Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA

Over on the discord chat, we have been quite the contrarians. One of my sayings has always been: if what the mainstream financial media told you was true, everyone would be rich. Market structure has given us solid entries on the cruise ships (the breakouts have occurred and the charts are still great), the banking/financial stocks, oil (which is continuing) and oil producers, and of course the airlines.

It did take some time for the breakouts to occur, but when they did boy did they move. Some members are already up over 45% on their holdings in a matter of a few days. All we do is look for market structure, and then enter the trades on the reversal. Markets only move in three ways: uptrend, range and a downtrend. We look for patterns in extended downtrends, and then look for the exhaustion. This is where we begin to see no new lower lows and then eventually a range or a reversal pattern confirming the reversal. For all the mentioned sectors that were hated, I spoke about how all the bad news had already been PRICED IN. We saw this with horrible earnings and price not reacting by making new lower lows. Because all the bad news and data was reflected in the price. Market structure told us that price was late in the trend…and when that is the case, we do NOT want to chase. If you feel like you are missing out…you HAVE missed out and it is best to not give in to the FOMO and await another set up.

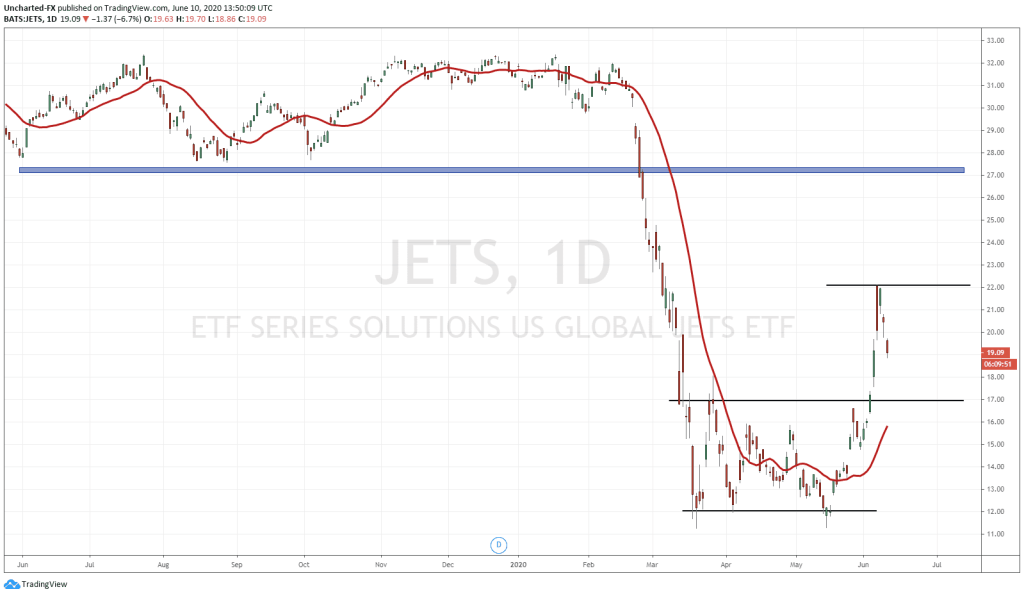

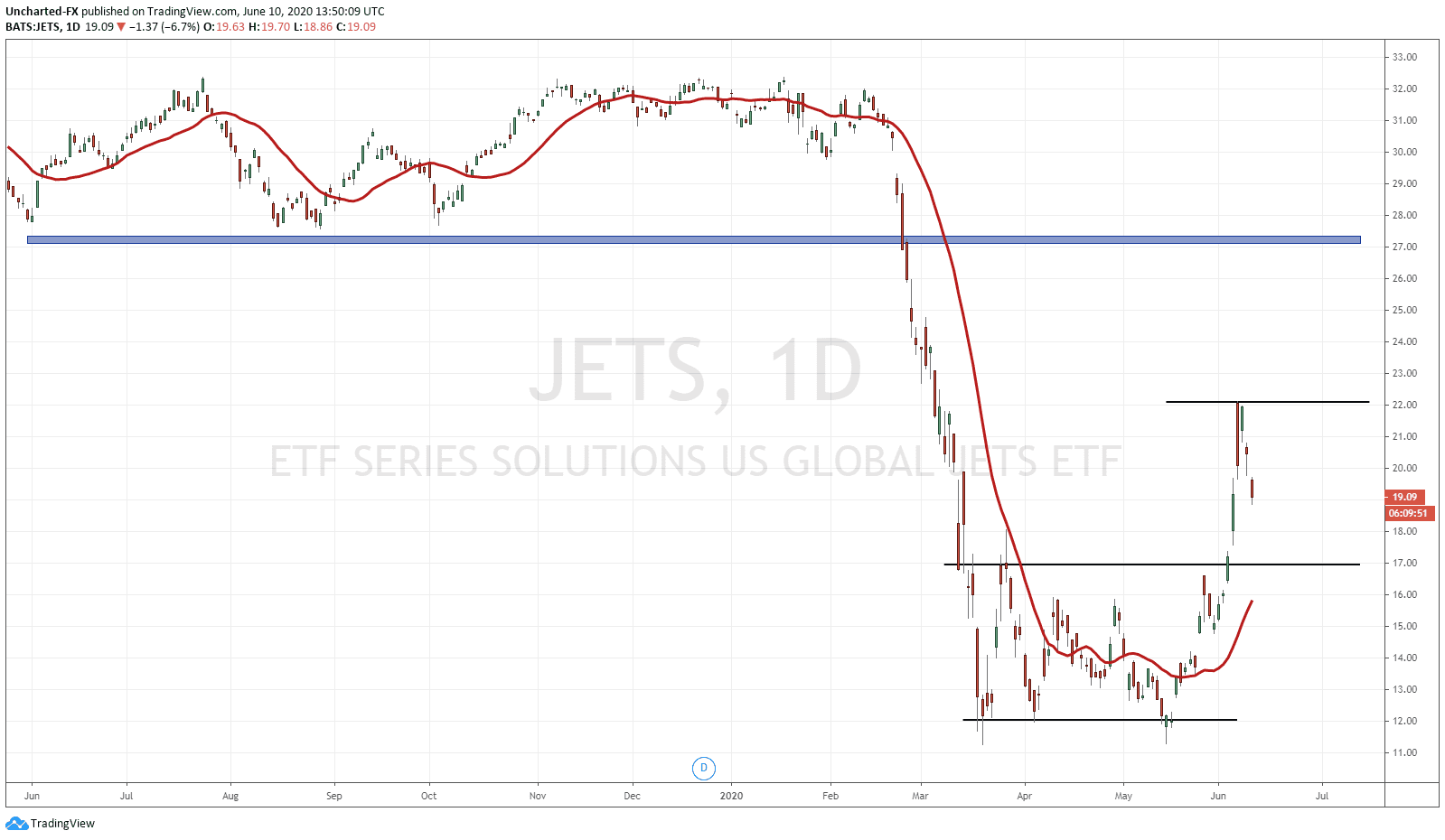

The chart that is worth following is the ETF JETS (featured above). This was a chart I posted on the blog a few weeks back, and we have kept tabs on it over on Discord. You can see we bottomed with pricing attempting to make new lows three times, but price always not closing below to make them. You can call it a range or a double bottom, whatever you like, but the key is market structure indicates that the downtrend was exhausted and over. To confirm that, we needed the break out, which we got with price breaking above 17. Price so far has never looked back. To me this is still early in this new uptrend because price has not made a higher low yet. Generally, this happens on the retest of the breakout zone but that is not always the case. We can see buyers are stepping in currently and perhaps this is the higher low forming. We will not know until price makes new highs by breaking above 22.13. However, I would NOT enter any position just yet, as we have the Fed up today and markets will likely pullback or consolidate until his press conference. The pullback to the breakout zone can still play out here depending on how the market reacts to Powell and the Fed. It is purely on risk vs reward. If you enter now, you have a higher risk, because price could potentially move down to retest the break out zone of 17, where you would place your stop loss. As long as we are above 17, we are technically in an uptrend. The safer entry is to await for the break higher to make new highs, then placing your stops below the higher low. Your risk vs reward ratio might be somewhat diminished, but the probability of success is much higher. Trading is just the business of probabilities.

Let’s take a look at the charts of other Airline stocks I have mentioned on the breakout and see how they have progressed. Hint: most of them have hit their first take profit zone.

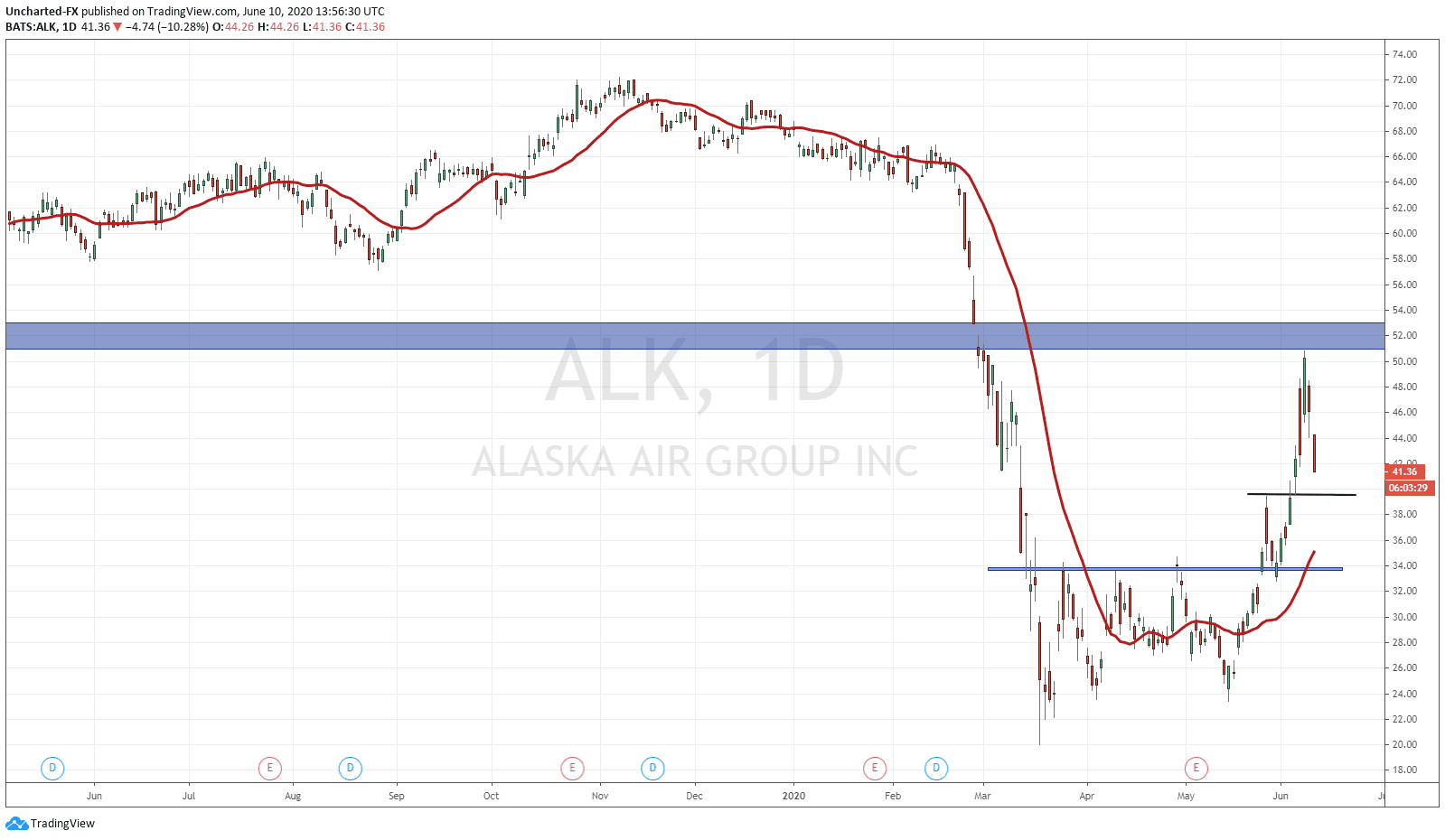

Starting with Alaska Airlines (ALK), we called the bottoming and the breakout at 34. That was the trigger. Notice how in this case price pulled back to retest the breakout zone? Before breaking into new highs and hitting our target at the 50-52 zone (50 being a psychological important number and zone). On that retest, you could have entered with a higher risk vs reward ratio since your stop loss would have been quite small. Or, you could have waited for price to break and close above the highs of 39.60 before entering, with your stop loss below the confirmed higher low swing just below 32.77. Yes the risk vs reward would not have been as great as option number 1, but the probability of success was much higher as it confirmed the higher low retest. From here, we can expect one more higher low swing targeting the 58-60 zone. I generally look for two higher low swings AFTER the break out pattern before I say the trend is late and jumping in would be FOMO. That’s just me. Price can make more than two swings to the upside.

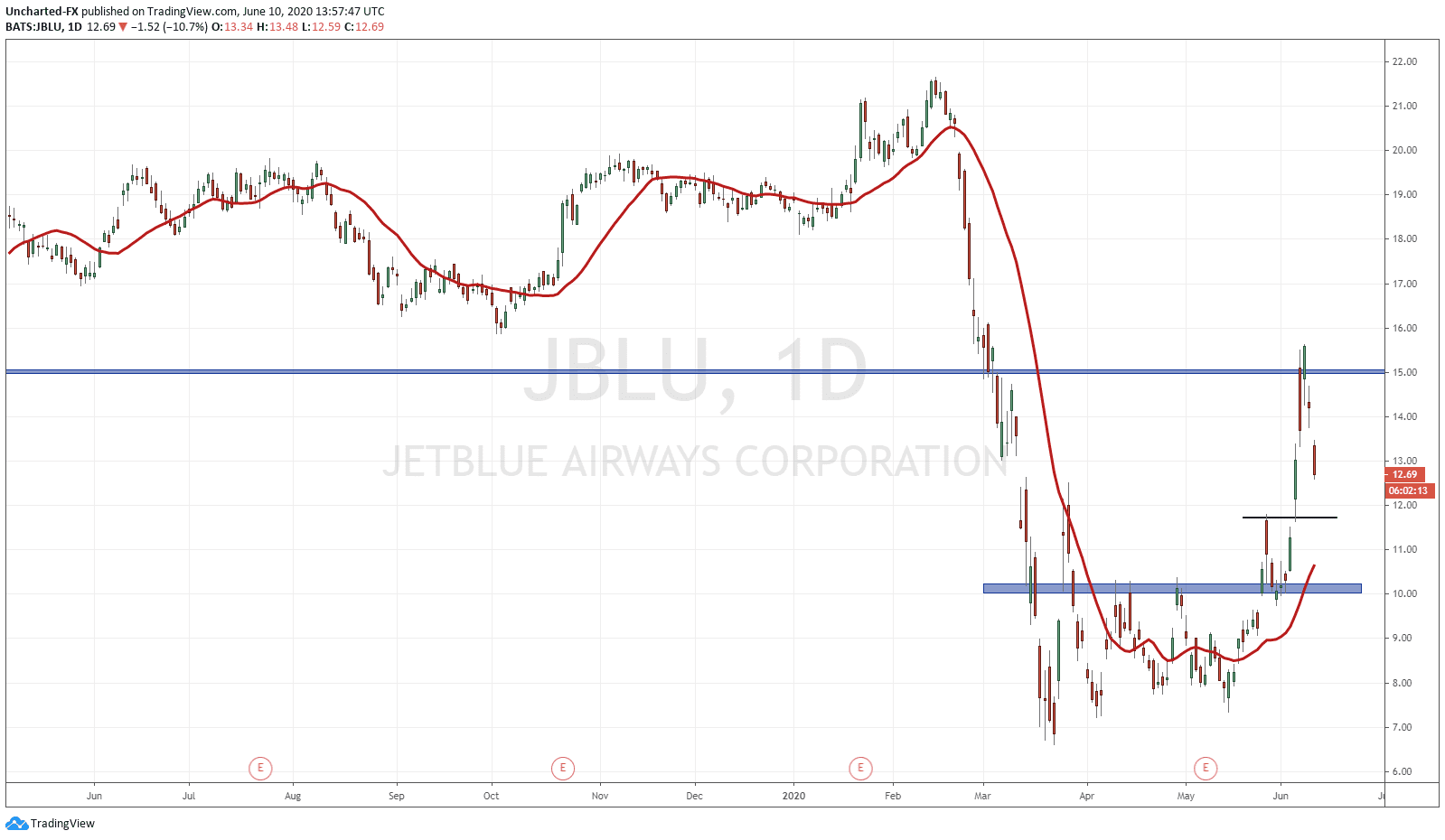

Jet Blue as discussed previously is a favourite long term investment for a member over on Discord. Already up 45% on his investment in just under a week. Not too bad. All the same principles discussed with Alaska apply here. Notice price pulling back to the break out zone and retesting it before moving higher. We should expect another swing to form here, with a break higher taking us to 17.00.

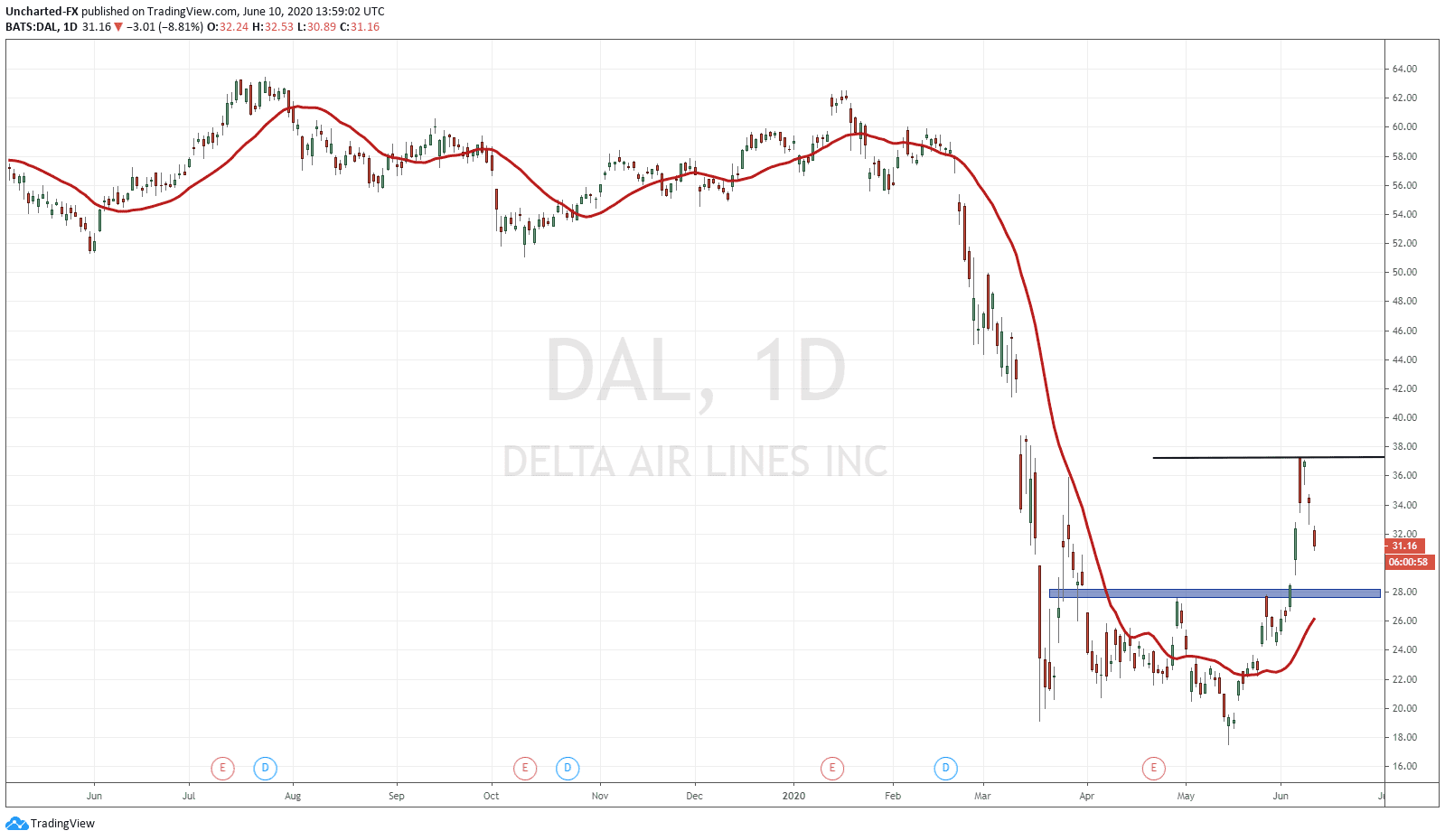

Finally onto Delta Airlines. Warren Buffett’s name comes up a lot when you discuss this, as he sold his position before this rally occurred. People saying Buffett may have lost his touch, but to be honest, I think this is an environment that does not care about fundamentals as much. In my opinion, Buffett missed the inverse head and shoulders pattern (the technicals) which indicated a bottom. The downtrend was far too extended, and the pattern was there. It was not a textbook head and shoulders pattern, but it indicated a switch from lower highs to higher lows. A shift or reversal in a trend. This is why this pattern is our top reversal pattern. I discussed it in yesterday’s Market Moment post where we looked at Gold. Still a valid trade and we are just awaiting the trigger as discussed.

Delta has not retested the break out zone, but as mentioned earlier, that is not always the case, and this is why it is best to await the break above the recent highs here at 37.33. If Delta fills the gap here, it can lead to more momentum. Gaps are generally filled, and you see a powerful move once they are. In this case, we could see a nice rise up to the 45.50-46.00 zone.

In summary, I hope my work on market structure proves that technicals, and especially, market structure, is a tool you should use in your trading and investing. This is based on cycles and all markets repeat these cycles regardless of the asset class. It is just how markets move. That’s it. I have used this simple and basic approach to call moves in equities (calling the drop beginning in late February), rallies in Silver, Bitcoin, Gold, Currencies, TSX Junior Miners, Oil and other assets. As for today, I would wait out before dipping into the markets with the Fed rate decision today. Many know what they will say, but nobody knows how the markets will react to his words. I will be watching for his comments on the job data on Friday, and if he sees that as a step towards recovery and what that would imply about the Fed continuing their programs.