as if the mainstream media wants the markets to fall. I have been trading for 7 years, I have not seen headlines like this. Marketwatch had headlines such as “we are in deep trouble” and “economic depression is only just beginning”. None of these headlines came out when we were in the midst of the pandemic. To me it is a bit odd but maybe I am thinking too much about this. Media has been peddling fear and the market does not like it.

There is now talks of a second round of lockdowns. Plenty of things this would do. First of all, it would ensure most small businesses fail and become debt slaves. Corporations will get more powerful. People’s mental health and state will drop dramatically, in fact, some are saying many would rebel if a second lock down is imposed. The social issues will be huge and I have been talking and warning about these for some time. They will worsen regardless due to the monetary policies central banks have implemented.

The fear is that these resurgence in cases will dampen the hope of any economic recovery. There will be no V shaped recovery. Many larger industries will need more bailouts just to survive. There will be a second round of layoffs. It really is scary stuff and would probably even surpass great depression like levels.

2) US China Trade War

Being a bit of a contrarian myself, my belief is that markets actually fell last week more on the US and China trade deal fears and uncertainties rather than covid surges. Markets have already swatted away the pandemic and great depression like economic data. They could do so once again. The geopolitical stage is on watch. Last week we had Peter Navarro come out saying the trade deal is “dead”. The clean up campaign afterwards was epic. Navarro denied ever saying that even when it was caught on video, and the President himself came out saying the deal is intact. Everything to keep markets propped.

Well on Friday, the Chinese came out and once again reiterated that they may back out from the trade deal if the US meddles with affairs in Hong Kong and Taiwan, which the Chinese say falls under their sphere of influence. China has threatened this many times before, but most people probably now know the trade deal is dead after what Navarro said. The truth is out. My followers and readers know my thoughts on this. China can be patient because they will wait for the elections and perhaps a weaker US President from the Democratic side. They also are pulling the strings. Chinese strategists know that President Trump needs to keep this charade of a trade deal intact because he does not want stock markets to tumble. Markets are his achilles heel. If markets are not up during the Fall, his slogan of “Keeping America Great” takes a hit. The Chinese know that if markets fall on hope of a trade deal, it will be President Trump desperate for a trade deal. The Chinese can then dictate the terms in their favour. In all honesty, China buying more US agriculture is not an improvement. They can always walk away and buy from Brazil or Russia, which they have threatened. The US needs to be more aggressive if they want to win this trade war.

My advice for the President is give China an out. Do the unexpected. China does not expect the President to come out saying the deal is cancelled due to the markets. If the US pulls out, China will be upset. Yes, both US and Chinese markets will take a hit, but I think they will rebound due to hopes of an actual REAL deal. Right now most people know that this deal is a farce. We have repeated the narrative of deal struggling and deal back on. Would not be surprised if we see the “China trade deal going well” headline floated out to try and prop markets up. The only thing is when will the market stop buying it?

3) Black Swan event

My followers and readers know my opinion on markets. With the discrepancy between the stock markets and the real economy, fundamentals are out the window. Markets are moving up due to a hunt for yield. This is why markets have gone up even with all the bad news thrown at it. It doesn’t matter. We have even seen the Fed enter the markets buying bond ETF’s and even individual corporate bonds. There is a case to be made the Fed could be using repo to give banks excess funds so they can then turn around and use them to buy stocks for profits and propping. This is the managed market environment we are in. The only thing that can bring this down is a black swan event. The fear factors I mentioned in 1 and 2 can play out. Especially if the President does rip up the trade deal. No one would be expecting it. This is the crux of a black swan event. They are unpredictable and take the markets by surprise.

There are so many candidates. It could be a geopolitical issue like North Korea, the Middle East, and/or India and China. It would even be election news. Biden or Trump overtaking polls etc although I would be careful with this. When President Trump won the elections in 2016, many thought this was a black swan event. Markets initially fell, but recovered and moved up higher dramatically.

What I would be watching is for a financial event. So far the Fed has been throwing money at everything, propping banks and corporations. We have seen some companies going under like Hertz and GNC . It would have to be a bank issue that does this. People are saying this is a financial crisis like 2008, but we are missing our Lehman Brothers moment. Something that would impact the credit/debt markets which have ballooned to extraordinary levels now. The dangers of this are real even though the Fed has implemented tons of policies to prevent this. This is just my opinion, but I believe these things just have a way of playing out even with manipulation.

Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA